Part 1: The Future of Workplace EV Charging in India

Raghav Bharadwaj

Chief Executive Officer

Published on:

05 Aug, 2025

Updated on:

28 Jan, 2026

Is home charging really accessible for India’s EV owners?

According to McKinsey’s Global Automotive Consumer Survey: India, 55% of EV owners in India have access to home charging, while the remaining 45% rely on alternatives like public, shared, or workplace EV charging India to charge their vehicles.

However, access to public charging in India is still evolving. Today, the country has approximately 1 public charger for every 135 EVs, compared to a global average of 1 charger per 6 to 20 EVs, highlighting the need for more destination-based EV charging infrastructure.

This charging gap opens up a clear opportunity, especially as millions of Indians return to offices post-pandemic. For most commuters, the workplace is where their vehicle sits idle for 8–10 hours a day, an ideal window for charging.

Globally, studies show that combining home and workplace charging can cover over 90% of daily driving needs. And in India, where public charging remains limited and home charging isn’t universal, the workplace EV charging in India is emerging as the next high-impact node in the EV ecosystem.

Yet, most Indian offices and depots are not EV-ready. While corporate fleets still account for less than 20% of EV adoption in India, demand is rising fast, driven by ESG targets, cost savings, employee expectations, and the promise of smarter, solar-integrated, grid-aware EV charging infrastructure.

- In this article, we focus on the following three questions:

- What are the benefits of workplace EV charging in India?

- What is the current state of workplace EV charging in India?

- What is the future of workplace charging in India, and how will it scale by 2030?

3 Benefits of Workplace EV Charging in India

Providing EV charging at corporate campuses presents a win-win opportunity. For employees, they get a convenient “top-up” charging, and for employers, this amenity enhances the company’s sustainability profile and employee satisfaction.

According to a 2022 KPMG analysis, the majority of charging for private EVs in India, particularly two- and four-wheelers, is likely to be conducted at home or at work using AC slow/medium chargers. By installing EV charging stations, companies demonstrate ESG commitment and help overcome one of the biggest perceived barriers to EV adoption in India: lack of charging infrastructure.

Encouraging EV adoption

A recent survey in Bengaluru found that ~25% of people commute on two-wheelers, but many hesitate to switch to electric due to charging access. Workplace charging can directly address this: IT office parking lots host approx. 500,000 two-wheelers daily in Bengaluru alone. Simply providing basic 3-pin sockets or AC charging points in these lots (even at a modest fee) would let employees charge over 6–8 hours of work, ensuring they have enough range to get home and back the next day. Such initiatives could create a massive incentive for millions of commuters to opt for EVs nationally.

Employee benefits and retention

Free or low-cost charging is seen as a valuable perk. Companies offering workplace charging have reported improved employee satisfaction and retention. Globally, employees have indicated that workplace charging access influences their choice of employer; one survey found 82% of EV drivers consider on-site charging an important benefit. In India, forward-thinking firms like Vedanta and MakeMyTrip are subsidizing employee EV purchases and installing campus charge points as part of “green perks” packages.

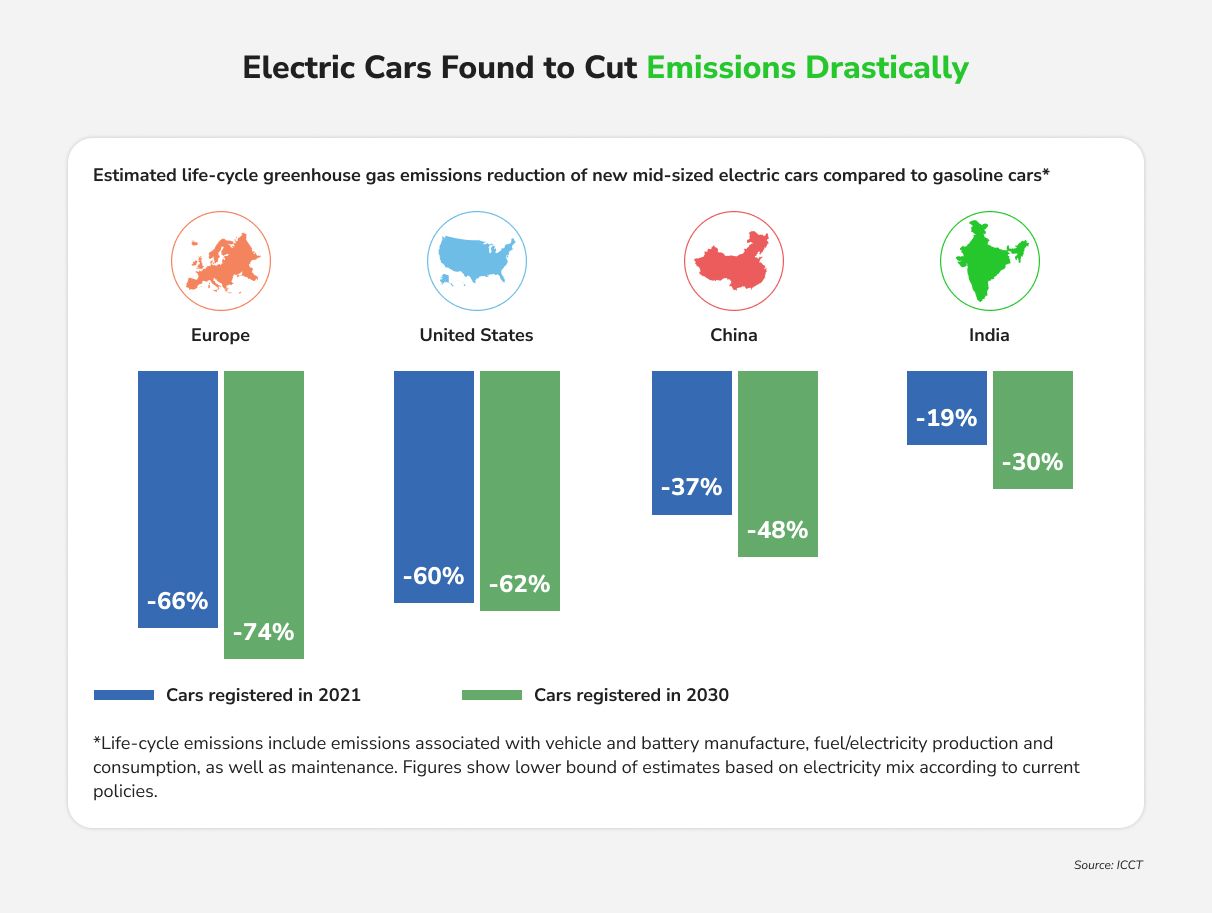

Reducing emissions and costs

Workplace charging aligns with corporate sustainability goals. Every kWh delivered at work (especially if coupled with solar power) displaces fossil fuel usage in employees’ commutes. EVs also cost far less per km to run, around ₹1.2–1.5 per km versus ₹5–7 for petrol cars, translating to savings for employees. Workplace charging thus directly supports staff in cutting their fuel bills and carbon footprint.

Current State of Workplace EV Charging

As of 2025, India’s EV charging infrastructure has grown rapidly, supported by both government initiatives and private sector participation. Workplace charging, is gaining traction as businesses incorporate EV facilities for employees and fleet vehicles. Corporate leaders are now treating EV charging stations as an essential amenity for offices, comparable to Wi-Fi or parking security, to future-proof their facilities and align with sustainability goals.

Key aspects of the current state include:

Surge in charging points

According to the Ministry of Power, India had 12,146 operational public EV charging stations as of February 2, 2024, nearly double the count from 10 months prior. Major business hubs lead in charger deployment, for example, Maharashtra and Delhi had approx. 3,079 and 1,886 public chargers respectively by early 2024. By mid-2025, the total number of public chargers is expected to be well beyond this figure (likely in the 15,000–20,000 range) as new stations come online monthly. Notably, oil marketing companies (IOCL, BPCL, HPCL) aggressively added stations at their fuel outlets – around 8,000 fast chargers were installed by these firms during 2023–24 alone, under FAME II funding support. This expanded network directly benefits workplaces located near highways or urban fuel stations, improving charging access for commuting employees.

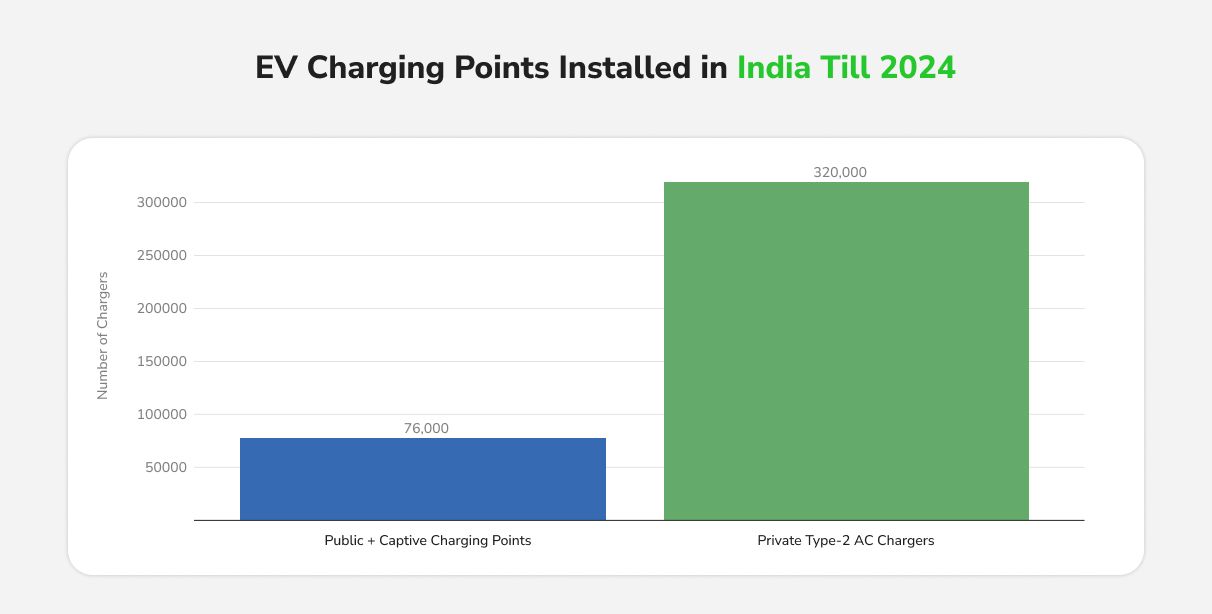

Private and captive charging growth

Alongside public chargers, there’s been a boom in private (captive) charging at workplaces, apartment complexes, and fleet depots. A recent industry report noted that by 2024 India had about 76,000 charging points in total (public + captive) and over 320,000 private chargers (mostly home chargers) installed. Many large companies, especially in IT parks, logistics, and hospitality, have set up dedicated employee charging stations. These are typically AC slow/medium chargers (3.3 to 7 kW) that can top up vehicles over the workday. The majority of charging for private EV owners in India is expected to happen at home or at work using AC chargers, a trend now visible in corporate sustainability plans. For example, tech campuses in Bengaluru and Gurugram have started offering free or subsidized EV charging, paralleling practices in Silicon Valley.

Scalability for decarbonization

Public-private partnerships is emerging to build large charging hubs for commercial use. For instance, Flipkart partnered with a utility to set up 38 dedicated charging sites (190 fast chargers) across cities to support its delivery of EV fleet. These hubs not only serve company vehicles but can often be opened to other fleets or even the public, maximizing utilization. The opportunity is huge: India’s logistics and service sectors operate millions of vehicles, and electrifying even a fraction by 2030 will require thousands of depot charging stations.

How India’s Charge Point Operators (CPOs) are powering the workplace charging ecosystem

The charging infrastructure market now hosts 40+ active CPOs offering various hardware and software solutions. Many national and global players are now partnering with corporates and real estate developers to install chargers at workplaces, shopping centers, and parking lots. The private sector’s role is evident in the growing diversity of charger types, from 15A charging sockets to Type 6 and Type 7 connectors (primarily for two- and three-wheelers), Type-2 AC connectors for cars, and 60 kW CCS2 DC fast chargers for commercial fleets. The ecosystem has matured to the point where workplace charging solutions — such as load-managed smart charging for office parking garages and charger management systems (CMS)— are now offered as turnkey services by emerging energy startups.

Government initiatives and policies

The policy environment in 2022–2025 has significantly favored faster charging rollout:

In 2022, the government issued revised Guidelines and Standards for EV Charging Infrastructure. These allowed individuals to use existing electrical connections at homes/offices for charging EVs, mandated that distribution companies provide connections for public chargers expeditiously, and capped tariffs for EV charging (with a special EV tariff not exceeding the average cost of supply. Such measures directly encourage workplaces to install chargers, since offices can now easily add charging points on their premises without regulatory hurdles.

Several state EV policies (e.g., Maharashtra 2021, Karnataka 2022) include provisions for charging infrastructure in commercial buildings. Delhi’s subsidy for 30,000 private chargers was fully subscribed, boosting installations in office complexes and apartments. States like Telangana, Tamil Nadu, and Gujarat have also provided capital subsidies or tariff concessions for charging stations, spurring private investors to set up charging hubs that often cater to nearby office clusters.

In late 2024, the government approved the PM e-Drive (Electric Drive Revolution) scheme, essentially FAME II’s successor. With an outlay of ₹10,900 crore for 2024–26, it earmarks ₹2,000 crore specifically for charging infrastructure. This injection of investment is accelerating installations in cities with high EV adoption and along key highways. We are already seeing the impact in 2025: tenders and grants for workplace charging clusters (in government office complexes and tech parks) have been rolled out under this program.

More ease of access for users

With more chargers around, using an EV for commuting is far more practical in 2025. Payment and access have been streamlined. Most public and workplace chargers support digital payments and interoperable RFID/mobile app access, often integrated via aggregators or the government’s One Nation One Card for EVs initiative. Tariffs for workplace charging are often subsidized by employers or offered at cost (and remember, in India charging at the workplace using an employer’s electricity is allowed on the company’s connection). This ease of access is encouraging more employees to consider electric company cars or to switch to electric two-wheelers for their daily commute. Backing this shift, several companies now offer reimbursement programs that make buying an EV not just sustainable, but financially rewarding.

Outlook 2025–2030: Forecasts and Future Trajectory

The next decade will be transformative for EVs in India, and workplace charging infrastructure is expected to grow exponentially to keep up with rising demand. Key forecasts and data-backed estimates include:

EV adoption rates

Government targets and industry projections indicate that EVs could form 30% of new private car sales, 70% of commercial vehicle sales, 40% of buses, and 80% of two- and three-wheeler sales by 2030. In absolute numbers, one analysis projects around 50 million EVs on Indian roads by 2030, up from only ~2 million in 2023. This surge will be driven largely by two/three-wheelers and commercial fleets, segments that heavily rely on workplace or depot charging.

Charger deployment needs

To support these EVs, India will need a massive build-out of charging infrastructure. Estimates vary, but a 2024 report by Forvis/Mazars suggests about 1.3 million charging stations will be required by 2030 (roughly a 1:40 charger-to-EV ratio). This implies installing approx. 400,000 chargers per year through 2030. For context, as of early 2024, India had only approx. 16,000 public charging stations. A significant share of the new chargers will be semi-public (at workplaces, malls, fleet depots, etc.) rather than purely public ones. Workplaces are expected to become a major venue for EV charging, second only to home charging, as EV adoption expands.

Workplace charger demand & utilization

As more employees drive EVs, the demand for office charging points will rise. Today, the availability is limited; only about half of EV drivers in one 2025 survey had access to workplace charging, but employee interest is extremely high. In the US, 98% of surveyed commuters without workplace charging said they want it available, and Indian employees echo similar sentiments anecdotally. We can expect utilization of workplace chargers to start modestly perhaps a few uses per charger per day when EV penetration is low) and climb steadily through 2030. Global data shows that when offered, many EV owners plug in at work 1–3 times per week, mostly to replenish the daily commute. One US Department of Energy program found that employees at companies with charging were six times more likely to drive an EV than the average worker.

Typical charger utilization

A single Level 2 charger can often fully charge 2–3 cars during an 8-hour workday if drivers rotate, but in practice, cars often remain plugged in for the entire workday. This means that current utilization (charging time vs. connected time) is relatively low. However, as EV numbers grow, we can expect smarter usage policies to increase throughput. By 2030, it’s plausible that workplace chargers will operate near capacity during daylight hours, especially in large campuses. Fleet depot chargers will also see intensive use. For example, ride-hailing and delivery fleets might cycle vehicles such that each charger is used for multiple sessions per day. Overall, industry planners anticipate average charger utilization rates rising from <15% in early years to 40%+ by the late 2020s for public/commercial chargers, as EV adoption reaches critical mass. High utilization is key to making the economics of charging stations viable.

EV charging cost trends

The cost of EV charging equipment and installation is expected to gradually decrease, making workplace chargers more affordable. Today, a basic 3.3–7 kW AC charger unit in India costs on the order of ₹10,000–₹100,000 (plus installation), while a 60 kW DC fast charger costs over ₹5 lakh. These costs have already fallen from a few years ago, thanks to local manufacturing and economies of scale.

By 2030, continued innovation and volume production could further reduce hardware costs per charger by 20–30%. Additionally, battery improvements might allow smaller chargers to deliver more service, improving cost-effectiveness. On the electricity side, tariffs may evolve with more time-of-use pricing, potentially lowering off-peak charging costs. Overall, the total cost of providing workplace charging (per vehicle served) is expected to trend downwards, improving the business case for employers.

Energy demand and grid impact

If tens of millions of EVs charge at homes and workplaces, what does it mean for energy demand? According to a 2019 Brookings India study, even under a scenario where all vehicle sales shift to electric, EV electricity demand would remain under 100 TWh by 2030, but still make up between 1.3% and 4.8% of India’s total electricity use that year. Daytime/work charging is actually advantageous for the grid if it aligns with solar generation. India’s policy think tanks note that unmanaged evening charging (everyone charging after 6pm) would stress the grid, but shifting more charging to daytime (at workplaces during solar peak hours) can reduce loads and cut emissions. Thus, forecasts to 2030 increasingly favor “solar-friendly” charging patterns, with workplaces playing a crucial role in absorbing midday solar surplus by charging cars while the sun shines. By 2030, we may also see vehicle-to-grid pilots where workplace EVs can discharge power back to the grid or building during peaks (this remains experimental but could become part of beyond-2030 forecasts for office campuses).

Policy trends and government roadmap

Policy will continue to be a key driver. We can expect:

Continued incentives

The upcoming years might see an extension or evolution of subsidy schemes. With FAME II concluded, the PM e-Drive scheme (2024–26) provides fresh capital for chargers. If the EV sales trajectory remains steep, policymakers could extend such incentives beyond 2026. We might also see state-level mandates, for instance, requiring office complexes above a certain size to install EV chargers (some cities globally have done this). In India, several state governments already require new commercial buildings to allocate 20–25% parking for EVs with charging facilities; enforcement of these rules will tighten by 2030.

In short, through 2030 and beyond, workplace charging infrastructure in India will expand from a niche offering to a mainstream feature of corporate campuses and logistics hubs. We will likely go from only a few thousand workplace chargers today to tens of thousands (if not more) by 2030. This growth will mirror and support the rapid rise in EV ownership, helping India stay on track to meet its electrification and climate goals.

In the next part of this series, we’ll explore what India, as an evolving market, can learn from other countries about building effective workplace EV charging networks. We’ll also break down the business models and ROI structures that are working globally. And finally, we’ll highlight where the real investment opportunities lie for Indian enterprises, utilities, and infrastructure players.

Feb 27, 2026 • EV Technology and Trends

Renewable Energy and EV Charging in India: Technical Integration [+ Challenges]

Read More