Part 2: Scaling Workplace EV Charging in India: Global Case Studies, Business Models, and Investment Opportunities

Raghav Bharadwaj

Chief Executive Officer

Published on:

07 Aug, 2025

Updated on:

28 Jan, 2026

A few days ago, we published Part 1: The Future of Workplace EV Charging in India, a deep dive into why workplace charging matters, the current state of deployment, and what the future could look like as EV adoption accelerates, especially as EV charging infrastructure in India continues to grow.

In part 2, we go a level deeper, focusing on how India can translate that potential into real, scalable outcomes.

- This article answers three questions:

- What can India as an evolving market learn from other countries about building effective workplace EV charging networks?

- What EV charging business models and ROI structures are working—and what should Indian enterprises consider?

- Where do the real investment opportunities lie for businesses, utilities, and infrastructure players?

Let’s dive in.

Global Lessons: What India Can Learn from the US, China, Norway, and Germany

While India’s EV charging journey has its own unique story, there are valuable lessons we can embrace from countries that are ahead in the EV adoption curve, particularly regarding workplace EV charging infrastructure.

In this blog, we highlight insights from the United States, China, Norway, and Germany, four markets with advanced EV ecosystems, and how India can adapt their best practices.

United States of America

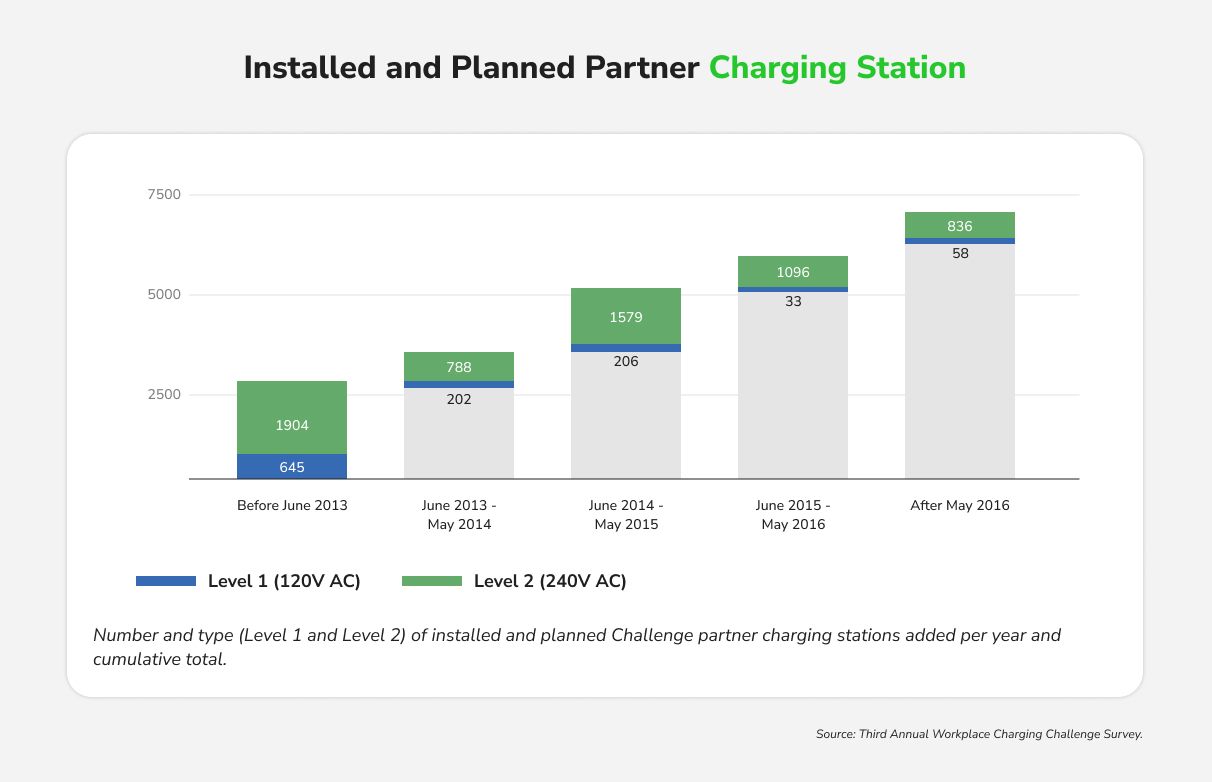

A key lesson from the US is the role of public-private partnerships and employer initiatives in expanding workplace EV charging. Early on, the US Department of Energy launched the Workplace Charging Challenge (2013–2018), which rallied employers to voluntarily install EV chargers for their staff, significantly raising the profile of at-work charging.

Major American companies (tech firms, automakers, and universities) responded by installing charging bays as an employee amenity, normalizing the idea of charging at work. Additionally, federal incentives such as tax credits for installing charging stations helped encourage more people to adopt EVs. Strategically, the US is now investing heavily in charging infrastructure nationwide (through the Bipartisan Infrastructure Law). Under earlier federal initiatives (Biden–Harris administration), the US set a clear goal of deploying 500,000 publicly available EV chargers by 2030. While not exclusively intended for workplace use, a substantial portion is expected to be installed in locations such as office parks, retail centers, and multi-unit dwellings, including DC fast charging stations for higher throughput.

India can learn from the US by creating similar corporate challenge programs (to encourage Fortune 500 companies in India to pledge chargers at all their sites) and by providing financial incentives (tax breaks or subsidies) for workplace charger installation. The US experience also underlines the importance of reliable maintenance; many American firms partnered with charging network providers to ensure uptime, something Indian companies will need to emulate as they scale up internal charging facilities.

China

China’s approach to EV infrastructure is characterized by strong government mandates and rapid scale, offering a blueprint for India in policy enforcement. Notably, since 2022, China has had a national policy that all new residential communities and workplaces must have EV charging infrastructure built in. This kind of mandate, coupled with strict local implementation, ensured that new office buildings in China’s megacities come pre-equipped with a substantial number of charging points (or at least the electrical capacity and conduits to add them).

Moreover, China has deployed massive numbers of chargers. The country is expected to reach a total of 17.47 million EV charging points by the end of 2025, with around 4.66 million of those installed during that year alone. This expansion is intended to meet the rising demand for charging infrastructure as the country’s electric vehicle fleet approaches an estimated 40 million units. Many of these are in commercial and workplace parking lots, often installed with government subsidies or utility company support.

What can India adapt?

Firstly, a similar mandate in building codes nationwide. While India has guidelines for 20% EV-ready parking, making this a legally binding requirement with enforcement (as China did) would be impactful.

Secondly, China’s practice of empowering state-owned utilities to invest in charging has yielded results; India’s utilities could take a more proactive role in setting up workplace charging parks, possibly offering it as a service to large employers.

Finally, China’s tech infrastructure, common payment platforms (QR code payments via apps like Alipay/WeChat for any charger), and real-time status apps make using public/workplace chargers very convenient. Indian startups and DISCOMs can collaborate to ensure interoperability and user-friendliness, learning from Chinese platforms to strengthen EV charging infrastructure in India.

Norway

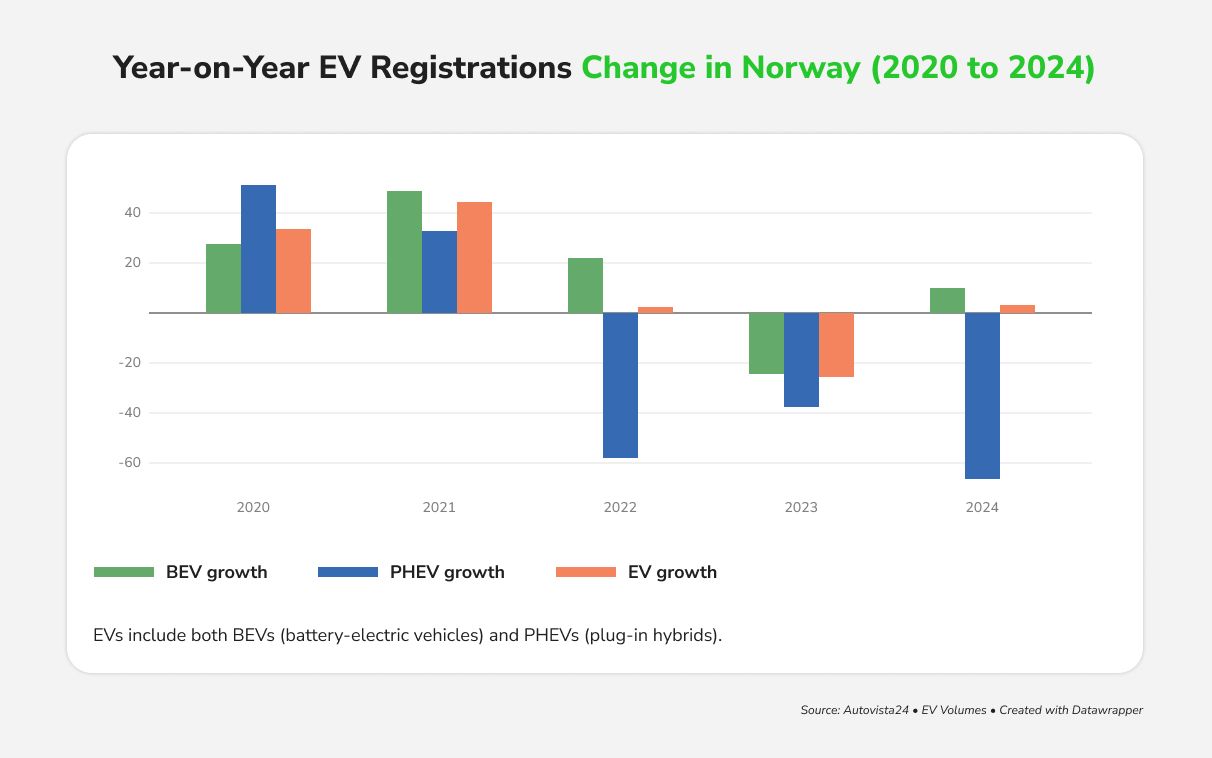

Norway continues to lead the world in electric vehicle adoption. In June 2025, EVs accounted for 96.9% of all new passenger car registrations, a milestone that signifies the country’s near-total transition to electric mobility. This record was surpassed in July, when EVs made up 97.2% of new car sales, reinforcing Norway’s position at the forefront of the global EV movement.

One key lesson from Norway is how comprehensive incentives and cultural support drive infrastructure naturally.

The Norwegian government made EV ownership extremely attractive (no purchase tax, no VAT, free tolls, etc.), which created consumer demand that in turn spurred workplaces to add chargers to accommodate employees. Many Norwegian companies provide free or very low-cost charging for staff as a perk, and thanks to government policy, this is often cost-neutral for both parties (for example, providing free workplace EV charging is not considered a taxable benefit in Norway up to a certain limit, similar to how India treats subsidized canteen meals). Norway also heavily invested public funds in charging infrastructure, ensuring even smaller towns and rural areas have good coverage.

The takeaway for India:

- Incentivize both end-users (employees) and providers (employers):

If India continues to increase demand-side incentives for EVs while simultaneously offering benefits to companies such as recognition, ESG score improvements, or financial perks for installing chargers, the market will organically drive much of the rollout.

- Invest in education and awareness campaigns:

Norway’s example shows that awareness matters. Government authorities and the Norwegian EV Association actively educated employers about the benefits of providing workplace charging, including environmental branding and improved employee satisfaction. Indian industry bodies can run similar campaigns to promote workplace charging as a smart business investment.

- Plan ahead for grid capacity in high-EV zones:

Norway’s grid foresight included upgrading transformers in areas with high EV density. Indian utilities should take note, especially in business districts likely to experience a surge in daytime charging demand.

Germany (and EU)

Germany provides a case of integrating EV charging into policy and corporate practice through a mix of regulations and incentives. On one hand, the EU’s building directives now require new and renovated non-residential buildings to have a minimum number of charging points (e.g., at least one charger for every 20 parking spaces, under the updated Energy Performance of Buildings Directive). This means German workplaces are increasingly pre-wired for EV charging from the construction phase.

On the other hand, Germany introduced a novel incentive: the tax exemption for employees for free charging at the workplace. Since 2017 (extended through 2030), if an employer offers free or discounted electricity for EV charging on-site, the employee does not incur it as a taxable fringe benefit.

This policy led many companies to offer free charging as part of their corporate sustainability programs without tax paperwork hassle. Additionally, Germany rolled out grants for companies to install chargers, especially for small and mid-sized enterprises.

For India, adopting a similar tax treatment could be a game-changer. Currently, if an Indian company provides free charging, there’s no specific tax guidance, but making it explicitly tax-free (or offering tax credits to employers) would remove any hesitation.

Germany also underscores standardization and safety. The government enacted a Charging Station Ordinance (2016) to ensure all public chargers have common connectors and safety standards.

As India’s network grows, focusing on common standards (Type-6/Type-7/Bharat/DC001/Type-2/CCS2 as default standards) will be vital to ensure any EV can plug in at any workplace or public station.

Moreover, Germany’s push for “roaming” between charging networks (so one subscription works everywhere) is a practice Indian networks can emulate via unified payment interfaces. In short, the EU/German experience teaches that a combination of regulatory requirements, smart incentives, and emphasis on interoperability can accelerate workplace EV charging deployment and support various EV charging business models.

In all these international cases, a recurring theme is that workplace EV charging is not just about technology; it’s about policy support and stakeholder buy-in. India stands to gain by adopting a hybrid of these approaches: encourage companies with incentives, mandate readiness in new buildings, and make it part of a broader cultural shift to EVs. By learning from these pioneers, India can leapfrog some challenges (such as charger underutilization or grid strain) and create a robust, future-proof workplace charging ecosystem.

Investment Potential and Market Size of Workplace EV Charging in India

The acceleration of charging infrastructure is a significant investment opportunity. The CEEW-CEF report (2020) estimated $2.9 billion for deploying public chargers by 2030 in the base scenario, covering hardware, installation, and grid upgrades. With scale projected to reach 2 million chargers, this number may rise.

Beyond chargers themselves, investments in grid infrastructure (distribution upgrades, transformers) and charging software will be important. India’s deployment has grown at approx. 120% CAGR, and industry analysts predict robust growth through 2030.

Moreover, strategic localization is underway. The CII-Edelman report noted that India has the potential to become a global manufacturing hub for EV charging stations and components.

Domestic companies are ramping up production of everything from charging kiosks to power electronics. For investors, this means opportunities across manufacturing, CPO services, and even renewable energy integration.

It’s worth noting that operational models are evolving rapidly. By 2030, many workplaces are expected to offer charging-as-a-service, specialized firms will install and operate chargers at offices, and employees or visitors will pay per use. This model is already taking hold, and it attracts investment into CPO startups that see revenue in kilowatt-hours dispensed rather than just hardware sales.

For investors and stakeholders in the EV charging industry, the coming years represent a period of rapid boom, like telecom towers in the 2000s or solar farms in the 2010s.

With over a million chargers forecasted and billions in investments required, opportunities span hardware manufacturing, software platforms, CPO services, and infrastructure financing. Importantly, the ecosystem is likely to remain data-driven with metrics like utilization rates, energy management, and ROI shaping strategies. We can expect innovative business models, such as energy companies partnering with real estate developers to integrate charging in commercial leases, or startups delivering end-to-end EV charging solutions for office parks (installation, software, and even renewable energy integration).

Strategic investors should actively evaluate supply chain partnerships, from smart EV switchgear makers to aggregators enabling grid services.

Business Models and ROI for Workplace Charging

Installing EV chargers is one thing; making them financially and operationally viable is another. Here we explore business models, monetization strategies, and return on investment (ROI) for employers and building managers:

Monetization & Pricing Models

Many companies face the question: should we offer charging for free or charge a fee? Globally, around 80% of workplaces that provide EV charging have offered it free to employees, treating it as an employee amenity like free parking. Free charging can significantly incentivize EV adoption, but it also incurs electricity costs. Some Indian companies initially offer free or heavily subsidized charging as a pilot, then move to a paid model once usage grows.

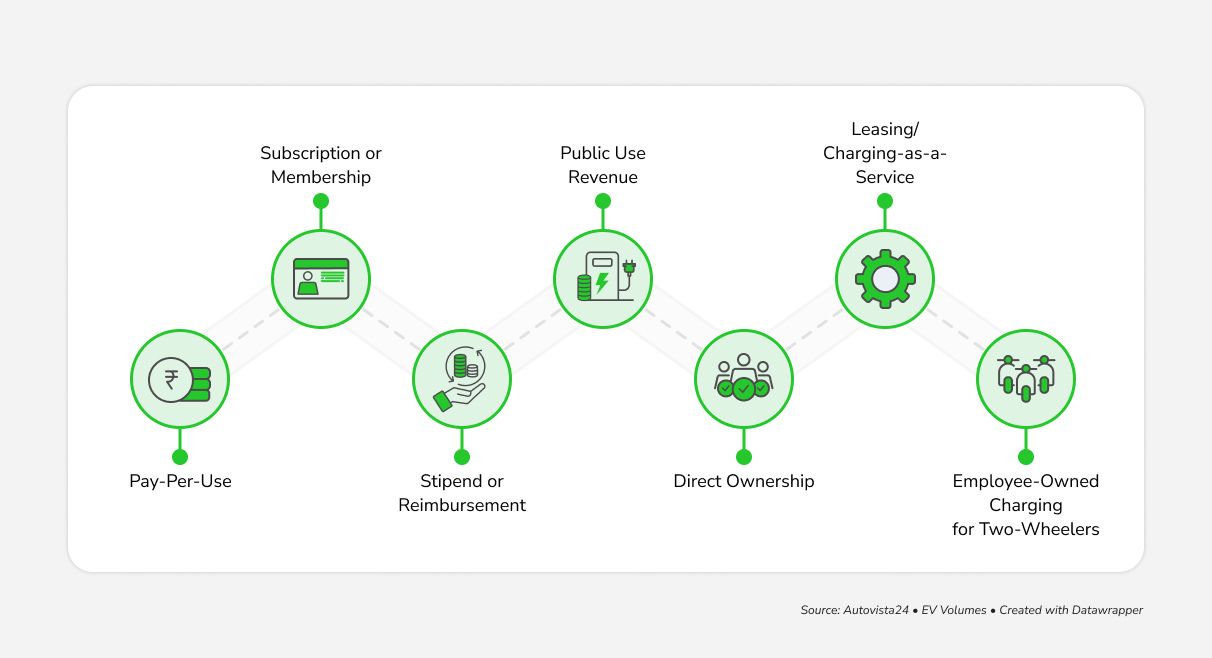

Common pricing models include:

- Pay-per-use: Charging the employee or fleet driver per kWh consumed or per hour. In India, typical rates are ₹10–20 per kWh for paid charging. Employers might charge at cost or include a small margin to cover maintenance.

- Subscription or Membership: Employees pay a monthly fee for unlimited or discounted charging at work. This provides cost certainty and encourages regular use.

- Stipend or Reimbursement: Conversely, some companies give EV-driving employees a monthly charging stipend (especially if charging is done on personal electricity at home). This can be an incentive baked into salary/benefits.

- Public Use Revenue: An emerging model is to open workplace chargers to the public or visitors for a fee during off-hours. For example, a company may allow its chargers to be used by the public on weekends and bill them via a mobile app. This can generate a small revenue stream and improve overall utilization.

Ownership vs. Service Models

Organizations can either invest in owning the charging infrastructure or leverage third-party services:

- Direct Ownership: The company purchases and installs chargers and either provides electricity free or handles billing internally. This gives maximum control and allows the company to capitalize on any government incentives like depreciation benefits or subsidies on chargers. Capital costs for a basic setup, say 5–10 AC chargers, might range from ₹5–10 lakhs, including installation and electrical upgrades.

- Leasing/Charging-as-a-Service: EV charging providers offer turnkey solutions where they install and operate chargers at your site at little or no upfront cost in return for a service fee or revenue share. For instance, a provider might install chargers in an office parking lot and charge users per kWh, sharing a percentage with the site owner. This Public-Private Partnership (PPP) approach reduces risk to the employer. Several Indian startups and energy companies are active in this space, often proposing revenue-sharing models or fixed-service fees to workplaces.

- Employee-Owned Charging for Two-Wheelers: In Bengaluru’s IT parks, a simple and cost-effective model is gaining traction: employers provide basic 3-pin, 3.3 kW charging sockets in parking areas, and employees use their own portable chargers, typically bundled with their electric two-wheelers. This approach requires minimal infrastructure, avoids the complexity of smart chargers, and allows companies to recover costs through a nominal usage fee. It’s a practical way to support EV adoption without heavy investment, especially for large campuses with high two-wheeler traffic.

Return on Investment (ROI)

Workplace charging can be measured in both direct financial terms and indirect benefits:

- Direct ROI: Charging stations can generate revenue when offered as a paid service. For example, at ₹15/kWh and an average of 4 kWh dispensed per workday, one Level-2 charger could earn approx. ₹1,200 per month. With higher utilization, revenue scales up. One analysis projected a ₹2.95 million public charging investment yielding ₹1.7 million net profit over 5 years, with utilization rising from 15% to 65%. While office chargers operate at a smaller scale, employers can still break even within a few years.

- Intangible ROI: Many companies adopt workplace charging for its indirect returns. Better ESG and sustainability scores improve brand image and stakeholder relations. It also supports employee retention; eco-conscious professionals value green workplace initiatives. Additionally, reduction in commute-related CO₂ emissions can contribute towards ESG reporting. Some firms even include avoided emissions from employee EV usage in sustainability reports.

- Tax and Incentives: The Indian government has begun offering incentives for charging infrastructure. For example, some states provide capital subsidies (up to 50–100% of charger cost) for installations in workplaces or public spaces. There are also tax benefits: under income tax rules, businesses can claim accelerated depreciation on EV charging equipment, lowering taxable income. Any GST reduction on EV chargers (currently 5% GST) and schemes like the Fame-II subsidies for charging stations also improve ROI. Employers can thus take advantage of these policies to reduce upfront costs, shortening the payback period.

Public-Private Partnerships & Service Models

In India, new partnership models are emerging to fund and operate charging networks:

- Some city governments and utilities are inviting PPP models where private operators install chargers on public or commercial premises in exchange for land lease or advertising rights. Workplaces can tie into these programs to host chargers without owning them.

- Energy companies have inked Memorandums of Understanding (MoUs) with large firms and real estate developers to deploy charging points at offices, malls, and highways. For example, bp (British Petroleum) and Infosys announced a collaboration to provide Energy-as-a-Service on Infosys campuses, integrating solar power, EV charging, and battery storage on a digital platform. Such partnerships bring expertise and capital from energy companies to create smarter charging ecosystems on campuses.

- Fleet operators and logistics companies often work with charging providers to set up depot infrastructure. A notable trend is companies like Amazon and Flipkart partnering with charging specialists (Flipkart with Adani, Amazon India with Gentari) to roll out charging hubs for their delivery fleets. These hubs may serve multiple fleet owners in the area, effectively acting as multi-client charging depots.

Pricing Strategies and Cost Management

To ensure a sustainable operation, building managers consider:

- Time-of-Day Pricing: Incentivizing employees to charge at certain times, like encouraging daytime charging when solar power is abundant and rates are low. If an office has solar panels, midday charging might even be free or discounted to utilize surplus generation.

- Demand Charge Management: For commercial electricity tariffs, high peak demand (kW) can incur hefty charges. Smart charging systems can stagger charging to avoid spiking the building’s load (discussed more under Technology Trends). This protects the facility’s electricity bills and improves ROI by minimizing demand charges.

- Maintenance and Reliability: A charger that is frequently down for maintenance loses revenue and frustrates users. Many opt for annual maintenance contracts (AMC) or choose units with remote monitoring to ensure high uptime. Some providers include maintenance in a service model, which can be cost-effective.

- Scaling vs. Stranding: There is a fine balance in how many chargers to install. Installing too few leads to queuing and unhappy users; too many can mean underutilized assets. Companies often start with a pilot (a handful of chargers) and expand as EV adoption among employees rises. The modular nature of charging, like adding ports as needed, helps manage capital efficiently. Additionally, installing conduit and panel capacity for future chargers during initial setup (when civil work is done) significantly lowers cost for expansion, a practice recommended in building guidelines.

Final Thoughts

Global markets have shown that workplace EV charging succeeds when policy, private enterprise, and user behavior align. From China’s mandates to Norway’s cultural momentum and the US’s corporate-led adoption, the path is clear: create incentives, build trust, and ensure ease of use. But the real opportunity lies in India’s ability to leapfrog, to design scalable, smart, and sustainable models that are rooted in its unique economic and infrastructural context. With the right blend of mandates, partnerships, and business innovation, India can unlock a trillion-rupee opportunity in workplace EV charging and take a decisive step toward its electric future.

Feb 27, 2026 • EV Technology and Trends

Renewable Energy and EV Charging in India: Technical Integration [+ Challenges]

Read More