India’s EV Charging Infrastructure Policy 2025: Impact on CPOs and OEMs

Raghav Bharadwaj

Chief Executive Officer

Published on:

28 Nov, 2025

Updated on:

11 Feb, 2026

By 2025, domestic EV sales reached approximately 2.5 million units, and the government targets approximately 30% of all new vehicle sales to be electric by 2030.

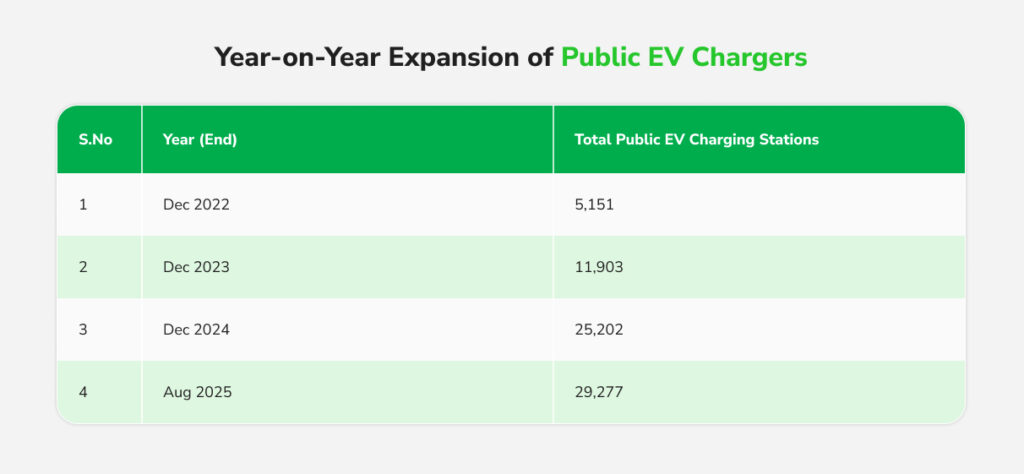

To sustain this growth, the charging infrastructure has become a national priority. Installation of public EV charging stations in India expanded from 5,151 stations in Dec 2022 to 25,202 by Dec 2024, and approximately 29,300 by Aug 2025.

However, density remains low relative to EV adoption. Policymakers have therefore updated guidelines, incentives, and regulations to build infrastructure for all segments while ensuring business viability.

In this blog, we explore:

1. What India’s new EV Charging Infrastructure Policy changes in practice

2. How these policy shifts impact the profitability, expansion strategy, and technology roadmap of Charge Point Operators (CPOs)

3. What EV OEMs must do to stay compliant and competitive

Central Government Initiatives

Revised MoP Charging Guidelines

In Sep 2024, the Ministry of Power issued fresh “Guidelines for Installation and Operation of EV Charging Infrastructure – 2024”, revising standards, safety, and siting norms. Key changes include mandating chargers at workplaces, residential complexes, bus depots, and public hubs. EV charging is now declared an “unlicensed” activity, with emphasis on EV charging network interoperability via open protocols (OCPP/OCPI) and unified roaming apps. In Jan 2025, MoP also released India’s first guidelines for battery swapping stations, detailing technical standards for interoperable swap bays. Together, these reforms aim to make charging safer, more accessible, and commercially sustainable.

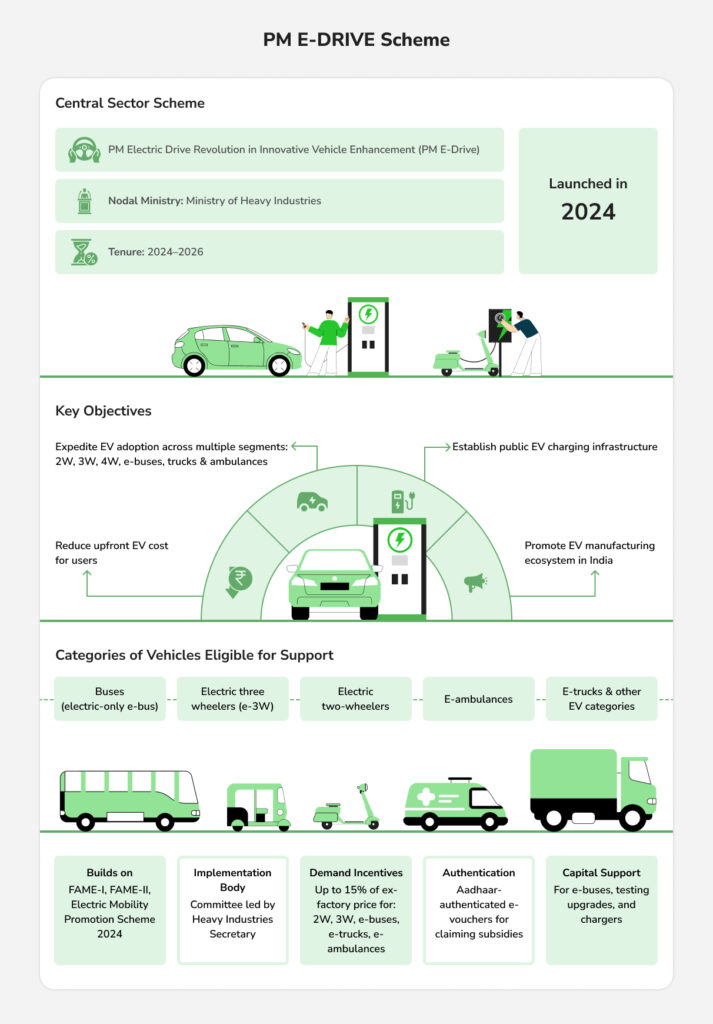

PM E-DRIVE Scheme

The PM-Electric Drive Revolution in Innovative Vehicle Enhancement (E-DRIVE) scheme (notified Sep 2024) allocates ₹10,900 crore for FY2024–26 to boost EV demand and infrastructure. Of this, ₹2,000 cr is earmarked for public charging stations. The government plans to deploy approximately 72,000 fast chargers across highways and urban sites by FY25–26 and co-fund depot chargers for e-buses and fleets. The scheme also supports consumer subsidies and ₹4,391 cr for 14,028 e-buses. In sum, PM E-DRIVE provides large-scale funding and a national mandate to expand commercial EV charging stations quickly.

Revamped Distribution Scheme (RDSS)

The Revamped Distribution Sector Scheme encourages state DISCOMs to invest in EV charging. New guidelines allow DISCOMs to use RDSS funds for public charging connectivity and grid reinforcement.

States/DISCOMs/SERCs are urged to incentivize EV charger rollout and incorporate charging obligations in grid planning.

Urban Mobility

The Ministry of Housing & Urban Affairs (MoHUA) approved the PM e-Bus Sewa scheme (2023) to electrify city bus fleets with 10,000 buses on PPP, supported by ₹20,000 cr. This will create strong demand for depots and en-route charging for urban mass transit. MoHUA and MoP (Ministry of Power) are also encouraging cities to integrate chargers in parking lots, metro stations, and street hubs. Model building bye-laws (amended 2019) require major developments to allot space for EV charging.

Regulatory Changes Impacting CPOs and OEMs

Recent rule changes affect how CPOs operate and how OEMs plan networks:

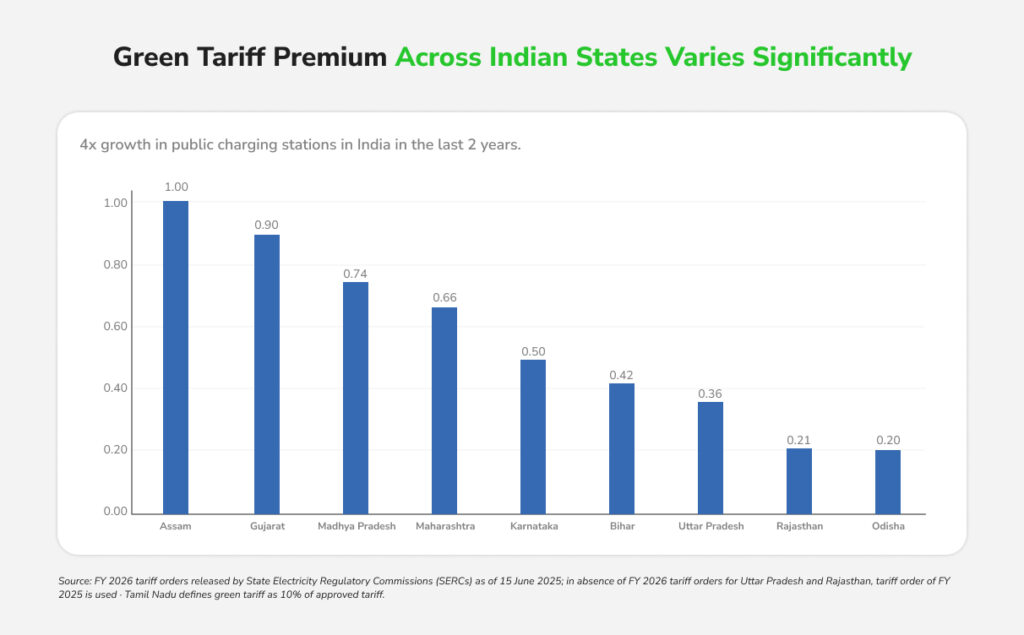

Time-of-Day Tariffs (ToD)

Some states introduced ToD pricing to shift charging to daytime solar hours. Tamil Nadu pioneered ToD in 2023, cutting midday rates by ~50%. However, its latest tariff order (Jul 2025) raised rates across all periods (solar ₹6.50/kWh, peak ₹9.75) and doubled fixed charges on high-tension connections. Operators warn this 20% hike erodes earlier cost advantages. Other states (e.g., Karnataka) maintain cheaper midnight rates. Tiered tariffs reward solar-time charging but penalize low-utilization sites via high fixed fees, squeezing CPO margins. CPOs must therefore optimize charging schedules (e.g., offer discounts off-peak) and may need to invest in on-site solar or storage.

Land and Zoning Mandates

Urban building codes increasingly require EV charging readiness. Delhi’s rules (2020) were updated so major developments must reserve EV-ready parking. Maharashtra, Karnataka, and others have inserted similar clauses. These mandates give CPOs predictable demand (e.g., malls and offices must allot charging spaces) and encourage OEMs to ensure dealer showrooms are EV-ready. Land allotment schemes are also emerging for charger parks.

Interoperability Standards

The government emphasizes a standardized, interoperable network. All new public chargers must support open communication protocols (OCPP for charging backend, OCPI for roaming) and UPI-based payments. This fosters EV roaming: drivers can plug in to any network using one app or RFID. When multiple CPOs joined a common roaming platform in 2023, charger utilization jumped from <10% to over 20%. Compliance with national protocol mandates is therefore essential for CPOs, and OEMs must equip vehicles with standard connectors (Type-2/CCS2 for cars and Bharat DC-001/Type-4 for two-wheelers).

Other Technical Mandates

Safety and quality standards (CE/IS certifications, surge protection, secure payments) have been tightened. The CEA has added electrical safety requirements for EVSE. In the future, grid codes may require smart charging features (V2X-readiness, load management) to support grid stability. OEMs must coordinate vehicle-charger compatibility (e.g., ISO15118/BMS standards).

Implications for Charge Point Operators (CPOs)

CPOs stand to benefit from these policies but also face new challenges:

Subsidies and Funding

Central and state grants lower CAPEX for public and depot chargers. Unlicensed status and expedited permissions speed up rollout. Participation in schemes like PM E-DRIVE provides direct reimbursements.

Regulatory Costs

Higher DISCOM tariffs raise OPEX. Low utilization of public chargers means steep fixed charges hit profitability unless offset by subsidies or dynamic pricing. CPOs must optimize placement (high-demand locations) and consider bundled services to improve throughput.

Standards Compliance

Meeting interoperability and safety standards adds complexity. CPOs must ensure all new chargers are OCPP-compliant and join national roaming platforms. Legacy stations may need upgrades.

Market Opportunities

Residential and workplace charging are now covered in MoP guidelines, opening new revenue streams. Public-private partnerships are now more attractive with co-funding available. Highway and city charging corridors offer scale, especially for commercial EV charging stations. Retail partnerships are encouraged by state incentives.

Strategic Alignment

CPOs must align rollout plans with OEM sales and fleet electrification. As more EVs hit the roads, OEMs will demand robust charging access to reassure buyers. Savvy CPOs will partner with OEMs on service networks (e.g., providing chargers at dealerships or fleet depots). Many OEMs are already entering the CPO space or partnering with other CPOs to ensure customer access.

Implications for EV OEMs

Original Equipment Manufacturers (OEMs) likewise feel the policy effects:

Demand Stimulation

Policy support (subsidies, mandates, infrastructure funding) reduces range anxiety and total cost of ownership, boosting EV sales, which is the OEMs’ primary goal. A denser EV charging network makes it easier for consumers to choose EVs, enabling OEMs to accelerate EV model launches.

Technical Coordination

OEMs must ensure their vehicles are compatible with mandated standards (CCS2, Bharat DC-001, ISO15118). The push for interoperability means OEMs should also prioritize OCPP & OCPI compliance in India when collaborating with CPOs, ensuring seamless integration across networks.

Network Partnerships

Many OEMs are investing in charging networks (e.g., Tata Motors with Tata Power; MG has partnered to roll out DC chargers; Hero MotoCorp’s Ather with Uber to install bike chargers). Policies encourage such tie-ups. OEMs should seek alliances with CPOs (or become CPOs themselves) to enhance brand value and customer retention.

Product Planning

OEMs will time vehicle launches with infrastructure milestones. Entry-level e-2Ws/3Ws rely on home-charging incentives, while cars follow fast-charger expansion.

Fleet Segment

OEMs supplying buses, trucks, and specialized EVs (ambulances, tractors) must coordinate with cities and operators to co-develop depot charging layouts. Government procurement under the E-DRIVE creates large opportunities.

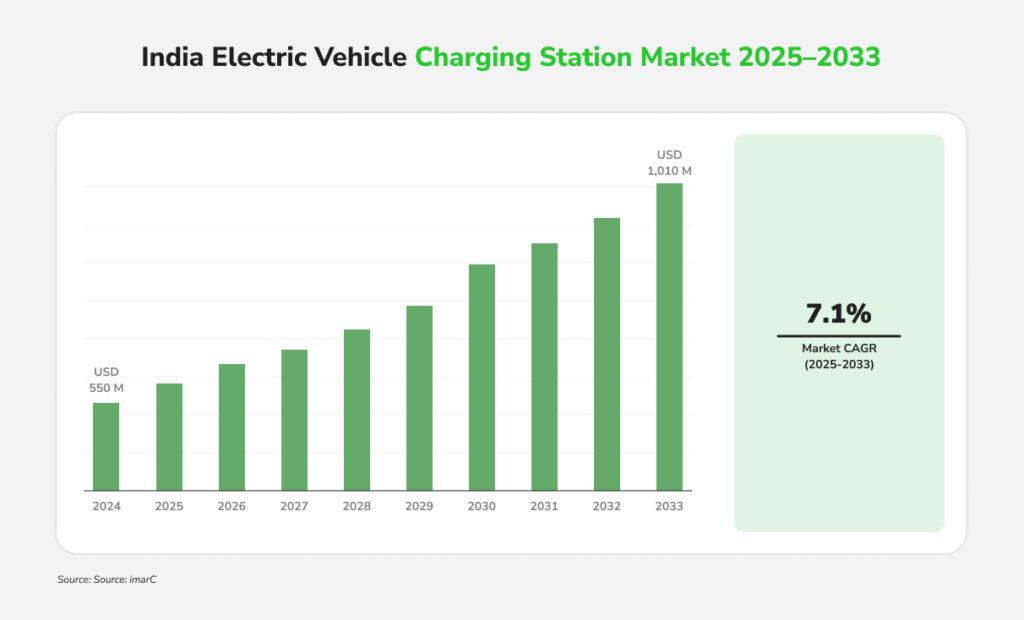

Outlook and Actionable Insights

The 2024–25 policy wave signals that EV charging is now a national infrastructure priority. For senior decision‑makers, the imperative is twofold: execute on current incentives and prepare for the next phase. Key takeaways include:

- Integrate planning across stakeholders. Governments should synchronize EV sales targets with charging rollout, for example, creating dedicated EV cells in states and coordinating DISCOMs’ infrastructure plans with urban development authorities, and enforcing land-use mandates.

- Leverage subsidies wisely. CPOs and real estate developers should tap central and state grants now, before funds lapse, and invest in data analytics to site chargers optimally. Utilities (DISCOMs) can use RDSS funds to upgrade networks for high-demand sites and shape ToD tariffs to smooth demand curves.

- Adopt open standards. Both CPOs and OEMs must ensure compliance with OCPP and OCPI in India to support unified payment systems and roaming. Such interoperability will ultimately raise charger utilization (as real-world pilots have shown).

- Monitor evolving regulations. Tariff changes highlight the need for CPOs to engage with regulators actively. Likewise, OEMs must remain agile in adapting to local charging infrastructure rules such as new EV parking requirements.

- Plan for scale and future tech. With the government’s 2030 vision, OEMs and CPOs should prepare for higher EV volumes, faster chargers, and emerging models like wireless charging or integrated solar and storage at charging hubs.

Final Thoughts

India’s 2025 EV charging infrastructure policy measures have laid the groundwork for commercial EV charging stations in India. For CPOs, this means new funding streams and clearer norms, but also higher standards and competition. For OEMs, it promises greater EV uptake and responsibilities in infrastructure integration. By acting swiftly, building chargers in tandem with vehicle rollouts, engaging in partnerships, and managing regulatory risks, industry stakeholders can ensure India’s EV revolution is fully charged for the future.

Frequently Asked Questions

How will higher DISCOM tariffs impact EV charging prices for end users in 2025–2026?

Where ToD tariffs increased, CPOs may pass on 10–20% higher charging prices during peak hours. Many are shifting to time-based discounts, solar-hour deals, or subscription models to protect affordability.

How should OEMs prepare for interoperability mandates like OCPP, OCPI and unified payments?

OEMs must ensure vehicles use standard connectors (Type-6/Type-7/CCS2/Type-2/Type-4) and support communication layers like ISO 15118. Backend teams must align with CPO partners using OCPP 1.6/2.0.1 and enable UPI-ready payment APIs for India-wide roaming.

What are the best locations for new charging stations in 2025–2030?

Based on demand analytics across India:

- High-footfall urban hubs (malls, offices, tech parks)

- National highways with 24/7 amenities

- Large housing societies (supported by MoP mandates)

- Fleet depots (e-bus, e-cargo, ride-hail)

- Metro stations and transport hubs

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More