Navigating the Dynamic EV Landscape and Market in Singapore

Raghav Bharadwaj

Chief Executive Officer

Published on:

31 Jul, 2023

Updated on:

24 Nov, 2025

Electric vehicles (EVs) not only benefit the environment, reduce pollution, and promote energy security, but also create significant economic opportunities. Singapore is committed to reaping all of these rewards by fostering the EV industry’s immense potential.

Due to its small size, high cost of labor, and limited resources, Singapore is unlikely to become a manufacturing hub like Thailand or Indonesia. However, the city-state can still leapfrog in the electrification journey by establishing itself as a research and development epicenter for Southeast Asia’s EV industry.

Furthermore, although Singapore’s EV adoption rate for private vehicles remains low, introducing attractive incentives and implementing a strong public charging infrastructure could help to boost future demand.

This article will explore Singapore’s EV landscape. In particular, it will address the following questions:

- Who are the major players in Singapore’s EV industry, and what role do they play in the EV market’s evolution?

- How are the Singaporean government and private sector promoting EV usage?

- What are the challenges and opportunities for EV adoption in Singapore?

Current State of Singapore’s EV Market

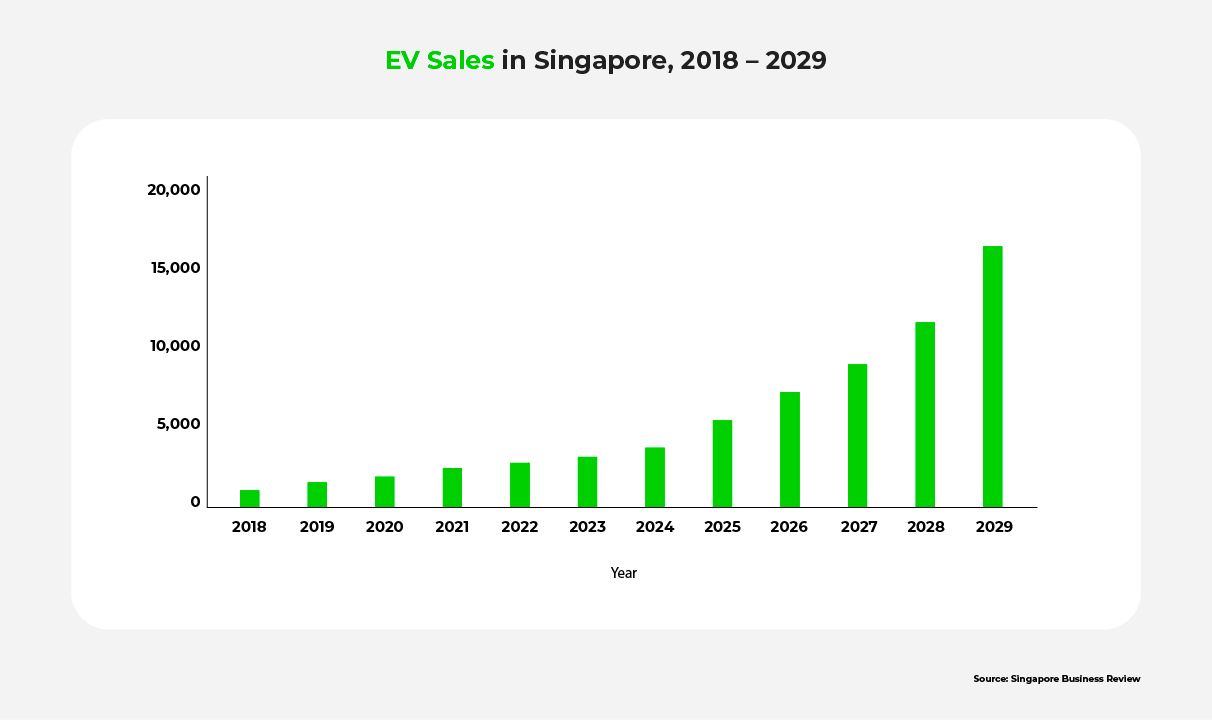

According to the Land Transport Authority (LTA), EVs comprised almost 12% of 2022’s car sales in Singapore, up from almost 4% in 2021. The trend is continuing: 13.26% of cars sold during the first quarter of 2023 were EVs (including plug-in and battery-electric cars).

The overwhelming majority of vehicles in Singapore are four-wheelers; two- and three-wheelers account for only about 10% of all vehicles. Accordingly, the rate of electrification for two- and three-wheelers remains low, whereas the number of hybrid and electric four-wheelers in the car, taxi, and goods vehicle segments is increasing.

In the interest of phasing out internal combustion engine (ICE) vehicles by 2040, several stakeholders in Singapore, including OEMs, fleet managers, and governmental entities, are working together to accelerate the EV adoption rate. The next section will discuss the various stakeholders involved.

Major Players in Singapore’s Four-Wheeler Market

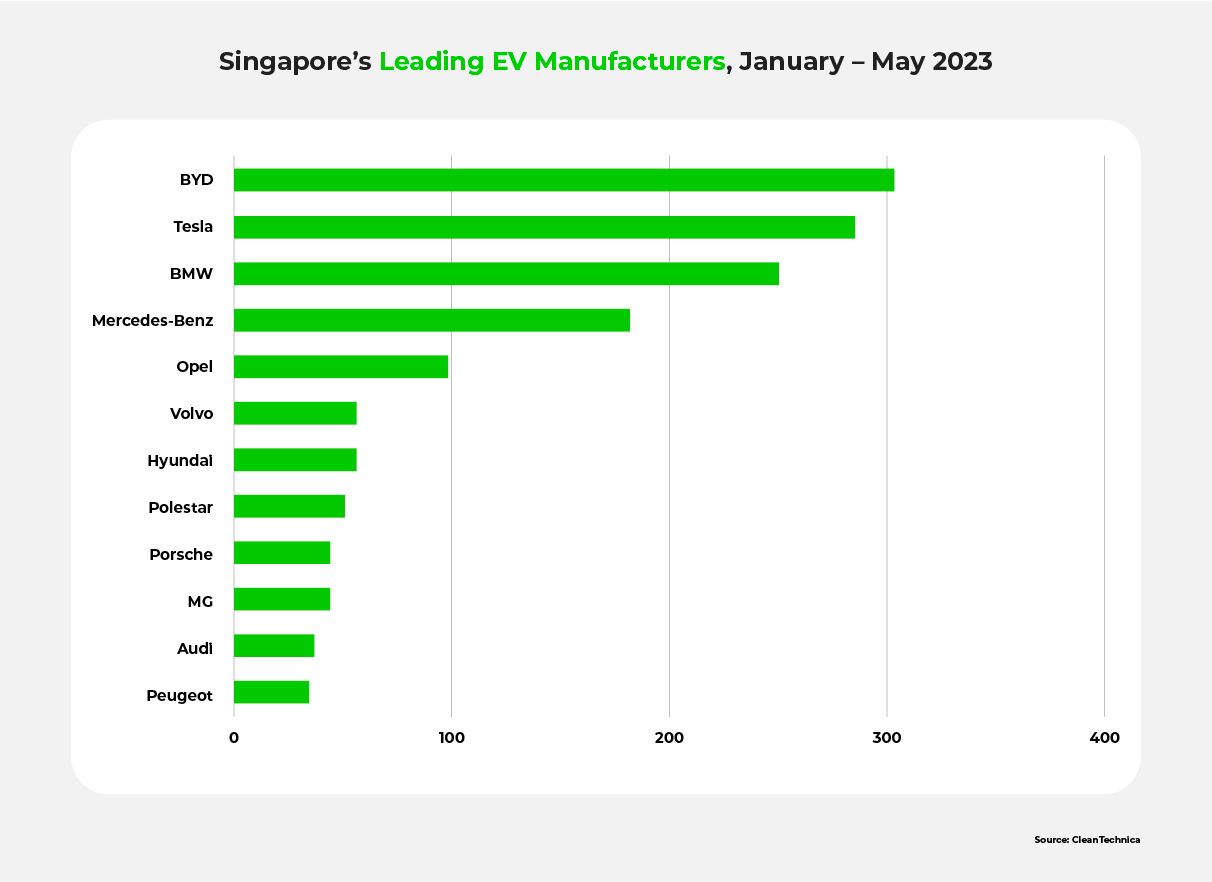

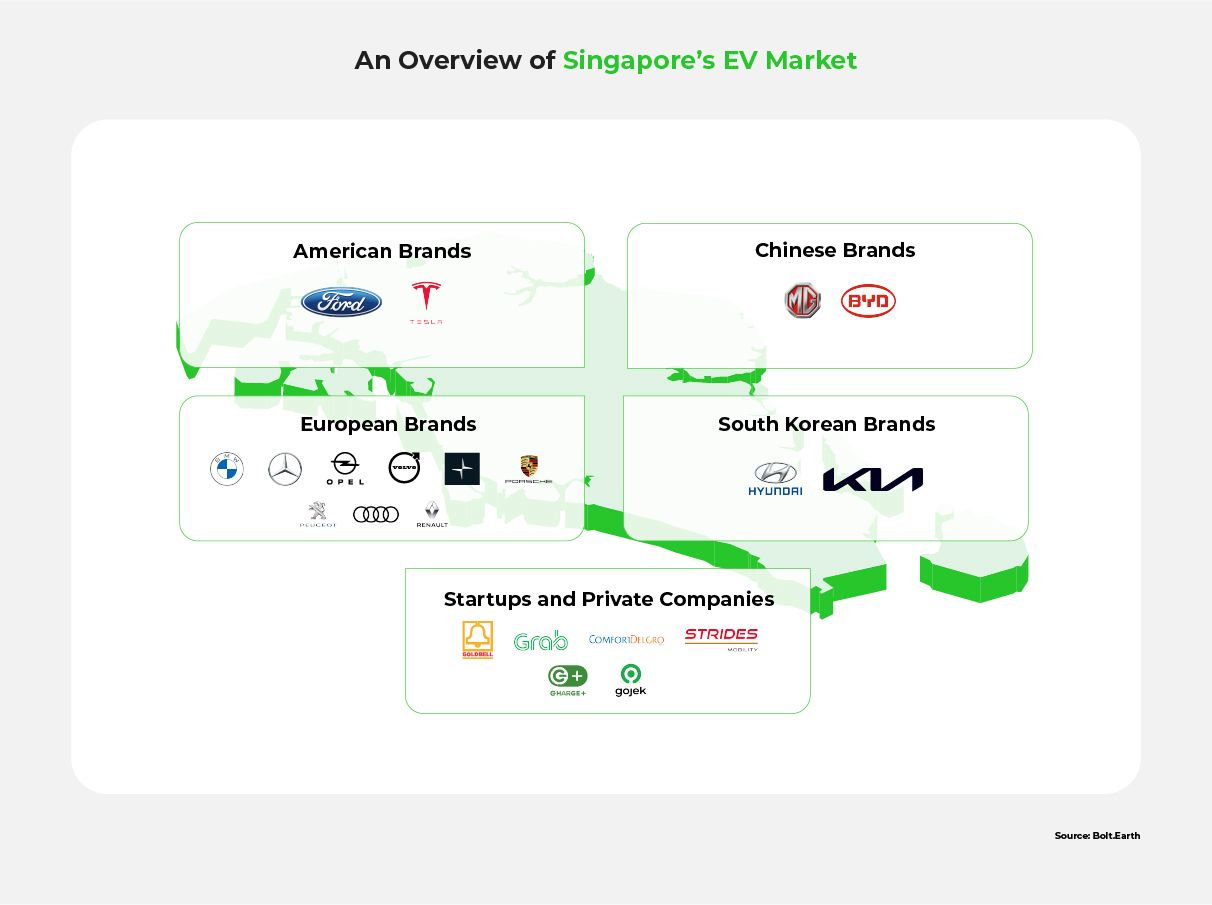

Leading OEMs, such as BYD, Tesla, Bluecar, Hyundai, Renault, MG, Nissan, Volvo, BMW, Kia, Audi, Porsche, Polestar, Mercedes, Honda, and Ford, offer low-emission cars in Singapore. BYD, Tesla, and Bluecar manufacture only battery electric vehicles, while the rest of the automakers also offer ICE, mild-hybrid, and strong-hybrid vehicles.

According to the latest data from Singapore’s LTA, BYD dominates the EV market; with 303 registrations in the first half of 2023 alone, they command 20.7% of the market.

For nearly a decade, BYD has made significant contributions to Singapore’s new energy vehicle market. Their 7+4 Full Market Strategy aligns with the government’s commitment to green mass transit. Their range of products initially comprised taxis, buses, trucks, forklifts, and fleet vehicles, but in July of 2022, they leveraged their strong brand presence to introduce the popular ATTO 3-passenger vehicle model. With control over the entire supply chain and expertise in lithium battery production, BYD delivers electric vehicles at competitive prices, even supplying batteries to competitors like Tesla.

Tesla’s sales soared in 2021 when Model 3 was launched to the public in Singapore, at substantially lower prices than imported European and East Asian brands offer. The allure of a luxury brand name coupled with an attractive price point has become a driving force in shaping the market.

Other brands are also making efforts to establish a presence in Singapore’s EV market. For example, Hyundai is building the Hyundai Motor Group Innovation Center in Singapore (HMGICS), an R&D center and small-scale production facility which will help forge a new supply chain by manufacturing up to 30,000 vehicles.

Major EV Fleets

Fleets also play a crucial role in the transportation sector. Under the Land Transport Master Plan 2040, Singapore’s taxi and private hire car companies are actively embracing EVs to contribute to a more sustainable transportation future; they have committed to fully transitioning to cleaner energy by 2040. At least half of the total taxi fleet will go electric by 2030.

Here’s how various fleet companies in Singapore are adopting EVs:

Blue SG Car-sharing Service launched in 2017, and is owned by Goldbell Group. It offers 100% electric Bluecar vehicles at self-service charging stations in 500 locations across Singapore.

ComfortDelGro Taxi is Singapore’s leading taxi operator. It aims to introduce up to 400 electric taxis by the end of 2022, and increase the EV fleet to 1,000 taxis by 2023.

Strides Mobility plans to electrify its entire taxi fleet within the next five years, starting with 300 electric taxis arriving progressively from July 2021 onwards.

Tribecar plans to electrify its fleet of rental cars, in collaboration with Charge+. It has not indicated a specific timeframe for EV adoption.

Grab aims to electrify 100% of its ride-hailing fleet and 50% of its private hire cars (GrabRentals) by 2030.

SingPost, Singapore’s postal service provider, is introducing electric three-wheeler scooters and vans, and plans to electrify all of its motorcycles, scooters, and vans by 2026.

Ninjavan, a logistics company, initiated an EV pilot trial in October 2022, starting with 10 electric vehicles before considering a larger-scale roll-out.

GoJek aims to operate a fully electric fleet by 2030, and has joined Singapore’s Electric Vehicle Accelerator (EVA) program for emission reductions.

Government Incentives & National EV Targets

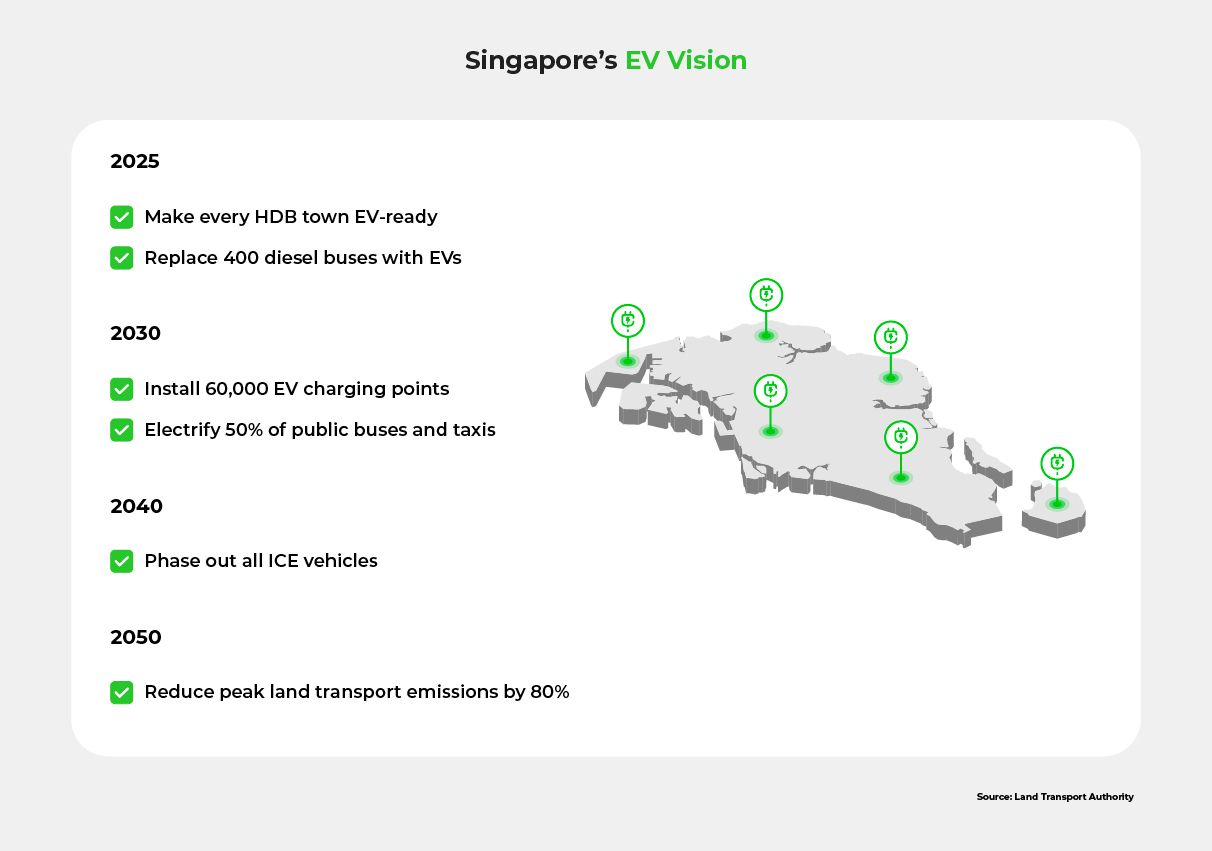

Singapore’s ambitious goal to reduce land transport emissions by 80% from the 2016 peak is achievable through initiatives like electrification, active mobility, and public transport. Switching from ICE to EVs can cut CO2 emissions by 50% and significantly contribute to national sustainability targets.

Accordingly, the Singaporean government has developed systematic regulations and incentives to increase EV adoption.

Singapore’s EV Vision

Singapore’s government is committed to phasing out ICE vehicles and electrifying the transportation sector by 2040. Their plan includes promoting EV adoption, bolstering charging infrastructure, and promoting environmental health in both the private and public transportation sectors. For example, Singapore aims to establish 60,000 EV charging points — 40,000 in public car parks, and 20,000 on private premises — by 2030.

EV Incentives

Such ambitious goals require government incentives and support. Accordingly, Singapore has adopted a three-pronged approach involving tax incentives, regulations and standards, and EV charger deployment. Tax incentives mainly serve to stimulate demand by incentivizing the use of eco-friendly vehicles. Meanwhile, charging regulations and standards, along with government pilot projects to install charging points, function as instruments to facilitate the supply of EVs. As all of these initiatives demonstrate, Singapore is determined to hasten EV adoption.

Tax incentives

The government has implemented several measures to lower the cost of purchasing and operating an electric vehicle.

● EV Early Adoption Incentive (EEAI), until December 2023: 45% Additional Registration Fee (ARF) rebate of up to $20,000, reducing the upfront investment.

● Enhanced Vehicular Emissions Scheme (VES), until December 2025: increased rebates of $5,000 for cars, and $7,500 for taxis.

● Additional Registration Fee (ARF) floor reduction, until December 2023: $0 ARF for electric cars and taxis, and combined rebates of up to $45,000.

● Road tax reduction, from January 2022: Up to 34% reduction for electric cars, aligning with internal combustion engine equivalents.

Regulations and standards

Clear regulations and national charging standard TR25 empower the LTA to promote and regulate EVs, ensuring alignment with best practices.

EV charger deployment

In September of 2021, Singapore’s Urban Redevelopment Authority (URA) and LTA awarded a pilot tender for 600+ EV charging points in public car parks. Additional tenders and the EV Common Charger Grant promote charger deployment in private residences.

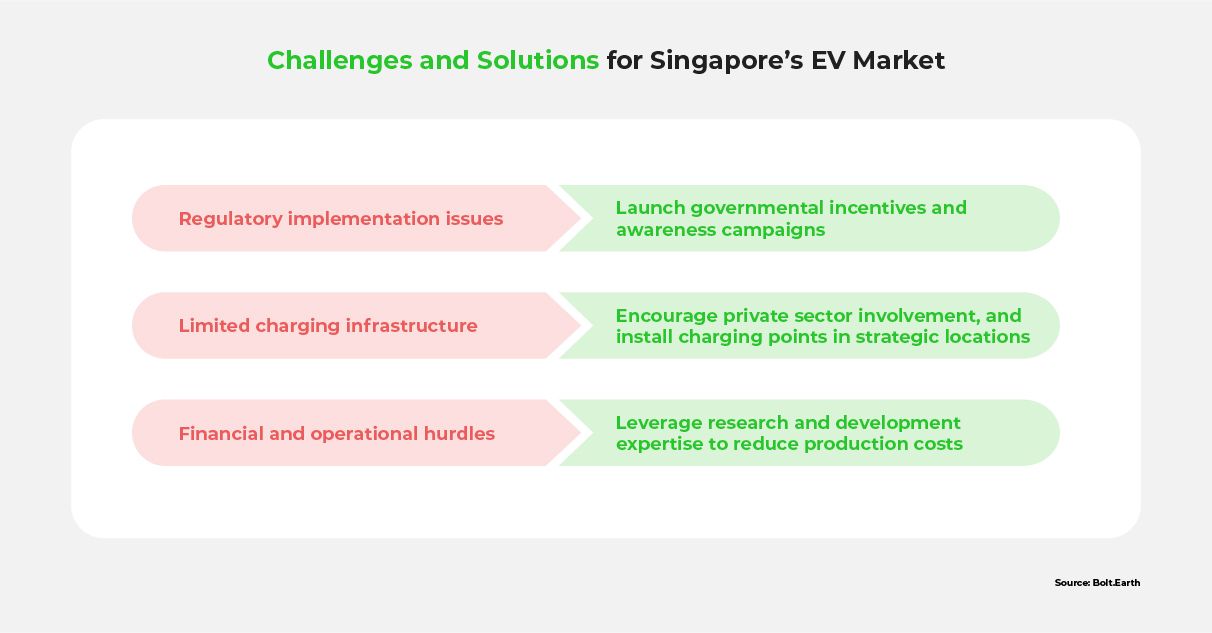

Potential Challenges in the Singaporean EV Market

Singapore has made substantial progress but is still far from achieving its electrification goals. An overwhelming 97% of the private vehicles on Singapore’s roads are ICE vehicles. This is due to multiple significant challenges within Singapore’s EV ecosystem.

Regulatory Implementation Issues

Governmental tax incentives and grants for EVs and charging have provided Singapore’s market with early momentum. But these policies are struggling to achieve long-term implementation.

Subsidies like EEAI and VES will only be available until 2025; the government has not proposed new policies to support further market growth after that point.

Furthermore, although the current policies successfully mitigate consumers’ cost concerns, they largely disregard the other major obstacle to EV adoption in Singapore: range anxiety. This is difficult to remedy simply through regulations since addressing it requires fostering a widespread societal mindset shift. As a result, policymakers must turn their attention to more creative solutions.

Singapore’s ambitious goal of phasing out ICE vehicles brings its own set of challenges. For example, it requires the government to create and implement regulations to overcome obstacles specific to fleets, such as limited EV models, high costs, impractical charging times, and a weak second-hand market.

Limited Charging Infrastructure

Singapore’s underdeveloped charging infrastructure and limited distribution of charging stations present another major obstacle to EV adoption.

An overwhelming 80% of residents live in non-landed public housing, which does not typically contain EV charging stations, and are therefore effectively precluded from EV ownership.

Furthermore, as the charging network expands, the electric grid may require upgrades to meet increased demand. This is particularly problematic because Singapore has only one entity operating the national grid.

Financial and Operational Hurdles

In Singapore’s current market, EVs are not a financially viable option for many consumers. Although pricing varies to some extent, EVs tend to be significantly more expensive than ICE vehicles, due to the high cost of electrical components like batteries and motors.

Furthermore, mass production of petrol-powered cars lowers costs, whereas the lower demand for EVs renders them more expensive to manufacture. Commercial fleet adoption of EVs is particularly affected by limited availability and exorbitant upfront costs. Long charging times also impact operational efficiency.

Overcoming these hurdles requires collaboration and innovation among industry players, policymakers, and stakeholders.

Solutions for Future Growth

To achieve widespread EV adoption, Singapore must address these challenges head-on. Implementing supportive policies, improving charging infrastructure, and reducing price disparities are vital steps towards fostering a more favorable environment for EVs.

Governmental Support and Campaigns

To take the next step towards its electrification goals, Singapore should focus on policies involving sustainability and implementation.

For example, Singapore can increase demand for EVs by making them more affordable, via incentives such as road tax rebates and COE discounts. Singapore can further encourage EV adoption among private consumers by launching public awareness campaigns to correct misconceptions about EVs, address range anxiety and emphasize the convenience and lifestyle benefits that come along with EV ownership. To also promote EV adoption in commercial fleets, Singapore should implement incentives such as asset leasing and insurance to reduce upfront costs.

Meanwhile, on the supply side, Singapore can expedite EV infrastructure development by utilizing its financial markets and S$30 billion in planned green bonds. Leveraging its position as a regional financial hub will attract private financing and accelerate infrastructure deployment.

Charging Infrastructure Expansion

Supporting EV infrastructure growth in Singapore is a relatively manageable project, due to the country’s small geographical size and low average daily mileage. As a result, Singapore is already making substantial progress. For example, Singapore has announced that every Housing & Development Board (HDB) town will be EV-ready by 2025, starting with 3 to 12 charging points per car park.

Equipping strategic locations such as residential car parks and strategic locations with chargers can also go a long way to drive EV adoption. Strategically installing a combination of fast charging stations in commercial areas and slow charging stations in residential areas promises to stimulate considerable EV infrastructure growth.

Private sector involvement is crucial, not just government support. In particular, encouraging taxi fleet operators to install charging points nationwide can increase profits and generate interest in fleet electrification.

Affordability Initiatives

In addition to implementing financial incentives, Singapore can make its EVs more affordable by finding ways to reduce production costs and encourage investment. In particular, it can leverage its research and development expertise to develop new technologies across the entire EV ecosystem.

For example, Singapore can consider scaling up its production technologies, including battery and component manufacturing, charging infrastructure development, and management and analytics software, to lower manufacturing costs and bolster the EV industry’s economic impact. By investing in these areas, Singapore can lower EV prices, as well as creating more job opportunities, and further establish itself as a regional hub for advanced EV technologies.

Further opportunities lie in the downstream value chain. For example, optimizing material use by embracing circular technologies significantly reduces production costs, in addition to promoting sustainability. Car manufacturers can minimize waste and make EVs more affordable by using recycled and reprocessed materials to create components such as exterior panels. Meanwhile, technologies such as rare earth element recycling can help extend EV batteries’ lifespan, thereby further reducing costs.

The Future of EVs in Singapore

Singapore’s commitment to a greener future is establishing it as a dynamic player in the EV landscape. Governmental support and participation of OEMs and fleet operators, along with unique research and development advantages, have enabled Singapore to successfully increase its EV adoption rates, despite financial and infrastructural obstacles. As Singapore continues to lead the way in electrification, it will provide valuable insights for other markets worldwide.

The next part of this series will explore Vietnam’s potential role in the electrification revolution.

For more information, check out the FAQ and Resources below!

FAQ

How is Singapore’s transportation sector transitioning towards electrification?

Singapore’s transportation sector is transitioning towards electrification through initiatives such as tax incentives, grants, and the development of a robust charging infrastructure. The government aims to phase out internal combustion engines in favor of EVs by 2040, thereby promoting a sustainable future.

Which EV models and brands are available in Singapore?

Singapore offers a range of EV brands, including BYD, Tesla, Bluecar, Hyundai, Renault, MG, Nissan, Volvo, BMW, KIA, AUDI, Porsche, Polestar, Mercedes, Honda, and Ford. These brands provide a combination of pure electric, hybrid, and plug-in hybrid models to cater to different consumer preferences.

What is the status of charging infrastructure in Singapore?

Singapore has made significant progress towards implementing a robust EV charging infrastructure. Public charging points are being installed in car parks, and by 2025, every Housing and Development Board (HDB) town will have 3 to 12 charging points per car park. Fast charging stations are also available in commercial areas, contributing to the overall charging network.

How do EV financing options and costs compare to those of traditional petrol vehicles in Singapore?

EV financing options in Singapore are supported by tax incentives such as the EV Early Adoption Incentive (EEAI) and Enhanced Vehicular Emissions Scheme (VES). While EVs generally have higher upfront costs than traditional vehicles, due to expensive electrical components, subsidies and reduced road taxes help bridge the price gap.

How do consumers perceive and use EVs in Singapore?

Consumer perception and usage of EVs in Singapore are increasing. Thanks to public awareness campaigns addressing range anxiety and highlighting the convenience and benefits of EVs, the EV adoption rate for private vehicles has risen, with cleaner vehicles becoming more common in the car, taxi, and goods vehicle segments.

What are the environmental benefits of EVs in Singapore?

EVs in Singapore offer environmental benefits such as reduced CO2 emissions. By switching from internal combustion engines to EVs, Singapore can cut CO2 emissions by 50%, contributing significantly to sustainability targets. EVs also help to reduce pollution, improve air quality, and enhance energy security, leading to a greener and more sustainable transportation ecosystem.

Resources

CMS Legal: Electric Vehicle Regulation And Law In Singapore

Explore Singapore’s regulatory system here.

Maximize Market Research: Singapore Electric Vehicle Market – Growth, Trends, Covid-19 Impact, And Forecasts (2023 – 2028)

Gain insight into the Singaporean EV market here.

EV Reporter: Singapore EV Landscape

Learn about the EV charging landscape in Singapore here.

Market analysis of two- and three-wheeler vehicles in key ASEAN member states

Understand Singapore’s role among ASEAN countries here.

Buying An Electric Car In Singapore: A Complete Guide

Find out how to buy an EV in Singapore here.

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More