Fast Charging vs. Battery Swapping: Evaluating ROI for Indian EV Fleets

Raghav Bharadwaj

Chief Executive Officer

Published on:

31 Jul, 2025

Updated on:

28 Jan, 2026

In India, the number of public commercial EV charging stations has surged to over 26,367 by early FY25 (early 2025), dwarfing the roughly 2,600 battery swapping stations currently in operation. This sharp difference in infrastructure adoption raises a key question for fleet operators and policymakers: which model offers better long-term value? Both fast charging and battery swapping promise to minimize downtime and operational costs for electric vehicle (EV) fleets, yet their economic and practical viability differ across vehicle segments, especially when considering the right fleet charging solution.

In this blog, we address the following key questions:

- What is the difference between fast charging and battery swapping?

- Which model, fast charging or battery swapping, offers better ROI for different fleet types in India?

- What is the infrastructure, cost, and operational implications of each approach?

What Is the Difference Between Fast Charging and Battery Swapping?

Fast charging refers to high-powered charging stations that can replenish an EV’s battery in a fraction of the time of standard home charging. Modern DC fast charging solutions operate at power levels of 50 to 24 kW (and even higher in the newest versions), enabling much quicker top-ups. For example, by 2023, some EVs were able to add over 160 km of range in just 15 minutes using the latest ultra-fast chargers.

Continued innovation, such as 800-volt battery systems and upcoming megawatt charging standards, is pushing charging times closer to gas station refueling, making it ideal for EV charging for fleets.

Battery swapping takes a different approach: instead of waiting for the battery to charge, the EV’s depleted battery is physically replaced with a fully charged one at a swap station. This typically takes only a few minutes, after which the vehicle drives off with a full “tank” of energy. The used battery is left behind to be charged off-board and later reused. Swap stations are usually automated facilities where robots handle heavy battery packs, making the process seamless for the driver. Better Place, a pioneering startup in the 2010s, could swap a car’s battery in about five minutes and built 37 swap stations across Israel. Today’s advanced swap systems (like those by NIO in China) complete the process in as little as 3 minutes without the driver even stepping out.

Both fast charging and swapping aim to minimize downtime, but their infrastructure and business models differ. Next, we compare these approaches across key dimensions: speed, convenience, infrastructure costs, battery lifecycle, operational use cases, and the specific context of India’s EV market, especially for those evaluating a scalable fleet charging solution.

ROI Across Fleet Types: Fast Charging vs. Battery Swapping

Understanding ROI for fast charging and battery swapping requires looking at how each model performs across different vehicle categories. Fleet operators in India manage a spectrum of vehicles ranging from two-wheeler delivery bikes and three-wheeler e-rickshaws to four-wheeler taxis and electric buses. Each segment has unique energy needs and duty cycles that influence which charging model makes more financial sense. Below, we compare fast charging and battery swapping side-by-side for key vehicle categories, focusing on metrics like TCO, uptime (vehicle availability), battery life, and overall operational cost.

Key Takeaways:

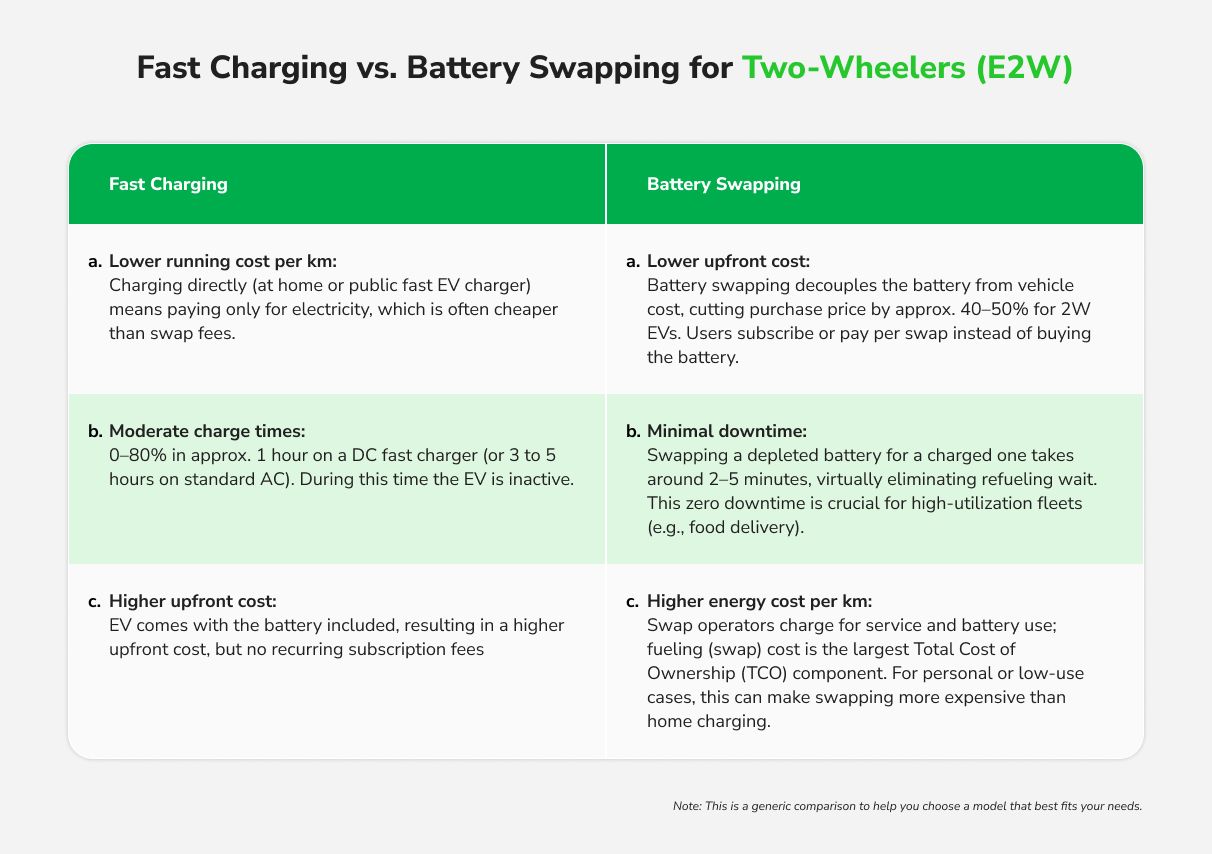

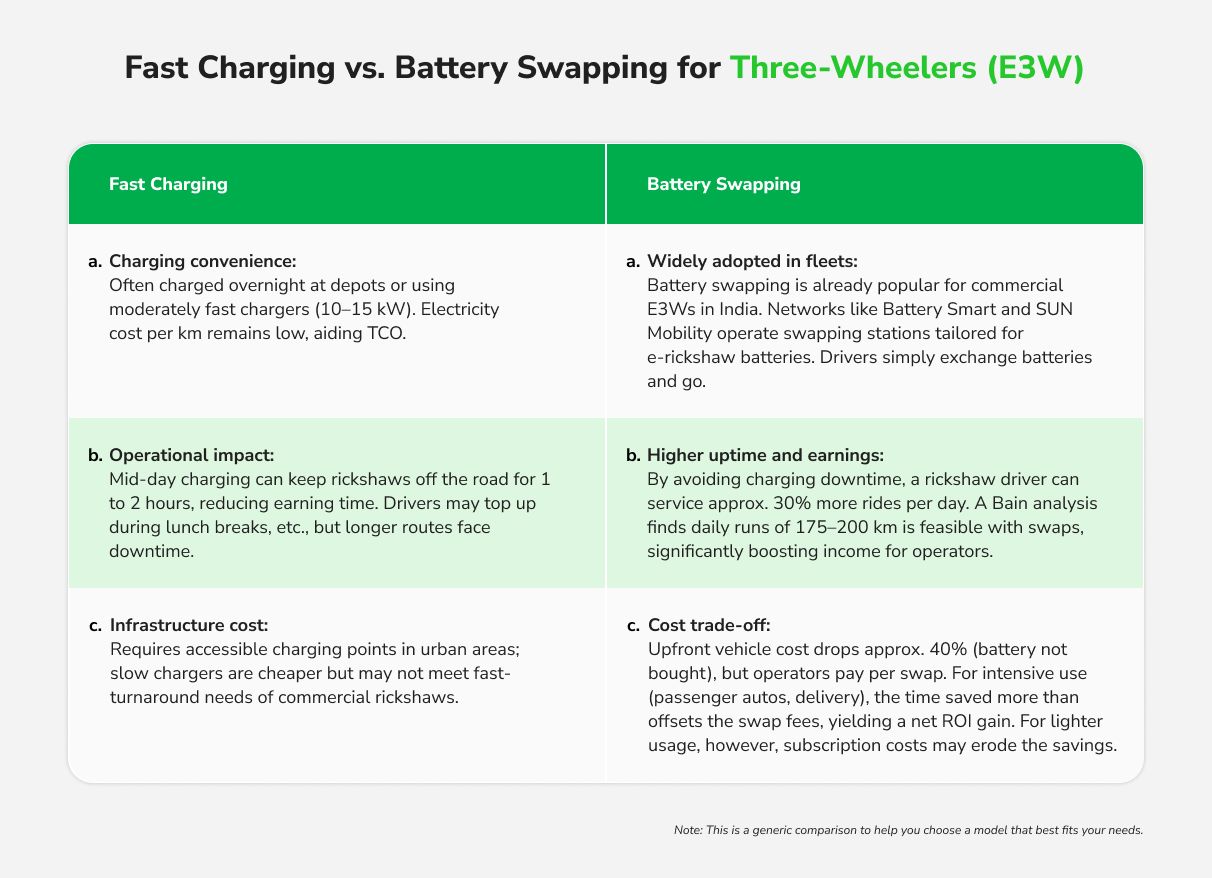

For two-wheelers and three-wheelers, battery swapping can offer superior ROI in high-utilization scenarios like delivery fleets or passenger rickshaws. Studies show that a ride-hailing e-scooter using swaps can achieve 15% lower TCO than one using charging, thanks to zero downtime and no battery replacement cost over the vehicle’s life.

Likewise, a typical e-rickshaw driver might increase earnings by approx. 30% with swapping due to more service hours and paying only per use of the battery. However, these benefits depend on intensive use; for private owners or low-mileage commercial use, the extra per-swap fees mean point charging can be more economical.

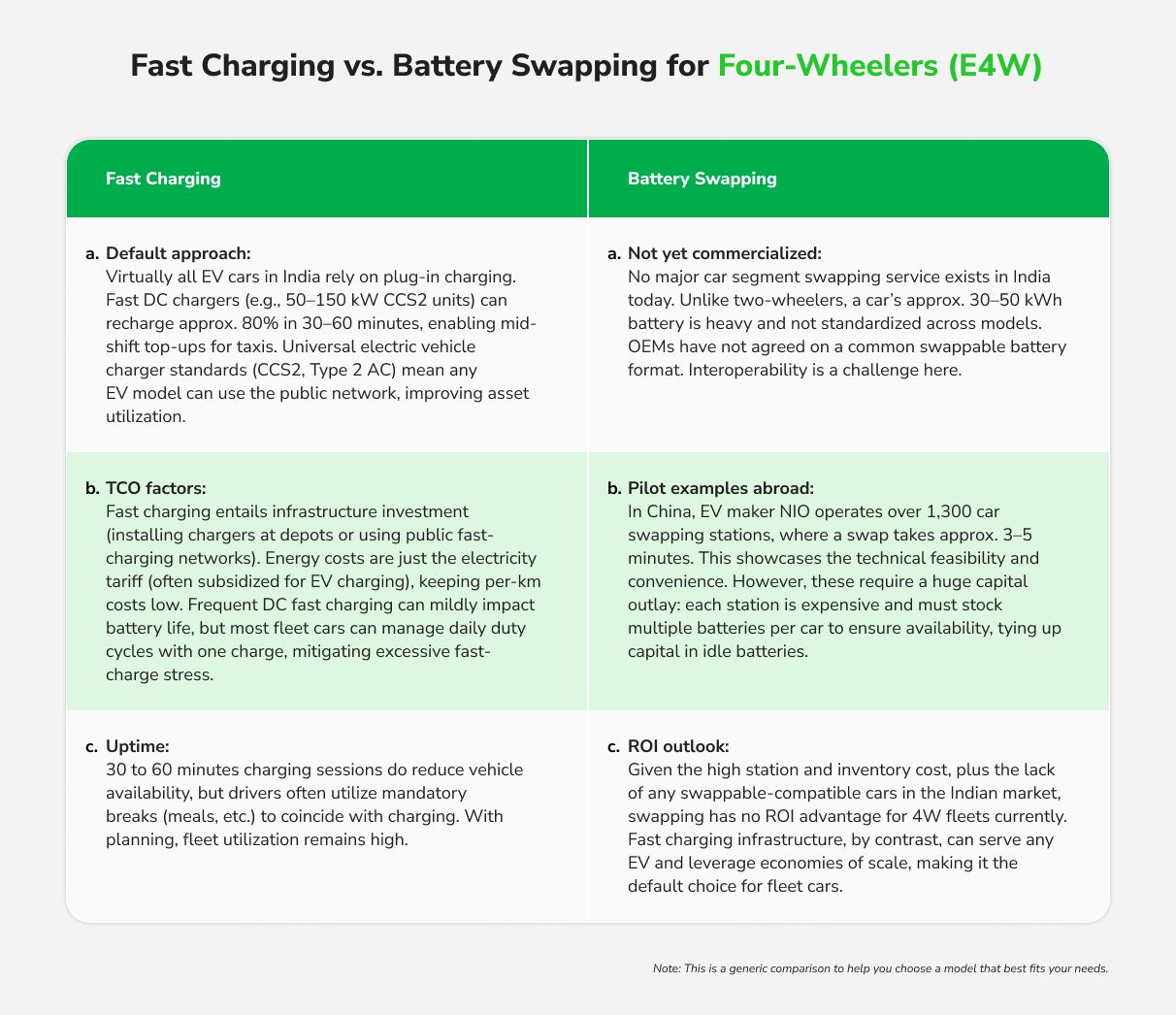

For four-wheelers, fast charging clearly dominates the ROI equation in India today. The lack of a universal battery format for swapping means fleets have no choice but to use fast chargers. Fortunately, they are becoming more ubiquitous and standardized with universal electric vehicle charger protocols like CCS2. Consumers have also shown a preference for the convenience of fast charging; a McKinsey survey found most Indian EV buyers are willing to pay 10 to20% more for faster charge speeds. Thus, investment in fast charging has a larger immediate user base and also avoids the interoperability pitfalls of car battery swaps.

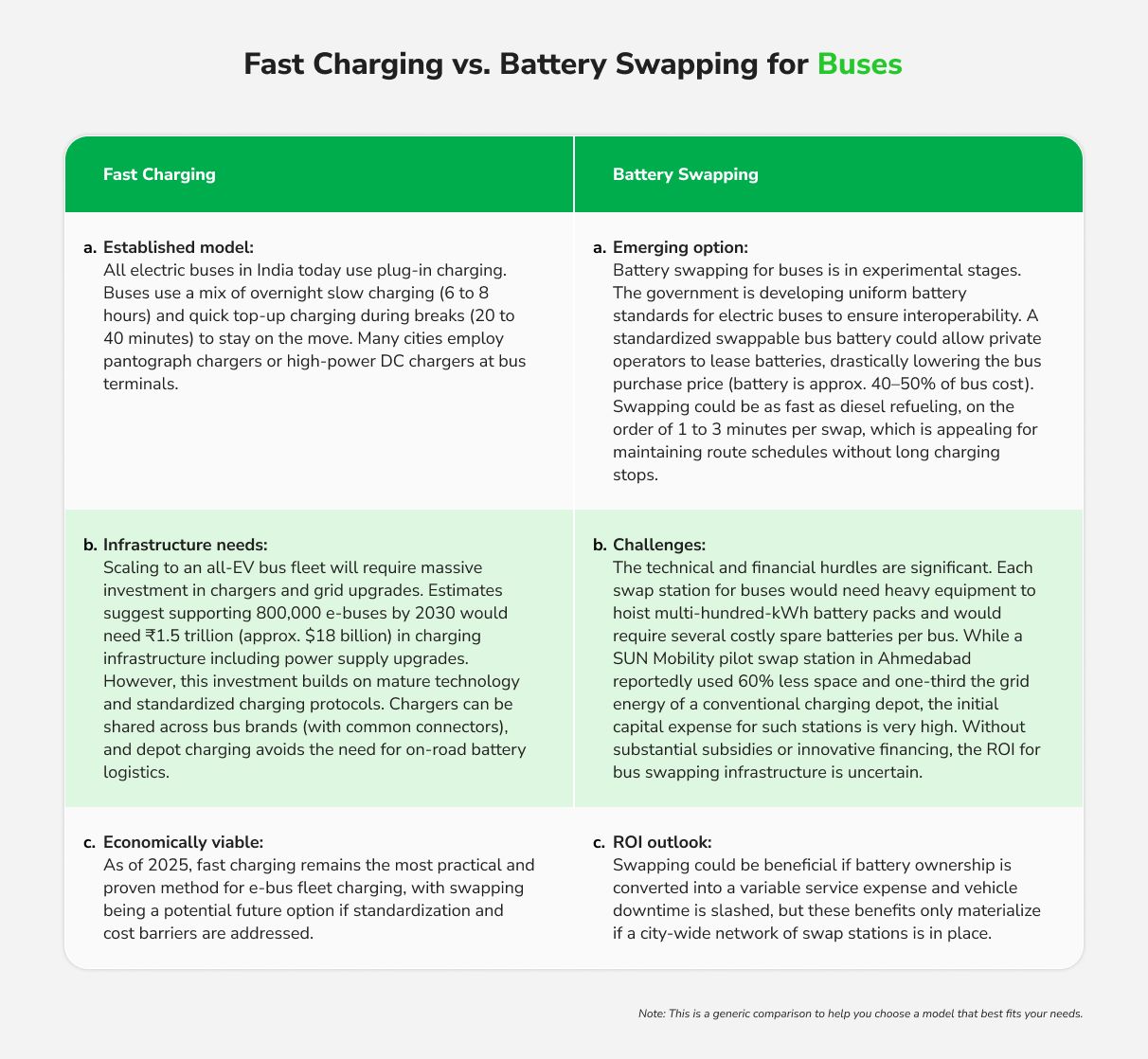

For buses, the jury is still out. Swapping holds theoretical appeal to eliminate long charging downtimes and reduce bus acquisition costs, and the government’s push for standardized swappable bus batteries signals interest. Yet, given the enormous scale of infrastructure needed, fast charging is a more straightforward path for the foreseeable future.

In summary, fast charging infrastructure tends to yield better ROI across most vehicle categories due to its broader applicability and lower systemic costs, while battery swapping shows targeted ROI advantages in certain niches, notably 2W/3W fleet operations, but faces significant constraints scaling beyond those.

Infrastructure, cost, and operational implications

The choice between fast charging and battery swapping is not just a financial calculus but also an infrastructural and operational one. Each model demands a different kind of ecosystem, with distinct cost structures and practical considerations:

Space and location

Fast charging stations require parking bays where vehicles remain plugged in for anywhere from 30 minutes up to several hours. This means higher space requirements, especially for large fleets needing many simultaneous charges. Battery swapping stations, on the other hand, can be more compact; they store charged batteries in racks and only need space for vehicles to briefly dock for a swap.

As NITI Aayog noted in its draft policy, swapping stations can mitigate urban space constraints by stacking batteries and not occupying parking spots for a long period of time. In dense cities like Bengaluru or Delhi, this space efficiency is a clear point in favor of swapping. However, swapping stations might need to be more expansion to cover a wide area of service, whereas fast chargers can be installed more flexibly.

Capital expenditure (Capex)

Fast charging infrastructure cost is driven by the charging hardware and electrical grid connection. High-power DC fast chargers (50 kW and above) are expensive and often require grid upgrades or transformers, but one charger can service many vehicles per day in sequence.

Battery swapping demands a different kind of Capex: the station mechanism (automated robotics or manual racks) plus an inventory of extra batteries. For every EV in a swapping network, operators might need 1.5 to 2 batteries available (to ensure a charged battery is ready when needed). This means a significant upfront investment in batteries themselves, essentially duplicating battery assets.

For instance, a swapping network serving 100 e-rickshaws may need approx. 150 battery packs in circulation. These spare batteries tie up capital, although they are the core “fuel” inventory for the operator’s business model. The initial expenditure to establish a wide network of swap stations is substantial, often cited as a major barrier. In contrast, installing an equivalent coverage of fast chargers could be less capital-intensive since the fleet vehicles carry their own batteries (no extra inventory needed). A Council on Energy, Environment and Water (CEEW) analysis highlighted that while swapping stations have high upfront costs, they can lower vehicle purchase prices and potentially spread battery costs over multiple users, an investment model attractive only if high utilization can be achieved (idle batteries earn nothing). Thus, fast charging may have a lower breakeven threshold in many cases, unless supported by innovative financing for swapping.

Operational complexity

Operating a fleet on fast charging is straightforward. It ensures vehicles have access to chargers and manages charging schedules to match operations. The operational challenges are mitigating queue times at charging stations and maintaining these chargers. With battery swapping, operations become more complex logistically. The swap operator must manage charging hundreds of batteries off-board, keep track of battery health, and position charged batteries at the right stations to meet demand. Interoperability issues add to the complexity. Batteries must be compatible with multiple vehicle models. Without industry-standard batteries, swap providers like Battery Smart have had to form partnerships with specific OEMs or retrofit vehicles to accept their batteries, essentially creating “walled gardens” of compatibility. This lack of universal interoperability means an e-scooter using one network’s batteries cannot simply swap at a different provider’s station. By contrast, fast-charging standards like Bharat DC-001 and CCS2 make it easy. Any electric vehicle that supports these can charge at any compatible station, no matter the brand. This interoperability of chargers greatly simplifies operations and consumer experience akin to how any petrol car can refuel at any petrol pump. In effect, fast charging benefits from being a more open ecosystem, whereas battery swapping is currently a more closed, network-specific operation in India.

Maintenance and battery lifecycle

Battery health is a crucial factor in fleet economics. Fast charging, especially high-speed DC charging, can induce stress on batteries (heat and high C-rate currents), possibly shortening their lifespan if done very frequently. Modern battery management systems and liquid cooling in vehicles are mitigating this, and many fleet managers optimize charging to occur at moderate speeds when possible and reserve ultra-fast charging only for occasional use. Battery swapping introduces a different dynamic. The batteries are actively managed by the swap operator, who can charge them in optimal conditions. However, frequent swapping itself can lead to wear and tear on connectors and the battery housing.

Moreover, batteries in a swap system cycle more times per day , meaning they accumulate charge/discharge cycles faster than a battery dedicated to one vehicle. Providers must invest in high-quality, long-cycle-life batteries to make the economics work. If poorly managed, accelerated battery degradation can eat into the ROI of a swapping model. This is why compatibility and quality control across various manufacturers’ batteries are vital. In sum, fast charging externalizes battery care to each vehicle owner (or fleet operator), whereas swapping centralizes battery maintenance with the service provider. The latter can be an advantage or a risk .

Energy costs and utilization

Fast charging draws power from the grid whenever needed, and since tariffs often change by time of day, this can significantly affect operating costs. Fleet operators can take advantage of lower tariffs during solar hours or nighttime for charging, as guided by revised tariff policies (e.g., India’s tariffs allow 0.7× cost during solar hours to encourage daytime charging).

Battery swapping stations keep charged batteries in stock by continuously recharging them. By timing this recharging during off-peak grid hours, operators can manage loads and reduce electricity costs. But swap operators also incur overhead costs for station operation and battery cooling, etc., so they typically charge a premium above the raw electricity cost. Essentially, swapping monetizes convenience and saves time. For high-utilization vehicles, paying this premium makes financial sense but for lower usage, the premium might not be worth it. Simply using a public charger or a depot charger yields better ROI.

Final Thoughts

From an infrastructure planning perspective, fast charging appears more scalable and flexible in the Indian context. Public agencies and private companies are rapidly expanding charging networks, and oil companies are installing thousands of fast chargers at fuel stations. These chargers cater to all vehicle types, effectively making them a universal solution.

By contrast, battery swapping infrastructure is growing but in a more limited scope, primarily serving e2W and e3W segments. Battery Smart’s 1,400+ swapping stations (as of late 2024) are impressive growth, yet those stations serve approx. 60,000 drivers, a fraction of India’s EV user base. To match the scale of charging infrastructure, swap networks would require enormous capital infusion.

Furthermore, each new vehicle model with a different battery size presents a challenge unless standardization is enforced. The Ministry of Power’s 2025 battery swapping guidelines and the draft policy by NITI Aayog are attempts to bring some order, proposing uniform battery pack standards, safety and performance requirements, and interoperability protocols. If these succeed, some infrastructure duplication can be avoided, improving the economics of swapping. Until then, fast charging holds an edge in simplicity. A fast EV charger installed today can serve a wide range of current and future EVs with minimal adjustments, ensuring the investment continues to generate returns as the EV market grows.

Feb 27, 2026 • EV Technology and Trends

Renewable Energy and EV Charging in India: Technical Integration [+ Challenges]

Read More