Why Range Anxiety Is a Myth, And What Should We Be Talking About

Raghav Bharadwaj

Chief Executive Officer

Published on:

19 Nov, 2025

Updated on:

10 Feb, 2026

Despite massive improvements in battery tech and charging access, many buyers still worry that EVs won’t take them far enough. The irony? Real-world data shows most Indians drive far less than the range even entry-level EVs offer today.

In this blog, we break down why range anxiety is largely outdated and what the real barriers and conversations should be in 2025, including:

- How actual Indian driving patterns compare with modern EV ranges

- Why different EV segments (2W, 3W, cars, buses) experience range differently

- Beyond range anxiety, what really matters to EV users in 2025

Range Anxiety vs. Reality: How Far Do Indians Really Drive?

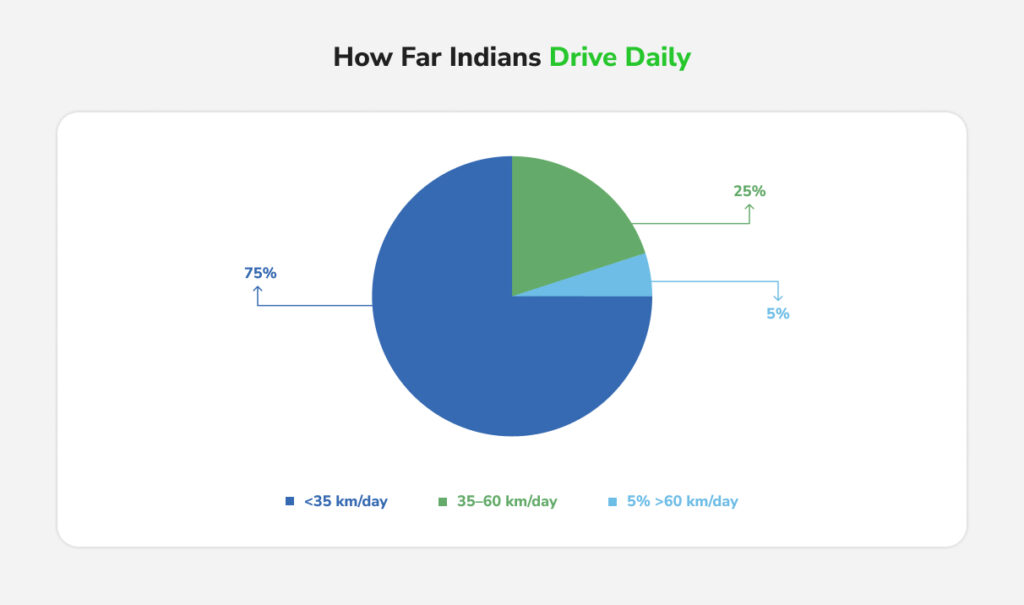

Range anxiety assumes drivers often need more range than EVs provide. But Indian driving patterns show the opposite. Most Indians simply don’t drive very far in a day.

- 75% of Indian commuters travel under 1,000 km per month (roughly <35 km per day), according to a multi-city survey.

- Many personal cars see only 500–700 km per month, that’s barely 20 km a day.

- Modern electric cars typically deliver 200–400 km per charge, while popular two-wheelers offer 80–100 km per charge.

Even factoring in occasional longer trips, today’s EVs comfortably cover common use cases. As one industry expert quipped, “Nobody worries about a petrol car’s range because fuel pumps are everywhere. The same is becoming true for EVs.”

Data reinforces this confidence.

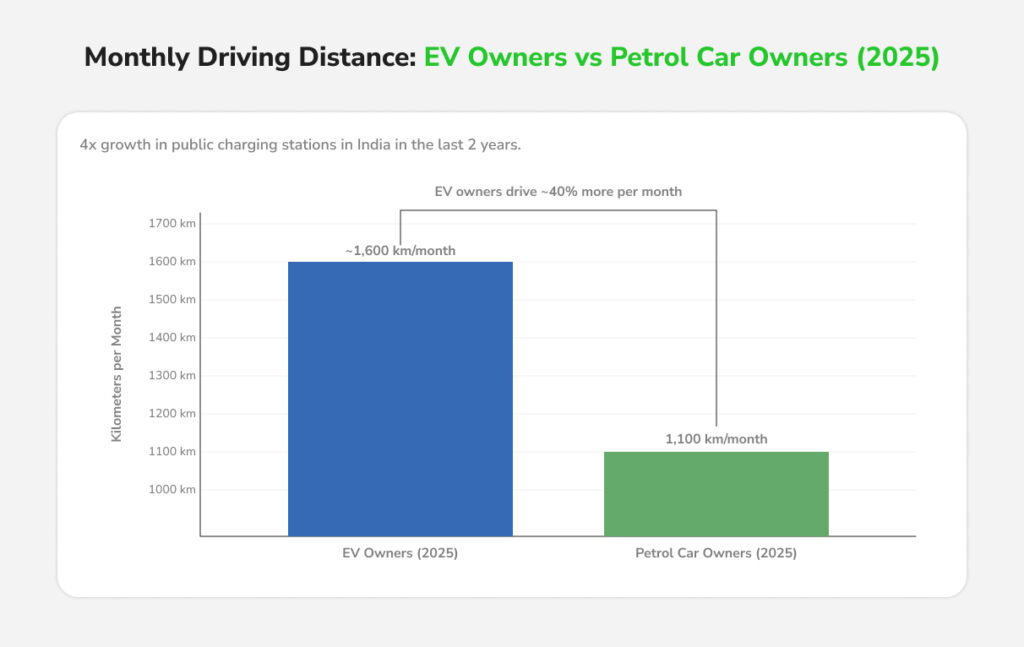

- In 2025, Indian EV owners drive about 1,600 km per month—roughly 40% more than petrol car owners. That’s about 50+ km per day of electric driving. Such confidence comes from knowing their vehicle range can handle it and that chargers are available when needed.

- 84% use their EV as their primary vehicle (up from 74% two years ago), and half of Tata’s EV customers have completed road trips over 500 km on major routes like Delhi–Manali or Mumbai–Goa.

These real-world behaviors show that range is hardly a limiting factor anymore. Long EV trips are practical and increasingly popular, and daily commuting barely scratches an EV’s battery capacity.

EV Range by Segment: 2W, 3W, Cars & Buses in India

Range anxiety means different things depending on the EV category.

- Electric Two-Wheelers: Scooters and bikes continue to dominate India’s EV market, with small e-scooters and e-rickshaws accounting for 94% of all EVs sold. Their typical 50–100 km range is perfectly in line with daily city travel, where most users cover well under 35–40 km a day. Models like the TVS iQube and Ola S1, offering around 100 km per charge, comfortably cover a couple of days of commuting, and overnight home charging makes range concerns negligible. As a result, range anxiety is practically nonexistent for e-2W users.

- Electric Three-Wheelers (E-Rickshaws & Autos): Electric rickshaws are now a familiar sight, especially in tier-2/3 cities and small towns. With a range of 80–120 km per charge, these vehicles easily handle a day’s worth of short, frequent local trips. Uttar Pradesh alone has over 4 lakh registered EVs, largely e-rickshaws, showing how deeply they’ve penetrated even rural markets. Drivers typically top up during breaks. Range anxiety is rarely a concern; drivers focus more on convenient charging points and long-term battery health. Several states, like Assam, are confident enough in this segment’s readiness that they are pushing for 100% electrification of three-wheelers in the next few years.

- Electric Cars (Four-Wheelers): This is the segment where range anxiety was historically the biggest talking point. Today, mainstream EVs like the Tata Nexon EV, MG ZS EV, and Hyundai Kona offer 200–300+ km of real-world range, depending on variants. For most users, 200 km covers almost a week of normal city commutes. Home charging gives car owners a full charge every morning, eliminating the need for frequent public charging. For longer highway trips, India’s expanding charging network makes even 400–500 km intercity journeys manageable with planned charging breaks. As a result, most EV car owners report that any initial range anxiety disappears within the first few weeks of ownership.

- Electric Buses: Electric buses are steadily transforming urban and intercity public transport. With typical ranges of 150–250 km per charge, they can cover an entire day’s scheduled operations. Fleet operators plan their charging strategically, usually overnight at depots and occasionally during layovers, so passengers never feel the impact. India now has nearly 10,000 electric buses on the road, thanks to programs like FAME II for funding both buses and depot charging infrastructure. This segment demonstrates that range management is primarily a behind-the-scenes operational task rather than a user concern, enabling large-scale adoption without compromising service reliability.

Top EV Challenges in India 2025: Charging, Costs and Resale Value

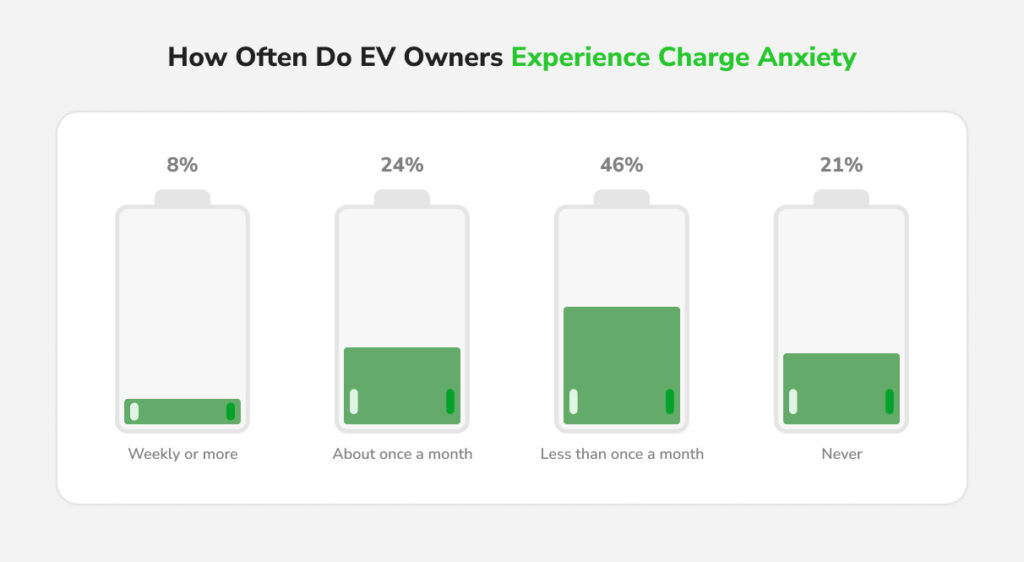

Charging Uptime, Accessibility & User Trust

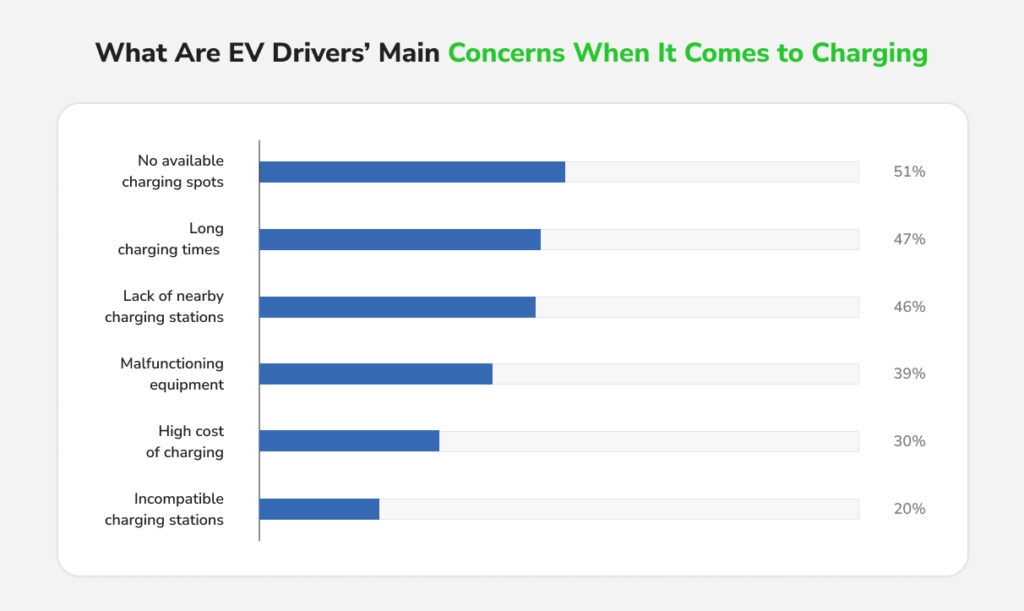

Having chargers available is one thing; having them operational and reliable is another. Charger uptime, meaning the charger actually works when you get there, has become a critical concern. Many EV owners report arriving at a public charging station only to find stations out of service, occupied, or slower than advertised.

A recent survey of EV car owners in Delhi, Mumbai, and Bengaluru found “charging anxiety” is now a bigger concern than range anxiety, with 88% of owners citing difficulties in finding accessible, safe, working charging stations. This is despite the presence of tens of thousands of chargers on paper.

The visibility and reliability of chargers need improvement too. Better signage, real-time status updates in apps, and maintenance to reduce downtime. The good news is that the industry is starting to respond. Operators are committing to higher uptimes, and the government is discussing uniform charger maintenance standards and auditing. But until that fully materializes, charger reliability remains a top-of-mind issue.

Fragmented User Experience

India’s charging ecosystem is fragmented across multiple apps and providers (government-run, private startups, oil companies, and automakers). This creates a confusing user experience since they have to juggle multiple registrations, wallets, and RFID cards, and there is no single view of available chargers. EV users are calling for interoperability, the ability to use any public charger with a universal access card or a common app, much like ATMs.

The government’s one-nation-one-card ambition for EV charging and emerging aggregator apps are steps forward in streamlining this. A fragmented experience is an inconvenience to users and also discourages new adopters who aren’t tech-savvy.

Resale Value Uncertainty

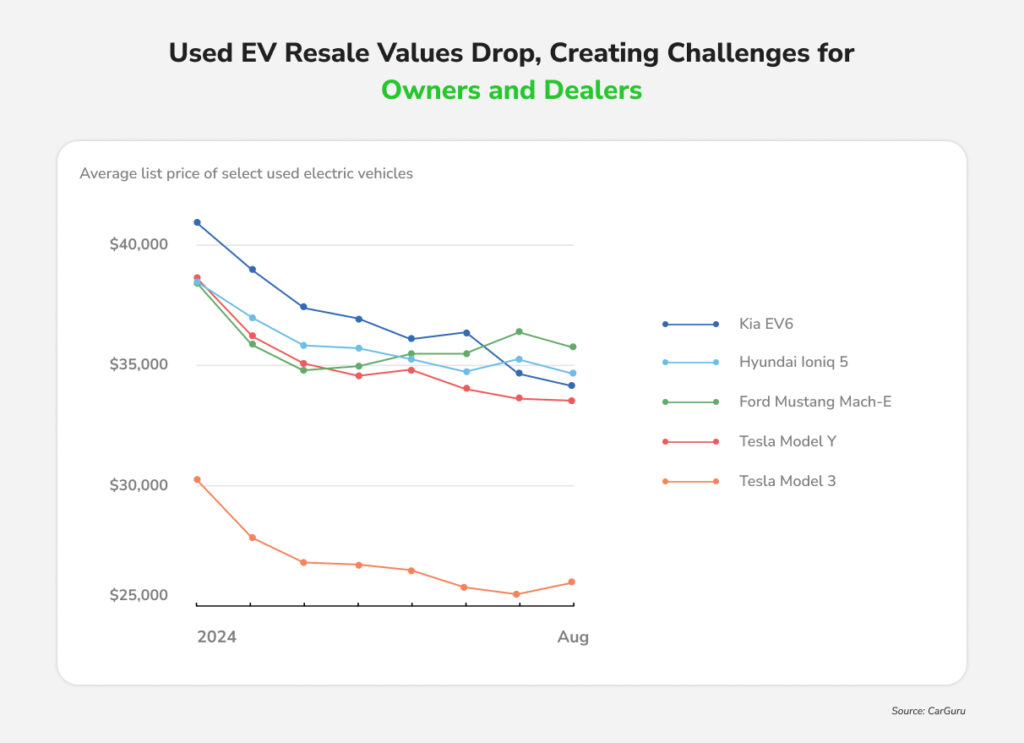

As the first generation of mainstream EVs in India ages, owners are worrying about resale value. Historically, petrol/diesel cars in India retain decent resale prices due to a well-understood used car market. However, EVs’ resale value still remains uncertain due to battery health concerns.

A 5-year-old EV might still run perfectly, but prospective buyers worry about battery degradation. Since the battery is the costliest component, accounting for 30-40% of EV cost, a lack of clarity on its condition hits resale quotes. In the Park+ survey, one-third of EV owners reported a significant drop in their vehicle’s resale value, often lower than expected. Part of the issue is information asymmetry: unlike checking engine compression or mileage in an ICE car, there isn’t yet a widespread, trusted method for a used EV’s battery health certification. Having said that, the situation improving. Some dealerships and service centers now offer battery health reports, and government agencies are exploring standard test procedures.

As the market matures and more second-hand EVs find new buyers, confidence in resale will grow. For now, though, concern about resale value and long-term battery life is a common refrain. The industry will need to address this through assured buyback programs, battery warranties, and transparency on battery performance over time.

High Upfront Costs & Affordability

EV prices in India are falling, but the upfront cost remains higher than petrol vehicles. Batteries still make up one-third of the manufacturing cost, the main reason for this price gap.

Government incentives have helped, but several of these subsidies are now tapering off. And to bridge the affordability gap, the industry is focusing on local battery production and leasing models to separate battery cost from vehicle price. Banks are also offering EV-specific loan products with lower interest rates or longer tenures.

Price parity remains the key milestone: until EVs are priced closer to petrol vehicles, upfront affordability will likely slow adoption more than range concerns. But the good news is that battery prices are expected to drop by nearly 50% by 2026, driving affordability.

Maintenance and Service Support Challenges

EVs are simpler machines than ICE vehicles, with fewer moving parts and generally lower routine maintenance needs. But when issues do occur—battery modules, electronics, or software glitches—the repair experience can be difficult.

India still lacks a widespread network of EV-skilled mechanics, and local garages often aren’t equipped to handle high-voltage systems. According to a survey, 73% of EV owners faced challenges with maintenance because local mechanics struggled to diagnose or repair. As a result, owners must depend on limited authorized service centers, leading to delays and uncertainty.

The ecosystem, however, is improving. OEMs and startups are investing in training programs; third-party EV repair workshops are emerging, and government initiatives like ASDC are building EV-specific skills. Over time, EV maintenance should become more routine, but in 2025, after-sales support remains a major concern for many users.

Final Thoughts

Range anxiety is no longer the barrier it once was. Modern EVs already exceed the daily driving needs of most Indians, and real-world usage proves drivers trust their vehicles.

The real challenges in 2025 lie elsewhere:

- Reliable charging uptime

- Seamless charging experience

- Clear resale value expectations

- Stronger service networks, and

- Affordable upfront pricing

Solving these issues is what will shape India’s EV adoption curve. The good part is solutions are already in motion: better charger standards, unified payment systems, battery health reporting, local manufacturing, and technician training. As these gaps close, the EV ecosystem will become more accessible, predictable, and user-friendly.

In short, India is moving beyond range anxiety. As EV adoption accelerates, the real priority is building a reliable, seamless EV ecosystem, one that ensures charging uptime, affordability, and service support. That’s the key to unlocking mass adoption.

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More