How Tamil Nadu’s EV Policy Is Accelerating DC Fast Charging in India

Raghav Bharadwaj

Chief Executive Officer

Published on:

17 Oct, 2025

Updated on:

05 Feb, 2026

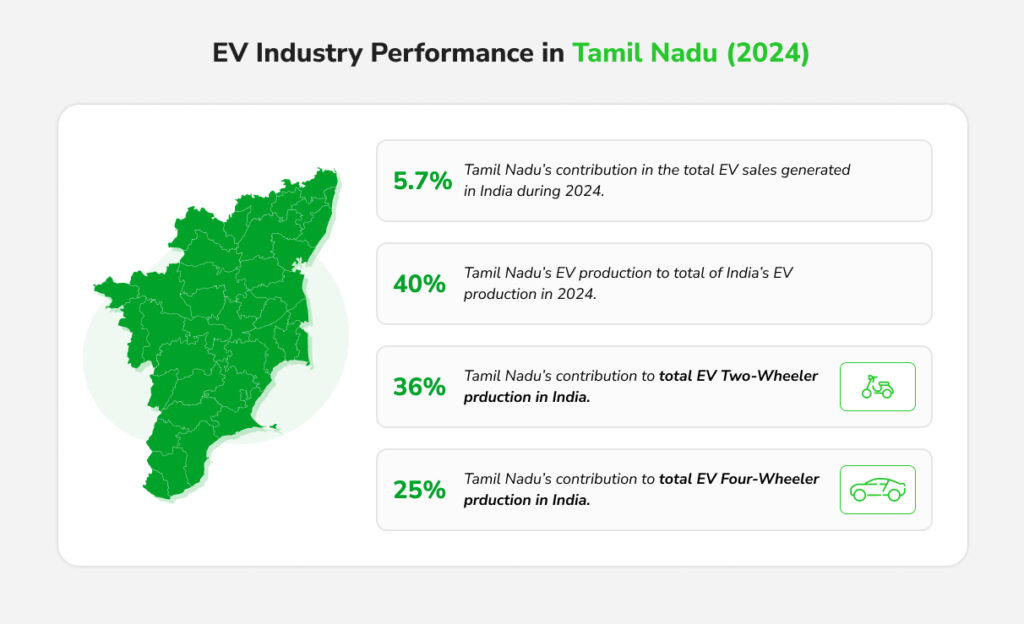

Tamil Nadu is rapidly positioning itself at the forefront of India’s EV revolution, driving the expansion of DC fast chargers and broader EV charging infrastructure in India through bold, clear-sighted policy measures. Its latest Tamil Nadu EV policy 2025 blends financial incentives with smart governance, lowering costs, streamlining approvals, and inviting private participation to build a dense, reliable charging network. In doing so, the state is powering its own mobility transition while setting a national benchmark for DC fast charging solutions and EV infrastructure growth.

This blog explores:

- The financial and operational measures that make dc fast-charging solutions more viable for investors.

- The collaborative models and institutional mechanisms driving large-scale rollout.

- The results on the ground and how Tamil Nadu EV policy 2025 is influencing state EV policies in India.

Incentives Fueling Fast Charger Deployment

Tamil Nadu’s policy introduces significant financial and operational incentives to spur DC fast charging station deployment:

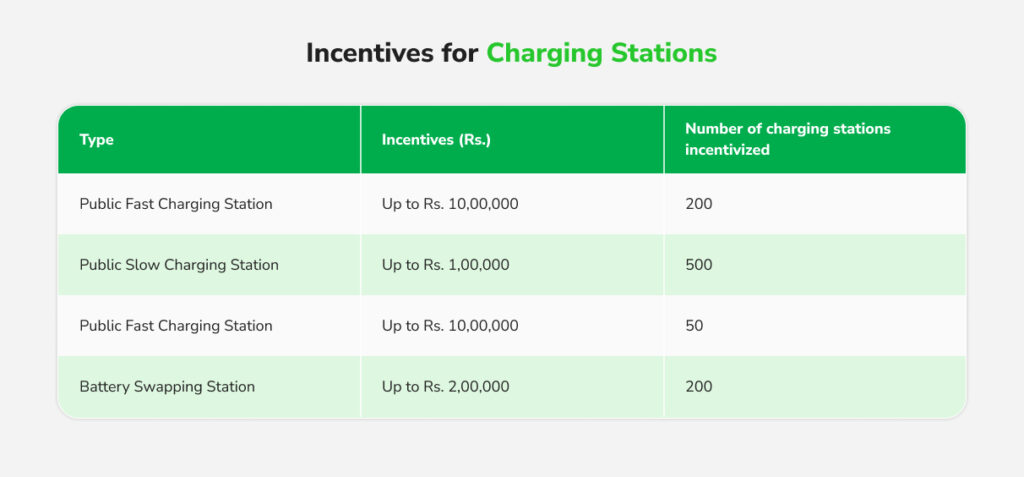

- Capital Subsidies: The state offers a 25% capital subsidy on equipment and machinery costs for companies setting up public charging stations that meet national guidelines. Additionally, the first 50 private charging stations qualify for a 25% subsidy, up to ₹10 lakh each, on charger hardware, encouraging early private investment. These grants substantially reduce the high capital expenditure of DC fast chargers, which often exceed ₹20–30 lakh for 50 kW+ units.

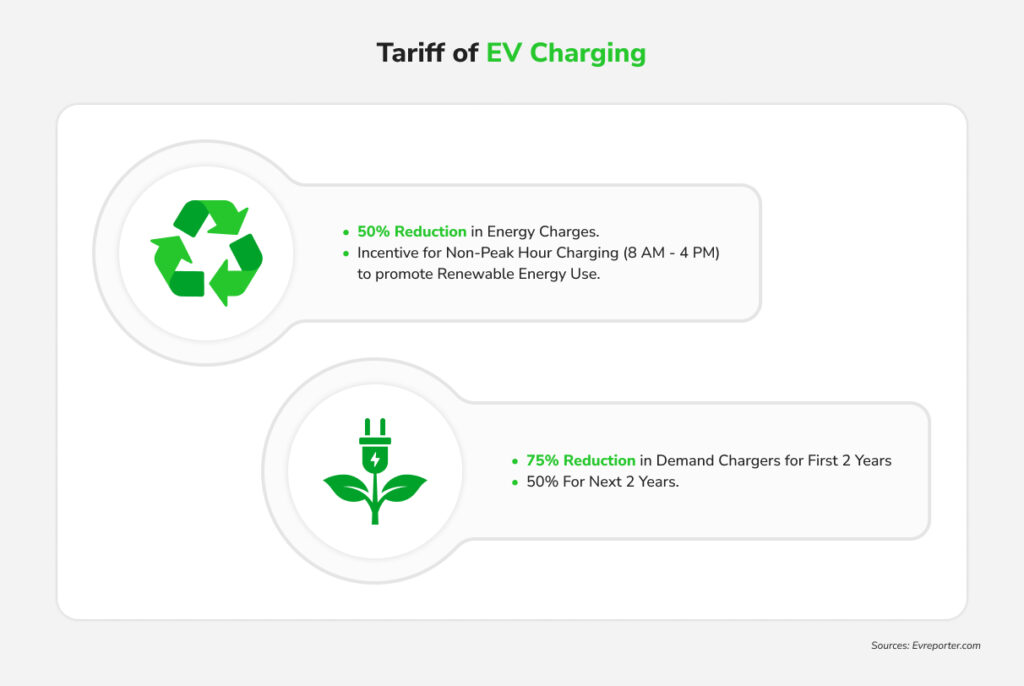

- Reduced Power Tariffs: To improve the business case for charging operators, Tamil Nadu slashed electricity rates and demand charges for EV charging. Demand charges are cut by 75% for the first 2 years and 50% for the next 2 years for EV power connections. Energy tariffs are reduced by 50% during daytime off-peak hours (8 AM–4 PM), encouraging use of surplus solar power. This time-of-day tariff model directly lowers operating costs for high-capacity DC fast charging solutions, improving profitability and attracting private players.

- Land and Infrastructure Support: Access to affordable land is critical for charger installation. Tamil Nadu offers land at concessional rates in dedicated EV parks, with a 50% discounted land price for companies building EV or charging equipment factories. While this primarily targets manufacturing, it indirectly benefits the dc fast charging solutions ecosystem by lowering hardware costs. For charging station siting, the state is leveraging public land – highway rest areas, bus depots, and municipal parking lots – to host chargers in high-demand locations. Tamil Nadu Generation & Distribution Corporation (TANGEDCO), the nodal agency for charging infrastructure, and the Tamil Nadu Green Energy Corporation Ltd. (TNGECL) are working with local bodies to earmark government-owned sites for rollout.

- Tax Exemptions: Tamil Nadu has waived 100% of electricity tax for EV charging operators for five years and classifies public charging under a special tariff category. Electricity duty holidays ensure energy drawn by DC fast chargers isn’t burdened with extra levies. These financial sweeteners improve ROI for commercial EV DC fast charging stations, which typically have longer payback periods than slower chargers.

Public-Private Partnerships and Policy Enablement

Tamil Nadu’s EV policy actively promotes public-private partnership (PPP) models to accelerate charging network growth. Rather than relying solely on government installations, the state is inviting private capital and expertise to co-develop infrastructure:

- PPP on Highways: The policy envisions a fast charging station every 25–30 km on major roads and EV “green corridors” via PPP initiatives. The TANGEDCO can set up charging stations independently or through private operators under revenue-sharing or co-investment models. This approach enables faster deployment along strategic routes without overburdening public finances.

- Nodal Agency & Single-Window Clearance: TANGEDCO is the state nodal agency for EV charging, responsible for planning and facilitating network expansion. Guidance Tamil Nadu acts as a single-window facilitator for EV infrastructure projects. An inter-departmental EV cell coordinates efforts across power, transport, housing, and industry departments. For a private operator, this means faster and centralized approvals and reduced procedural delays.

- Collaborative Investments: The state has announced plans for high-speed charging stations for commercial EV fleets in partnership with industry. These “ultra-fast” charging hubs will be developed jointly by the Energy and Transport departments with private investors. Such projects signal openness to innovative partnership models and reduce the fiscal burden on the state while tapping private efficiency and capital.

- Land & Utility Cooperation: Municipal corporations are working with TNGECL to offer bus depots and parking lots as sites for private firms to install DC fast chargers. Public entities provide the space, while the private player bring equipment and operational expertise. TANGEDC supports these PPP stations by ensuring sufficient power supply and encouraging open access to renewable energy. This cooperation lowers barriers to entry for private operators.

Fast Charging Rollout Targets and Progress

Tamil Nadu has set ambitious targets for expanding its EV charging infrastructure in India. From just151 public charging stations in 2022, the number jumped to roughly 3,000 public charging stations by mid-2025, thanks to the policy push and FAME India Scheme. However, charger density remains low, approximately one public charger per 316 EVs in 2025, compared to a healthy ratio of 1 per 6–30 EVs.

To address this, Tamil Nadu EV policy 2025 aims to install about 24,715 charging stations by 2030. This nearly ten-fold increase within the next five years would elevate Tamil Nadu into a leading position for EV charging infrastructure in India.

A large portion of these will be DC fast chargers, especially along highways, fleet hubs, and urban grids. The roadmap calls for coverage of all major highways with fast chargers every 25–50 km, and at least one fast charging station per 3×3 km grid in dense cities. The first 200 public commercial EV charging stations have already been incentivized with capital subsidies up to ₹10 lakh each.

This scale-up contributes meaningfully to India’s overall EV charging outlook. Nationwide, about 29,277 public charging stations were installed as of August 2025. Tamil Nadu’s 2030 goal would account for roughly 5% of the country’s public chargers, assuming India meets its target of 4–5 lakh chargers by 2030. With nearly 4.5 lakh EVs already on road by 2025), Tamil Nadu’s rollout, is both necessary and influential. Success here could bolster confidence and inspire similar projects across other state EV policies in India.

Streamlined Implementation and National Ripple Effects

Tamil Nadu is not only crafting incentives but also focusing on execution mechanisms. In July 2025, the state released the Tamil Nadu Public Charging Infrastructure Guidelines, India’s first comprehensive state-level framework for EV charging rollout. These guidelines clarify agency roles, technical standards, and processes like obtaining connections and approvals. They encourage smart charging, and processes like obtaining connections and approvals. They encourage smart charging and renewable integration to minimize grid impact and outline a single-window system for permits.

This move is nationally significant. Few states have published such detailed guidance, so Tamil Nadu’s document is poised to become a reference for other state EV policies in India.

More broadly, the state’s policy approach is shaping best practices across India:

- Traffic reform: Tamil Nadu’s innovative tariff model is inspiring similar reforms in states like Maharastra and Karnataka. Adjusting demand tariffs and enabling open-access renewable power for fast chargers are key to avoiding a fragmented policy landscape.

- PPP models: Tamil Nadu’s emphasis on private sector participation provides a working model for sharing costs and responsibilities. Offering upfront subsidies for a limited number of private stations and reserving government support for corridor charging can be replicated with local tweaks.

- Integrated ecosystem planning: Tamil Nadu links EV manufacturing incentives with charging infrastructure goals. Subsidizing charger deployment while attracting equipment manufacturers creates synergy; many chargers installed in the state may be locally produced, lowering costs and ensuring supply. Other states may follow suit by aligning their industrial policy (attracting EV/charger production) with infrastructure deployment, creating regional EV hubs. Indeed, Tamil Nadu aims to attract ₹50,000 crore (approx. $6B) of EV investment by 2030, and its success in drawing major EV and battery makers is partly due to such comprehensive planning. If this strategy continues to pay off, it will set a benchmark for treating the EV ecosystem as an end-to-end value chain in policy design.

- Regulatory best practices: Publishing detailed guidelines and establishing an EV cell demonstrates proactive governance. These efforts address interoperability and safety norms, which, if adopted widely, could lead to more uniform charger installations across India. Tamil Nadu’s framework tackles multi-agency coordination, consumer awareness, and grid readiness, common challenges in fast charger deployment.

Final Thoughts

Tamil Nadu EV policy 2025 has become a strong accelerant for DC fast charging infrastructure, within the state and as a national trend-setter. For B2B stakeholders, charging infrastructure providers, automakers, utilities, and policymakers, the key takeaway is the power of a comprehensive policy framework in unlocking the EV charging infrastructure in India.

By coupling financial incentives with enabling measures like PPP models, nodal agency support, and clear guidelines, Tamil Nadu has rapidly expanded its DC fast charging network and attracted significant private investment. Its trajectory over the next five years could very well shape the confidence and strategies of players across India’s EV sector. If the state meets its 2030 targets, it’ll be a proof-of-concept that robust state policy can drive the EV transition at a pace and scale needed to meet India’s electrification goals. Tamil Nadu has effectively thrown down the gauntlet, demonstrating how to supercharge the drive toward an electric mobility future.

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More