How India’s EV Infrastructure Rise Will Reshape Mobility, Mindsets, and Market Dynamics by 2040

Raghav Bharadwaj

Chief Executive Officer

Published on:

26 Sep, 2025

Updated on:

28 Jan, 2026

India is on the cusp of an EV revolution. Over the next two decades, the EV charging infrastructure in India is projected to explode in scale dramatically, an 80-fold increase in DC fast chargers, from about 14,000 today to 1.1 million by 2040. This rapid buildout, driven by strong government policy support and a booming EV market, isn’t just about installing hardware; it promises to reshape how Indians move, think about transport, and do business.

In this blog, we’ll explore:

- How will the rise of EV infrastructure reshape everyday mobility by 2040?

- In what ways will it shift consumer mindsets from range anxiety to range confidence?

- How will it spark dynamic changes across industries and markets?

India’s EV Infrastructure: An 80-Fold Expansion

To appreciate the scale of change, consider where we are now and where we’re headed. As of 2025, India had roughly 14,000 DC fast charging stations, mostly in cities. These high-powered stations can refill a car’s battery in minutes rather than hours. Thanks to government programs and private initiatives, the number of charging points has already been rising rapidly. For instance, about 40,000 new public chargers were installed in 2024 alone. Under the national FAME-II scheme, oil marketing companies like IOC, BPCL, and HPCL received funding to install 7,432 chargers at fuel stations, contributing to a total of 8,885 new public chargers by mid-2025. These efforts mark just the beginning.

Looking ahead, forecasts by Wood Mackenzie project India’s charging network to reach 1.1 million DC fast chargers by 2040. That’s a breathtaking leap, and it aligns with India’s ambitious EV targets. The government aims for 30% of all vehicles sold by 2030 to be electric and has backed this vision with robust policies. Programs like the PM-Electric Drive (E-DRIVE) scheme (₹10,900 crore) subsidize millions of e-two-wheelers, three-wheelers, trucks, and buses, including ₹2,000 crore earmarked specifically for new charging stations across highways and cities. Another policy introduced in 2024 offers ₹20 billion (~$240 million) in incentives for public fast chargers, signaling the government’s resolve to fill charging gaps. By building chargers in urban centers and along busy transport corridors, India is laying the groundwork for an EV charging infrastructure that reaches every corner.

From a global perspective, India’s rollout is part of a broader wave. Worldwide, EV charging ports (including home chargers) are expected to grow at 12.3% annually through 2040 to about 206 million. The Asia-Pacific region leads this expansion, with China dominating public charging and India emerging as a key growth market.

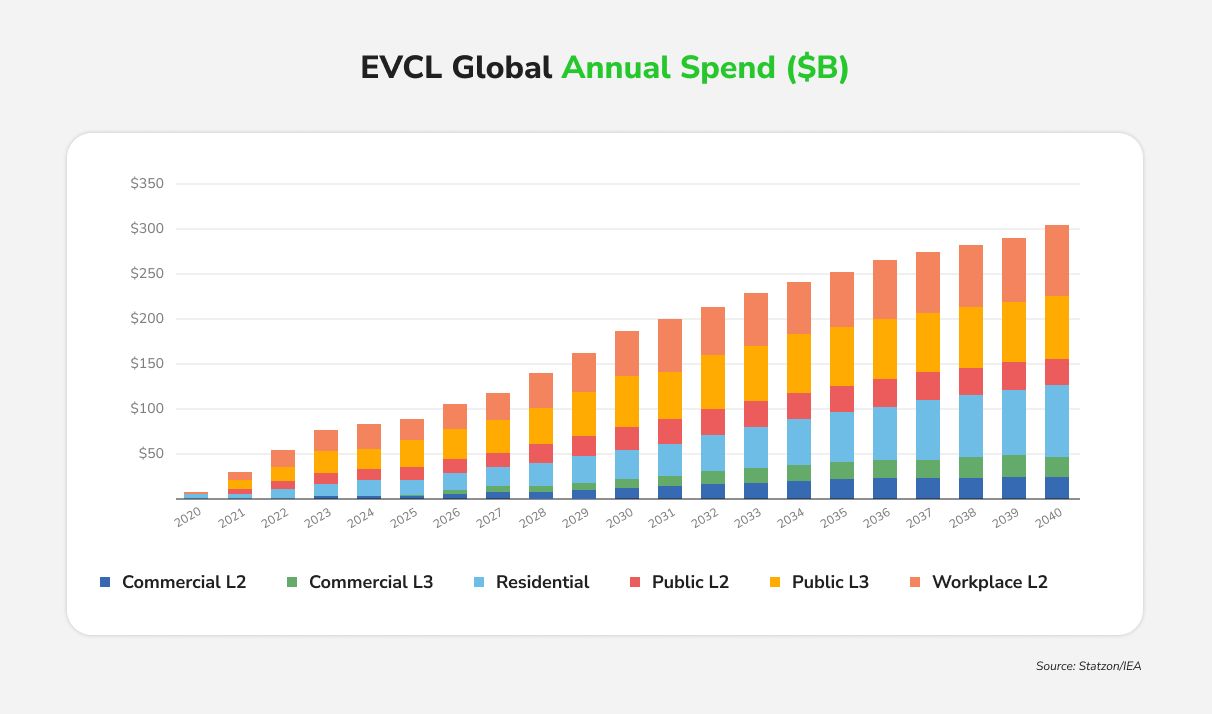

Annual global investment in charging infrastructure is set to hit $300 billion by 2040, and India will account for a significant share of that spending. Identified as one of the fastest-growing markets for EV chargers, the EV charging market growth in India is being driven by policy push and rapid adoption. By 2040, what is today a sparse network will become a dense web, spanning from metropolis highways to smaller towns. This vast infrastructure growth will directly enable new forms of mobility and convenience.

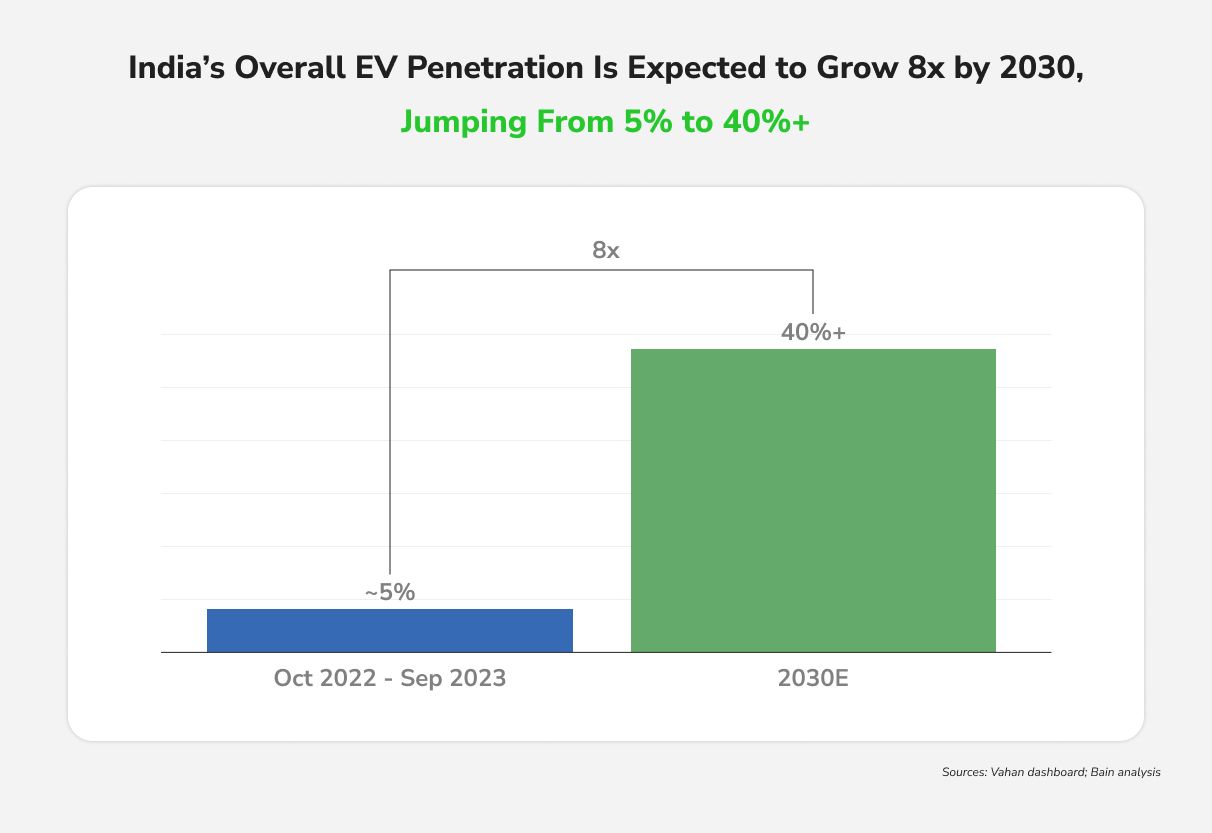

Driving Mobility into an Electric Future

The most immediate impact of a robust charging network will be on mobility – how people and goods move. Today, EV adoption in India is accelerating across all vehicle segments, but it’s still early days. EVs (including two-wheelers and cars) made up only about 5% of vehicle sales in 2023, albeit with strong growth in categories like electric scooters and rickshaws. By 2030, industry analyses suggest EVs could exceed 40% of new vehicle sales, and by 2040, nearly all new vehicles sold might be electric. A million-plus chargers will ensure these EV owners can drive anywhere without worrying about finding a plug.

Every day commuting stands to become cleaner and cheaper. For longer journeys, highways will be lined with fast-charging stations every few dozen kilometers, much like petrol pumps today.

The European Union is already mandating fast chargers every 60 km on major highways, and India’s plans are moving in a similar direction with corridor charging under schemes like PM E-DRIVE. With 120 kW “mega chargers” being rolled out at 500 locations by EV charging companies, in the next two years, even a quick 15-minute stop could add hundreds of kilometers of range.

Range anxiety, the fear of running out of charge, will no longer dictate travel plans. Instead, EV drivers will have the freedom to take impromptu road trips, confident that a charger is always within reach.

Crucially, better charging infrastructure also means public transportation can go electric at scale. India has already approved a ₹580 billion ($7 billion) plan to deploy 10,000 electric buses in 169 cities, aiming ultimately for 50,000 e-buses nationwide. These buses need reliable charging depots and en-route top-up points. By 2040, many city bus depots will have turned into high-capacity charging hubs, enabling entire fleets to run on batteries. The result? Quieter, zero-emission buses for millions of daily riders, improving air quality and commuter comfort. Likewise, electric three-wheelers and two-wheelers, which already form the majority of India’s EVs today, will benefit from abundant neighborhood charging.

Even freight and trucking could see a transformation. While heavy trucks are harder to electrify, India has initiated its first incentives for electric trucks and commercial vehicles. As charging infrastructure extends to highways and logistic hubs, medium-duty electric trucks become viable for regional transport. By the late 2030s, we may see dedicated “electric lanes” on highways or priority charging for cargo vehicles at distribution centers.

Government data shows trucks and buses contribute disproportionately to emissions (3% of vehicles but approx. 34% of CO₂), so electrifying these via targeted charging infrastructure will have outsized benefits. Imagine a future where major trucking routes have “charging plazas” every 100 km for fleet trucks, reducing diesel consumption and operating costs. Enhanced infrastructure will also encourage innovations in mobility services: ride-sharing fleets and corporate fleets could all be electric, knowing they can recharge quickly between shifts.

Overall, the expansion of charging stations acts as a force multiplier for EV adoption, eliminating the practical constraints and ushering in an era where the future of electric mobility becomes the default for personal, public, and commercial transport.

From Range Anxiety to EV Optimism: Changing Mindsets

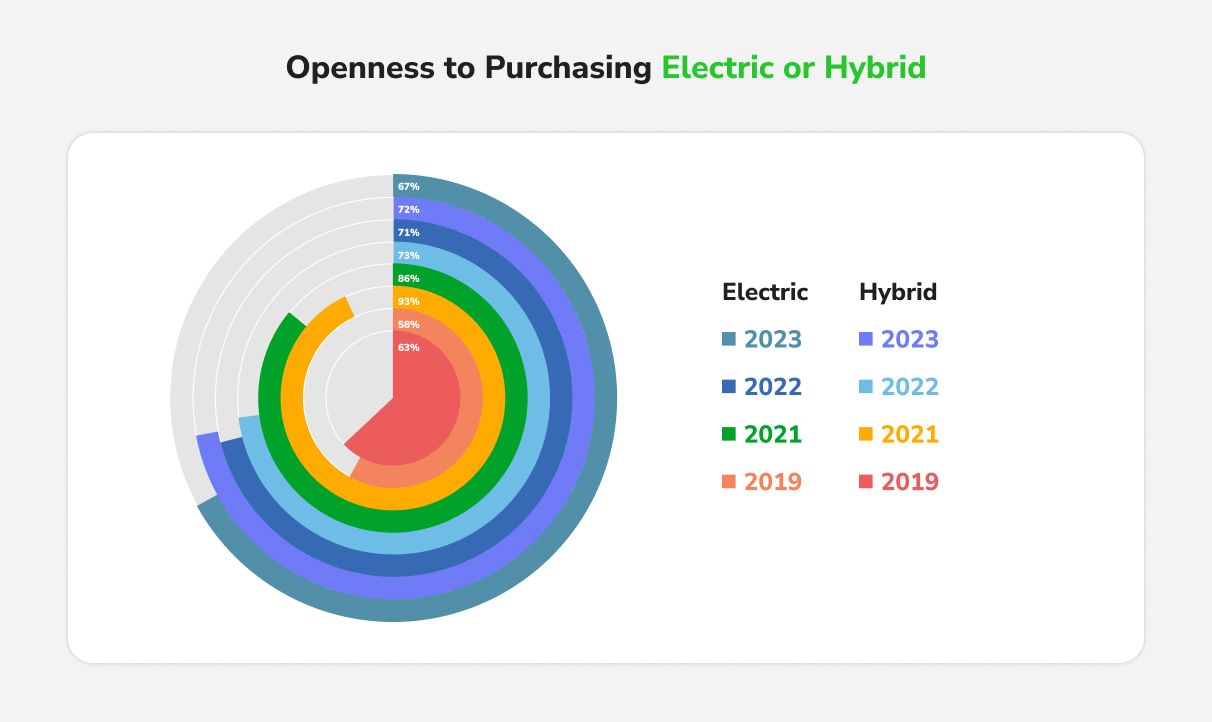

The rise of charging infrastructure isn’t just an engineering feat; it’s changing how people feel about electric vehicles. In the early years, many Indians were understandably hesitant to switch to EVs. Concerns about limited range, scarce charging points, and long charging times loomed large.

In 2023, India had roughly 200 electric vehicles for every one public charging point, a far higher ratio than countries like the US (approx. 20 EVs per charger) or China (<10 EVs per charger). That imbalance fed a perception that EVs might leave one stranded, a mindset summed up as “range anxiety.”

In fact, surveys have shown charging access to be a key barrier. Policymakers acknowledged that “limited charging infrastructure remains a significant barrier to EV adoption” and have given charging stations infrastructure status and GST incentives to spur growth.

But as infrastructure expands, these fears are subsiding. Confidence in EV technology is growing hand-in-hand with charger installations. By the end of 2025, India is expected to have around 500,000 EVs on the road (excluding the millions of e-scooters). This jump, from just 50,000 EVs sold in 2016 to over 2 million EVs sold in 2024, shows that consumers are warming up to electric mobility, especially as they see charging points popping up in their cities.

Government incentives have made many EV models as affordable as their petrol counterparts, nudging buyers towards the new tech. Consumer mindset is shifting from skepticism to curiosity and even enthusiasm. As one Gartner analyst noted, “Indian customers are increasingly willing to make procurement decisions that will result in improving air quality levels.” In other words, people are motivated by the promise of cleaner air and are trusting EVs to deliver.

A robust charging network reinforces this trust. When a new EV owner knows they can find a charger at their apartment, office, supermarket, or on a highway, the psychological barrier crumbles. Range anxiety gives way to range confidence. Globally, as EV ranges improved and networks grew, consumers started worrying less about range. In one survey, concerns about range and charging dropped on the list of EV purchase barriers, overtaken by cost concerns. We can expect a similar trend in India. By 2040, charging an EV might be as routine and banal as charging one’s phone or grabbing groceries. Many households will install home chargers (remember, residential chargers are forecast to make up two-thirds of all charging ports worldwide by 2040). For those who can’t charge at home, the wide availability of EV charging solutions ensures they’re never far from power.

Public perception of EVs is also set to evolve from niche to normal. Early adopters often had to plan routes carefully and field constant questions about “what if you run out of battery?” By 2040, such questions will sound quaint. The average Indian driver will likely have multiple EVs, and charging will be second nature. EVs will no longer be seen as experimental or elite, but a default choice for families, commuters, and businesses alike. And with every new charger installed, that confidence will deepen. This shift in mindset, from hesitation to habitual use, will be one of the most profound cultural changes in Indian mobility. Moreover, major automakers like Tata and Maruti have roadmaps for launching multiple new EV models by 2030, signaling to consumers that EVs are the future of mobility.

Environmental consciousness is also shaping how the public perceives EVs in India. As cities battle with air pollution and rising oil import bills, the discourse around EVs has turned positive. People are recognizing that electric mobility, when paired with a greener grid, promises cleaner air and reduced dependency on fossil fuels. The government’s push for EV adoption is partly to improve urban air quality and fight climate change, and citizens are on board with that vision. In the coming years, owning an EV could be seen not just as economically smart but as a point of pride for contributing to a cleaner India and the future of electric mobility.

Market Dynamics: New Industries and Economic Impacts

The ripple effects of India’s EV infrastructure boom will extend far beyond the vehicles on the road; they’ll reshape market dynamics and the economy at large. One of the most visible shifts is within the automotive industry itself. As charging infrastructure makes adoption easier, EV charging market growth in India is expected to grow into a $100+ billion opportunity by 2030 and even larger by 2040.

Traditional automakers are racing to electrify their lineups, while EV-only startups are entering the scene. Legacy companies like Tata Motors are already leading early EV sales, strengthened by their partnership with Tata Power for charging infrastructure. Meanwhile, newcomers like Ola Electric are rapidly scaling up. By 2040, the auto market may look entirely different, EVs could dominate vehicle sales well before then, and companies that invested early in charging networks and EV charging solutions will likely hold a competitive edge.

For example, Tata Motors announced plans to more than double its charging points to 400,000 by 2025 (including home and public chargers), recognizing that a convenient charging ecosystem drives vehicle sales. Other carmakers are following suit, forming alliances with charging providers or building their own networks. This trend is blurring the line between car manufacturer and energy provider, a dynamic new facet of the evolving market.

Energy and utility companies are adapting too. Oil companies like Indian Oil, BPCL, and HPCL have started installing EV chargers at fuel stations, signaling a pivot in their business models. As EV adoption rises, demand for petrol and diesel is expected to decline, reducing India’s petroleum consumption. This is significant in a country that imports 90% of its crude oil. Studies suggest a high EV penetration scenario could cut India’s oil imports by 90% by the mid-2040s, saving around $240 billion on oil import costs. In practical terms, that’s money that could stay within the country and be reinvested in renewable energy to power the EV fleet.

The synergy between EVs and renewable energy is a game-changer. India’s grid is projected to be 80% clean by 2040, thanks to massive investment in solar and wind capacity. When EVs charge on a green grid, transport emissions drop drastically. According to IEA scenarios, by 2050, India’s EV fleet could avoid between 110 to 380 million tonnes of CO₂ annually.

This environmental dividend also has market consequences: carbon credits, cleaner cities that reduce healthcare costs, and a boost to sustainable industries across the board.

Meanwhile, the charging infrastructure itself is giving rise to a new sector and job market. Think of the thousands of new charging stations, each one requires hardware (chargers, transformers), software, skilled installation, and maintenance. Companies providing these EV charging solutions are growing rapidly, creating job opportunities in manufacturing, energy services, and tech.

Global players are offering charging hardware, while local startups are gaining ground with “Make in India” chargers. Service providers like charging network operators manage the stations, process payments, and offer apps to help users find chargers. This entire ecosystem barely existed a decade ago; by 2040, it’s expected to become a thriving industry employing skilled technicians, software developers, network planners, and more.

Annual spending on EV charging infrastructure in India will be massive, especially considering the global figure of $300 billion by 2040. Investors are already taking notice. For example, Macquarie launched a $1.5 billion platform focused on financing fleet electrification and EV charging solutions in India.

Another emerging market dynamic is electric utility load management and innovation. Utilities will view EVs as both a challenge and an opportunity. On one hand, millions of EVs plugging in could significantly increase electricity demand. On the other hand, EVs function as mobile batteries, a potential asset for the grid. By 2040, smart charging technologies may allow EVs to routinely feed power back into the grid (vehicle-to-grid or V2G) during peak hours, improving grid stability. Policies are already evolving to support this shift; California, for example, will require new EVs to support V2G by 2027. In India, EV numbers grow, utilities could introduce special tariffs for off-peak charging or incentives for V2G participation, effectively turning vehicles into part of the power infrastructure. This opens up new revenue streams for EV owners and for service providers who aggregate these capabilities.

Battery manufacturing and supply chains in India are also transforming, altering market dynamics in the automotive supply landscape. With rising demand for EVs and chargers, battery needs will surge. The government’s Production-Linked Incentive (PLI) schemes for advanced batteries with an outlay of (₹18,100 crore) have already attracted major investments, aiming for 50 GWh of domestic capacity. By 2040, India could emerge as a global hub for battery production, reducing import dependency and creating an export market. This directly supports infrastructure growth, as locally produced batteries lower EV costs and ease deployment bottlenecks.

The circular economy around batteries, including recycling, is set to expand. By 2030, automakers globally plan to recycle 95% of EV batteries, and India will likely adopt similar practices by 2040.

Finally, consider the macroeconomic and consumer benefits rippling through the broader market. According to a study by an energy think tank, an aggressive EV transition could generate $2.5 trillion in net consumer savings for India by 2047, driven by lower fuel and maintenance costs. EV owners spend less on fuel (electricity is significantly cheaper per km than petrol) and on upkeep (fewer moving parts mean fewer service visits). Multiply those savings across tens of millions of vehicles, and the result is more disposable income circulating through the economy.

As India reduces its oil imports, the currency and trade balance benefit, potentially easing inflation and reinforcing market stability and growth. In essence, the EV infrastructure boom is not just a technological upgrade; it’s a powerful economic catalyst. It will spur industries like automotive, energy, and tech, cut costs for consumers, and help position India as a leader in sustainable mobility.

Conclusion

By 2040, India’s landscape of mobility and commerce will likely be transformed by the vast EV charging network now taking shape. For the average Indian driver, charging anywhere, anytime will be second nature, a dynamic shift from the sparse charger map of the 2020s. This confidence will have propelled electric cars, bikes, buses, and trucks into the mainstream, fundamentally changing how people move.

The psychological shift, from worrying about range to viewing gasoline vehicles as outdated, will be reflected in consumer choices and urban planning. Meanwhile, industries will have evolved and emerged: oil companies reimagined as energy providers, utilities managing millions of mobile batteries, automakers and startups competing in an electrified market, and India Inc. benefiting from reduced oil dependence and cleaner air.

At the heart of all this transformation is infrastructure; the charging points quietly doing the work of “refueling” our vehicles. The data paints an exciting picture: a future where over a million fast chargers stitch the country together, supporting tens of millions of EVs, cutting emissions, and saving billions of dollars. Importantly, this isn’t speculative hype; it’s backed by concrete trends and targets being hit year by year.

India’s EV infrastructure boom is well underway, and its ripple effects will be far-reaching. Mobility will become more sustainable and convenient, mindsets more open and optimistic about technology’s role in solving big challenges, and market dynamics more innovative and self-reliant. In sum, the charging cables being laid today are powering not just vehicles but also India’s journey into a new era of mobility and growth, an era that truly takes off by 2040.

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More