How Fleet Electrification Can Help India Achieve Its 2030 EV Goals

Raghav Bharadwaj

Chief Executive Officer

Published on:

14 Aug, 2025

Updated on:

28 Jan, 2026

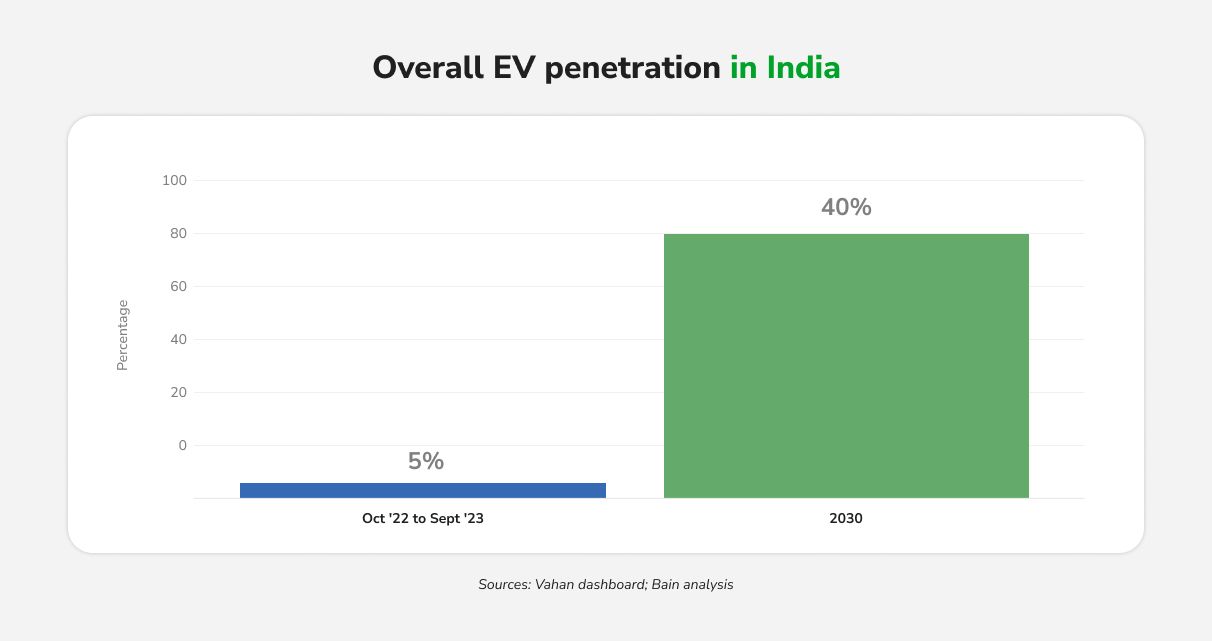

India’s transition to electric vehicles (EVs) has gained remarkable momentum, yet EVs still comprise only a small fraction of the nation’s overall vehicle fleet. EV adoption in India rose to 6.3% by 2024, totaling over 5.5 million EVs on Indian roads in early 2025.

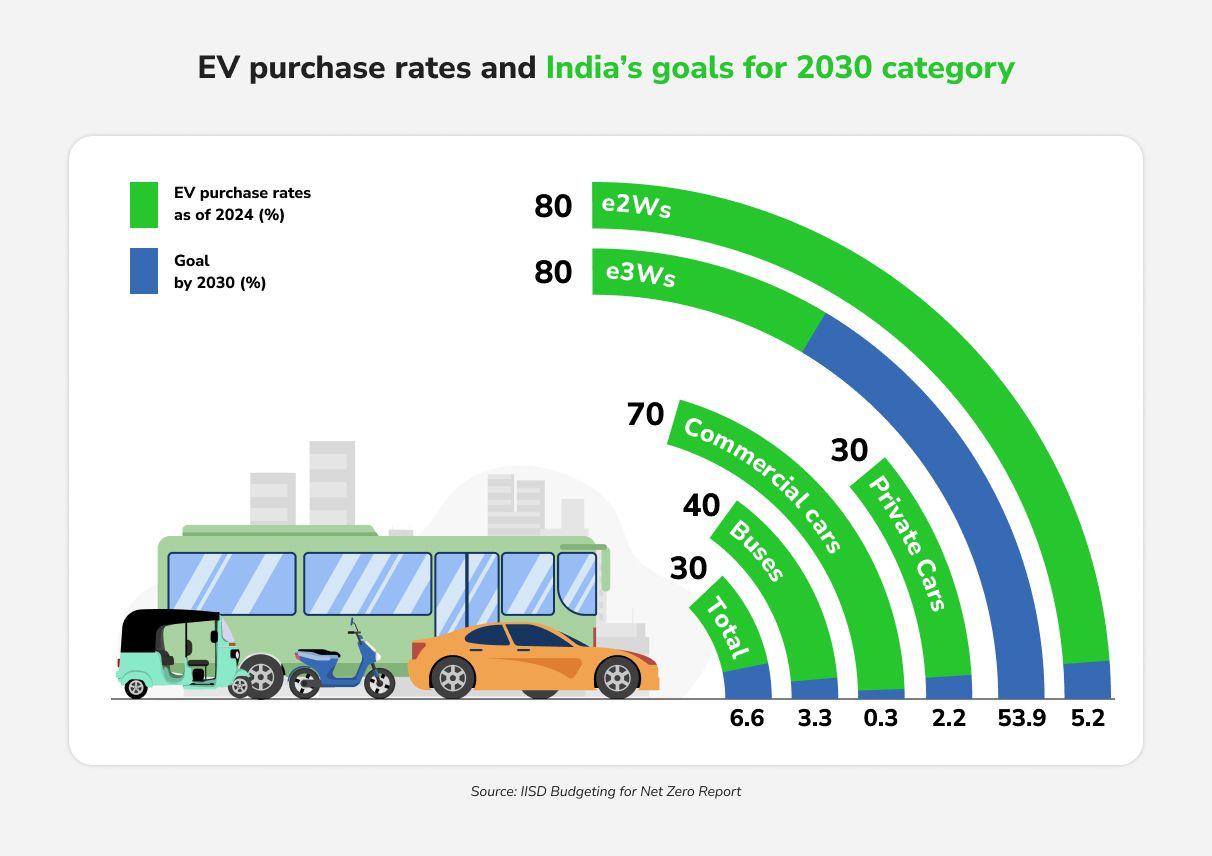

The Indian government has set ambitious targets for 2030, including 30% of private cars, 70% of commercial vehicles, 40% of buses, and 80% of two- and three-wheelers to be electric by 2030. Achieving these goals will require bold action across all mobility sectors. Increasingly, experts and policymakers recognize that enterprise and commercial vehicle fleets, ranging from delivery vans and ride-hailing cars to government vehicles and buses, will be the linchpin of India’s EV revolution.

This blog answers three key questions:

- Why are enterprise fleets crucial for India’s EV transition?

- What is the current state of fleet electrification in India, and how are companies and governments driving it?

- What immediate actions should CEOs and fleet leaders take to future-proof their organizations through EV adoption?

Why Enterprise Fleets Are Crucial for India’s EV Transition

Several factors make enterprise and commercial fleets key catalysts for India’s shift to electric mobility:

Scale and Speed of Adoption

Unlike individual consumers who adopt vehicles one by one, enterprises can convert dozens or hundreds of vehicles at once. Fleet operators, from delivery companies to taxi aggregators, can deploy EVs in bulk, rapidly boosting EV numbers on the road. By 2030, commercial EVs are expected to account for approx. 70% of all EVs in India, underscoring the outsized role of fleets in the transition and the importance of scalable EV fleet solutions.

Total Cost of Ownership (TCO) Advantage

Fleets typically log high daily mileage, making fuel savings and maintenance benefits of EVs accrue faster. According to industry analysis, most EV categories in India are already TCO-positive for high-use scenarios, making them attractive as fleet and B2B vehicles.

In other words, while an individual car buyer might worry about the higher upfront cost of an EV, a business calculating lifecycle costs may find an EV cheaper overall than a gasoline or diesel vehicle due to lower electricity vs. fuel costs and reduced maintenance. This economic rationale is a powerful driver; fleets can justify EV investments to their CFOs by projecting fuel cost reductions and lower total operating costs over time, strengthening the case for EV fleet solutions.

Infrastructure and Operational Control

Fleet operators benefit from controlled use cases and depots, simplifying charging solutions. For instance, e-commerce companies can install private charging stations at warehouses to recharge electric vans overnight. Public transport agencies can set up charging at bus depots, contributing to the growth of EV charging infrastructure in India.

This depot-charging model sidesteps one of the main consumer concerns, public charging availability, because fleets can ensure dedicated access.

Enterprises can also experiment with solutions like battery swapping for two- and three-wheeler fleets, minimizing downtime. By investing in their own charging infrastructure, fleets effectively expand the nation’s charging network.

Market Signaling and Ecosystem Boost

When large companies electrify their fleets, it sends a strong market signal to automakers and investors that EV demand is real. Corporate fleets committing to EVs give confidence to the ecosystem (manufacturers, charging providers, and financiers) to scale up. Moreover, fleet vehicles typically have defined turnover cycles; after a few years of service, they are resold into the second-hand market. Thus, today’s fleet EVs become tomorrow’s affordable used EVs, broadening access. Fleets, therefore, can jump-start a robust used-EV market, allowing middle-class consumers to buy pre-owned EVs at lower price points in a few years, further accelerating mass EV adoption in India.

Environmental and Social Impact

Commercial vehicles contribute disproportionately to urban pollution and carbon emissions due to their intensive use. Electrifying these yields outsized gains in emissions reduction and air quality.

For example, the government estimated that electrifying all government-owned vehicles could save ₹1.63 lakh crore (₹1.63 trillion) in fuel and avoid 12.13 lakh tonnes (1.21 million tons) of CO₂ emissions over their lifetimes, an outcome aligned with progressive EV policy in India.

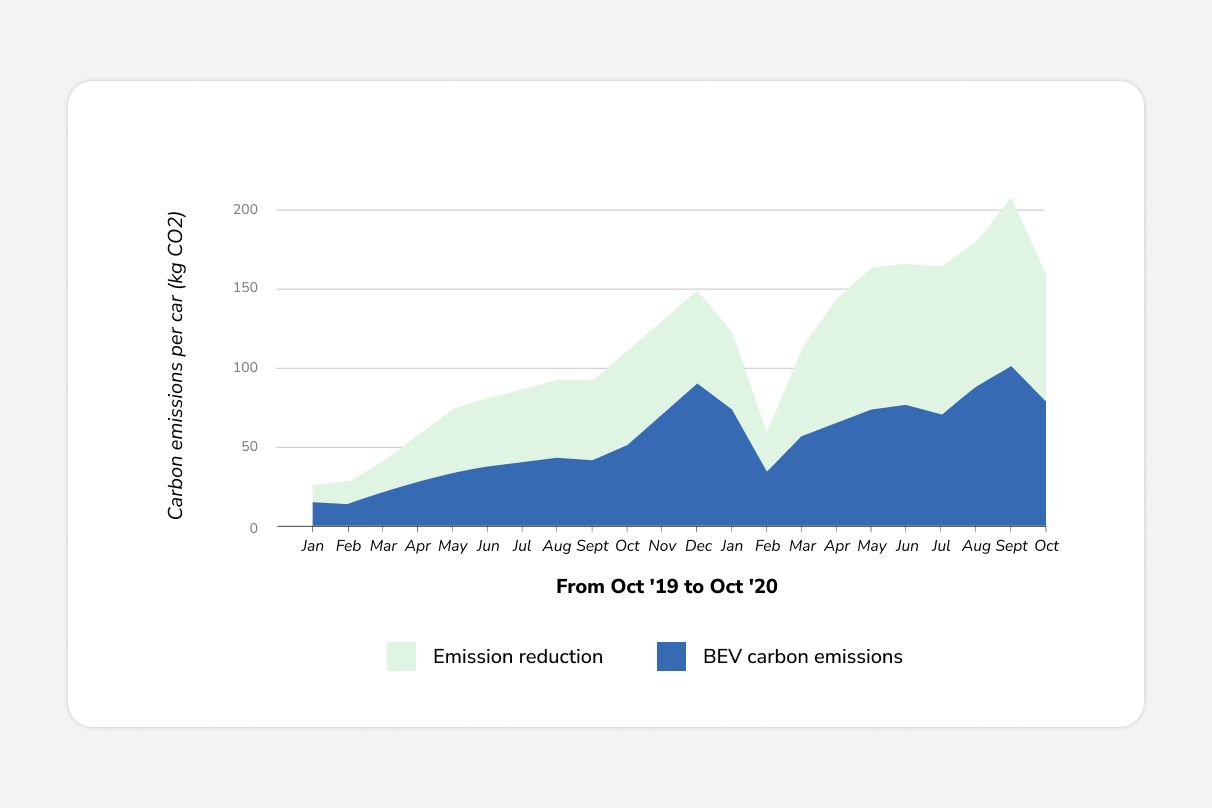

Another real-life example could be China’s. Using real-world driving data, a study shows a significant drop in carbon emissions when Battery Electric Vehicles (BEVs) replace fuel-powered vehicles over the same driving distances. Emission reductions displayed a steady upward trajectory throughout the study period, rising from about 8.72 kg of CO₂ per BEV in January 2019 to roughly 63.83 kg of CO₂ by October 2020. This represents an average monthly increase of 9.47%.

Now extend that impact to the vast commercial sector, delivery trucks, ride-share cars, and company-owned buses, and the benefits to India’s energy security (cutting oil imports), climate goals, and public health (cleaner air in cities) are enormous. Fleet operators, often being large companies, are also under pressure to meet sustainability and ESG (Environmental, Social, Governance) goals. By switching to EVs, enterprises can dramatically shrink their carbon footprint and showcase climate leadership, aligning with India’s net-zero vision for 2070.

- Enterprise fleets offer a fast-track pathway to scale EV adoption. They have the:

- Means – capital and scale to invest in new technology

- Motive – cost savings and ESG commitments

- Opportunity – structured operations that can accommodate charging logistics

The Current State of Fleet Electrification in India

While private EV ownership (particularly electric cars) is in its early stages, electrification is racing ahead in certain vehicle segments and use cases, many of them enterprise-driven. Let’s examine the landscape segment by segment and through key examples:

Two- and Three-Wheelers (2W & 3W)

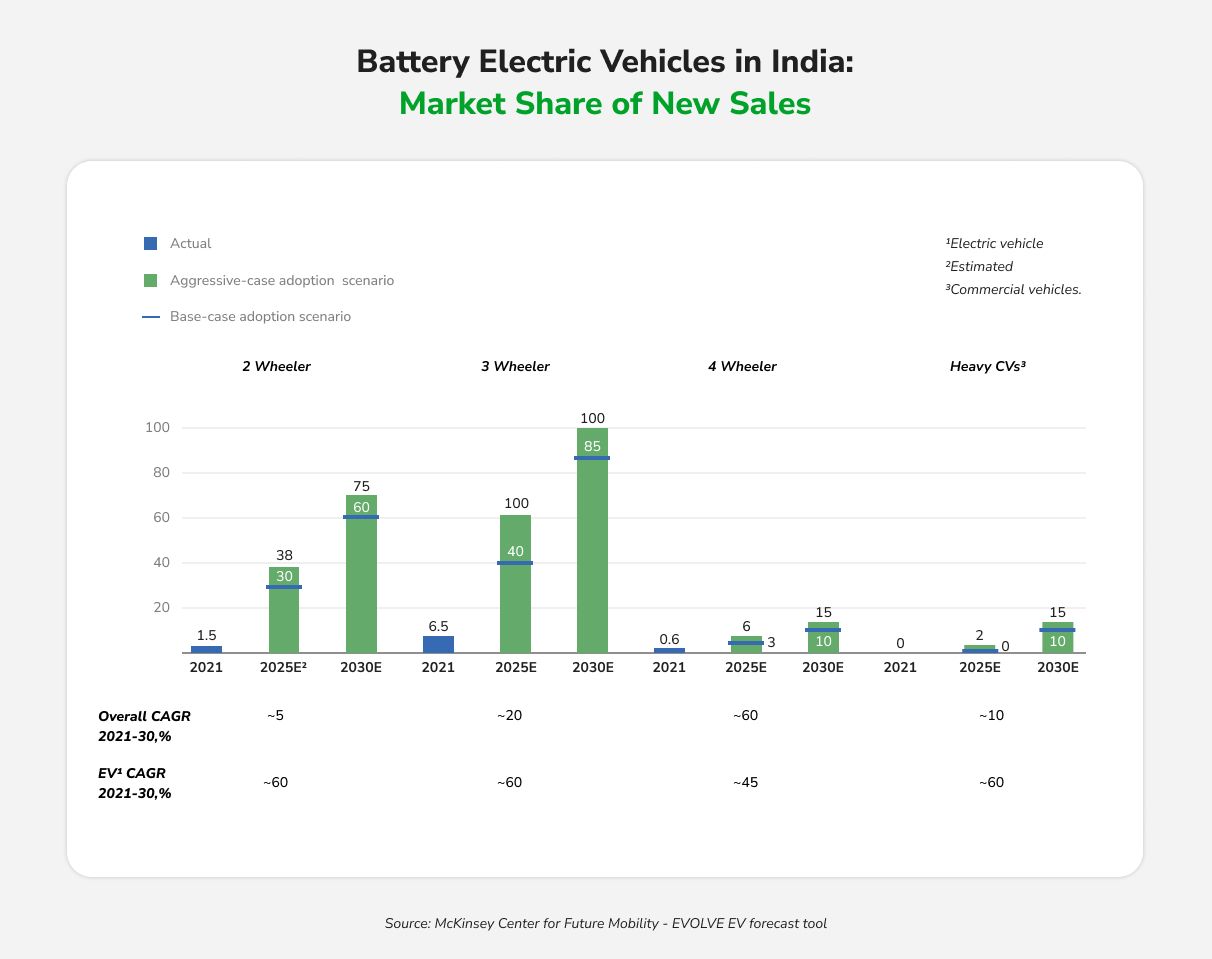

India’s largest EV volumes today come from two-wheelers and three-wheelers, which account for over 85-90% of all EVs sold. A significant portion of these are used in commercial operations: from gig delivery workers to electric auto-rickshaws. By 2030, electric two-wheelers could reach 50% of new sales and electric three-wheelers 70%, driven by their lower operating costs and suitability for short-range urban duty.

For instance, food delivery companies and courier services are rapidly onboarding e-bikes: Zomato and Swiggy have pledged 100% electrification of their delivery fleets by 2030. These companies are already deploying thousands of electric two-wheelers in major cities, often through partnerships or incentives for their delivery partners. The cumulative effect is significant; millions of daily delivery miles are now electric, cutting fuel use and emissions.

Four-Wheeler Fleets (Cars and Vans)

Adoption of electric passenger cars by individual consumers remains modest, but enterprise momentum is building. EVs were approx. 25% of new car sales in 2022, per industry reports. Taxi and ride-hailing fleets are a prime example. Uber India announced plans to deploy 25,000 electric cars by 2025-26 as part of its “Uber Green” initiative, partnering with fleet operators and automakers.

Its domestic competitor Ola (which also launched its own EV manufacturing arm, Ola Electric) had similar bold plans to electrify its ride-share fleet.

Corporate fleets for employee transportation are also switching to EVs in tech hubs like Bengaluru and Hyderabad, supported by leasing companies offering EV fleet solutions.

On the logistics front, Amazon India is adding 10,000 electric delivery vans to its fleet by 2025. Flipkart has deployed over 10,000 EVs in its delivery fleet as of 2024 and is steadily increasing that number. Flipkart’s EV fleet, comprising electric vans and two-wheelers, already contributes to over 55% of its grocery delivery orders in major cities being completed by EVs. The company has committed to 100% electrification of its last-mile fleet by 2030 as a member of the global EV100 initiative.

Buses and Public Transport Fleets

Electrifying buses is a priority for cleaner public transit. Here, fleets are largely government or public-private entities, but they behave like enterprise fleets in adoption decisions. Under the FAME II scheme and PM e-Bus Sewa program, thousands of electric buses have been ordered for city fleets, reflecting the impact of evolving EV policy in India.

In FY 2024 alone, over 3,700 electric buses were sold across India and the market is growing quickly. The goal is to replace 800,000 diesel buses by 2030. Cities now run e-buses for urban routes, and state transport units are partnering with OEMs via leasing models to reduce upfront costs. India’s focus on early electrification of bus fleets is positioning the country as a leader among emerging markets, setting a valuable example.

Government Fleets

Progress in electrifying government-owned vehicles has been slower; as of early 2022, only about 0.6% of government vehicles in India were electric, but efforts are underway.

Agencies like EESL (Energy Efficiency Services Ltd) initiated procurement of 10,000 EVs for government use.

A few states have even set targets. States like Delhi have mandated EVs for all government hires, and Haryana and Uttar Pradesh have announced 100% electrification goals for their official fleets by the mid-2020s, though implementation remains weak.

Converting government fleets boosts public confidence in EV and sets an example for private EV buyers and businesses.

Corporate Commitments and Coalitions

Indian businesses are joining coalitions to promote fleet electrification. The Climate Group’s EV100 initiative has attracted at least 12 Indian companies, such as Flipkart and BSES, which have committed to 100% electric fleets by 2030.

Under the “Moving India” platform by the World Economic Forum, over 30 businesses and government bodies are collaborating on electrifying corporate fleets, logistics, and financing.

There are also public-private partnerships targeting specific segments. For example, several companies (Amazon, JSW Steel, IKEA, etc.) launched EV pilots for trucking through EV100+ to kickstart electric truck deployment in India. Such collective efforts are addressing common challenges (like lack of suitable vehicle models or financing hurdles) and sending a unified message to suppliers and policymakers that the demand for fleet EVs is robust.

Automaker and Industry Response

Automakers are tailoring products for the Indian fleet market. Tata Motors launched the XPRES-T EV, a version of its electric sedan designed for fleet use.

However, industry analysts note that the market still lacks an economical, entry-level electric car designed for fleet operators; existing electric car models are mostly higher-end, and even the XPRES-T is priced significantly above equivalent gasoline/CNG models.

Partnerships like Tata Motors supplying EVs to Uber and Mahindra Electric focusing on e-3Ws for deliveries show that the automotive value chain is adapting.

Battery leasing models, fleet energy management software, and dedicated B2B sales teams are becoming central to India’s auto industry strategy.

Key Actions for Executives: Seizing the EV Fleet Opportunity Now

For a CEO or senior executive convinced by the arguments above, the logical next question is, “What should we do to get started on our EV journey?”

Here is a checklist of concrete actions and best practices to initiate today, ensuring your organization stays ahead in the EV transition:

- Develop a Clear EV Fleet Vision and Policy: Articulate a top-level commitment (e.g., “50% of our delivery fleet will be electric by 2025, and 100% by 2030”). Make EV adoption part of your sustainability strategy and public ESG goals.

- Conduct a Fleet Audit & Segmentation: Map out all vehicles in use and segment them by use case, mileage, and replacement timeline. Identify “low-hanging fruit” vehicles or routes that can be electrified immediately. Also note upcoming procurement cycles: if certain diesel vehicles are due for replacement in 2024–25, plan for EV options now rather than locking into another ICE for 5+ years.

- Run Pilot Projects and Training: Select a city or business unit and launch a pilot with a handful of EVs. Training programs for drivers and fleet managers on EV basics (charging protocols, driving techniques to maximize range, and safety procedures) can help address any anxiety or resistance to new technology.

- Engage Finance Early: Involve your CFO or finance team to explore leasing, hire-purchase, or the “EVs-as-a-service” model. Consider total cost over vehicle life, and tap into green finance or CSR budgets for pilot funding.

- Plan Your Charging Infrastructure and Strategy: Conduct a site survey to install chargers. Decide whether you need fast DC chargers or slower AC chargers. Consider integrating solar energy and setting up software to monitor charging data such as sessions, costs, and energy consumption from day one.

- Leverage Government Incentives and Partnerships: Track central and state incentives. Ensure timely application for subsidies on each vehicle purchase. Networking with government agencies can also present opportunities to collaborate on pilot programs (like electric bus or freight corridor pilots), which often come with support. Being visible in the public sustainability space can open doors. For instance, if a city is creating an EV task force, have your company represented.

- Communicate and Celebrate Milestones: Publicize your progress through press releases and social media. It not only boosts your brand but also holds the organization accountable to keep the momentum. Internally, celebrate the first 100,000 electric kilometers driven, or the first 100 tons of CO₂ emissions avoided. This reinforces the positive feedback loop and builds pride among employees that they are part of a forward-thinking, purpose-driven organization.

- Monitor, Measure, Improve: Set up a dashboard for the leadership team to track key fleet metrics such as utilization, costs, downtime, driver feedback, and emissions saved. Encourage continuous improvement and plan for scale beyond the pilot stage.

- Build Ecosystem Partnerships: Partner with OEMs, charging providers, tech startups, and fellow corporations to share knowledge and resources. Join consortiums like the Climate Group’s EV100 or NITI Aayog’s stakeholder committees to facilitate peer learning and collective action.

The EV transition is a “sooner is better than later” scenario. Early movers gain cumulative benefits, while late adopters risk falling behind. With prudent planning and bold leadership, enterprise fleets can transform from carbon-intensive cost centers into efficient, innovative, and green assets for the organization.

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More