EV Charging Trends 2025: What OEMs, Airports, and Governments Are Prioritizing

Raghav Bharadwaj

Chief Executive Officer

Published on:

02 Sep, 2025

Updated on:

28 Jan, 2026

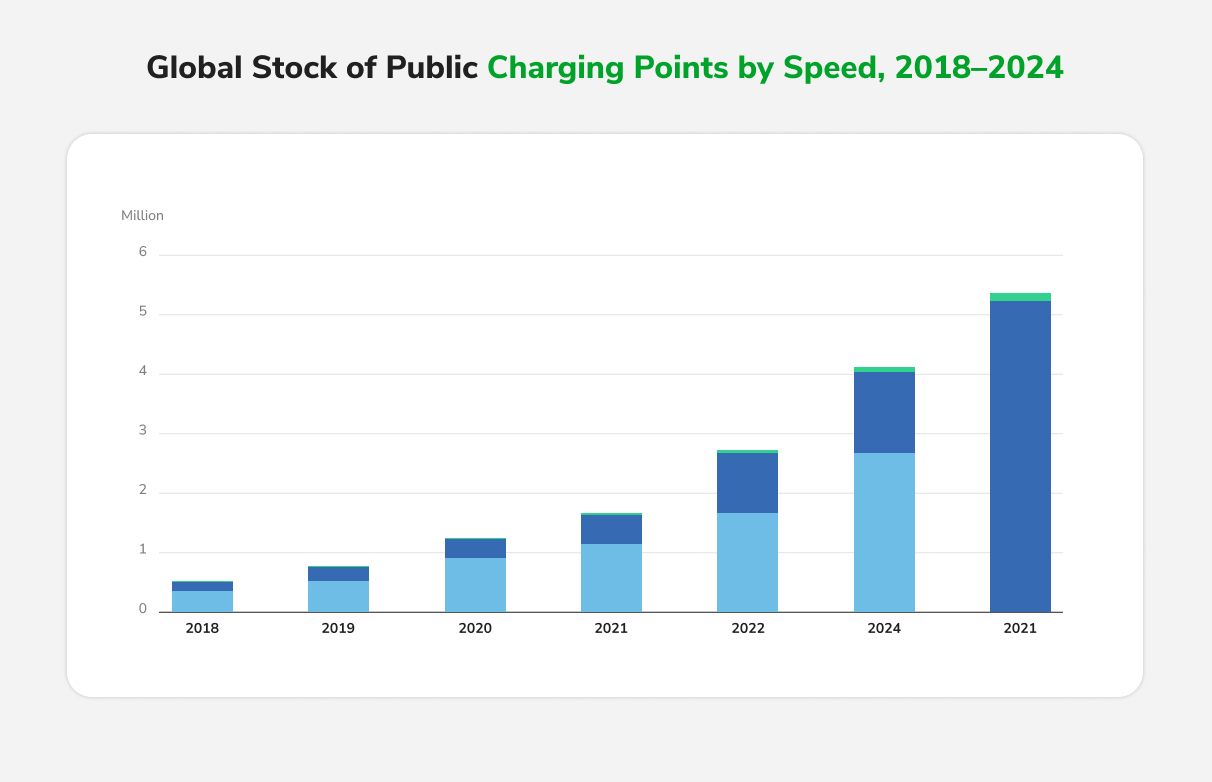

Electric vehicles are hitting the road in record numbers, but is the charging infrastructure in India and globally keeping up? By the end of 2024, over 5 million public EV charging stations were in operation worldwide, double the number just two years prior.

This rapid expansion reflects surging EV adoption and strong policy pushes, especially in China and Europe. Yet challenges remain. EV charging network in India and other regions is growing, but unevenly. China now hosts about 65% of all public chargers globally, while India, the US, and the UK face higher EV-to-charger ratios as adoption outpaces charger deployment.

So what exactly are different stakeholders prioritizing in 2025 to accelerate EV charging? Let’s answer three core questions upfront:

- What are automakers (OEMs) prioritizing when it comes to EV charging?

- How are airports ramping up EV charging, and why does it matter?

- What are governments doing to accelerate EV charging infrastructure in India and worldwide?

What are automakers (OEMs) prioritizing when it comes to EV charging?

Selling EVs is only half the battle; ensuring drivers can easily charge them is the other. In 2024–2025, OEMs are investing aggressively in EV charging stations, technology standards, and partnerships to make charging faster and more accessible.

Expanding Fast-Charging Networks

OEMs are building their own EV charging station business models to reassure customers. Tesla led the way with its global Supercharger network, and now others are following suit. In North America, seven major automakers (BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz, and Stellantis) launched a joint venture in 2023 to install 30,000+ high-powered chargers across the US and Canada. The first stations opened in 2024, offering both CCS and Tesla’s NACS connectors. Similar OEM-backed networks are expanding in Europe, signaling that automakers now view EV charging infrastructure as a competitive necessity.

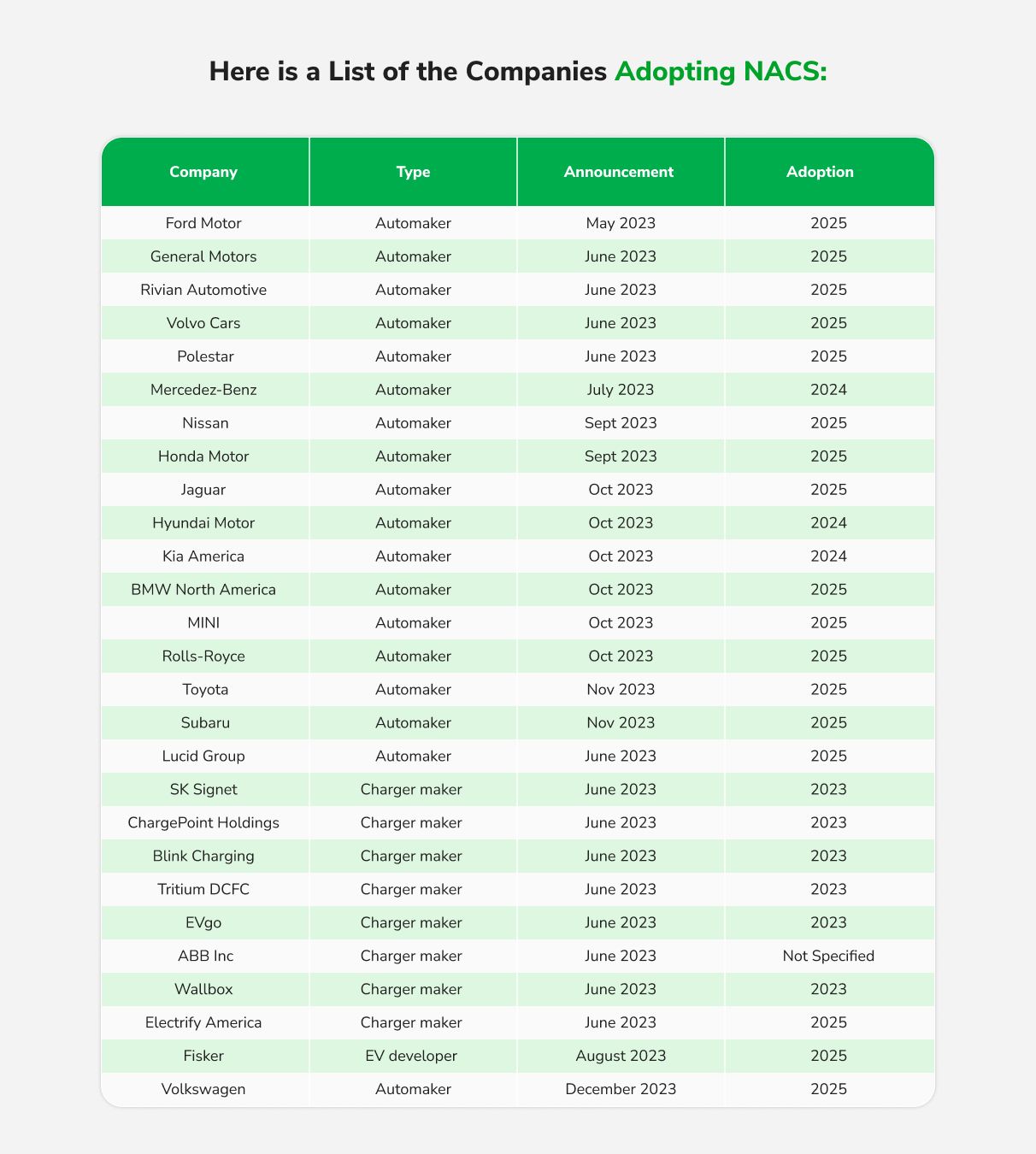

Converging on Standard Plugs and Seamless Charging

Convenience and interoperability are top focuses. By late 2023, nearly every major automaker had agreed to adopt Tesla’s North American Charging Standard (NACS) connector. Starting in 2025, new models from Ford, GM, Mercedes, Honda, and others will include NACS ports, granting native access to Tesla’s Supercharger network. Plug & Charge capabilities (per ISO 15118) are also rolling out, enabling automatic authentication and billing; no cards or apps required.

Partnering to Accelerate Infrastructure

Most OEMs are teaming up with charging operators and energy firms to speed up deployment. For example, Mercedes-Benz is working with ChargePoint and energy firm MN8 to deploy thousands of ultra-fast chargers in the US (part of Mercedes’ plan for 10,000 chargers globally by 2030). Shell and BP are also investing heavily, with Shell targeting 2.5 million chargers by 2030. These collaborations blend customer reach with infrastructure expertise, often leveraging public grants to accelerate deployment.

How are airports ramping up EV charging, and why does it matter?

Airports are emerging as key players in EV charging infrastructure expansion. With millions of travelers, rental cars, taxis, and employees passing through, major airports are prioritizing EV charging solutions for businesses as part of both their customer service and their sustainability goals. In fact, the airport EV charging market is projected to reach $4.1 billion by 2031.

Scaling up chargers for travelers

The United States has over 5,000 public airports, and most large airports now offer EV charging stations in at least one parking facility. Globally, airport-based chargers doubled from 2022 to 2024 (from around 1,500 to 3,000 units, according to industry estimates). Yet demand often exceeds supply, prompting airports to expand installations in long-term parking lots, garages, waiting areas, and rental car centers.

Supporting electric taxis and ride-shares

Airports are building charging hubs for taxis and ride-hail vehicles. In late 2024, New York’s JFK Airport opened a new fast-charging site with 24 DC fast chargers in its for-hire vehicle lot, doubling JFK’s EV charging network capacity.

LaGuardia Airport is constructing a 48-port facility for Uber/Lyft drivers and taxis. These high-powered stations allow commercial drivers to recharge quickly between trips, an essential step as cities move toward electrifying taxi fleets. The pattern is global: from Los Angeles to Oslo, airports are designating areas for ride-share and taxi EV charging stations so that zero-emission vehicles can reliably serve travelers. It’s a win-win: the airport reduces local emissions and congestion from idling gas vehicles, while drivers save on fuel and comply with evolving clean-air regulations.

Electrifying airport fleets and operations

Airports aren’t just catering to passenger cars; they’ve pledged to convert their ground service equipment and vehicle fleets to electric by 2030. For instance, across New York’s JFK, LaGuardia, and Newark airports, there are already 1,400+ electric ground service vehicles in use, supported by over 775 dedicated charging points for this equipment.

Spain’s AENA (which operates Madrid and Barcelona airports) plans to install 250 airside EV chargers by 2026 and about 890 by 2030 to power its growing electric fleet.

These efforts reduce emissions and turn airports into test beds for high-power charging management.

The business case

EV charging is becoming a revenue stream. While many airports initially offered free charging, paid models are gaining traction. The market projection of $4.1 billion by 2031 for airport EV charging station business indicates that private firms and investors see profitability in these installations.

Partnerships with private operators, like what JFK did with Revel, help airports defray costs and manage charging services while supporting their broader environmental objectives (many airports have sustainability certifications or carbon accreditation to maintain).

What are governments doing to accelerate EV charging infrastructure?

Governments are playing a pivotal role in scaling up EV charging, recognizing that market forces alone won’t build infrastructure fast enough or in all the right places.

Massive public investments

The United States, for example, launched a $5 billion National EV Infrastructure (NEVI) program for highway fast chargers. The European Union is directing billions of euros from its Alternative Fuels programs into charging stations across member states.

China, which hosts about 65% of the world’s publicly accessible chargers, has leveraged generous subsidies and utility partnerships.

India allocated ₹20 billion (approx. $240 million) in 2024, adding 40,000 new public EV charging stations that year to strengthen the EV charging network in India.

Coverage mandates and targets

Beyond funding, policymakers are also setting concrete targets to ensure chargers are distributed widely. The EU’s new Alternative Fuels Infrastructure Regulation (AFIR) mandates one 150 kW fast charger every 60 km on core European highways by 2025. The UK targets 300,000 public chargers by 2030. California aims for 250,000 chargers by 2025. These mandates ensure geographic coverage and readiness for the gasoline phase.

Standards for reliability and interoperability

Governments are enforcing open access and uptime standards. US federal funding requires both CCS and NACS plugs. Texas mandates NACS on state-funded chargers.

Likewise, the EU requires transparent pricing, common payment methods, and real-time data on availability. Building codes are evolving to ensure new constructions are EV-ready.

Public-Private Partnerships and Utility Regulation

Governments are also encouraging collaboration with utilities and private firms. Utilities often need regulatory approval to invest in charging infrastructure. In many US states, public utility commissions (PUCs) have approved utility programs to build out charging infrastructure or offer rebates for home charger installations, recognizing it as beneficial for the public interest.

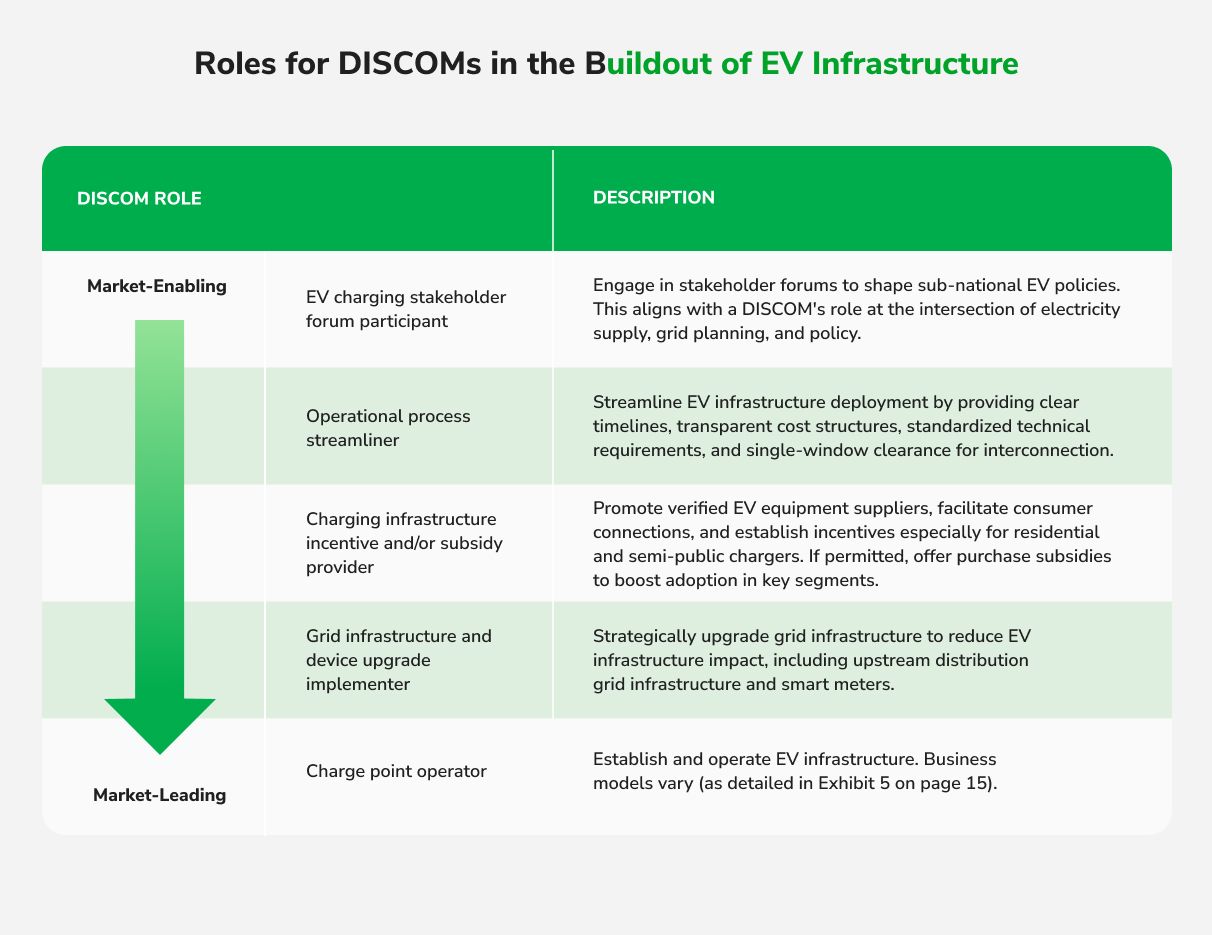

California and New York have approved hundreds of millions of dollars of utility-led programs. In India, as mentioned, utilities (DISCOMs) are being guided to support charging infra and streamline grid connections. The Indian government’s 2025 policy framework suggests DISCOMs could serve as nodal agencies for EV charging infrastructure in India, coordinating between charger installers and the often-complex local grid upgrade process.

Some Indian states (like Maharashtra and Delhi) introduced time-of-day electricity tariffs to encourage off-peak charging, aligning consumer behavior with grid capacity.

Meanwhile, India’s central government has layered multiple initiatives: the new PM E-DRIVE earmarks funds largely for urban charging, and there are generous incentives for charging equipment manufacturing (tying into India’s broader “Make in India” push, so that chargers themselves are produced domestically).

By the end of 2024, India had about 75,000 public chargers in place, and the Stated Policies Scenario (STEPS scenario) projects roughly 375,000 by 2030, a fivefold jump. Hitting that will require sustained year-on-year installation growth of approx. 50,000 units. It’s an ambitious trajectory, but India has signaled it will adjust policies as needed.

Localized Initiatives

City and regional governments are doing their part, too. Many cities have added requirements that new parking lots include EV charging spots or at least a conduit. Some have streamlined permitting; historically, installing a single public charger could require dozens of permits and months of paperwork, but places like Amsterdam and Los Angeles have introduced “one-stop shop” permitting that cuts through red tape. We also see novel ideas like curbside charging in dense cities. These smaller-scale initiatives, often supported by local government funds or utilities, make a big difference in driver convenience, especially for those without driveways.

Conclusion: Key Takeaways and Outlook

Across automakers, airports, and governments, 2025 is marked by collaborative momentum. Stakeholders are tearing down the chicken-and-egg problem of vehicles vs. chargers; they are growing together.

Fast, convenient charging is becoming the norm. High-power chargers, standardized plugs, seamless payment, and reliable uptime are reshaping the EV experience. As infrastructure scales, EVs edge closer to mainstream adoption.

Looking ahead, expect exponential growth in public chargers, deeper integration with energy systems, and innovation in fleet and highway charging. EV charging is no longer a niche experiment; it’s a cornerstone of transportation planning, charging full speed ahead into the future.

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More