Exploring the UK's Dynamic EV Market Landscape

Raghav Bharadwaj

Chief Executive Officer

Published on:

25 Dec, 2023

Updated on:

22 Jan, 2026

In 2019, the UK set a historic precedent: the government officially committed to achieving net zero greenhouse gas emissions by 2050. Despite some delays, the UK’s transport sector stands out positively in carbon emission reduction. In 2022, nearly one out of every five cars sold was fully electric, surpassing the government’s goals.

Nevertheless, the UK’s ranking in the EV Country Readiness Index has dropped, from 4th place in 2021 to 5th in 2023, raising concerns about the country’s electric vehicle (EV) market.

This article will provide insight into the UK’s EV situation by addressing the following questions:

- What is the current state of the UK’s EV market; who are the major players, and what are the government’s goals?

- What challenges does the UK’s EV market face?

- How can the UK progress in the international EV industry in the upcoming years?

The UK’s Current EV Market

The UK’s EV market has seen rapid growth, registering over 260k new electric cars in 2022, a significant increase from 15k in 2018.

According to the Society of Motor Manufacturers and Traders (SMMT), zero-emission vehicles accounted for an impressive 37.3% of new car registrations in September 2023. Growth is evident across battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs) alike.

Meanwhile, fleet-driven growth increased by 40.8% in September 2023, reaching a 52.5% market share. This indicates a market adjustment following limited supply in 2022, which constrained deliveries to business and fleet customers. Private consumer demand rose by a less dramatic 5.8%, reaching 122,944 units.

The increase in ultra-low emission vehicles began with plug-in hybrid electric vehicles from 2014. Specific BEV growth surged from early 2019, outstripping PHEVs from Q4 2020 onward. As of November 2023, BEVs remain in the lead, taking up 16.4% of the automotive market. PHEVs are also continuing to grow, but lag behind, at a 6.8% market share.

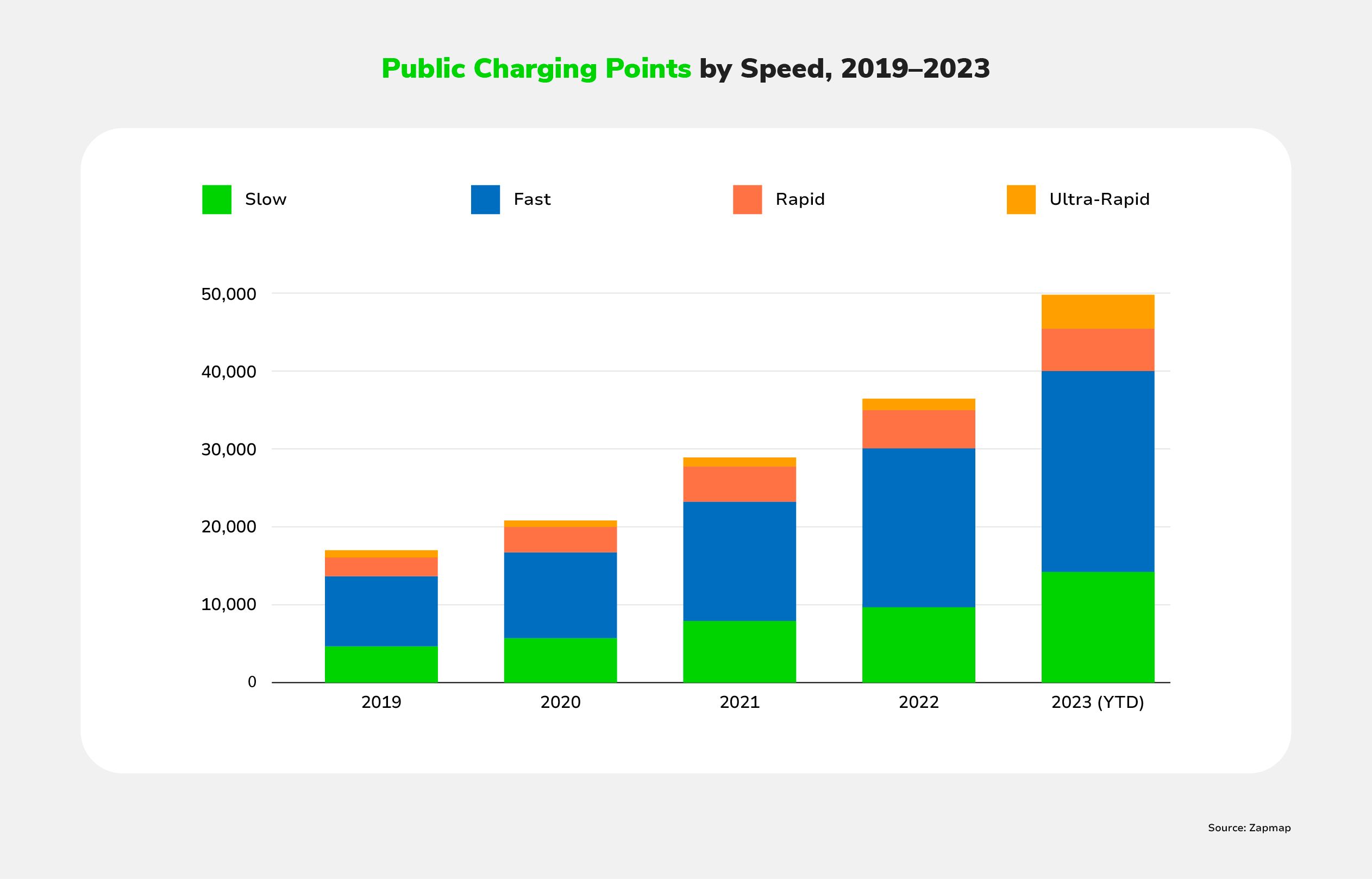

The UK’s charging infrastructure is starting to catch up with the rising EV adoption rates. As of September 2023, the UK boasts 49,882 public electric vehicle charging points across 29,709 locations, marking a 43% growth since September 2022. Home and workplace charging installations bring the country’s total up to approximately 680k.

Currently, rapid and ultra-rapid chargers make up around 20% of public charging devices; there are 9,209 rapid and ultra-rapid charging devices spread across 4,809 locations, with a growth rate of 68% YoY.

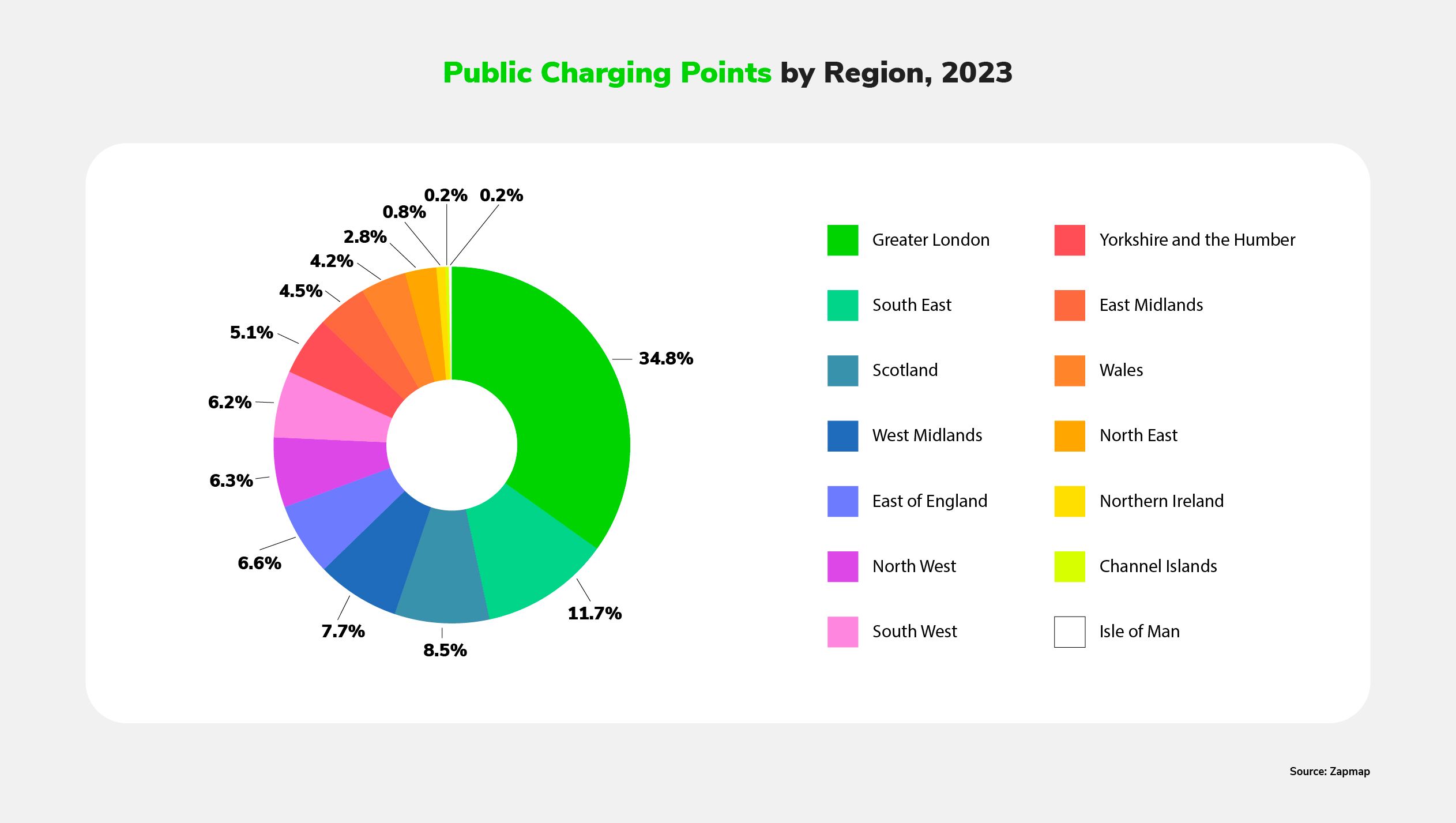

Greater London tops the list of charging points in 2023, with an estimated 17,380, accounting for an impressive 34.8% of the entire UK’s public charging infrastructure. Southeast England and Scotland follow, with 5,812 (11.7%) and 4,245 (8.5%), respectively.

Demand for affordable zero and low-emission cars is growing, as evidenced by rising second-hand sales figures; from March to June of 2023, second-hand EV sales surged by over 80%, reaching more than 30.5k units. Despite setting a record for the sector, however, these EV sales still constitute just 1.7% of the total second-hand market.

Enhancing the second-hand market is crucial for broadening the accessibility of electric vehicles, which currently remain more expensive than ICE models.

The UK’s electric 2-wheeler market is also growing, driven by increasingly affordable prices and rising traffic congestion. 2-wheelers up to 125cc currently dominate due to fuel and cost efficiency, and manufacturers are focusing their research and development efforts on premium high-capacity bikes to further amplify market growth. The strong leisure market, especially for adventure bikes, also contributes to market expansion. Anticipated growth in registered motorcycles over the next five years will further drive the UK’s two-wheeler market.

Major 4W Market Players

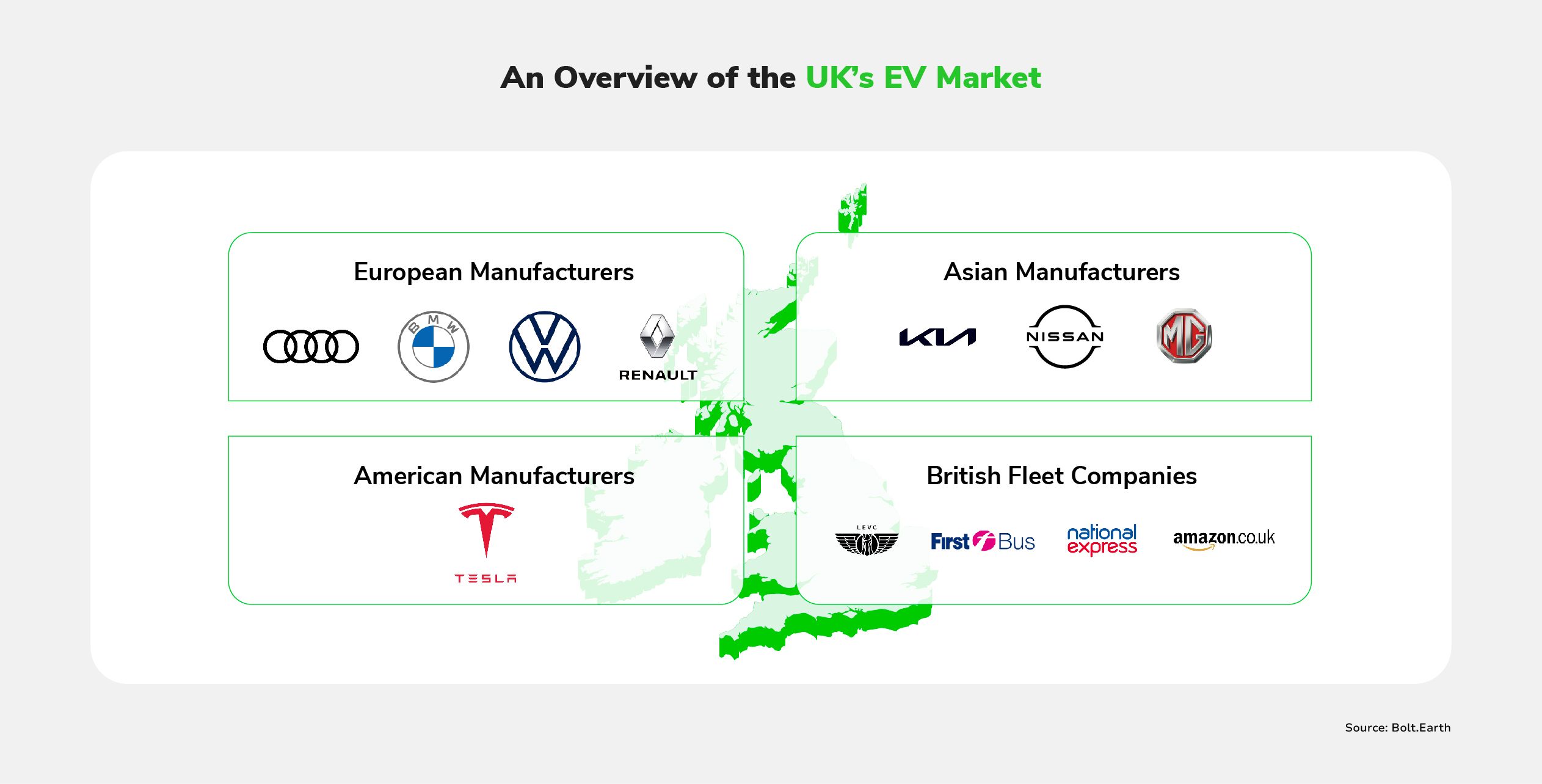

Overall, the UK’s EV market is dominated by five foreign brands: Audi, BMW, Renault, Tesla, and Volkswagen.

In 2022, the Kia e-Niro and Nissan Leaf were the 3rd and 5th best-selling EV models in the UK. 2023 has seen the arrival of a new Asian brand: China’s MG. During the first seven months of 2023, the MG4 was the UK’s #2 best-selling EV, beaten only by Tesla’s Model Y.

Tesla

Tesla’s Model Y and Model 3 were the UK’s best-selling EV models in 2022. The Model Y, a family SUV with a 319-mile range, is priced between £52k and £68k (USD 65,047 – 85,057), accelerating 0 – 60 mph in 3.5 seconds. The Model 3, priced between £48,490 and £61,490 (USD 60,653 – 76,914), charges from 10 to 80% in 23 minutes on a 200kW charger, making it a popular and affordable choice in the UK.

Despite lacking a Gigafactory in the UK, Tesla offers another innovative approach: electricity generating. They recently applied for a license to generate electricity with the UK’s Gas and Electricity Markets Authority in Great Britain, showcasing their commitment to sustainability.

German Legacy Brands

BMW and Audi, legacy manufacturers of luxury cars, have recently grabbed the British EV market’s attention with the BMW i4 and Audi Q4 e-tron models.

Audi has announced an ambitious goal: achieving full EV production by 2029. All existing production facilities will be retooled, new plants will be built where additional capacity is needed, and the range of models will grow.

Volkswagen is planning a similar transition, but is targeting the mid-end market.

Kia

Many buyers view Korean brand Kia as comparable to Volkswagen. They provide similar range — around 260 miles — and safety features, at a near-identical price.

However, Kia’s longer warranty and faster charging capability offer a better user experience, which is helping Kia make progress in the British market.

MG

China’s share of the European electric car market has more than doubled in less than two years. This is largely due to MG’s success.

China’s dominance is further accentuated by its lead in battery production, leaving the European industry dependent on a geopolitical rival until it establishes its own “gigafactories.”

In the case of MG, which is owned by SAIC, successful localization efforts include establishing a design studio in London and crafting cars that resonate with the preferences of the UK market, exemplified by the Cyberster series.

Thanks to these efforts, in addition to competitive pricing (£26,995 to £32,495), the MG4 appears poised for a promising future in the British market.

Major EV Fleets

The UK has been making strong efforts to electrify its fleet and business vehicle sectors.

Government Fleets

In January 2023, the British government announced that it had successfully achieved its 2022 target: ultra-low emission vehicles now comprise 25.5% of government fleets.

A notable instance is the integration of 3-wheeled electric motorbikes, the Yamaha Tricity 300, into the British police force. This initiative is endorsed by the Department for Transport and Innovate UK. The electric police bike incorporates a venturi duct traversing the center of the motorcycle, aiming to markedly minimize drag and improve efficiency.

Taxis

As of Q4 2021, there were 5,440 electric taxis registered in the UK, 3,621 of which were in London.

London Electric Vehicle Company (LEVC), a prominent player in London’s taxi market, has been promoting the TX range-extended electric black cab since 2018. With over 6,000 vehicles now in operation, the LEVC TX comprises more than 40% of all black cabs in London. The LEVC TX, equipped with a 110-kilowatt electric motor, offers an impressive 78 miles of pure electric range and a flexible total range of 333 miles on the WLTP test cycle, driving in full-electric mode at all times.

LEVC is contributing significantly to London’s transition to a cleaner, greener EV black cab fleet, positively impacting air quality.

Buses

Buses are responsible for 2.2% of the UK’s transport-related emissions. As of 2023, the Department for Transport has issued £320mn to obtain 4,000 zero-emission buses by 2025. The Transport Secretary has pledged £129 million to back local authorities in introducing zero-emission buses.

Major operators like First Bus and National Express aim for zero-emission fleets by 2030 and 2035, respectively. With sufficient funding, it’s expected that over two-thirds of new bus purchases in England by 2025 will be zero-emission, aligning with the Confederation of Passenger Transport’s goal for full adoption by the same year.

Freight

In 2021, heavy goods vehicles (HGVs) contributed 19% to the UK’s domestic transport emissions. While electric HGVs have a higher upfront cost and an average shorter range of 220 km, their lifetime expenses are lower, including fuel and maintenance savings.

Forward-thinking operators are adopting electric HGVs for a greener fleet. For example, Amazon UK has incorporated five heavy-duty electric trucks from DAF Trucks, capable of carrying up to 37 tons.

Meanwhile, DHL Supply Chain has pioneered the use of four 40-tonne Volvo FM fully-electric HGVs in the UK. Featuring a substantial 540kWh battery, these zero-emissions trucks have a range of up to 180 miles and have received positive early feedback from DHL drivers, especially regarding acceleration and hill performance.

Government Incentives & National EV Targets

As far back as 2008, the UK had already started to explore green transportation. However, after many initiatives and campaigns, the results were not as expected.

Until 2019, the Labor Party said it would aim to ban the sale of new non-electrified cars by 2030. Although the deadline shifted with each Prime Minister, the strict policy significantly boosted the UK’s market overall.

EV Master Plan

Shortly after announcing its goal of phasing out ICE vehicles by 2030, the British government issued the Ten Point Plan for a Green Industrial Revolution.

To align with the 2030 goal, this plan suggested several funding schemes to support supply chain and charging infrastructure. The plan’s expected impact includes boosting the employment rate, unlocking private investments, and mitigating carbon emissions. In 2021, the government followed up with a more detailed transport decarbonization plan.

Recently, like its neighbor Germany, the UK realized the importance of implementing charging infrastructure to sustain the EV ecosystem. As a result, in 2022, they published an electric vehicle infrastructure strategy to support EV adoption. Under this strategy, the UK will have an estimated minimum of 300k public charging points by 2030. However, this figure is highly uncertain.

After the Plug-in Car Grant (PiCG) purchase incentive was dropped in 2022, the government shifted focus to EV infrastructure and to other vehicles.

EV Supply-Side Incentives

Grants for Charging Infrastructure

The Ten Point Plan proposed issuing £1.3bn to accelerate charging infrastructure, and £582mn in extended grants. Major grants for charging points include the EV chargepoint grant and EV infrastructure grant. In addition, the Local Electric Vehicle Infrastructure (LEVI) funding program is specifically designed for residents without access to off-street parking. Meanwhile, the long-awaited Rapid Charging Fund has committed £950 million to install rapid chargers at key motorway service areas.

Research and Development Funding

The British government and private sector have continuously provided R&D funding to the EV industry. For example, in 2020, the government announced £12mn in funding for “groundbreaking research” into zero-emissions transport, including EV charging.

As of January 2023, 17 projects aim to advance EV battery technologies in the UK. These are funded with £27.6mn from UK Research and Innovation (UKRI) through Innovate UK to bolster the UK’s competitiveness across the battery value chain.

Furthermore, £89mn in funding has been granted to 20 pioneering projects in net-zero technology, solidifying the UK’s global leadership in zero-emission vehicle technology.

Incentives for Manufacturers

According to the Ten Point Plan, a £2.8bn support package was planned to boost EV manufacturing in the West Midlands, Wales and the North.

EV Demand-Side Incentives

Plug-In Car and Van Grants

The plug-in car grant was dropped in June 2022, leaving Britain as the only major European market with no consumer EV incentives. Grants for vans remain in effect, deducting 35% of the purchase price for small vans up to £2,500 and large vans up to £5,000. EV grants are also available for wheelchair-accessible vehicles, motorcycles, mopeds, trucks, and taxis.

Congestion Charge and Ultra Low Emission Zone (ULEZ) Benefits

EV drivers are not subject to current city congestion charges or low emission zone charges, such as London’s Congestion Charge or ULEZ.

Zero- or Reduced-Rate Benefit-in-Kind Taxation

Although the direct purchase incentive for EVs has been canceled, there are still various tax advantages%20came%20into%20fruition,hybrids%20until%20around%202018%2C%20too.). EVs are exempt from road tax, including the “premium car” tax for those with a list price over £40k. Fleet operators and company car users benefit from a low Benefit-in-Kind (BIK) rate of 2% for EVs, frozen until 2025, when it will rise.

Challenges to the UK’s Electric Vehicle Market

The UK’s EV market faces several similar challenges to other countries’, as well as some unique issues.

Energy Supply and Grid Capacity Limitations

In 2022, the UKs electricity demand reached a record low of 320.7 TWh due to the increased utility prices. Supporting electric vehicles would require an estimated 100 TWh in energy usage by 2030. This is not predicted to be a major problem, however, since almost 40% of electricity is expected to come from renewable resources by 2030.

A more serious challenge involves grid stability at a street level, and domestic infrastructure. There are around 400k substations in the UK, each serving approximately 1,500 homes and businesses. This creates a serious risk of electricity overload from using typical 7 kW EV chargers, since substations have power output limits.

Domestic wiring variations in the UK, such as TT, TNS, and TNCS, further complicate EV charging point installations; compatibility concerns with simultaneous household appliance usage must be addressed.

Inconsistent Policies and Regulations

The reduction in Plug-in Car Grant incentives led to an immediate decline in private EV sales in the UK, revealing the market’s dependence on policy support. Despite arguments that grants can kickstart ongoing EV demand, the cancellation raises concerns.

The Prime Minister’s plan to delay the deadline for consumer EV purchases until 2035 conflicts with the unchanged mandate for manufacturers: over 20% of each manufacturer’s new cars in 2024 must be zero-emission, or they face fines.

A lack of details and clarity causes further uncertainty for manufacturers, hindering investment and industry development. Furthermore, since the mandate now takes effect next year, manufacturers are already scrambling to adapt to the policy change.

Overall, abrupt policy changes create ongoing chaos and challenges for the automotive sector; inconsistent regulations, implemented with insufficient prior notification, are hindering the industry’s development.

Manufacturing and Supply Chain Issues

This is the challenge faced by many traditional automotive giants worldwide, like Germany, Japan and South Korea.

With half of its cars exported to the EU, the UK’s focus on limiting petrol and diesel sales faces a crucial shift, yet only 9.5% of 2022 car production comprises BEVs. This necessitates strategic moves to align with evolving global EV trends and secure export revenue. However, transforming the ICE supply chain into an EV-centric one requires substantial investment, new suppliers, and talent, all of which are difficult to find.

Furthermore, post-Brexit, the UK’s EV supply chain is struggling to meet the rules of origin criteria outlined in the UK-EU Trade and Cooperation Agreement (TCA). To qualify for zero tariffs, EVs must meet specified content percentages originating from the UK or EU, starting with 40% by December 31, 2023. Brexit-induced trade barriers may impact material, component, and EV costs due to reduced market access.

Charging Infrastructure Challenges

EV adoption faces hurdles in the UK, with 70% of stakeholders highlighting on-street charging inadequacy as a key concern. A third of households lack driveways, creating a strong need for robust public charging infrastructure.

Unclear public-private network relationships and requirements and a costly and time-consuming planning permit system also hinder EV infrastructure establishment. Furthermore, the UK is facing a critical shortage of skilled EV infrastructure technicians, with only 6% currently possessing the necessary skills, and a projected deficit of up to 35k by 2030.

Opportunities for Future Growth in the UK

Battery Technology Advancements

As mentioned above, the British government is committed to providing financial and regulatory support to enable mass-scale EV battery production. Notably, Williams Advanced Engineering and Fortescue Metals Group are partnering to develop a bespoke battery system for a 240-tonne electric mining haul truck. The innovative battery electric powertrain, featuring regeneration capabilities, will be integrated into the prototype. The collaboration also involves creating a fast-charging unit, facilitating the broader adoption of a battery-electric haulage fleet. Meanwhile, Moixa’s

solar battery integrates hardware and GridShare software for renewable energy management. It optimizes EV battery charging in real-time, considering factors like driver behavior, energy costs, and weather forecasts.

Second-Hand EV Market Development

Although the upfront cost of EV is not consumers’ top concern, it still needs to be addressed. With used cars representing 82% of all cars sold in the UK in 2021, it is critical to optimize the second-hand market as a catalyst for a nationwide adoption of EVs. To do this, the government could incentivize buyers with a new battery or financial refund, easing worries about battery health. Standardizing battery life and quality with a certification could further enhance consumer confidence. Finally, public awareness campaigns could dispel concerns about purchasing used EVs and educate consumers about charging costs and locations, enabling a smoother transition to electric vehicles.

Domestic Manufacturing Support

Britain’s new relationship to the EU has important implications for automakers, specifically for the whole value chain. As of 2023, the UK has already developed a foundational EV supply chain to produce almost every component of EVs.

An SMMT report established plans for future direction anchor vehicle production in the UK via three strategies:

1. Boost Government Support for EV Manufacturing

To benefit from tariff-free trade, the UK needs investment in domestic minerals refining, battery manufacturing, and electric drive units. A competitive incentive package is crucial to attract global investors and position the UK as a top destination for green technology investment.

2. Simplify Administrative Processes

It is better for the UK to streamline regulatory frameworks for projects like battery production and renewable energy facilities. Faster access to funding and market reforms, such as decoupling electricity and renewable energy prices from gas, are essential for attracting investments.

3. Forge Global Partnerships

The UK can secure minerals processing capacity by expanding trade agreements and partnerships with resource-rich countries. Priorities include expanding free trade agreements, establishing partnerships, encouraging British investors in sustainable mining, and creating favorable conditions for remanufacturers.

Charging Infrastructure Expansion

Like Europe, the UK is actively working to expand its charging infrastructure. It has identified several areas for improvement.

Home Charging

Promoting residential EV charging is prudent, given unpredictable private-public charging proportions. Residents can charge their cars overnight, or establish a DER for extra income.

The British public is open to home EV charging, as shown by a 2023 survey; nearly half of homeowners are willing to pave over their front gardens to accommodate charging devices, and 70% of EV owners have already modified homes for charging. The demand for home charging is expected to continue rising.

Charger Technology Improvements

According to British charger company Zap-Map, the latest ultra-rapid charging devices already enable some EVs to add more than 100 miles in as little as 10 minutes. To address the public charging network’s inadequacies, the UK could spread out more ultra-rapid chargers to low dense areas.

Innovative companies such as Swarco, which provide expert-level 24/7 in-house customer support to optimize the user experience, could further support this transition.

Grid Stability Optimization

Since grid stability is the main concern when it comes to EV charging, the UK has proposed introducing the G99.pdf) grid connection standard to revolutionize the way power is generated, transmitted, and consumed.

Accelerating Towards a Bright EV Future

The UK’s electric vehicle market stands at the edge of a transformative era. With government commitment, strategic investments, and innovative solutions addressing challenges, the road ahead looks promising. The UK is poised for a future in which residential charging becomes ubiquitous, cutting-edge battery technologies redefine possibilities, and a robust domestic supply chain solidifies the nation’s position in the global EV arena. Substantial challenges exist, but they are stepping stones to a cleaner, sustainable tomorrow. The UK’s EV journey is not just about reducing emissions; it also promises to steer the nation towards a dynamic and electrifying future.

FAQ

What are the key factors shaping the growth of the UK’s EV market?

The growth of the UK’s EV market is driven by government commitments to achieving net-zero emissions, rising consumer demand, advancements in technology, and supportive policies and incentives.

How do advancements in battery technology affect the UK’s EV landscape?

Cutting-edge battery technologies, including those developed by British companies like Williams Advanced Engineering and Moixa, are a major contributor to EV innovation in the UK, enhancing range, efficiency, and overall performance.

What incentives exist for businesses to invest in EV manufacturing in the UK?

Businesses receive substantial support, including a £2.8bn package, to boost EV manufacturing in regions like the West Midlands, Wales, and the North. Green finance initiatives and export support further incentivize investment.

What role does charging infrastructure play in boosting EV adoption in the UK?

Charging infrastructure is crucial for EV adoption in the UK. The government is investing in expanding charging points, and encouraging home charging. Challenges like on-street charging inadequacy and an overcomplicated planning permit system still need addressing.

What is the timeline for the UK’s ban on new petrol and diesel car sales?

The UK aims to ban the sale of new petrol and diesel cars by 2030. Hybrid vehicles will be permitted until 2035. As of September 2023, the Prime Minister was considering pushing the deadline back by 5 years, but no further details or plans have emerged.

How are consumer preferences evolving in response to the UK’s changing EV landscape?

Increased sales of second-hand EVs, growing demand for affordable zero-emission cars, and the popularity of EVs in various market segments all demonstrate a positive shift in consumers’ mindset toward electric vehicles.

Resources

SMMT: Society of Motor Manufacturers and Traders

Explore updated data about the British EV market here.

House of Commons: Electric vehicles and infrastructure

Find more details about the UK’s EV industry and infrastructure here.

Zap-Map: EV charging statistics 2023

View a map of the UK’s EV infrastructure here.

UK Gov: The ten point plan for a green industrial revolution

Read the British government’s plan for the EV market here.

UK Gov: UK electric vehicle infrastructure strategy

Discover the British government’s strategy for EV infrastructure here.

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More