Sodium-Ion vs. Lithium-Ion Batteries: Which Is Better for Electric Vehicles?

Raghav Bharadwaj

Chief Executive Officer

Published on:

25 Nov, 2025

Updated on:

12 Feb, 2026

The Race for EV Battery Materials

Electric vehicles (EVs) today rely heavily on lithium-ion batteries, but this dependence comes with challenges. Lithium resources are geographically concentrated; China dominates 79% of global lithium-ion battery production and 61% of lithium refining capacity. Countries like Argentina hold around 21% of global lithium deposits, creating supply risks. Demand surges have driven lithium prices up over 700% since 2021, inflating battery costs. These supply chain constraints and price volatility have automakers and tech companies exploring alternative chemistries for EV battery technology.

One promising candidate is the sodium-ion battery, which uses sodium, an element far more abundant and widely available than lithium. In fact, sodium is thousands of times more plentiful in the Earth’s crust than lithium — approximately 20ppm, whereas sodium is tens of thousands of ppm. This abundance makes sodium cheaper and easier to source, without the geopolitical bottlenecks associated with lithium.

This blog explores three key dimensions shaping the future of EV energy storage:

- Growing challenges of lithium-ion batteries and why the industry is seeking alternatives.

- Rise of sodium-ion technology and how it compares to lithium-ion in performance, cost, safety, and sustainability.

- Recent developments, market trends, and the future outlook for sodium-ion batteries in the EV industry.

How Sodium-Ion and Lithium-Ion Batteries Work

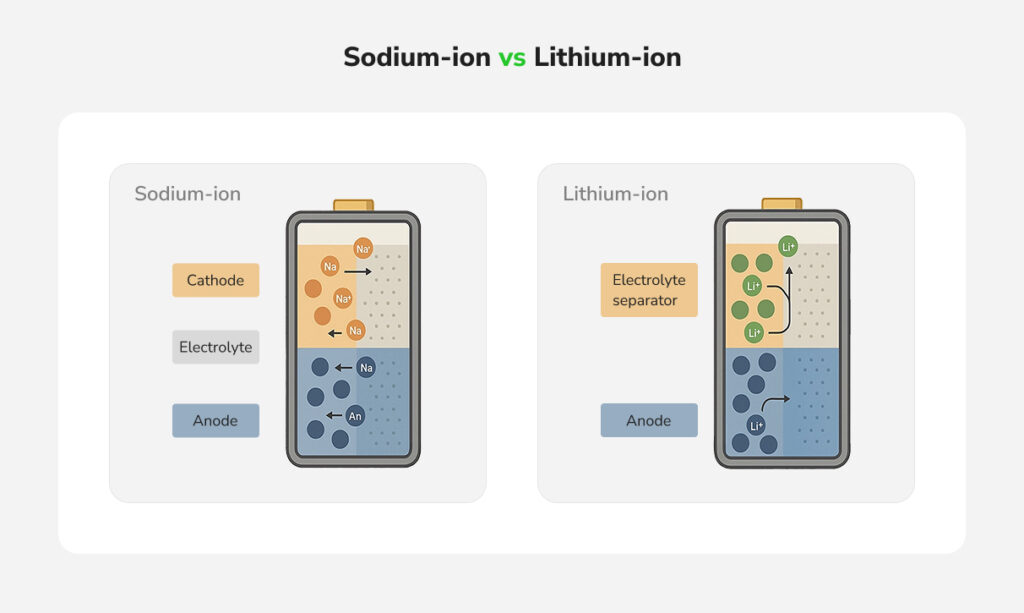

At a basic level, both sodium-ion (Na-ion) and lithium-ion (Li-ion) batteries shuttle ions between a cathode (positive side) and anode (negative side) through a liquid (or sometimes solid) electrolyte. The key difference lies in the charge carrier: sodium ions (Na+ ) versus lithium ions (Li+ ). This seemingly small change leads to notable differences in materials and performance.

Sodium-Ion vs. Lithium-Ion: Key Differences

Both battery types aim to deliver high energy storage and power, but there are critical differences in their material abundance, performance, and suitability for electric vehicles. Below, we compare several key aspects:

Resource Abundance & Cost

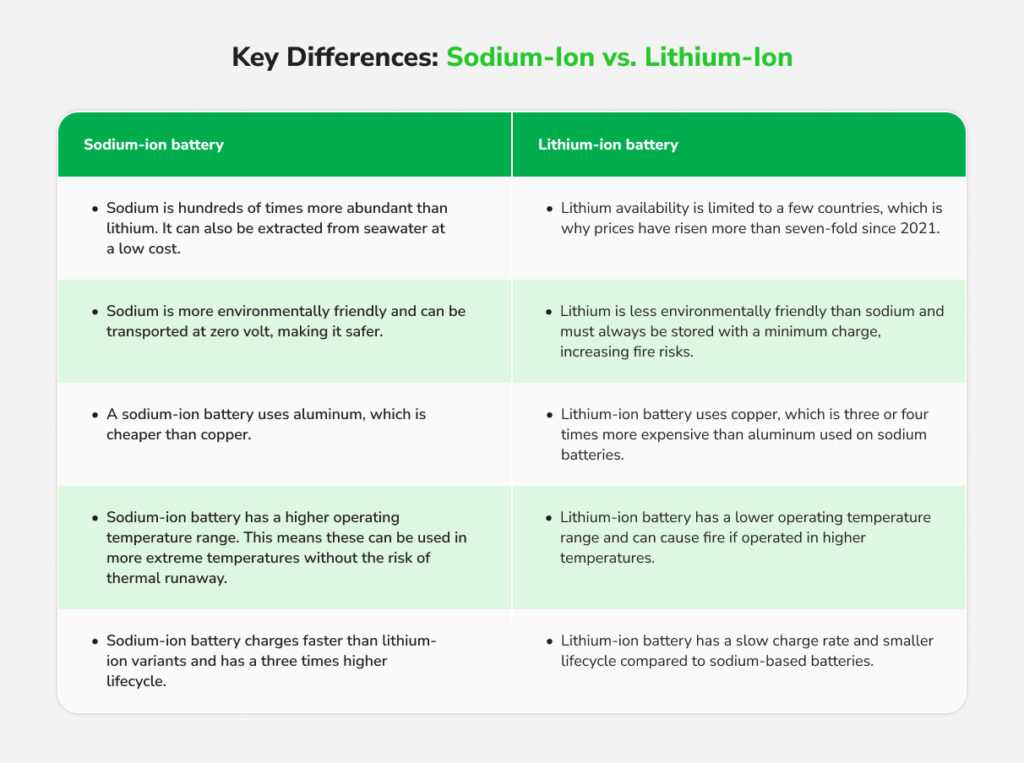

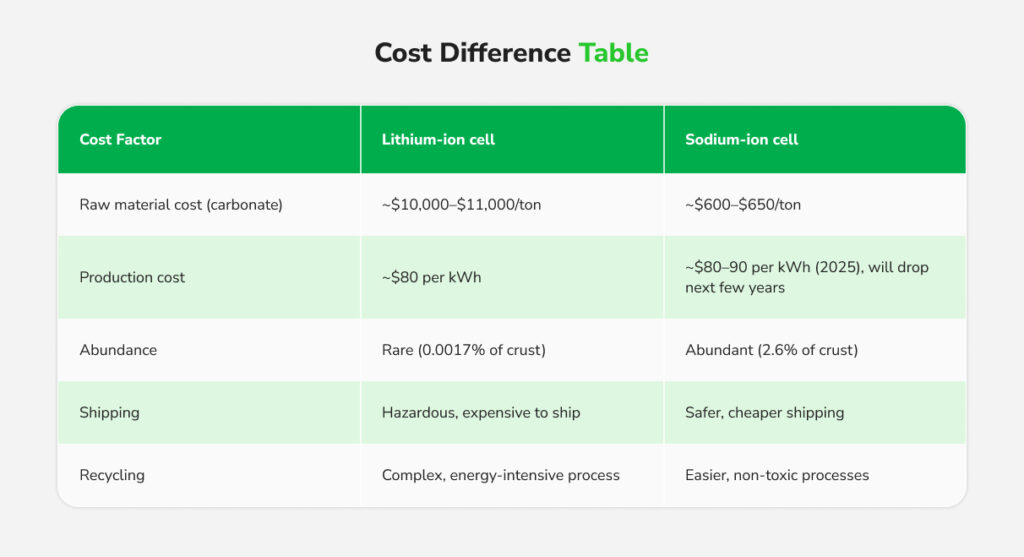

Sodium is extremely abundant and inexpensive. It can even be sourced from seawater, and it doesn’t require intensive mining.

In contrast, lithium is limited to specific regions and has seen skyrocketing costs due to scarcity. Sodium-ion cells also use lower-cost materials; they avoid expensive cobalt and use aluminum in place of copper, further reducing material costs. Overall, sodium-ion technology offers cost advantages, especially if lithium prices remain high, making it central to EV battery cost comparison.

Energy Density (EV Range)

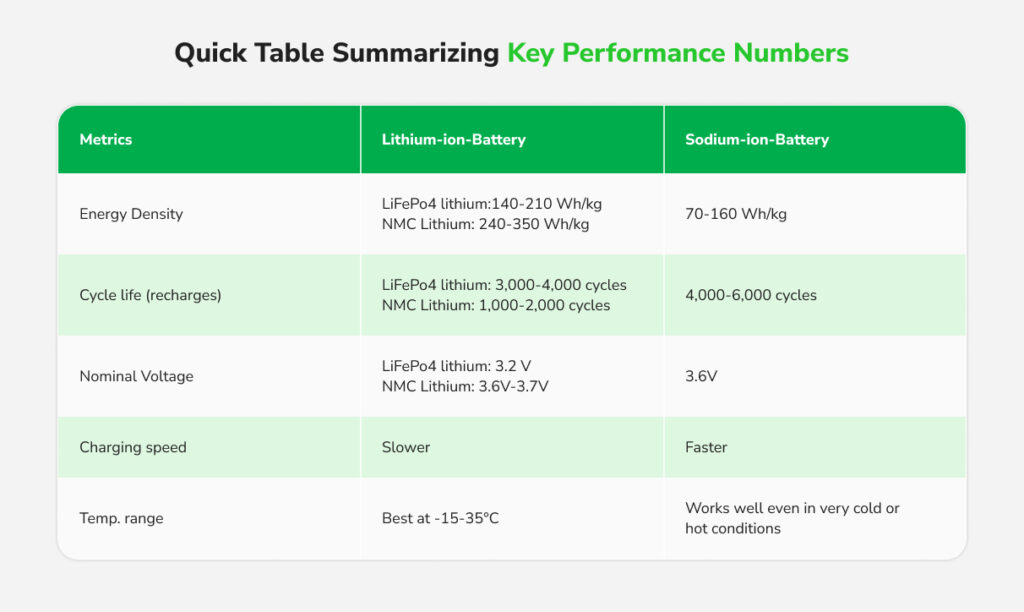

Lithium-ion batteries lead in energy density, a crucial factor for EV range. Current lithium EV batteries (e.g., NMC or LFP) deliver around 150–250 Wh/kg of energy density, enabling long driving ranges.

Sodium-ion batteries currently achieve roughly 100–160 Wh/kg. For example the first sodium-powered compact car in China (JAC’s Hua Xianzi) carries a 25 kWh sodium battery pack for about 250 km of range —suitable for city commuting but below typical lithium EV ranges. Researchers are optimistic that with further innovation, sodium-ion cells could exceed 200 Wh/kg in coming years, but for now lithium’s superior energy density makes it better for long-range performance.

Charging Speed and Cycle Life

Interestingly, sodium-ion batteries can charge faster and potentially last longer in certain designs. Sodium ions are larger, but the chemistry avoids lithium’s tendency for dendrite formation at high charge rates. Early tests show sodium cells comfortably handle fast charging; one prototype by HiNa Battery charges fully in about 20 minutes. Some sodium batteries have shown 4,500 charge-discharge cycles with 83% capacity retention, and next-generation designs (like CATL’s “Naxtra” sodium battery) aim for up to 10,000 cycles.

By comparison, lithium-ion cycle life varies by chemistry: high-nickel types might last a few thousand cycles, while lithium iron phosphate packs can exceed 5,000–7,000 cycles under good conditions. Some commercial LFP batteries approach 8,000+ cycles before significant degradation. In short, both technologies can achieve long lifespans, but sodium-ion is proving it can match or even surpass lithium in cycle longevity, a big plus for fleet EVs or grid storage that value long-term durability.

Safety and Thermal Performance

Sodium-ion batteries are safer and more stable in extreme conditions. They tolerate full discharge and high temperatures, reducing fire risk. A sodium-ion cell retains approx. 88% of its capacity even at -20°C, while lithium NMC cells drop to only approx. 20–50% at subzero temperatures. Sodium cells also perform well up to approx. 70°C without severe degradation.

Lithium-ion batteries require careful thermal management and can’t be fully drained without damage. Their flammable electrolytes pose that fire risks. Sodium-ion electrolytes and materials tend to be less reactive, improving safety margins. For drivers, pairing safer chemistries with dependable infrastructure, such as an electric car charger in India, reinforces confidence in both battery performance and charging safety. Overall, sodium-ion technology offers a more forgiving thermal and safety profile, which is attractive for automakers and aligns with sustainable electric vehicle charging solutions.

Environmental Impact

From a sustainability perspective, sodium-ion batteries have an edge in environmental friendliness. Sodium extraction and processing generally have a smaller environmental footprint than lithium mining. Lithium extraction is water-intensive and can pollute soil and water. Cobalt and nickel mining for lithium batteries also add social and ecological costs.

Sodium can be obtained more sustainably and doesn’t involve rare metals. Using aluminum instead of copper and avoiding lithium reduces the carbon footprint. In summary, sodium-ion batteries align well with sustainability goals, provided their overall efficiency and longevity continues to improve. Coupled with a robust EV charging network, these advances can accelerate the transition to a cleaner mobility globally.

Recent Developments and Industry Adoption

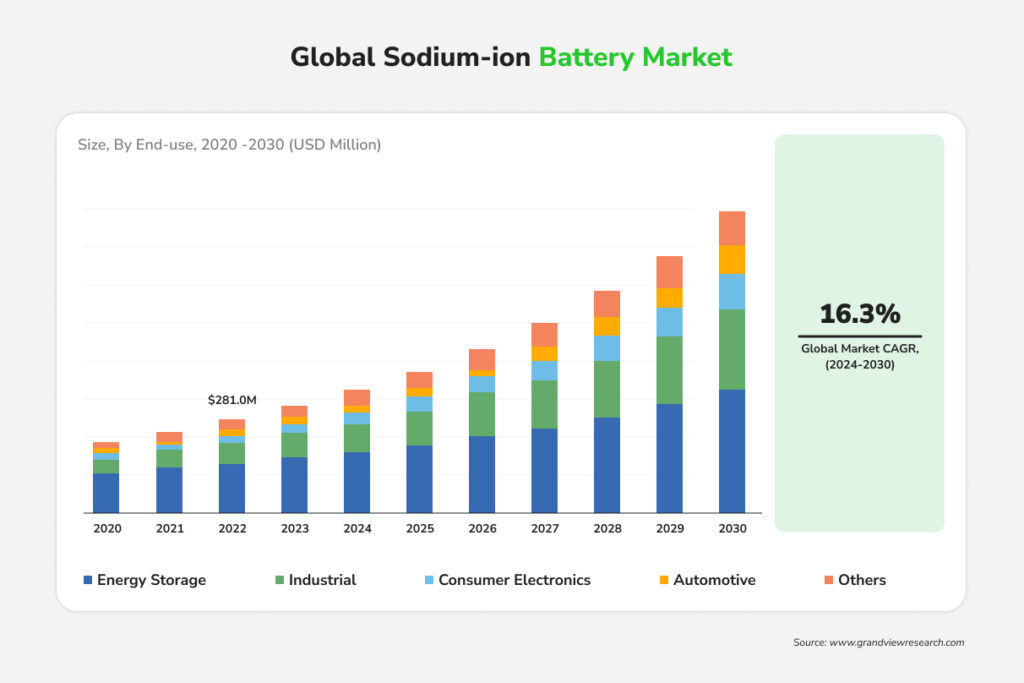

Thanks to the above advantages, sodium-ion batteries are gaining traction in the battery industry, including in EV applications. Major players like CATL, BYD, and Reliance Industries are investing heavily. Reliance’s 2022 acquisition of UK-based Faradion marked a key milestone in commercializing sodium-ion chemistry.

In China, CATL introduced its first sodium-ion battery in 2021, followed by JAC and HiNa Battery’s launch of the world’s first sodium-powered EV in 2023. BYD and CATL have since established large-scale sodium-ion factories, targeting up to 30 GWh annual capacity by 2025. CATL’s “Naxtra” batteries promise 175 Wh/kg energy density at costs below $20/kWh, potentially cutting EV battery prices by 30–50%.

Early adoption focuses on entry-level EVs, two-wheelers, and energy storage. European projects by BASF and Mercedes-Benz are exploring sodium-ion systems for energy independence. Although China currently leads production and is expected to control around 95% of sodium-ion output by 2030, the technology is moving swiftly toward commercial reality worldwide.

Challenges for Sodium-Ion Batteries in EVs

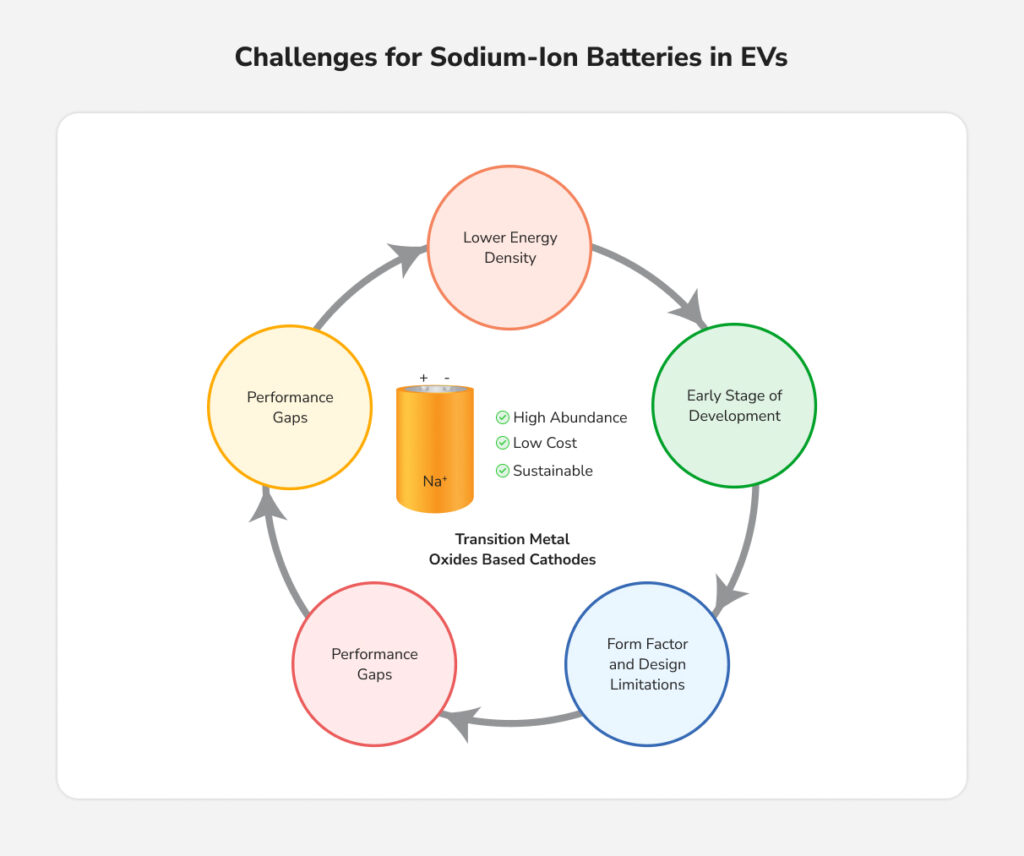

Despite their promise, sodium-ion batteries face several challenges before they can replace lithium-ion in mainstream EVs:

- Lower Energy Density: Sodium-ion cells store less energy per weight/volume than lithium cells. This is a critical drawback for EVs, where weight and space directly influence vehicle range. Until sodium batteries close the density gap (through improved electrode materials or cell design), they will likely be limited to shorter-range vehicles or require larger battery packs to match lithium EV range.

- Early Stage of Development: Lithium-ion technology has benefited from decades of R&D and massive manufacturing scale. Sodium-ion tech is still nascent. Only a few companies produce them at scale, and processes are not yet fully optimized. This means current sodium-ion batteries are relatively expensive to produce, ironically, despite cheap materials, mainly due to low volumes and nascent supply chains. Additionally, the supply chain for specific sodium battery materials isn’t well established yet.

- Form Factor and Design Limitations: Today’s sodium-ion cells have mostly been developed in pouch or prismatic formats. Some reports indicate they cannot yet be made in as many form factors (cylindrical cells, button cells, etc.) or as compactly as lithium cells. EV makers have fine-tuned battery pack architectures around lithium cell formats; switching to sodium may require redesign. However, this is likely a temporary issue, as R&D will adapt sodium chemistries to various cell formats in the future.

- Performance Gaps: While sodium-ion batteries show strong potential, some performance areas still lag in power density and room temperature efficiency, though this is improving with advanced electrolytes. And while lab tests demonstrate impressive cycle life (over 5,000 charge cycles), real-world validation is still limited. By contrast, lithium-ion batteries, especially LFP types, already deliver thousands of proven, reliable cycles in commercial EVs.

- Manufacturing and Investment Challenges: Transitioning to a new chemistry isn’t simple—it requires retooling factories, training, and ensuring the new batteries meet automotive standards. As the International Energy Agency notes, new battery technologies face an uphill climb against incumbent lithium-ion. Sodium-ion cells are viable, but scaling to the multi-gigawatt-hour factories will take time and investment.

Outlook: Complement or Replacement?

In the near term, sodium-ion batteries will complement rather than replace lithium-ion. Their cost, safety, and sustainability advantages make them ideal for urban EVs, electric two-wheelers, and large-scale grid energy storage — segments where weight is less critical.

If sodium-ion cells achieve approx. 200+ Wh/kg energy density and maintain their other benefits, they could begin to challenge lithium-ion even in mainstream passenger EVs. The cost reduction potential is a big motivator, especially in markets where electric vehicle charging solutions and infrastructure are rapidly expanding; some estimates suggest sodium-based packs might cut EV battery costs by 30-50%, potentially slicing thousands of dollars off an EV’s price. This would be transformative for mass EV adoption, especially in price-sensitive markets. Automakers like BYD and Ford are closely watching sodium battery progress, and some have hinted at integrating sodium cells in future entry-level models if performance improves.

However, it’s important to keep a perspective. Lithium-ion batteries have a huge head start and an enormous ecosystem behind them. They will remain the go-to for most EVs in the next few years. Sodium-ion batteries are best seen as an emerging alternative that will find its place alongside lithium. A recent analysis by EV industry experts noted that sodium batteries are “already viable for short-range EVs, two-wheelers, and stationary storage”, but for longer-range cars, lithium will continue to dominate unless sodium sees a breakthrough in energy density. Even the IEA commented that sodium-ion can only really compete with lithium iron phosphate on cost if lithium prices stay very high or if sodium tech makes a leap in performance.

The next few years will determine how far sodium-ion batteries can go in powering the EV revolution. The competition is on, and that’s a win-win for consumers and the planet.

Frequently Asked Questions

Will sodium-ion batteries make EVs cheaper in the next few years?

Potentially, yes. Sodium-ion cells use cheaper, abundant materials and avoid lithium, cobalt, and nickel. This could reduce EV battery pack costs by 30–50% once production scales. But mainstream affordability gains may take 3–5 years, depending on manufacturing expansion.

How will automakers integrate sodium-ion batteries without redesigning their entire EV platforms?

Automakers will integrate sodium-ion gradually, starting with models that don’t require major platform changes, mainly city EVs, scooters, and low-range vehicles that already rely on pouch or prismatic cell formats. Early deployments will likely involve partial or modular pack configurations that allow OEMs to test sodium packs without altering core architectures. Over the next few years, however, as sodium-ion matures, automakers will begin designing new platforms optimized specifically for sodium cells, much like they did for LFP-based EVs. This staged approach lets manufacturers adopt the technology with minimal disruption.

Will sodium-ion batteries meaningfully reduce pressure on public EV charging infrastructure?

Yes, especially in urban environments. Sodium-ion batteries are well-suited for small EVs that focus on short-range, high-frequency usage patterns. Because these batteries can charge quickly and are expected to be used primarily in entry-level vehicles, more owners will rely on home or workplace charging rather than fast-charging stations. This reduces congestion at public chargers and lightens the burden on high-power infrastructure. It doesn’t replace the need for public charging, but it reshapes demand so that fast chargers are increasingly used by long-range EVs, while sodium-powered vehicles utilize slower, distributed charging solutions.

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More

Feb 09, 2026 • EV Charging Infrastructure

The Current State of EV Charging in India [2026]: Public, Home, and Fleet Networks

Read More