How Real Estate Developers Can Monetize EV Charging in India (2026 Guide)

Raghav Bharadwaj

Chief Executive Officer

Published on:

24 Nov, 2025

Updated on:

12 Feb, 2026

Electric vehicles (EVs) are rapidly gaining traction in India’s mobility landscape, bringing new opportunities for real estate developers. By 2025, EV sales accounted for 7.6% of all vehicle sales in India, steadily climbing toward the government’s 30% target by 2030. This surge in EV adoption is driving demand for accessible charging infrastructure in residential complexes, commercial centers, and mixed-use developments.

Developers who integrate EV charging for real estate early can future-proof their properties, attract premium tenants, and command higher asset values. But monetizing EV charging is not a simple “install and forget” exercise. It requires navigating evolving policies, choosing viable business models, and balancing upfront costs with long-term returns.

In this blog, we explore:

- Direct revenue models for EV charging monetization

- Indirect ways EV charging enhances property value, occupancy, and ancillary revenue

Direct Revenue Models for EV Charging Infrastructure for Real Estate

Simply installing chargers is not enough. Developers need a clear business model to recover costs and generate returns. Below are the primary monetization approaches you can consider:

1. Pay-Per-Use Charging (Direct Revenue per kWh/Session)

Under this classic model, EV drivers pay for the energy they consume or the time they spend charging. The property owner (or its facility management) operates the chargers and collects fees directly from users.

Pricing is typically set on a per kilowatt-hour basis (e.g., ₹10–₹18 per kWh, often indexed to electricity cost) or per minute in the case of DC fast chargers.

Revenue Potential

Pay-per-use offers straightforward revenue that scales with utilization. For example, if you charge ₹12/kWh and a charger dispenses 300 kWh in a month, that’s ₹3,600 revenue per charger. At high-traffic locations, the numbers can be significant.

Use Case

This model works well for commercial and mixed-use developments such as malls, cinemas, highway food plazas, and hotels. It can also be applied in residential complexes or offices as a way for residents/employees to pay only when they charge (instead of a flat fee).

Management Considerations

If a developer chooses this model, they must handle the operations. This includes payment processing, uptime maintenance, and customer service. Luckily, there are white-label software platforms and O&M (Operations and Maintenance) service providers that make these tasks easier. Many charging stations today run on management apps that handle user authentication and digital payments, so the property doesn’t need to build its own system. Still, the developer is essentially running a mini-utility service.

Tip: Partnering with established charging networks ensures visibility on EV charger maps, boosting footfall.

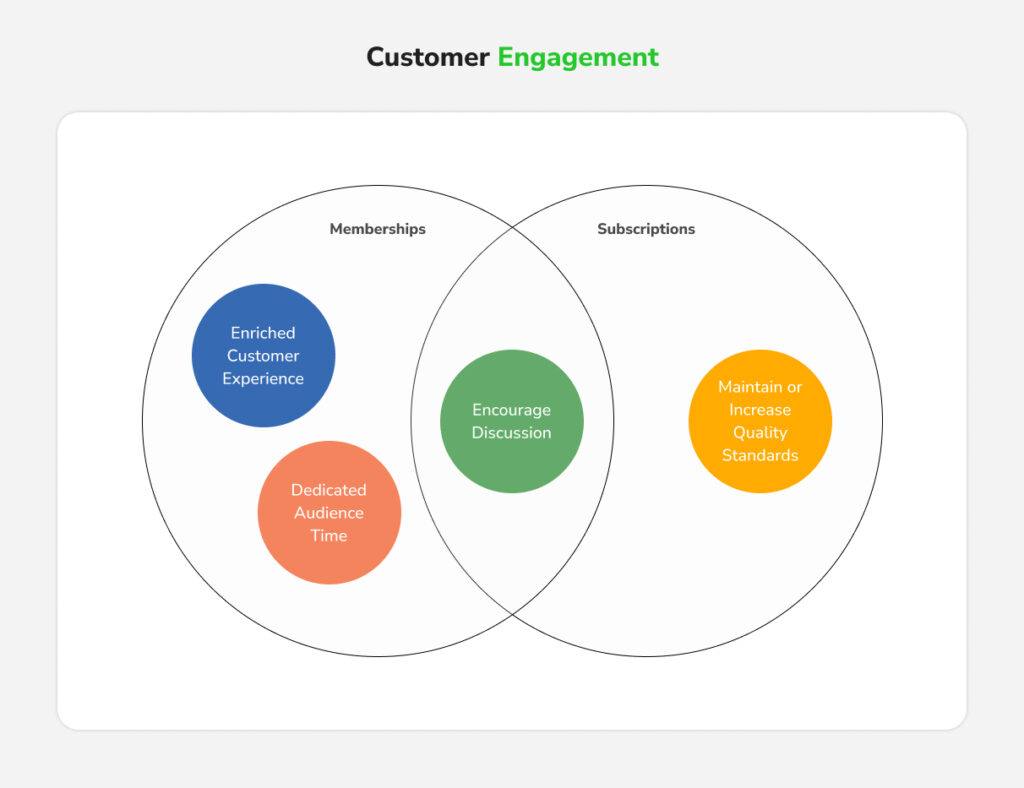

2. Subscription and Membership Models (Recurring Revenue)

The subscription model offers EV charging as a service package; users pay a fixed periodic fee for access to charging. This could be structured as:

- Monthly flat fee for unlimited charging.

- Membership plans offering discounted per-kWh rates or reserved charging slots for a subscription fee.

- Prepaid plans where residents or employees pay a fixed amount that includes a bundle of charging hours.

Use case

Subscription and membership models make a lot of sense for real estate developers:

- Residential Complexes: RWAs could levy an “EV charging amenity charge” of ₹500–₹1000 per month per EV-owning household. In return, those residents get unlimited charging at the society’s chargers (or a generous cap that effectively feels unlimited). This guarantees the RWA as a steady income stream to offset electricity bills and charger upkeep. It’s like adding an EV line item to maintenance dues.

- Offices and Campuses: An office park could offer employees a subscription (possibly paid for by the tenant company) for reserved daytime charging. E.g., employees pay ₹2000/month for the convenience of always finding a spot to plug in at work. Some employers subsidize this or include it in their green initiatives.

- Commercial Memberships: A retail chain or mall could have a loyalty program offering discounted charging for a yearly membership fee. Similar to how clubs offer parking privileges.

Revenue Potential

Subscriptions provide predictable recurring revenue. Even if a given subscriber charges only sparingly, you still collect the full fee, which helps cover fixed costs. It also increases charger utilization (since subscribers feel “I’ve paid for it, I should use it”), which is good for achieving ROI on the asset. In fact, one strategy is to combine subscription with usage fees. For example, offer a small monthly subscription that gives members cheaper per-kWh rates than non-members. This way, you build loyalty while earning steady recurring revenue.

Benefits

- User Stickiness: From a marketing perspective, once a resident or tenant is on a subscription, they are less likely to move out because they’ve integrated that service into their routine.

- Administrative Ease: Implementing subscriptions might involve some management overhead (tracking eligible vehicles, ensuring one subscriber doesn’t hog the charger 24×7, etc.). But these can be handled via simple tech such as RFID cards, app-based profiles, or a fair-use policy.

3. Leasing Space to Charge Point Operators (CPOs)

In this model, the developer leases space to a third-party charging company, who installs and runs the charging station.

The developer’s monetization comes from rent or revenue sharing from the operator. Essentially, your property becomes a host location —much as allowing a telecom tower or an ATM on your premises for a fee.

- No CapEx, Low Risk: The biggest advantage here is that the developer’s upfront investment is minimal. The CPO typically bears the cost of equipment and installation. For an existing building, this is hugely attractive; many housing societies have taken this route to avoid spending their own funds.

- Steady Income: The income to the developer in this model might be a fixed rental, say ₹X per month for using 5 parking spots, or 10-20% of the revenue from each charging session, or a combination. The absolute amount may be lower than what you could earn if you ran it yourself at high utilization, since the CPO keeps a cut for their services. From an ROI perspective, it turns a potentially large CapEx project into a simple real estate rental yield. For some developers, that trade-off is worth it.

- Expertise and Customer Base: Another benefit is that established CPOs come with their brand, app, and existing customer base. For example, if Bolt.Earth installs a charger at your mall, EV drivers using the Bolt.Earth EV Charging App will automatically see and use it, bringing in footfall. The operator ensures the station is maintained, the firmware is updated, etc. This takes technical and operational complexity off the developer’s plate.

Use Case

Locations with good potential usage where a charging company is interested in expanding. This could be a busy mall, supermarket, parking garage, highway hotel, or even a large residential complex. Many petrol pump owners have adopted this model; they lend space to a CPO to install chargers at the pump, often under a revenue share. The same concept extends to commercial EV charging stations: if you have a strategic location, multiple operators might even bid to set up there.

4. Integrated “Energy-as-a-Service” (EaaS) Solutions

This is an emerging, more holistic model where EV charging is combined with on-site energy infrastructure (like solar panels, battery storage, and energy management systems) and offered as a bundled service. Essentially, a third party or the developer itself provides the entire energy and charging setup to tenants as a service, often on a subscription or fixed-fee basis. It’s called “energy-as-a-service” because the focus is on delivering energy/charging to users without users investing in equipment like UPS or EV chargers.

- Monetization for Developer: If the developer partners with an EaaS provider, they might structure a profit-sharing or lease arrangement. Alternatively, large real estate players might set up their own subsidiary to provide EaaS in their campuses.

Benefits

- EaaS setups often incorporate renewable energy (solar) to reduce operating costs. Solar + battery can supply daytime EV charging at near-zero marginal cost after capex. This improves the ROI while also advertising the solution as 100% green.

- EaaS also enables peak load management; the battery can shave off peaks, ensuring the building’s overall electricity bill is optimized even as EV charging adds load. All these technical optimizations translate to better margins for the operator. From the user perspective, it’s convenient and can be cost-stable (e.g., a fixed rate per km or per kWh that the EaaS operator guarantees, insulating them from tariff volatility).

This model is complex to implement. It requires expertise in energy systems and a longer-term outlook. The contracts can be like mini power purchase agreements (PPAs) or service agreements spanning 5-15 years to make the investments worthwhile.

For a real estate developer, venturing into energy services might be a new territory, hence partnerships with specialist companies are common. However, given trends in sustainable smart buildings, this could become mainstream for large projects.

Use Case

- Tech parks, industrial parks, large mixed-use townships, or any development where energy usage is high and there’s scope for on-site generation.

- Forward-looking developers who want to differentiate with a “campus energy solution” approach.

- For smaller residential or single buildings, EaaS might be overkill unless packaged by a vendor in a simple way.

These four models are not mutually exclusive. Developers often deploy a hybrid approach. For example, lease out space for a public fast charger (Model 3) to serve visitors, while offering residents a subscription for the slower chargers (Model 2). Or run pay-per-use for anyone but give an option for employees to have a monthly plan. The right mix maximizes both usage and revenue.

Indirect Revenue and Value Addition Through EV Charging

1. Enhanced Property Value and Customer Attraction

EV charging stations significantly improve the marketability of both commercial and residential properties. As eco-conscious lifestyles become mainstream, tenants and customers increasingly look for locations that support sustainable choices.

Properties equipped with EV charging for buildings often experience higher occupancy rates, faster lease cycles, and the ability to command premium rental values. In fact, studies show that commercial properties with charging amenities can see a 10–20% increase in value, making EV infrastructure a strategic investment rather than a cost center.

2. Increased Dwell Time and Ancillary Revenue

Fast charging (20–40 minutes) keeps EV drivers on-site longer, boosting overall footfall and spending.

Retailers and property managers can capitalize by integrating:

- Cafes and restaurants

- Convenience retail

- Car wash services

- Co-working or lounge spaces

This increases per-visitor revenue and creates opportunities for revenue-sharing models with partner businesses that benefit from the added foot traffic.

3. Advertising and Sponsorship Opportunities

Modern EV chargers double as premium advertising real estate. With digital screens and high visibility, they attract both local businesses and national brands seeking exposure.

Monetization options include:

- Digital ad placements

- Sponsored charging zones

- App-based promotions

These passive revenue streams boost overall ROI while building brand presence for the property itself.

4. Strengthened Reputation and Attracting Premium Demographics

Installing EV charging showcases a property’s commitment to innovation and sustainability. This signals tenants, customers, and corporate partners that the location is aligned with modern values, a major advantage in competitive markets.

EV owners also tend to fall into higher-income segments, meaning their repeated visits bring additional premium spend and loyalty.

5. Long-Term Strategic and Operational Benefits

EV charging infrastructure opens the door to several strategic advantages, including:

- Integration with solar power for reduced costs

- Alignment with ESG and net-zero mandates

- Preparedness for V2G (Vehicle-to-Grid) technology

- Attraction of corporate tenants electrifying their fleets

As EV adoption accelerates, properties without charging infrastructure risk falling behind. Early adopters establish staying power and long-term competitiveness.

By 2026, EV charging will be a defining feature of competitive real estate in India. Developers who invest early can unlock multiple revenue streams, pay-per-use, subscriptions, leasing to CPOs, or integrated energy services, while boosting property value and tenant loyalty.

Final Thoughts

Beyond direct income, EV infrastructure enhances footfall, increases dwell time, enables advertising opportunities, and strengthens a property’s sustainability credentials.

The winners will be developers who treat charging not as an obligation, but as a strategic asset. Those who act now will future-proof their properties and secure long-term financial advantage in India’s electrifying mobility landscape. A well-planned real estate EV charging strategy ensures developers maximize both revenue and sustainability, while achieving strong EV charging ROI in India.

Frequently Asked Questions

How much investment should a real estate developer budget for installing EV charging infrastructure in India?

Costs vary widely depending on charger type, electrical upgrades, and installation complexity. A basic AC charger can cost ₹30,000–₹1 lakh, while DC fast chargers can range from ₹3 lakh to ₹15 lakh. Developers should also consider wiring, load enhancement, and civil work. Partnering with a CPO can eliminate most upfront costs.

Is EV charging profitable for low-traffic residential or commercial buildings?

Profitability depends on utilization, but even low-traffic buildings benefit indirectly. Properties with EV charging often lease faster, retain tenants longer, and command higher rents. Developers can also use subscription-based models, such as monthly EV amenity charges, which ensure predictable revenue even with low usage.

Are EV charging revenues taxable for housing societies or commercial buildings?

Yes, but the GST and taxation category depend on whether charging is offered as a service or as part of maintenance fees.

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More