Exploring the Indonesian EV Market

Raghav Bharadwaj

Chief Executive Officer

Published on:

21 Jul, 2023

Updated on:

24 Nov, 2025

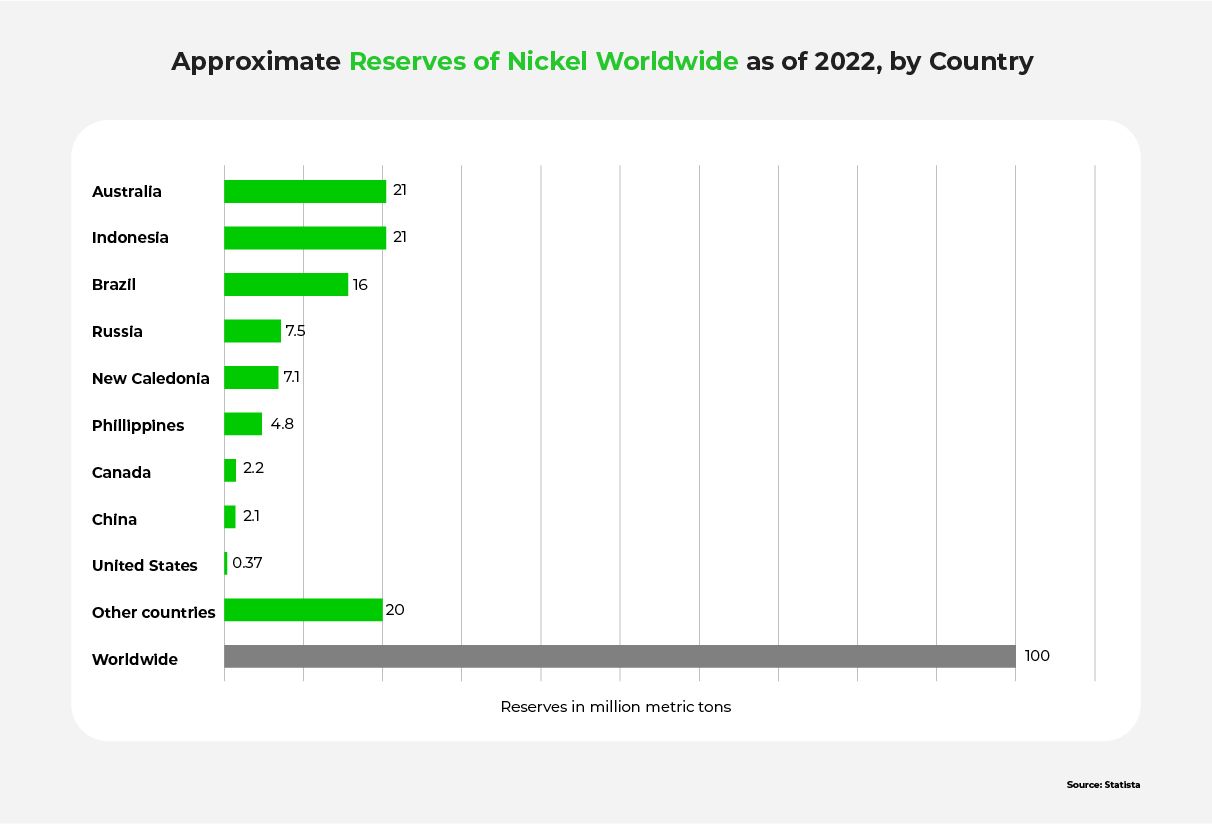

Indonesia sits on the world’s largest nickel reserve and is also the highest producer of this crucial raw material. It also has significant reserves of aluminum, cobalt, and copper.

Furthermore, with a population of 270+ million — the largest in Southeast Asia — Indonesia has a huge transportation sector, and is therefore a prime candidate for EV adoption. As a result, Indonesia can play a dual role in the global EV market: both as a supplier of EV components and as an EV consumer.

In this second part of the Asian EV landscape series, we zoom in on the Indonesian EV market, and answer these three questions:

- Who are the major contributors to the Indonesian EV market and what role do they play in the current state of the market?

- What initiatives are being taken by the Indonesian government to promote the use of EVs in the country?

- What are the challenges and opportunities in the Indonesian EV market?

Current State of the Indonesian EV Market

In 2022, Indonesia’s EV market was valued at US$ 533 million. With a projected CAGR growth rate of 20.9%, Indonesia’s EV market is expected to reach a value of US$ 2 billion by 2029.

As of October 3rd, 2022, Indonesia had around 28,000 EVs on the road. But the country has set a very ambitious target for its EV market — by 2025, Indonesia aims to have 2.5 million EV users.

Indonesia is also the second largest automobile manufacturer in the region, after Thailand. Similarly to Thailand, transforming vehicle production into EVs can have a significant positive impact on the country’s GDP.

Indonesia has therefore set an ambitious EV manufacturing goal — the country looks to produce 1 million EVs by 2035.

Provided it harnesses its strategic advantages, Indonesia has the potential to emerge as a major player in the EV market. To develop its EV ecosystem and secure a vital position in the EV supply chain, the country will need up to US$ 35 billion in investment over the next 5-10 years.

The Nickel Advantage

In 2021, Indonesia produced 760,000 tons of nickel. It has 21 million metric tons of reserves of the mineral. It also has the world’s second-largest copper deposit and significant reserves of other minerals that are required for EV production, e.g., cobalt.

The Indonesian government recognizes this advantage and is using it to attract investors to the country’s EV market.

In 2020, the Indonesian government implemented an export ban on nickel ore. It created a state-owned holding company, MIND ID, which became a major shareholder in the largest mining companies in Indonesia, Freeport Indonesia and Vale Indonesia.

In 2021, the Indonesian government established Indonesia Battery Corporation — a joint venture between state enterprises in nickel mining, oil and gas, and electricity sectors. This company is designed to leverage Indonesia’s strategic advantage in the battery sector and facilitate the development of Indonesia’s EV market.

Calling on the Outside

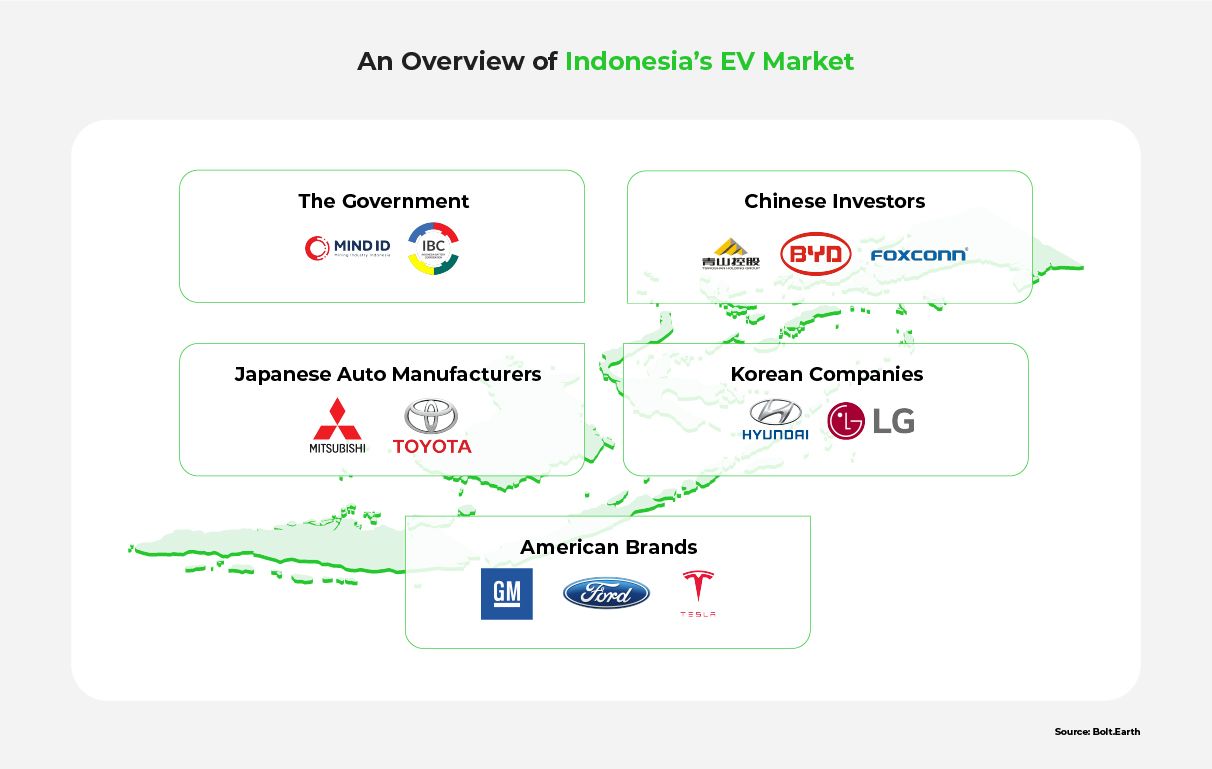

By requiring foreign firms to partner with state-owned enterprises, the government is both offering investors greater certainty and encouraging state governments to actively participate in improving the EV landscape. The aim is to attract international investors and develop a competitive advantage in EV batteries through partnerships. Policymakers are encouraging investors to set up facilities for refining, cathode, battery cell, and EV production in Indonesia.

Foreign direct investment (FDI) has started flowing into the nickel and EV sectors. In the last 3 years alone, the government has signed deals worth more than US$ 15 billion with international companies for nickel mining, refining, and battery manufacturing in the country. Major global brands such as Toyota, Mitsubishi, Hyundai, Ford, Foxconn, LG, and General Motors have invested in the country.

The Korean conglomerates are also investing US$ 1.1 billion to produce 150,000+ electric vehicle batteries per year. The Japanese company Toyota has also announced plans to invest US$ 2 billion in Indonesia over the 2019-2023 period.

Discussions with other major players such as Tesla and BYD are in progress.

Indonesia’s National Targets and EV Policy

Besides leveraging its mineral advantages, Indonesia has developed a US$ 17 billion roadmap to realize its EV ambition. The section below analyzes the Indonesian EV market’s targets, as well as the key components of this roadmap and the specific areas it aims to address.

To develop the Indonesian EV market, the government has set EV production and sales goals for 2025, 2030, and 2035:

- Sell 2+ million EV 2-wheelers and 2.5 million total EVs by 2025

- Produce 7.7+ million EV 2-wheelers by 2025

- Achieve a cumulative number of 2.2 million electric cars by 2030

- Achieve a cumulative number of 13 million EV motorcycles by 2030

- Make 20% of annual vehicle production by 2025 and 30% by 2035 Low Carbon Emission Vehicle (LCEV), including hybrid vehicles, PHEV, BEV, and FCEV

Reaching these targets requires significant efforts and preparations. As a result, the Indonesian government announced the EV roadmap and incentives for investors in 2021. Following this roadmap, Indonesia has set a 0% luxury vehicle tax, and 100% corporate income tax credit on investments exceeding Indonesian Rupiah (IDR) 500 billion.

In 2023, the government will also subsidize the sale of 200,000 electric 2-wheelers and 36,000 electric cars, aiming to reach a sales share of 4% and 5% respectively. The subsidies would reduce the price of an electric 2-wheeler by 25-50%.

The Focus on 2-Wheeler EVs

With 115 million 2-wheeler vehicles, Indonesia is the largest 2-wheeler market in Southeast Asia. Policymakers have recognized the importance of these EVs in the national transportation sector and have prioritized them in the EV transition plans.

The electric 2-wheeler industry has potential to add IDR 171 trillion in annual economic value. Additionally, it can create 215,000 jobs in component and vehicle manufacturing. By 2030, the country can realize IDR 746 trillion in cumulative economic value creation.

To encourage the purchase of electric 2-wheelers in 2023, the government has announced a subsidy of IDR 6.5 million. In Jakarta, policy incentives, such as a subsidy policy of 7 million rupiahs (around $460) on each new electric motorcycle that is locally made or that has at least 40 percent of its components sourced locally, have been announced.

The focus on electric 2-wheelers is also logical given the state of infrastructure in the country. Public charging stations in Indonesia are sparse, so home charging with slow chargers will be the mainstay in the short-term.

Despite the policy focus, and the current availability of charging infrastructure, the Indonesian EV market still faces several challenges that need to be addressed.

Challenges in the Indonesian EV Market

Despite its obvious advantages and strong policy push, the Indonesian EV market faces several challenges that might prevent it from reaching its goals for the future if left unaddressed. Below we examine three of these challenges.

1. Lack of Comprehensive Charging Infrastructure

By 2022, Indonesia had only 439 charging stations and 961 battery swap stations, most of them located in urban areas like Java and Jakarta. That’s a long way to go until the country can reach its target to install 31,859 charging stations and 67,000 battery swapping stations by 2030.

Although 2-wheelers can rely on the available home charging infrastructure, it won’t be long before the number of EVs on the road outgrows the available infrastructure. And as mentioned, the current infrastructure cannot support the electrification of larger, 4-wheeler vehicles.

However, improving the Indonesian EV infrastructure isn’t as simple as adding new charging points. Numerous issues still need to be addressed, including high investment costs for public fast charging stations, the absence of standards for charging station operations, lack of land availability in strategic locations, and untested business models for charging/battery swap stations.

Unfortunately, this lack of charging infrastructure in Indonesia prevents the public transportation sector and fleet operators from transitioning to EVs, which also hinders the growth of the Indonesian EV market.

2. Higher Cost of EVs

ICE vehicles’ cost in Indonesia is still relatively low compared to EVs. For example, even after the introduction of the new luxury tax, the total cost of ownership (TCO) of the Nissan Leaf BEV is greater than the cost of its gasoline counterpart, the 1.8L Toyota Corolla.

Contributing to the high cost of EVs in Indonesia is the import duty. The existing taxation scheme does not favor imports. Fully assembled units (CBU) face a 50% import duty, while imported parts that are assembled locally (CKD) are charged 10% of the value.

Given the insufficient supply of domestic components, Indonesia imports most components that go into EV production. Despite the savings on nickel and other minerals, the high import tax on the remaining components slows down local manufacturing.

The high costs of EVs in Indonesia are making them undesirable for end-users, which also puts a damper on the growth of the Indonesian EV market.

3. Lack of Public Acceptance

The challenge in Indonesia, as well as other emerging markets, is the perception of vehicles, especially battery electric vehicles (BEVs), as luxury items. Consequently, any government funding allocated to promote them is seen as a subsidy for the wealthy and is met with resistance from the public.

This raises concerns about the scale and sustainability of the subsidy in Indonesia. Convincing cost-conscious Indonesian buyers to transition to higher-priced BEVs will be difficult, making the subsidy crucial in reducing the price of BEVs to an acceptable level.

Unlike other countries like India and China, Indonesia does not have domestic automakers and a supplier base who are capable of developing and producing affordable BEVs.

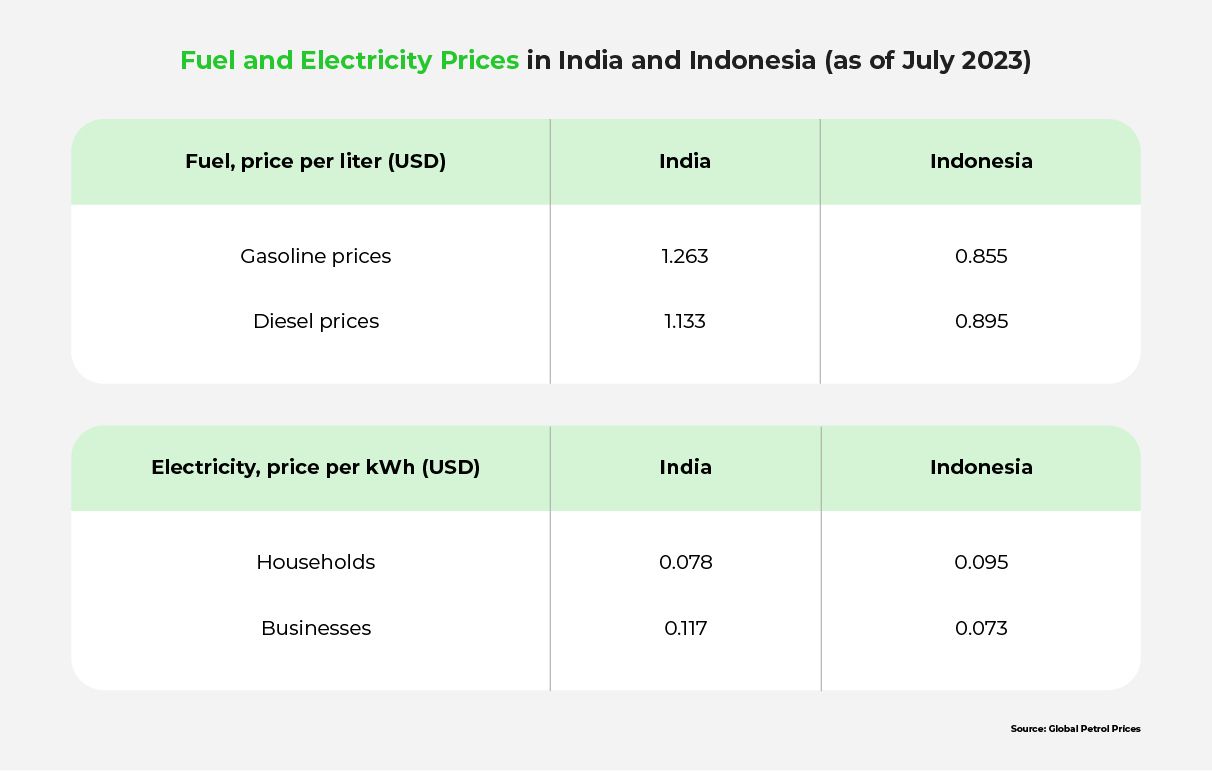

Additionally, compared to India, Indonesia has relatively lower fuel prices and higher electricity prices. This makes EVs less appealing due to their lower running costs per kilometer in Indonesia.

Strategies to Grow Indonesia’s EV Market

Although the journey to EV adoption in Indonesia is not an easy one, the country can still take several measures to facilitate the process. Given the significant positive impact of EVs, both on the environmental and socio-economic front, these efforts will be well worth it to grow Indonesia’s EV market.

Below we analyze three strategies the Indonesian government can consider to unlock the full potential of its EV market.

1. Develop EV Infrastructure

The government has already realized its infrastructural challenges, and is taking active steps to tackle the issue. Indonesia has tasked the Agency of Assessment and Application of Technology (BPPT) and the State-Owned Electric Company (PLN) with the responsibility of developing charging infrastructure.

PLN aims to install 31,000+ EV charging stations by 2030 and has earmarked a US$ 3.7 billion investment to meet its goal. It has offered to sell electricity for EV charging at IDR 714 (5 US cents) per kWh (bulk price) to charging companies, who can then sell it for up to IDR 1,300 (8 US cents) per kWh.

These kinds of initiatives will help startups and investors develop robust business models for charging infrastructure development. PLN is also offering several incentives for home charging, including discounts for connection upgrades and special tariffs for charging at night.

Here are some additional recommendations to help Indonesia roll out a robust charging infrastructure:

- Implement a centralized portal to check information on charging points and battery swapping stations

- Integrate EV charging infrastructure with renewable energy sources

- Encourage petrol stations to offer charging facilities on their premises

2. Make EVs More Affordable

The government is offering financial incentives worth IDR 7 trillion to encourage the purchase of 800,000 new electric motorcycles and conversion of 200,000 conventional 2-wheelers. The subsidies are in addition to the existing tax breaks. Incentives for around 35,800 electric cars and 138 electric buses are also planned.

Making EVs more affordable, however, requires more than tax breaks and financial incentives. The Indonesian EV market requires a more innovative approach to manufacturing, which could contribute to the lower cost of EVs, making them more desirable.

For example, the government can:

- Explore and develop new business models and technologies. Selling EVs without batteries is a great way to bring down their price, but this would require a mature, country-wide battery swapping network.

- Invest in R&D. R&D is crucial to help Indonesia become a manufacturing and assembling hub for EVs. If the country can achieve this goal, it can greatly reduce EV prices for its citizens.

3. Promote EV Acceptance Through Investments and Awareness Campaigns

The government needs to facilitate access to international sources of funding. EV projects qualify as sustainable projects and can get access to ESG funds. For example, electric bus operator DAMRI, Indonesia’s oldest state-operated public transport operator, is spearheading the transition to EVs in public fleets with US$ 150 million ADB funding.

Upon realizing that public transport is also shifting to EVs, consumers will be less prone to viewing electric cars as a luxury. Foreign investments will also help Indonesia address its citizens’ unique transportation needs, positioning EVs as a better choice than ICE vehicles.

Investment in renewable energy sources might also drive down electricity prices, making EVs more attractive to potential buyers. Finally, the country should promote investment in awareness campaigns on the benefits of EVs, to shatter any public misconceptions.

- Build a body of knowledge within the Indonesian EV market, like best practice documentation and innovative business models

- Promote collaborations, cooperative competition, and partnerships for international investors and large projects

- Engage the international EV community and investors in the Indonesian EV market

Future Outlook of the Indonesian EV Market

Indonesia, with its abundant reserves of nickel and other crucial minerals, has the potential to become a major player in the electric vehicle (EV) market. As the largest market in Southeast Asia and a significant producer of EV components, Indonesia aims to boost EV adoption among its citizens and become an EV producer by 2035. This, however, requires help from investors and the government.

Despite the government’s initiative, the Indonesian EV market faces challenges. The lack of a comprehensive charging infrastructure, the higher costs of EVs compared to internal combustion engine vehicles, and the need for adequate investment pose obstacles to its growth.

However, the government has outlined strategies to overcome these challenges, including infrastructure development, making EVs more affordable through innovative manufacturing approaches and financial incentives, and increasing investment in the EV industry through partnerships and research initiatives.

By addressing these challenges and implementing these strategies, Indonesia can unlock the full potential of its EV market and contribute to a greener and more sustainable transportation sector.

In the next part of this series, we will move to another major Southeast Asian market, Singapore.

To learn more about the Indonesian EV market, please see the FAQ and Resources sections below.

FAQ

What are the benefits of electric vehicles over traditional gasoline-powered vehicles?

Electric vehicles (EVs) offer multiple benefits over traditional vehicles. EVs are more environmentally friendly as they emit zero tail-pipe emissions and negligible noise. EVs are also more economical to run as the cost of charging is much lower than the fuel cost of traditional vehicles. EVs also have lower maintenance because they do not have an engine and have a much lower number of moving parts.

How is Indonesia building the necessary infrastructure for electric vehicles?

The government has tasked PLN, the state-owned power company, with the responsibility of developing charging infrastructure. PLN aims to install 31,000+ EV charging stations by 2030. This should help startups and investors to develop robust business models for charging infrastructure development. PLN has also offered several kinds of incentives for charging at home, including discounts for connection upgrades and special tariffs for charging at night.

What is the potential impact of electric vehicles on the environment in Indonesia?

The three major segments responsible for carbon emissions in Indonesia are electricity, industry, and transportation. EVs present an opportunity to address the air pollution caused by road transportation. EVs can also be leveraged to initiate a transition to renewable sources of electricity. For example, consumers and electricity companies can install solar power to charge their EVs. EVs also reduce noise pollution.

How does battery technology affect the development of the electric vehicle market in Indonesia?

The battery is the most important component in an EV and Indonesia has significant reserves of nickel, cobalt, and copper, which are required in battery production. Indonesia is discouraging the export of mineral ore and is encouraging companies to invest in the country for EV and battery manufacturing. Companies are investing in mining, refining, and manufacturing operations within the country. This is helping to develop the EV market in Indonesia.

How can individuals and businesses participate in the Indonesian electric vehicle market?

Investors can invest in the Indonesian EV market by participating in any of the priority areas identified by the policymakers. EV batteries are one of the most significant areas of focus because the country has adequate mineral reserves. The country also has a very large 2-wheeler market which offers potential opportunities for investment. Public fleet electrification and charging infrastructure development are other major opportunity areas.

Resources

International Council on Clean Transportation: Indonesia transport electrification strategy

Learn about Indonesia’s efforts to promote e-mobility across the country.

Maximize Market Research: Indonesia Electric Vehicle Market

Get a comprehensive overview and analysis of the EV market in Indonesia from 2022-2029.

MDPI: Current Readiness Status of Electric Vehicles in Indonesia

Learn how Indonesia can prepare itself for the shift to EVs in its transportation sector.

IEA: Global EV Outlook 2023

Learn about the latest innovations and updates in the global EV industry.

BCG Report: Electrifying Indonesia’s 2-Wheeler Industry

Discover why Indonesia’s policy focus on 2-wheeler EVs can help the country reach its goals for 2035.

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More

Feb 09, 2026 • EV Charging Infrastructure

The Current State of EV Charging in India [2026]: Public, Home, and Fleet Networks

Read More