China’s EV Market: Opportunities, Challenges, and Future Scope

Raghav Bharadwaj

Chief Executive Officer

Published on:

31 Aug, 2023

Updated on:

24 Nov, 2025

Over the last decade, China has led the race to transition to electric vehicles (EVs). It has been so successful that other countries have made immense progress by adopting its formula: a combination of significant capital investment and a centralized, interventionist approach. This strategy has successfully boosted EV adoption by supporting not only manufacturing, but also nationwide infrastructure development.

China has encouraged the potential of its EV market by gradually introducing financial subsidies in many cities. Thanks to substantial reserves of raw materials for batteries, continuous technological advances, increasingly widespread charging infrastructure, and export efforts by EV manufacturers, China’s EV momentum keeps accelerating.

This article will address the following questions:

- What is the current state of China’s EV market, and how is the market share distributed among different vehicle types and commercial EV OEMs?

- What potential challenges affect the Chinese EV market, and how do they impact EV adoption?

- How do governmental policies, incentives, and national targets support the growth and development of China’s EV market?

China’s Current EV Market

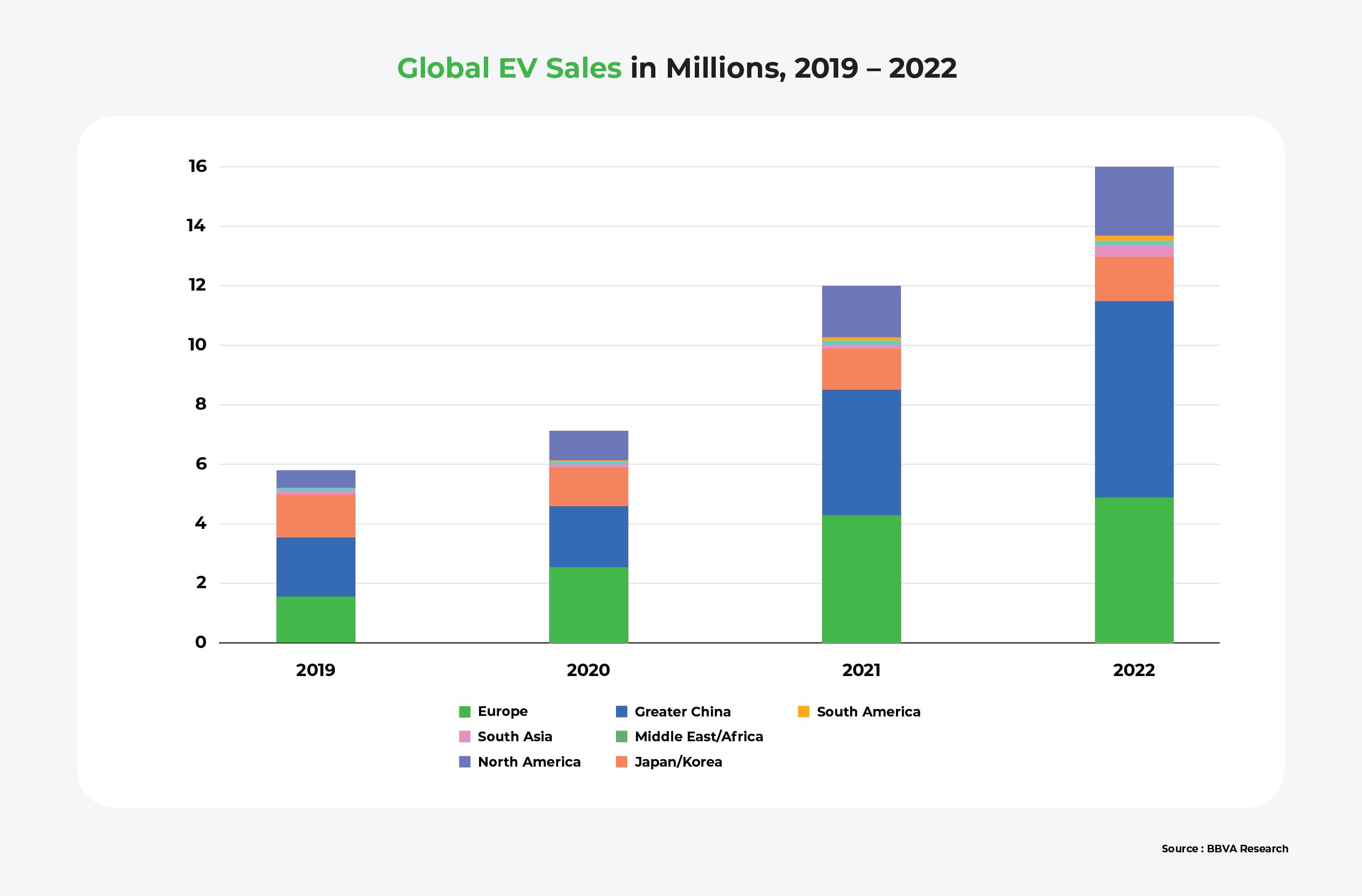

As one of the leaders in the EV world, China has successfully expanded its global market share from less than 30% in 2019 to 41.5% in 2022. Its role as the largest EV production base is even stronger, with 7.1 million units, representing 70% of the 2022 global total, made in China.

Within China, EV sales have increased from 16% of the domestic car market in 2021, to 29%, or 6.9 million vehicles, in 2022. The market is segmented into battery-electric and plug-in hybrid electric vehicles. Battery EVs (BEVs) made up nearly 77.9% of sales in 2022. Moreover, there was a remarkable 151.9% YoY surge in plug-in hybrid EV (PHEV) sales.

Currently, passenger cars are more popular than commercial vehicles, accounting for 95.1% of EV sales. The commercial vehicles sector is on the verge of widespread EV adoption, however; more than 30 cities are planning to fully electrify their public transit systems by 2028.

China also dominates the electric two-wheeler and three-wheeler markets. As of 2021, it had 93 million electric two-wheelers, thanks in part to a 2019 technical standard favoring lithium ion batteries. Domestic companies Yadea and Aima account for the majority of lower-end electric scooter sales, followed by Nio. Meanwhile, electric 3-wheelers are popular for goods and service deliveries, accounting for about 90% of urban last-mile deliveries.

The Chinese EV market is projected to continue growing, with an estimated revenue of US $292.1 billion in 2023, and a CAGR of 6.38% from 2023 to 2028. It remains competitive; more than 94 brands offer a total of over 300 EV models at various price points. Domestic brands like BYD lead, with an 81% share, while startups like Xpeng and Nio further intensify competition, solidifying China’s EV production dominance.

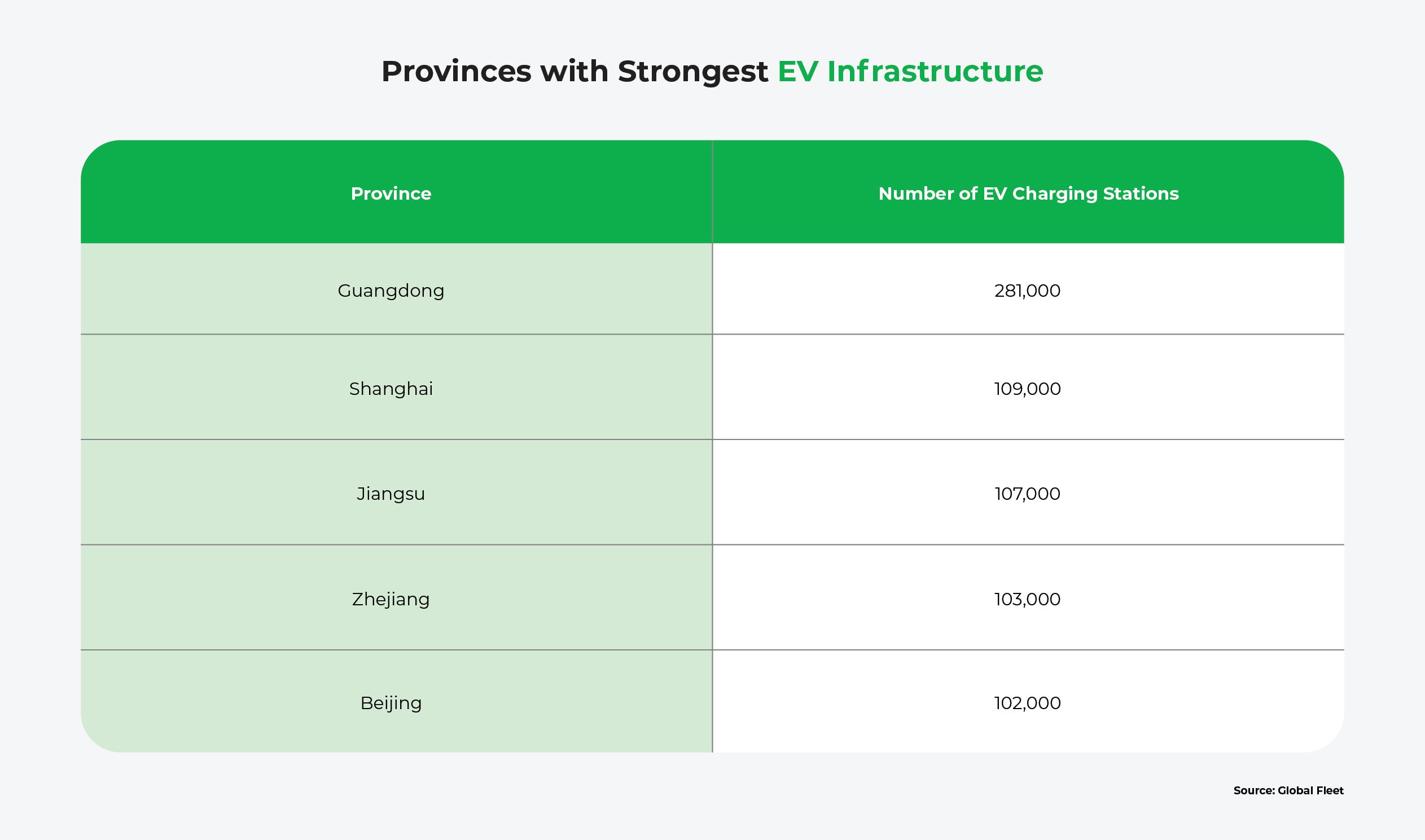

Like other countries with major EV markets, China is rapidly expanding its EV charging infrastructure; as of August 2022, it accounted for 65% of global public charging points. In May of 2022, China added 87,000 new charging stations, reaching a total of 1.419 million stations.

China aims for a ratio of 14.66 charging points per vehicle by 2025.

Major 4W Market Players

China’s domestic EV industry is well-developed, with many established manufacturers and an extensive supply chain. This has allowed Chinese companies to produce EVs at a competitive cost, making them attractive to consumers from other countries.

Foreign-brand joint ventures, as well as foreign brands such as Tesla with manufacturing facilities in China, have further contributed to the growth of China’s EV export industry. Some Chinese firms, like Geely, also own foreign-based subsidiaries.

Major EV Fleets

China’s fleet market is segmented into government firms, state-owned businesses, public services, taxis, and long-term rental companies.

In keeping with policy interventions, government and state-owned firms feature lower transaction prices, smaller engines, and increased use of domestic brands, with a mandate for 30% EV adoption.

E-buses and e-trucks are flourishing, constituting over 90% of the global e-bus market in 2021. Top 10 e-truck and e-bus manufacturers hold 70% and 85% market share, demonstrating consolidation through economies of scale.

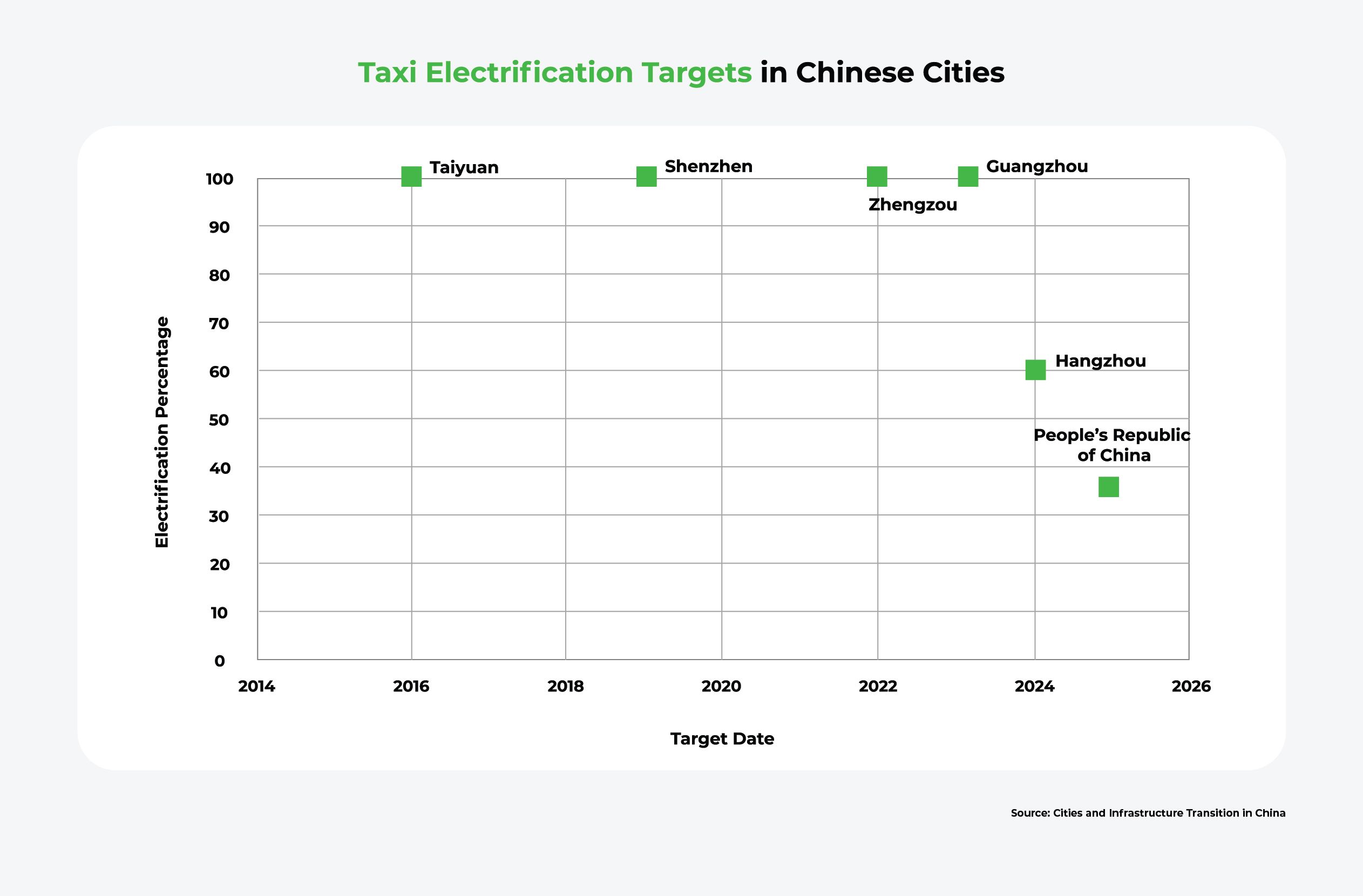

Major cities like Shenzhen, Chengdu, Zhengzhou, and Tangshan are experiencing high adoption of electric buses and trucks, due to policy-driven preferences. About 9.5% of conventional taxis were electric in 2020, and China’s 14th Five-Year Plan aims for 35% EV representation in the taxi fleet by 2025, with local targets in place.

China has two types of taxis: conventional taxis hailed on the streets, and taxis ordered via apps. Around 9.5% of conventional taxis were electric in 2020, and the 14th Five-Year Plan aims for EVs to represent 35% of the taxi fleet by 2025. Accordingly, many cities have set local targets for taxi fleet electrification.

Potential Challenges in the Chinese EV Market

Thanks to strong government support, China has emerged as a major driving force in the global EV transition. However, China still faces challenges involving making local EV brands more competitive, securing the supply chain for raw materials, and expanding charging infrastructure.

Transitioning from Subsidies to Market-Driven Demand

The Chinese government has significantly contributed to EV demand. However, in an attempt to stimulate organic consumer demand, the government gradually canceled subsidies between 2020 and 2022. As a result, battery electric vehicle (BEV) sales temporarily rose as customers rushed to make purchases while subsidies were still in effect, but have since slowed. This decline may not turn out to be a major concern, however; EV manufacturers show signs of successfully adapting to focus on diverse consumer needs in the absence of subsidies.

Competition and Market Consolidation

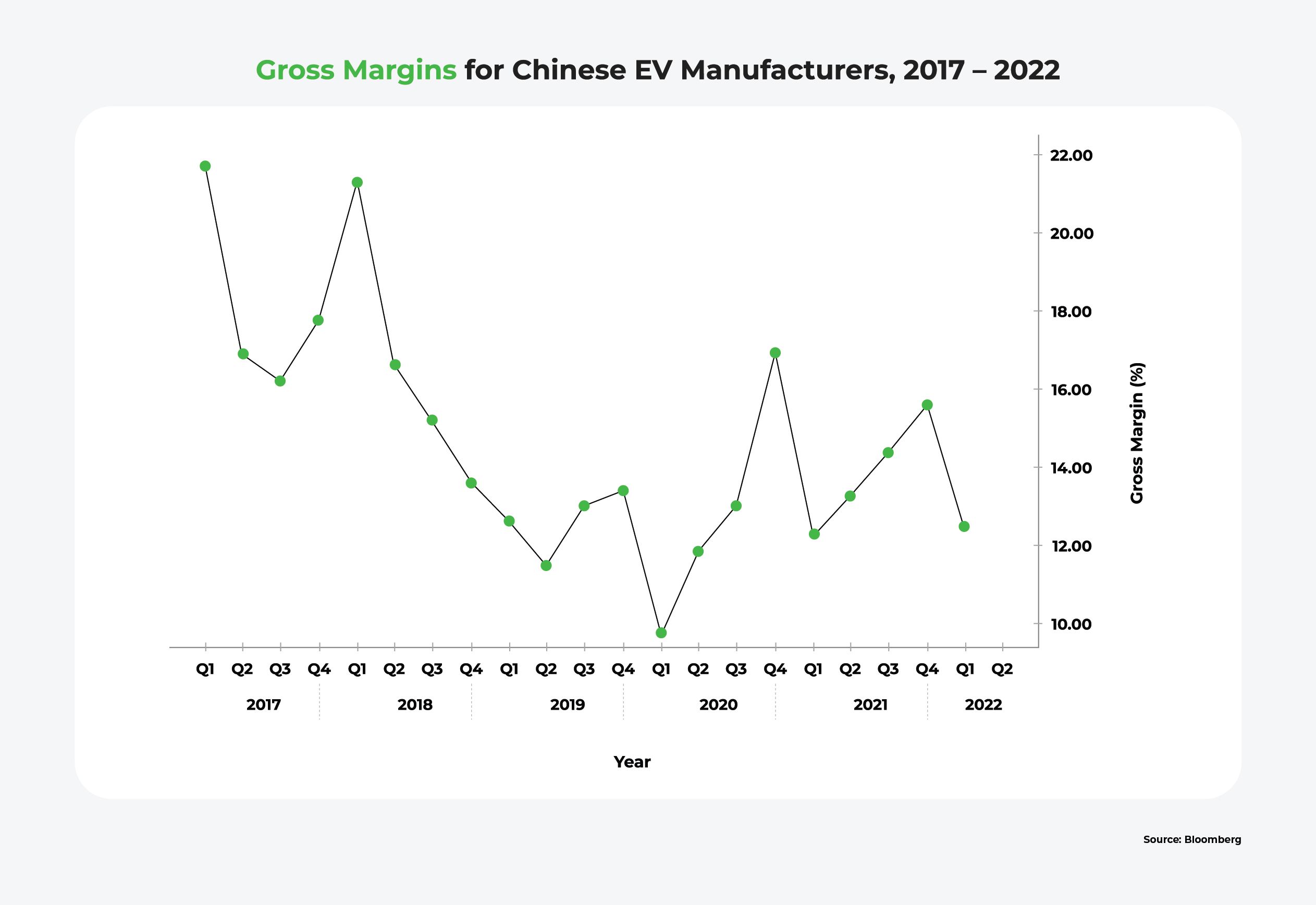

Intense price competition among 40 carmakers in China led to unprecedented cuts in vehicle prices, negatively impacting gross margins for domestic brands in Q1 2022. Generally speaking, China domestic brands’ gross margin dropped 19% in Q1 of 2022 compared with the previous quarter. In January 2023, Tesla reduced Model 3 and Model Y prices by between 6% to 13.5%%20from%20265,900%20yuan.), which caused another round of price wars in the domestic market. Trade conflicts and battery resource costs may further erode margins.

As a result, Chinese EV businesses are seeking opportunities abroad. This may come with its own set of obstacles, however, such as other countries’ local protectionism.

Battery Technology and Supply Chain Issues

Unevenly distributed reserves of raw materials may put the supply chain at risk. China holds a dominant position in global graphite mining, accounting for 82% of the market share and owning nearly 25% of the world’s graphite reserves in 2022. However, it has only a 1% share in cobalt mining and reserves. This imbalance poses a risk to the EV battery supply chain; rising costs of battery materials like cobalt, nickel, and lithium could increase battery prices, potentially affecting consumer demand for EVs. Low self-sufficiency in batteries, electric motors, and power semiconductors may pose further problems.

Government Incentives & National EV Targets

The Chinese government has been a driving force behind the EV industry, implementing supportive policies for R&D, manufacturing, and marketing since the 1990s. These policies include consumer subsidies, sectoral plans, technical standards, tax credits, and charging infrastructure strategies, as well as the “dual credit” system. Local implementation is fundamentally guided by the same central policies, but varies due to China’s diverse political economies and unique circumstances.

EV Master Plan: Made in China 2025

China’s “Made in China 2025” plan is a national strategy which targets 20% EV sales by 2025. China already surpassed this figure in 2022.

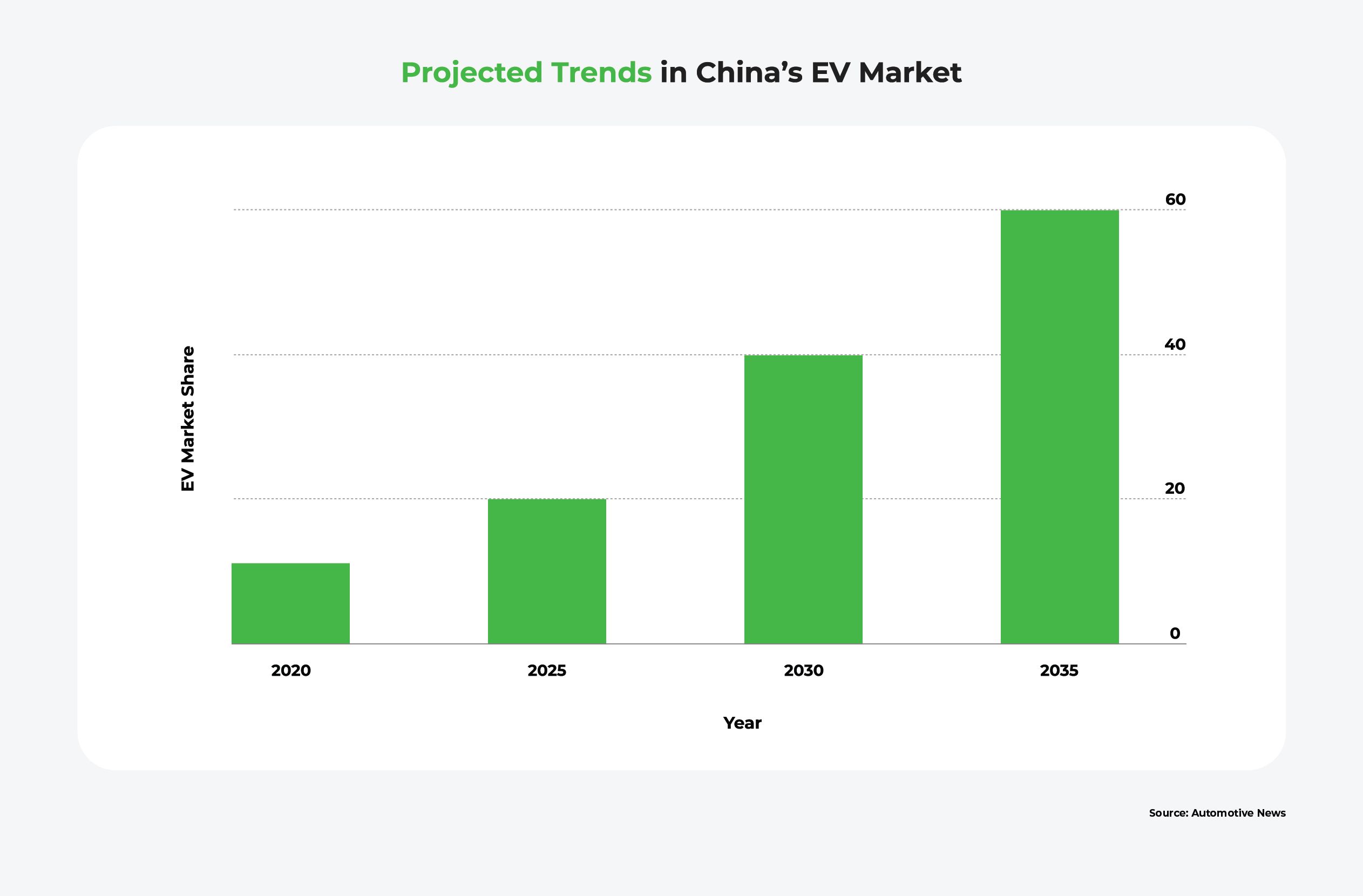

In 2020, China published the New Energy Vehicle Industry Development Plan (2021 – 2035) as a top-level policy to guide the comprehensive integration of new energy vehicles (NEVs) and intelligent connected vehicles (ICVs). The plan involves four principles: market-led development, innovation-driven development, coordinated promotion, and open development. By 2025, China envisions a more competitive EV market, while 2035 sees EVs reaching global standards and advanced charging infrastructure.

China has also proposed comprehensive targets to guide the development of battery and charging infrastructure. The 14th Five-Year Plan prioritizes strategic emerging industries, particularly involving new energy vehicles and batteries; the policy emphasizes EV manufacturing, battery R&D, and nano ion battery industry development.

Meanwhile, a January 2022 announcement revealed plans to establish 20 million EV charging facilities by 2025. Recently, the State Council set five major targets to create a high-quality charging infrastructure system by 2030, aiming for extensive coverage, moderate scale, balanced structure, and optimal functionality to support the growing EV market.

EV Supply-Side Incentives

Research, Development, and Tax Subsidies

Both state and city governments provide support for researching and developing EV-related technology. For example, as part of China’s Five-Year Plan, the central government offers special funds for innovation, demonstration projects, and application promotion, whereas local governments allocate matching funds for infrastructure and battery recycling. Meanwhile, companies and institutions engaged in EV development are exempt from business tax.

Since China bases its passenger car taxation system on average fuel consumption, EV users also benefit from tax relief. China’s vehicle purchase tax — a one-time tax that is paid when a new vehicle is purchased — is a significant cost, which can be up to 10% of the vehicle’s purchase price. Exemption from this tax is a major incentive for EV adoption in China. It makes EVs more affordable for consumers, and it helps to promote the use of cleaner transportation.

Manufacturing Support

In addition to implementing conventional policies and providing financial support, China utilizes a credit system to boost EV production. The International Council for Clean Transportation sets gradually increasing sales targets for domestic auto manufacturers, and enables flexible compliance through carbon-credit trading. Now that sales have surpassed the current 18% benchmark, the Ministry of Industry and Information Technology plans to set higher targets for the future.

Technology Development Funds

To support the EV industry, the government encourages financial institutions to provide credit reviews and diversified financing options to EV manufacturers.

EV Demand-Side Incentives

Purchase Subsidies and Tax Incentives

To promote EV adoption, the Chinese government offers purchase grants through central and local rules, granting subsidies of up to RMB 100,000 (approximately USD $15,000) per vehicle. These subsidies are reported to be the second most generous in the world, following Norway. The government further supports electric vehicle sales by offering 2023 tax exemptions on purchases of

new energy vehicles.

Charging Infrastructure

The Chinese government provides dedicated charging infrastructure subsidies to local governments that meet promotion targets. State Grid and China Southern Power Grid offer favorable treatment to charging station operators, exempting them from “basic charges” based on electricity usage. The basic charge is a predetermined charge based on the capacity of transformers used by significant industrial electricity consumers.

Driving and Parking Privileges

In some cities, like Nanjing and Shanghai, EVs are allowed to bypass traffic congestion by using bus lanes. Several cities are also encouraging public institutions to provide designated EV parking spots, including chargers.

Public Bus Policies

Subsidies and benefits for low-emission public bus fleets contribute to China’s optimistic outlook for EV development. The government has provided local governments with annual bus electrification targets, and penalizes noncompliance by reducing oil subsidies, thereby promoting EV bus adoption by increasing operating costs for traditional buses.

Opportunities for Future Growth

China’s significant domestic market and well-established technological competitiveness have already positioned it as a top player in the global EV market. With its commitment to achieving net-zero targets by 2060, China is ready to take advantage of new opportunities to further amplify its role in the electric revolution.

Promoting Investment for Sustainable Market-Driven Demand

The gradual end of financial subsidies may have short-term negative effects on the demand for EVs. The government could counter this potential downturn by providing different or non-financial incentives, such as free license plates, right of way privileges, or tax exemptions.

China could also compensate for the subsidy discontinuations by taking steps to further stimulate its domestic market. For example, it could make EVs more appealing by focusing on research and development to enhance battery technology, charging infrastructure, and autonomous driving capabilities.

As a matter of fact, starting from 2009, subsidies for the EV industry primarily manifested as conventional R&D grants, often channeled through established programs like the long-standing high-tech “863 Program.”

Alternatively, it could make EVs more affordable by implementing measures to scale up EV production, optimize the supply chain, and encourage local manufacturing to reduce production costs.

An even stronger target for phasing out ICEs might also be beneficial. Right now, only Hainan Province has announced a complete ban on ICE in the private vehicle sector by 2030; other cities or provinces could follow suit.

Creating an equal investment environment for foreign enterprises entering the Chinese market is also essential.

Supportive Infrastructure Development

Due to the increasing number of EVs, China finds itself tackling the challenge of meeting the growing demand for charging infrastructure. China is planning to add over 600,000 charging points in 2023, and to introduce ultra-fast charging stations with 120 – 350 kW capacity. To further strengthen its charging infrastructure, China could attract more investments, and encourage joint ventures. It will also need to focus on expanding infrastructure to inland cities; over 70% of existing charging stations are in coastal areas.

Technological Advancements and Innovation

China’s thriving EV landscape is partially due to battery innovation, which has enabled the country to surpass its 2025 targets in range and energy consumption. The time is now ripe to implement a new technology target. For example, China could seize the chance to become a leader in achieving better graphite quality for battery production. Alternatively, it could focus on advancements in AI.

Start-ups like Nio are already innovating new features in the premium EV market. China could further accelerate its EV technology and boost its competitive edge by forming joint ventures with, and further opening the market to, global players.

Electrification of Public Transportation and Commercial Fleets

China is strongly committed to achieving 100% electrification of its public transportation system, with many major cities setting clear timelines for this target. By rapidly adopting EV buses, China can open the door to significant advancements in fleet maintenance and management, and can go on to successfully implement smart city strategies.

For example, a centralized system utilizing advanced algorithms to analyze electric bus operations and energy consumption data could efficiently optimize fleet scheduling by monitoring performance and predicting passenger flow.

China’s Electric Future

China leads the global electric vehicle market, thanks to strong government support, improved technology, growing environmental awareness, and commitment to smart city strategies. Battery EVs dominate sales, and China’s net-zero targets drive continuous investment in research and development.

Despite challenges involving transitioning from subsidies to market-driven demand, handling intense price competition, and securing raw materials, China is on the verge of exploring opportunities to promote sustainable demand, develop charging infrastructure, and advance battery technology. With coordination among policymakers, manufacturers, and innovators, China can win the market in the long-term with its thriving and dynamic EV industry.

FAQ

What are the key factors driving the rapid growth of China’s electric vehicle (EV) market?

The rapid growth of China’s EV market is driven by a combination of government policies such as subsidies and incentives, heightened environmental awareness, continuous improvements in EV technology, and a strong focus on battery innovation to enhance electric range and energy density.

What are the latest trends and innovations in EV technology and infrastructure development in China?

China’s latest trends in EV technology and infrastructure development include advances in battery capacity, energy density, and charging infrastructure expansion with a focus on ultra-fast charging stations. These developments aim to meet the increasing demand for EVs and facilitate efficient charging options for consumers.

What advantages and benefits do Chinese companies gain by electrifying their fleets?

Companies gain multiple advantages from adopting EVs in their fleets in China. Government incentives and tax exemptions encourage fleet electrification, leading to reduced operating costs due to lower fuel expenses. Additionally, adopting EVs aligns with environmental goals738186_EN.pdf), enhancing companies’ sustainability image.

How are Chinese consumers responding to the availability and benefits of EVs in the market?

Chinese consumers are showing a positive response to the growing availability and benefits of EVs in the market. Due to increased awareness of environmental issues, more consumers are opting for EVs, contributing to rising market demand.

What are the investment opportunities and potential risks for investors looking to enter China’s EV market?

Investment opportunities in China’s EV market stem from its large domestic market, technological advancements, and robust government support for the EV industry. However, potential risks exist, including intense competition among manufacturers, supply chain challenges, and uncertainties in government policies, which may impact the market dynamics.

Resources

Mordor Intelligence: China EV Market Size & Share Analysis — Growth Trends & Forecasts (2023 – 2028)

Examine China’s current EV market here.

BBVA Research: The rise of China’s EV sector and its implications for the world

Discover China’s EV future and its global implications here.

ICCT: Nine trends in the development of China’s electric passenger car market

Explore trends in China’s EV landscape here.

McKinsey: Winning the Chinese BEV market: How leading international OEMs compete

Gain insight into China’s EV market here.

Bloomberg: Challenges facing the China EV market

Discover the challenges in China’s EV industry here.

MIT Technology Review: How did China come to dominate the world of electric cars?

Learn how China is leading the way towards global EV dominance here.

Mar 05, 2026 • EV Charging Infrastructure

The Hidden Cost of Poor Electrical Design in EV Charging Networks

Read More