Vietnam's EV Landscape & Market: An In-Depth Analysis

Raghav Bharadwaj

Chief Executive Officer

Published on:

10 Aug, 2023

Updated on:

24 Nov, 2025

Vietnam is one of the fastest growing economies in Southeast Asia, and the government is committed to making the country a leader in clean transportation. As part of this commitment, the government has set ambitious targets for the adoption of electric vehicles (EVs). By 2030, the government aims for EVs to account for 10% of all new vehicles sold in Vietnam.

Vietnam’s relatively new move towards e-mobility is largely powered by private enterprises. The local EV market initially concentrated on electric scooters. Recently, however, thanks to determined efforts from the private sector, Vietnam established itself as a key industry player by becoming the first country in Southeast Asia to have its own successful electric car manufacturing company. As a result, Vietnam’s EV growth could outshine that of nearby countries such as Thailand and Indonesia, and even disrupt China’s dominance.

Vietnam’s thriving middle class, which displays strong interest in cutting-edge technologies, fuel efficiency, and environmental awareness, is creating an opportunity for the country’s EV market to grow at a double-digit rate over the coming years.

This article will focus on the following questions about Vietnam’s EV journey:

- Who are the major players in the Vietnamese EV industry, and what role do they play in the market’s evolution?

- How are the Vietnamese government and private sector promoting EV usage?

- What are the challenges and opportunities for EV adoption in Vietnam?

Vietnam’s Current EV Market

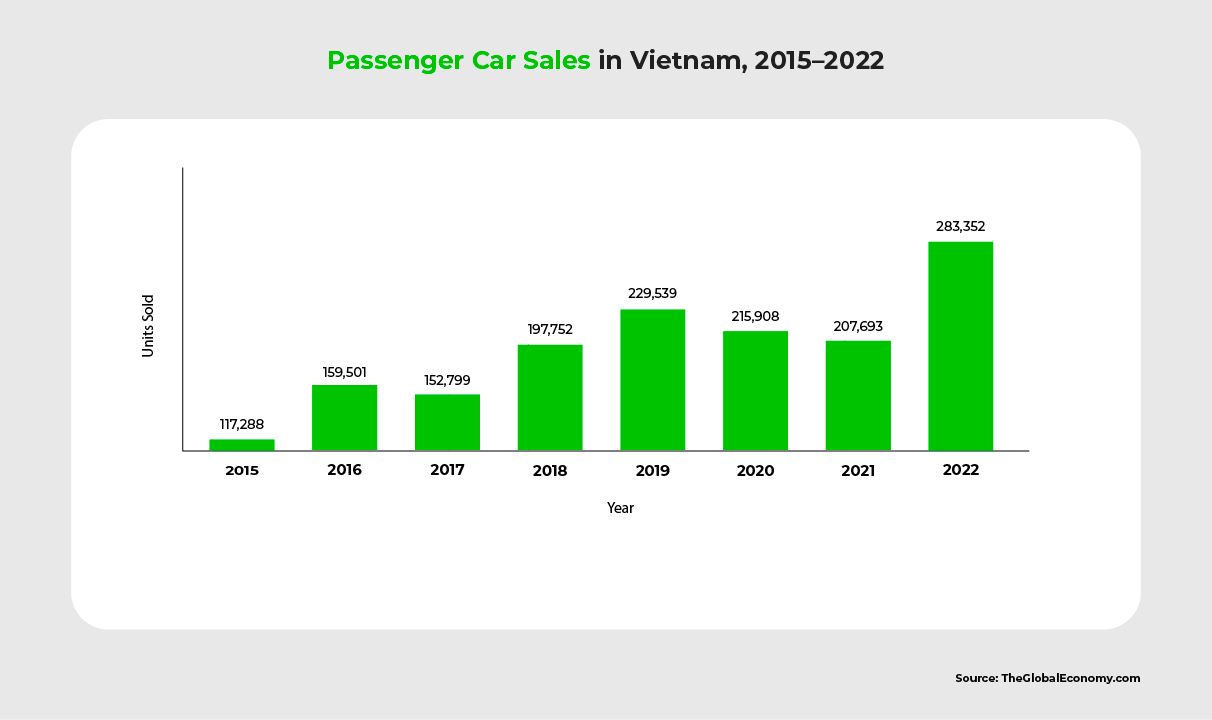

In Vietnam, motorbikes are the dominant form of transportation. In fact, in 2020, motorbikes outnumbered passenger vehicles by a staggering ratio of 30 to 1; the car ownership rate was merely 5.7%, substantially lower than in other Asian markets.

However, this rate is poised to grow, due to Vietnam’s growing middle class and increasingly popular ride-sharing fleets. The International Trade Administration predicts that car ownership will reach 9% by 2025, and 30% by 2030.

Unfortunately, this transformation comes along with a parallel increase in negative environmental consequences: the Vietnamese transport sector’s CO2 emissions are projected to rise from 33.2 million tons in 2014 to 89.1 million tons in 2030. Vietnam, however, has committed to regulating CO2 emissions, in keeping with the Paris Agreement. The best path forward, therefore, is to encourage EV adoption.

Vietnam’s EV market is just getting started, but shows potential for growth. Electric two-wheelers captured 10% of the 2-wheeler market in 2021, with nearly 1.8 million electric motorcycles and scooters in operation; as a result, Vietnam ranks second globally in two-wheeler electrification, after China. Local companies like VinFast and Pega dominate Vietnam’s electric two-wheeler market.

In the electric four-wheeler market, nearly 3,000 electric cars were produced, assembled, and imported as of August 2022, marking a substantial increase from 2019. VinFast leads the domestic companies, while foreign companies also enter the market with government support. EV adoption promises to reduce the transport sector’s greenhouse gas emissions, with a particular focus on clean, renewable sources.

Major Players in Vietnam’s Electric Four-Wheeler Market

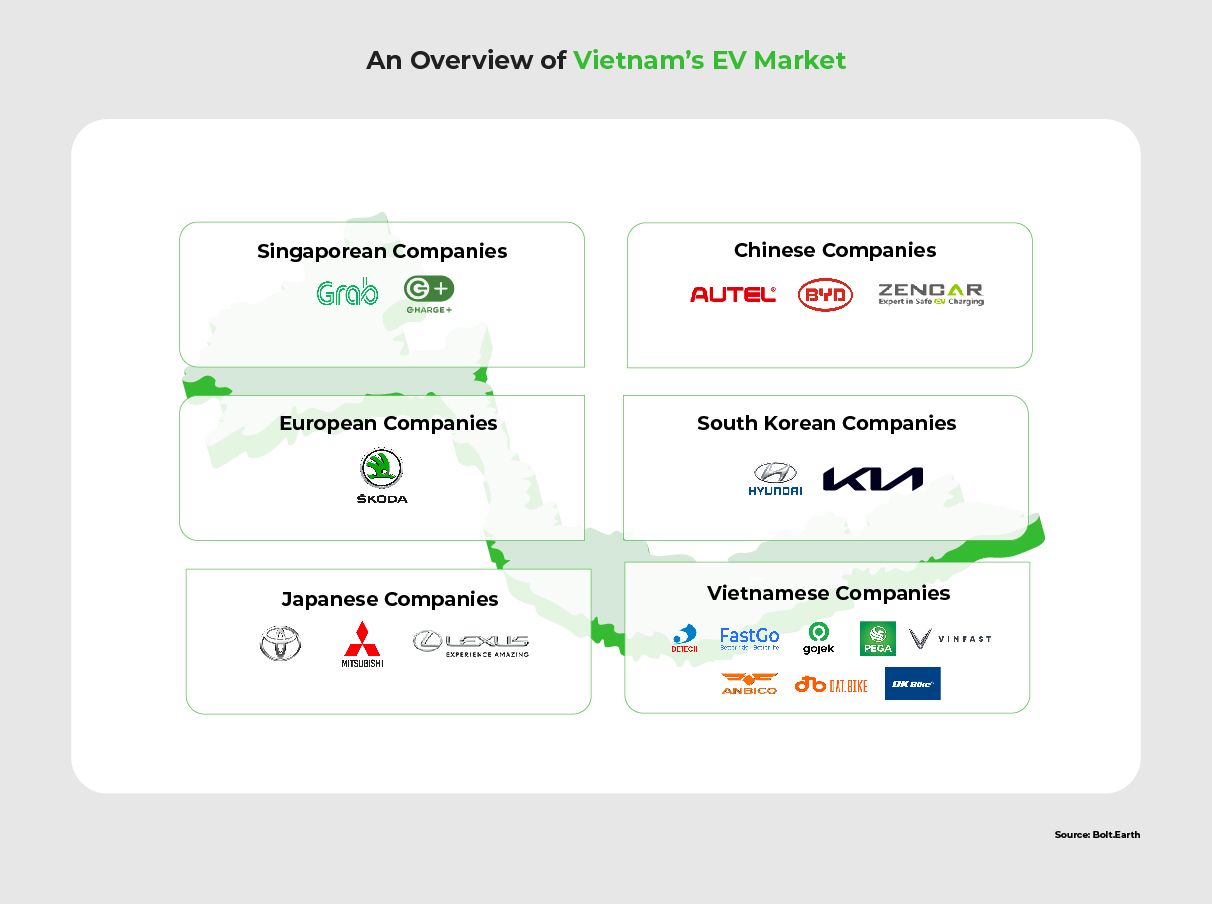

VinFast delivered 4,200 EVs from 2020 to 2022; this marks a huge increase from the 190 registered electric cars in Vietnam in 2019, all of which were imported. Furthermore, major Asian and European car manufacturers, like Kia, Hyundai, Audi, Mercedes Benz, Lexus, Toyota, and Porsche are planning to bring their own EV models and unique strategies to the Vietnamese market.

Foreign players commonly utilize strategies to develop the domestic supply chain and deploy charging infrastructure. Some companies, like Mitsubishi, Skoda, Toyota, Hyundai, and Kia, are establishing their entire supply chain within Vietnam. Others, like BYD, are setting up plants in Thailand to produce car parts for assembly in Vietnam, while also proposing to develop a local supply chain. Meanwhile, companies such as Mitsubishi and Porsche are actively deploying EV charging stations, while CHARGE+, ZenCar, Autel, and others offer battery charging solutions to support the growing EV demand in the market.

Electric Fleets

Electric 2-Wheeler Fleets

The recent increase in electric two-wheelers’ market share, from 5.14% in 2019 to 8.54% in 2020 and 10% in 2021, has created momentum to electrify Vietnam’s two-wheeler fleets. Transitioning from traditional two-wheelers to their electric equivalents is relatively easy, because many vehicle components are similar and have a high rate of local production.

Vietnam has seven E2W manufacturers, six of which — VinFast, Pega, Anbico, Detech, DK Bike, and Datbike — are Vietnamese.

Electric Buses

Demand for electric bus fleets is high, due to government policies which encourage the use of emission-free public transportation. Factors such as rapid urbanization, fluctuating oil prices and lowering battery costs further incentivize electric bus adoption. While the market for electric buses is growing, it is still limited by the higher upfront cost of electric buses compared to traditional buses.

Ride-Hailing Services

Use of ride-hailing services has surged, and is predicted to reach USD 2609.67 million by 2028. To gain a competitive advantage in Vietnam’s growing market, ride-hailing companies are converting gasoline vehicles to EVs, reducing emissions, promoting eco-friendly transport, and boosting EV awareness. Hanoi’s electric ride-hailing market is predicted to experience particularly rapid growth, thanks to newly launched companies like Grab, FastGo, and Gojek.

Other Electrification Projects

Several pilot projects by various companies and institutions demonstrate Vietnam’s progress towards developing E-mobility solutions. For example, VinFast has introduced free e-motorcycle charging points with plans for 30,000 to 50,000 installations. Other initiatives include quick charging for electric cars by Central Power Corporation and Mitsubishi, and e-bike sharing programs by Ho Chi Minh National University, UNDP, and others.

21 provinces have piloted electric three-wheelers for waste collection, and electric four-wheelers for tourism. Companies like Vingroup and VinBus plan to operate electric buses in major cities and Phu Quoc Island, which is supported by the Ministry of Transport’s focus on automobile industry development and sustainable transportation.

Government Incentives & National EV Targets

Vietnam’s EV industry has less policy support than other Southeast Asian countries do; instead, it is primarily led by private companies. However, although Vietnam lacks specific EV policy frameworks and incentives, its broader sustainable development plan is serving to promote EV adoption through sustainable development, green growth, climate change, and environmental protection laws.

EV Master Plan

Under the Paris Agreement, Vietnam has pledged to reduce greenhouse gas (GHG) emissions by 9% in 2030 compared to the business-as-usual (BAU) scenario, using domestic resources. It aims to increase this target to 27% against BAU, contingent upon receiving international support. It also plans to achieve net-zero emissions in the transport sector by 2050.

Several industry players are contributing to this general vision for environmental development. Most notably, the Vietnam Automobile Manufacturers Association (VAMA) has proposed the National Automobile Development Strategy (2021 – 2050), which targets a production capacity of 3.5 million electric vehicles by 2040.

Furthermore, various levels of Vietnam’s government have proposed plans involving EV development.

State Policies

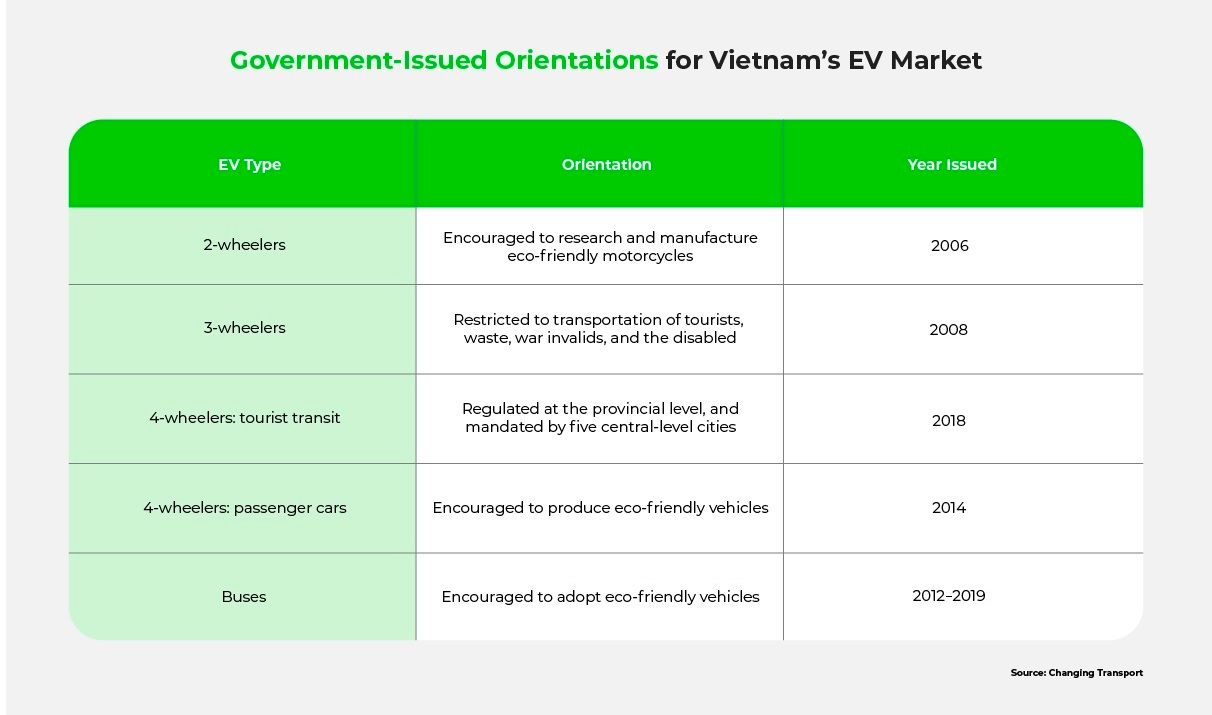

In the absence of clear national targets or roadmaps, Vietnam’s state-level government has provided some direction.

For example, in July of 2022, the Vietnamese government approved Decision No. 876/QĐ-TTg, which focuses on the Action Program for Green Energy Transition and Reducing Carbon and Methane Emissions in the Transport Sector. The decision emphasizes EV production, import, and charging infrastructure from 2022 to 2030, followed by phasing out fossil-fueled vehicles by 2040 and ensuring all road vehicles run on electric and green energy by 2050, supported by a nationwide charging infrastructure.

Other state-level policies share this attention to encouraging usage of clean-energy vehicles and public transportation. These policies also lay out orientations for each type of electric vehicle.

Provincial/City Policies

Article 33 of Decree 10/2020/ND-CP mandates provinces and central-level cities to create development and management plans for road vehicles.

For example, the pioneering Government of Hanoi has developed a road vehicle plan, with ambitious targets. They aim to electrify 5% of all motorcycles and 5 – 20% of four-wheelers by 2030. They also plan to expand the bus fleet from 2,900 vehicles in 2021 to 6,800 by 2030. Similarly, Nha Trang’s implementation of the national green growth strategy aims to put 200 e-buses into circulation by 2025.

EV Supply-Side Incentives

Vietnam’s government encourages investment in EV and battery production, but provides limited policy support. For example, Vietnam’s Ministry of Finance has rejected proposed tax incentives for imported electric cars due to concerns about negatively impacting local manufacturers. The government has also declined to contribute to infrastructure development or research and development.

Although Vietnam has implemented an “environmental tax” on users of fossil fuel, its impact has been limited. More effectively, the National Assembly’s excise tax reduction for electric cars has successfully reduced production costs and made electric four-wheelers more affordable for customers.

EV Demand-Side Incentives

There are several policies designed to support electric 4-wheeler adoption in Vietnam, although no corresponding measures to popularize electric two-wheelers exist. 4-wheeler EV incentives include:

- Registration fee reduction. The Prime Minister issued a Decree to reduce registration fees for electric vehicles. Within three years, fees for battery-powered EVs will be eliminated, and until then, they will be half as expensive as registration fees for petrol and diesel cars with the same number of seats.

- Special consumption tax. Prior to 2022, imported EVs faced special consumption taxes ranging from 15 – 70%. However, on March 1, 2022, the excise tax rates for EVs were reduced by up to 12%.

- Public transportation incentives. Decision 13/2015/QD-TTg uses incentives like preferential loans, import duty exemptions, and subsidies to promote development of public electric and natural gas buses.

Potential Challenges In Vietnam’s EV Market

Although Vietnam’s EV market seems poised for growth, it has experienced some growing pains.

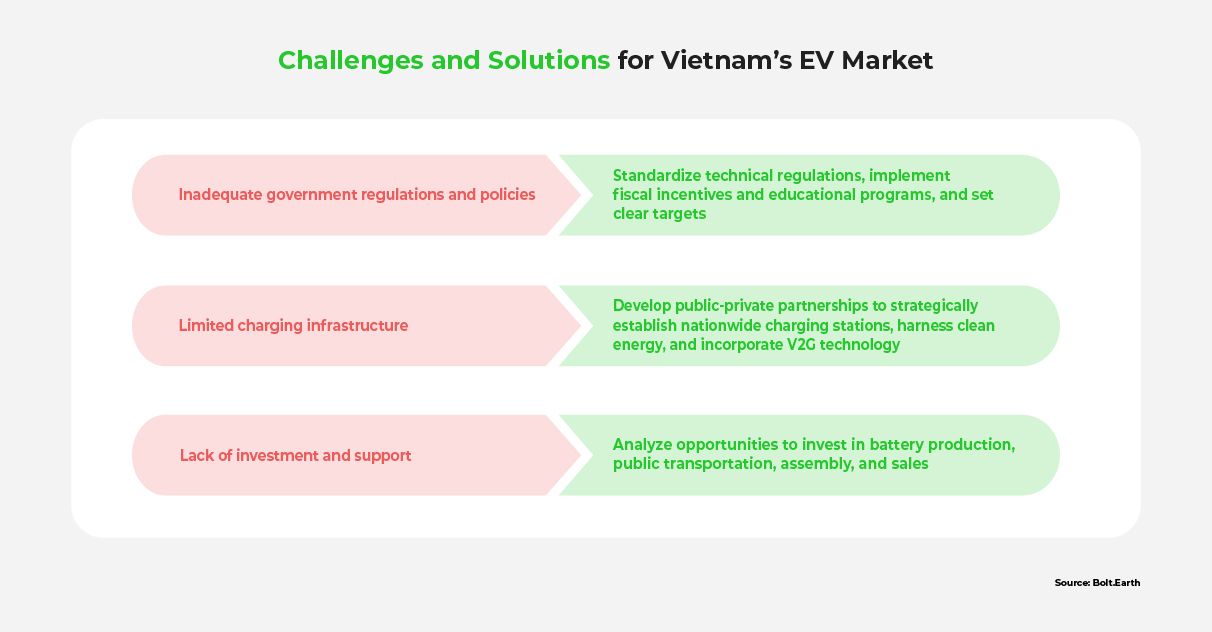

Inadequate Government Regulations and Policies

As mentioned above, Vietnam’s EV-related policies are both insufficient and ineffective. Policy makers are still struggling to develop regulations that will successfully attract more investment.

Furthermore, the government’s attempt to discourage ICE vehicle usage by imposing environmental taxes has not yielded significant improvements, possibly due to their insufficient impact on consumer mindset. Meanwhile, the lack of efficient incentives or price subsidies hinder EV adoption.The absence of specific regulations for battery production and charging infrastructure installation presents further obstacles to EV development.

Limited Charging Infrastructure

Many of Vietnam’s EV adoption challenges are related to battery and charging infrastructure. In particular, the scarcity of rapid-charging stations is a major obstacle. Companies like VinFast are attempting to install quick-charge stations for e-motorbikes, with limited success.

There have also been efforts to promote battery swapping, but this alleged solution brings its own challenges: it is only feasible for two- and three-wheelers, requires establishing expensive infrastructure, and is often restricted by incompatibilities between brand-specific systems.

Lack Of Investment and Support

Although Vietnam’s electric two-wheeler industry has substantial production capacity fueled by market demand, the electric four-wheeler market is lagging behind, largely due to lack of investment. As a result, consumers have an extremely limited selection of electric four-wheeler options. This scarcity perpetuates the problem by further slowing down market demand, which, in turn impedes industry development.

This phenomenon is partially due to Vietnam’s dependence on imported spare parts, which raises vehicle production costs. Gaps in EV-related technical standards compound the problem; in the absence of a complete set of regulations, manufacturers may be wary of investing in EV production.

Opportunities for Future Growth

Enhance Policy Measures

To accelerate the Vietnamese EV industry’s growth, the supply side should establish actionable production and sales targets aligned with Decision No. 876/QĐ-TTg. Standardizing technical regulations for EVs, charging infrastructure, and vehicle disposal will instill investor confidence in the entire value chain. Tightening emission standards for traditional vehicles can bridge the cost gap between ICE and EVs. Additionally, providing fiscal incentives like tax reductions, investment allowances, and VAT waivers for EV manufacturers can attract investments.

On the demand side, fiscal incentives for EV ownership and operation, such as purchase subsidies, tax exemptions, free parking, and lower electricity prices, can boost EV adoption. Non-fiscal incentives like priority lanes, parking spaces, and low-emission zones can offer convenience to EV users. Discouraging ICE vehicle ownership through low- or zero-emission zones, environmental taxes, and registration quotas can further promote EV adoption. Finally, educational programs and awareness campaigns on EVs are vital to building consumer confidence in EV technology.

For battery production and charging infrastructure, setting clear targets and regulations is crucial. Mandating EV charging station installations and E2W battery swapping services in new constructions while providing incentives like land rental waivers can boost infrastructure growth. Developing harmonized technical regulations and standards for charging infrastructure and battery swapping systems will enhance user experience. Moreover, upgrading the power grid to use renewable energy and phase out fossil fuels, while coordinating charging providers, can make EV charging more efficient and save money.

Establish an Extensive EV Charging Network

Many countries have made progress towards resolving the chicken-and-egg dilemma of EV ownership and charging infrastructure. For example, Singapore fosters public-private partnerships, whereas India and Taiwan explore battery swapping as a cost-effective alternative to plug-in charging. Vietnam could learn from these countries to develop its own EV charging network plan.

Other possible strategies include:

- Achieve strategic nationwide placement of public EV charging stations. The existing EV charging network should expand according to customer demands and existing power infrastructure. Stations should be strategically placed along popular routes and near transmission lines with adequate capacity to meet electricity requirements.

- Develop the public-private partnership model by attracting more private sector involvement. The government could participate more actively in the EV infrastructure landscape, and leverage private companies’ financing capabilities.

- Improve the efficiency of clean energy production such as hydroelectricity and solar power.

- Incorporate V2G (vehicle-to-grid) technologies into battery-swapping systems, to improve charging speed by supporting the electrical grid’s capacity.

Increasing EV adoption rates will also boost the demand for charging and attract more private sector investment.

Analyze Investment Opportunities

Automobile production is a pillar industry in Vietnam, comprising 3% of the country’s GDP. Vietnam has many large automotive assembly and production projects, with the aim of not only meeting domestic demand but also tapping into the regional market.

As a result, there are many opportunities for Vietnamese residents, businesses, and governmental entities to invest in EV production. Particularly strong investment opportunities include:

- Battery production. Vietnam’s total nickel and lithium reserves are estimated at 3.6 million tons and 1 million tons, respectively. However, the research and technology needed to effectively utilize these minerals are still limited.

- Public transportation. Like many countries, Vietnam hopes to reduce environmental pollution by heavily investing in public EV fleets.

- Assembly and sales opportunities. Under the recent EU-Vietnam Free Trade Agreement (EVFTA), investors can export Vietnamese-manufactured products to international markets.

The Future Of Vietnam’s EV Market

Thanks to private enterprises, Vietnam is growing rapidly in the EV space within Southeast Asia. Despite a dominant motorbike culture, the country is witnessing a rise in EV adoption, especially with electric two-wheelers capturing a significant market share. Governmental support for clean energy transition and emission reduction goals have led to initiatives promoting EV production, import, and charging infrastructure. Although local players like VinFast, as well as global car manufacturers, are making impressive strides in the EV market, challenges such as limited charging infrastructure and insufficient policies and investment remain. Nevertheless, with strategic government measures and private sector investments, Vietnam’s EV landscape holds immense potential for a greener and more sustainable future.

The next article in this series will examine China’s role within the Asian EV market.

FAQ

What government policies support the development of the EV market in Vietnam?

Vietnam’s government supports the development of the EV market through policies such as reducing registration fees, VAT reductions, excise tax reductions for electric cars, and incentives for public bus development with clean-energy buses.

Which companies are currently operating in the EV market in Vietnam?

Companies operating in the EV market in Vietnam include VinFast, KIA, Hyundai, Audi, Mercedes Benz, Lexus, Toyota, and Porsche, with VinFast being the first Vietnamese company to successfully manufacture electric cars.

What are the most popular EV models in Vietnam?

The most popular EV models in Vietnam include electric two-wheelers produced by VinFast and Pega, and domestic electric four-wheelers produced by VinFast.

How is the infrastructure for EV charging stations developing in Vietnam?

The infrastructure for EV charging stations in Vietnam is still developing, with some private companies like VinFast setting up quick-charging stations for e-motorbikes. However, the scarcity of rapid-charging stations remains a challenge.

What are the environmental benefits of transitioning to an EV landscape in Vietnam?

Transitioning to an EV landscape in Vietnam, especially by using vehicles powered by clean, renewable sources, offers environmental benefits by reducing greenhouse gas emissions and promoting eco-friendly transportation.

What are the potential impacts of the EV market on Vietnam’s energy grid?

The potential impacts of the EV market on Vietnam’s energy grid may include increased demand for electricity, especially during peak charging times, requiring upgrades and investments to accommodate the growing EV fleet.

Resources

MDPI: Vietnam: Analysis Study of Current Transportation Status in Vietnam’s Urban Traffic and the Transition to Electric Two-Wheelers Mobility

Learn more about Vietnam’s urban electrification here.

International Council on Clean Transportation: Promoting the development of electric vehicles in Vietnam

Gain insight into Vietnam’s current EV industry here.

NDC Transport Initiative for Asia: Study of Electric Vehicle Mobility Development in Vietnam

Find Vietnam’s 2021 report on electric mobility here.

World Bank Group: The Economics of Electric Vehicles for Passenger Transportation

Learn about Vietnam’s commercial EV fleets here.

World Resources Institute: Developing an electric mobility roadmap for Vietnam: Global experiences from national case studies

Explore relevant case studies here.

Vietnam Briefing: E-mobility Seminar Sheds Light on Vietnam’s EV Market

Discover the Vietnamese EV market here

Power Technology Research: Electric Vehicle Charging Infrastructure in ASEAN: Need of the Hour and Challenges in Way

Learn about ASEAN’s charging infrastructure here.

Mar 05, 2026 • EV Charging Infrastructure

The Hidden Cost of Poor Electrical Design in EV Charging Networks

Read More