Part 1: Assessment of India's Current Electric Vehicle (EV) Charging Infrastructure

Raghav Bharadwaj

Chief Executive Officer

Published on:

07 Jun, 2022

Updated on:

03 Nov, 2025

Explore the rapidly growing EV charging market in India

Since the beginning of 2020, the electric and connected car market has drawn more than $100 billion in investment globally. Over the past two years, India has also witnessed a rapid increase in the market penetration of Electric Vehicles (EVs) and EV charging points.

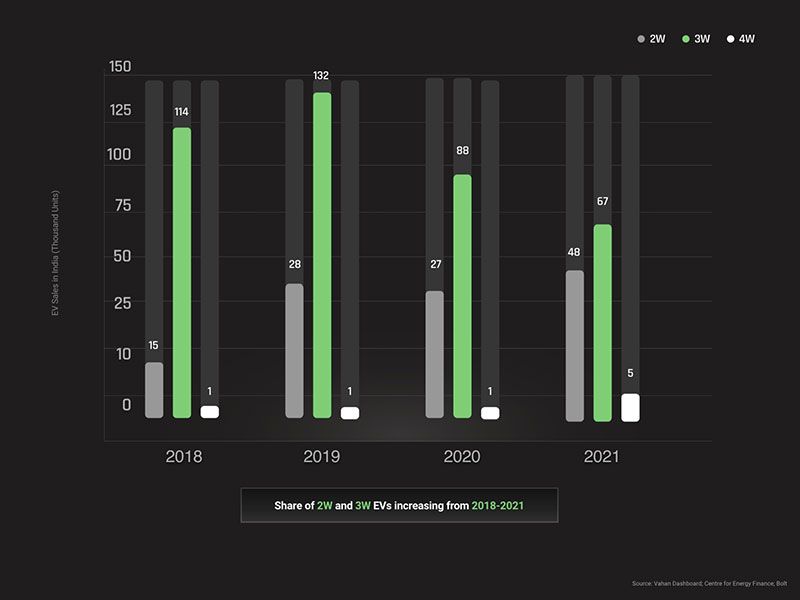

In the past four months alone, electric charging stations in India have increased by more than two-and-half times. The Council on Energy, Environment, and Water (CEEW) claims that the Indian EV industry will be worth $206 billion by 2030 if India meets its Clean Energy Ministerial (CEM) EV30@30 pledge. The CEM is a global forum that is currently trying to get all governments to help facilitate at least 30% of all automotive sales to be EV by 2030. This pledge isn’t legally binding, but provides a useful target for governments to align with. That said, it appears to be more than achievable in India based on current infrastructural growth rates, as seen in the figure below, led by 2 Wheeler and 3 Wheeler EV sales.

EV sales in India are looking good even throughout the pandemic.

The Indian government is currently focusing on developing a long-term strategic plan for electric vehicle adoption in India. In general, it’s planning to set up a vast array of charging points throughout India by investing in infrastructure improvements. If you didn’t know already, BOLT is already the largest EV infrastructure solution provider in India. This means we’re very excited by India’s EV adoption plans. To this end, we at BOLT decided to conduct our own market analysis and report findings here. We hope that this information will help illuminate what key requirements the Indian Government, startups, and the EV community need to consider, to set up a nationwide EV charging infrastructure.

What To Expect in This Article

In this article, we present what the current EV charging infrastructure looks like in India.

In addition, we also present you with the growth potential of India’s EV transition up until 2030. Our analysis here will clarify the opportunities the EV transition presents to the Indian industrial sector and society, and we can also give strategic recommendations to the Indian government and community leaders.

This article is the first in a three-part series where we analyze the market and specifically focus on EV charging infrastructure in India. Let’s initially take a look at BOLT and why we’re a leading authority in the EV infrastructure marketplace.

Why Choose Bolt.Earth?

Bolt.Earth is a venture-backed Electric Vehicle (EV) Ecosystem hardware and software business. We also operate the world’s largest peer-to-peer EV charging network and marketplace. Powered by the expansive Bolt.Earth Charging Network, we’re focused on creating a safe, smart, and connected ecosystem for EV users worldwide. In doing so, we aim to make range anxiety a thing of the past.

Bolt.Earth’s clients and partners include EV OEMs like Hero Electric, TVS, Bosch, Okinawa, BattRE, Zypp, and Sun Mobility. We also work with infrastructure management players, like MyGate, Park+, and more. BOLT has already installed 10,000+ EV charging points worldwide, and we’re on track to deploy 100,000+ more in the next 6 months. We’re also hoping to install 250,000 charging points across India within the next year.

>As an ecosystem player with B2B clients on the EV OEM side and B2C clients on the charging infrastructure side, Bolt.Earth is perfectly positioned to leverage a network of information nodes that represent the state of the market today.

Read on as we give you an overview of India’s EV ecosystem in the following section.

An Overview of India’s EV Ecosystem

In 2021, India’s EV growth was 168% up on its previous year, with 122607 EV units. Leading analysts expect this growth to continue throughout 2022 and also continue at an accelerated pace. In this section, we’ll take a look at infrastructure and future growth predictions.

EV and EV Charging Infrastructure in India: Future Adoption Predictions

Take a look at these:

3 predictions for the growth of the EV market in India:

- The Society of Manufacturers of Electric Vehicles (SMEV) predicts India will hit the 1 million sales mark for EVs by the end of 2022 (based on current sales trends).

- The India Energy Storage Alliance (IESA) expects the EV market to hit 6.34 million annual unit sales by 2027.

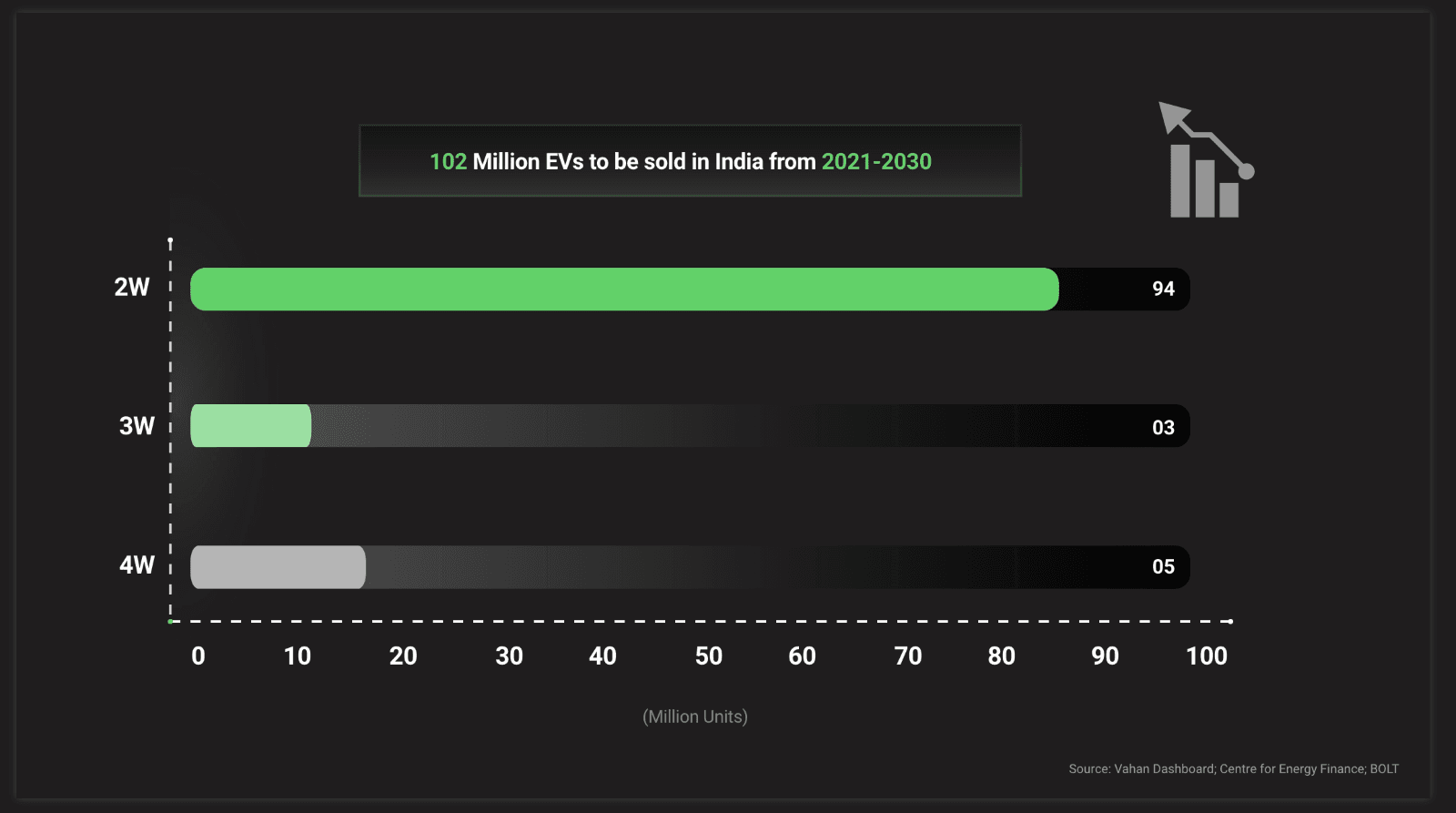

- The Council on Energy, Environment, and Water (CEEW) and Center for Energy Finance report that the cumulative EV sales in India from 2021 to 2030 will be around 102 million units.

Estimated EV sales in India between 2021-2030.

Our Assessment

The above projections all have an underlying theme: India is seeing a strong push toward transitioning to EV-based mobility. That, in effect, will bring a host of radical changes in the way India’s citizens move around.

Many factors are driving this growth in EV sales, indicating the Indian EV market is nearing an inflection point. EVs are expected to penetrate the different vehicle categories with varying adoption rates. Overall, the 2W EV and 3W EV markets will see rapid electrification in the near future. Rapid growth in 4W EV markets will likely begin between 2026 and 2027.

Key Findings

Given the new EV influx in the Indian automobile market, we’ll need an adequate EV charging infrastructure network. It isn’t hard to see how these two events are closely linked. Currently, the infrastructure may be the biggest barrier to EV transition in India.

India’s EV Charging Infrastructure Market

The EV charging infrastructure network in India is evolving. Several private, startups, and government entities are currently engaged in developing deployment strategies. Take a look at these examples.

- In January 2020, the DHI approved setting up 2,636 EV charging stations across 62 cities in 24 states and union territories (UTs) of India. These include 1,633 fast-charging stations and 1,003 slow-charging stations. The Ministry of Heavy Industries (MHI) also sanctioned 241 additional charging stations in September 2020.

- By 2030, the Bureau of Energy Efficiency (BEE) predicts that 2.26 Million charging points will be required in Delhi, 0.62 Million charging points in Lucknow, and 0.26 Million charging points in Nagpur.

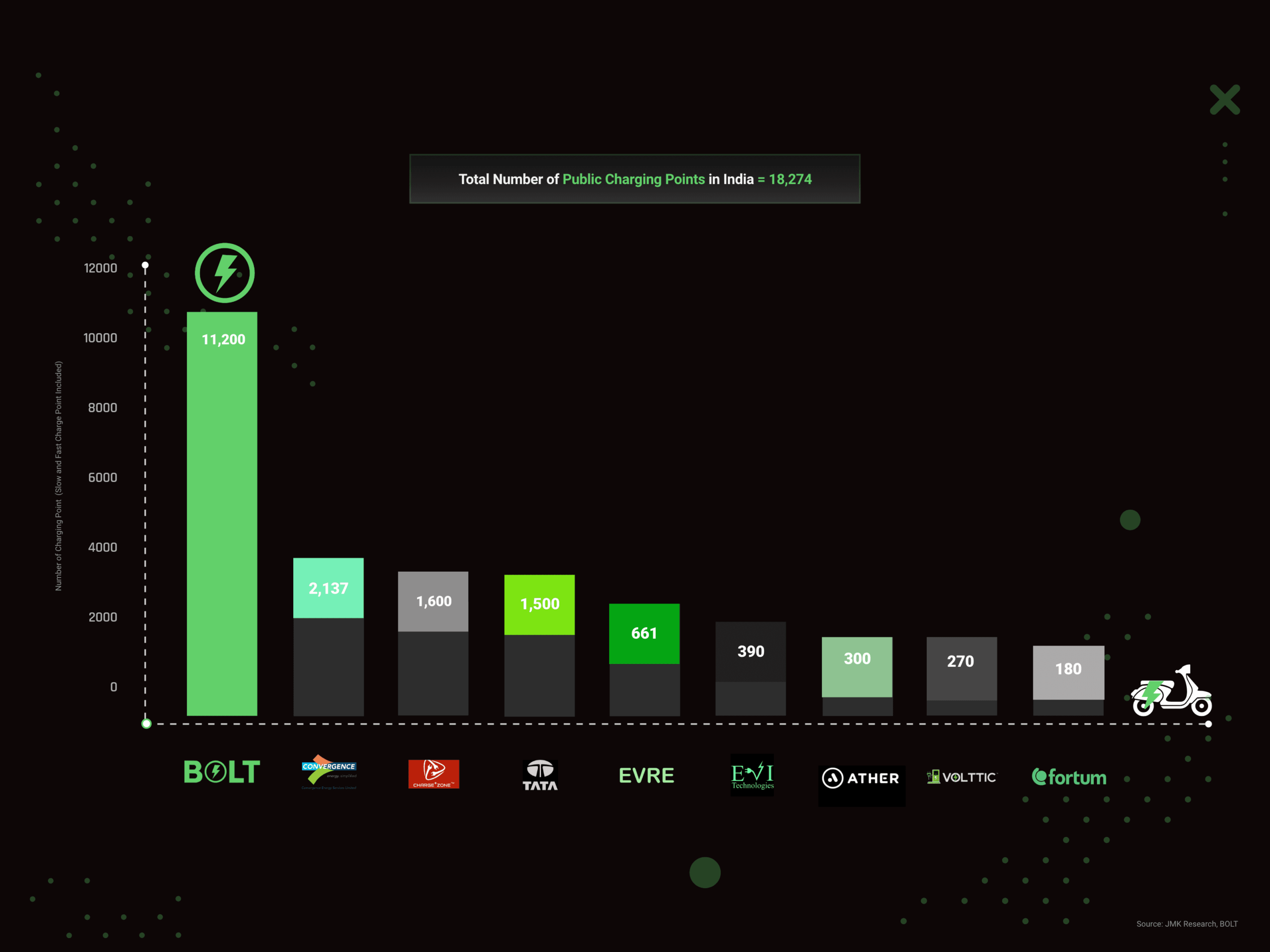

The key market players are a good mix of government-backed entities and private companies. They’re also looking to grow their installed base capacities to make several Indian cities ‘EV-Ready’ in terms of charging infrastructure deployments next year.

Total number of current public charging points in India by vendor.

Our Assessment

Private home EV charging is also expected to dominate the market by 2030 in both numbers and capacity, given the sheer volume of 2-wheeled and 3-wheeled vehicles in India. The Private EV charging at-work segment will also need chargers. Until 2030, slow chargers will dominate the public charging infrastructure, but public fast chargers will also see a significant uptick.

We’re already moving towards a trend of total disruption in India, which will see Charge Point Operators (CPOs) adapt to the evolving market changes. CPOs’ hesitancy to invest in new ideas and technologies or engage in major collaborations or acquisitions will also fail to capture key market positions.

Key Finding

The EV sector in India will expect access to an efficient charging infrastructure. CPOs need to prepare for a disruptive change in mobility. The Indian EV market is still in the development stage, but the market is heading toward making charging a commodity, just like oil or gas. In other words, the phrase: ‘electricity is the new fuel’ is gaining more merit.

Additional Opportunities in Charging

- Network Visibility in Charging: IoT-enabled platforms can make EV charging electricity lines smart by offering information on the infrastructure, location, availability, and real-time status.

- Ease of use of charging infrastructure: Payment methods and charging initialization is crucial in allowing EV users to transition.

- Data and Analytics: Geospatial data, network visibility, traffic density, and charging demand are also necessary to support a strategic deployment of a charging infrastructure across a city.

- Smart Charging Points: Smart, connected, IoT-enabled charging points that allow for monitoring of EV charging will develop as the surviving business model grows. The idea of creating separate electricity lines for EVs in India at all locations might not be feasible, given the costs and complexity involved.

- Alternative charging technologies: Alternative charging methods, like inductive charging, might find a market in India to solve space availability and cabling issues.

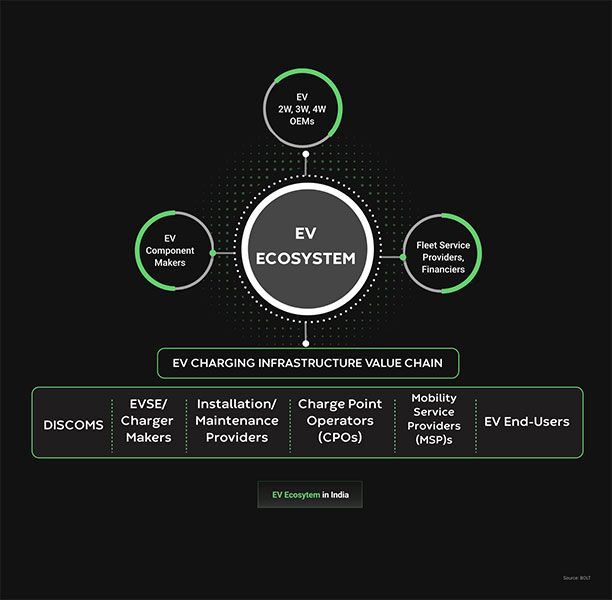

The Value Chain of the Indian EV Ecosystem

In terms of a public EV charging infrastructure, the value chain has had a few specific roles. Let’s take a look at 6 of these:

EV ecosystems provide an integrated approach to EV charging.

- Energy Suppliers and Distribution Companies (DISCOMs): Responsible for the supply of electricity at regulated tariffs for consumption by electric vehicles. DISCOMs need to understand where and when they’re facing peak demands to operate efficiently.

- EVSE and EV Charging Point Manufacturer: The charging equipment manufacturers who design, develop, and sell their own charging points or EVSE.

- Installation and Maintenance Providers: Responsible for the installation of chargers at locations desired by charging point real estate providers and ensuring device maintenance over time.

- Charge Point Operators (CPOs): Responsible for setting up, managing, and operating an EV charging station network for semi-public or public use. CPOs may directly own the charging points or operate the chargers on behalf of the charging point owners.

- Mobility Service Providers (MSPs): Responsible for helping EV users locate and provide the user interfaces to conduct transactions at EV charging points. They also enable “roaming” for EV users subscribed to one CPO, and to use another CPO’s charging networks. CPOs may also sometimes act as MSPs.

- EV End Users and Charging Point Real Estate Providers: Include both EV and EV charging station buyers.

The Path Forward: Future EV Charging Trends in 2022

The future evolution of the previously mentioned points will mean that value chain integration will force some segment absorption. Ultimately, only a few players across the chain will survive in the market. Who will it be? The ones that undergo continuous upgrades in their business models. On the end-user side, charging point real-estate providers will have to cope with increased peak loads. For example, we can think of providers like shopping centers, food courts, parking spaces, and apartment complexes. In this section, we define key EV charging trends that will influence the way India adopts EV technology.

CPO and MSP Roles

In BOLT’s opinion, the CPOs and MSPs form the more crucial part of this value chain. We also think they’re perfectly placed to expand across the entire value chain. What’s more, these entities are currently the most active players in the market, with a huge first-mover advantage. When CPOs reach a certain critical size and scale, MSPs will have a high incentive to collaborate with them.

Conversely, CPOs will feel as if they’re battling to expand their charging networks. Smaller players will most likely become aggregated, even at this growing stage. That way, CPOs secure the more strategically attractive charging locations for their slow/fast-charging services.

A small number of MSPs in India currently take up a significant chunk of the market share. Still, this trend will likely change rapidly as more players emerge over the next two years.

EV Market: Future Trajectory and Advantages

We expect the market to follow global trends and move towards ‘plug and charge’ standards. We also see these in the U.S., Europe, and Asia, where the standard automatically identifies what type of EV you’re plugging in and bills you accordingly. In market dynamics, this gives CPOs and MSPs closely tied to EV OEMs an added advantage. That’s because they’ll be able to choose to create a closed ecosystem of EV charging customers.

>For CPOs, the EV Ecosystem is all about scaling up – it’s a winner-takes-all market dynamic. For MSPs, the key to success will depend on how well they expand their network and diversify their operations in collaboration with the largest CPOs.

Final Thoughts

As the world adopts EVs more and more, it’s important to develop a proper EV charging infrastructure. That’s also the case in India, where EV adoption is increasing. To us, it’s important to analyze the current infrastructure state. Otherwise, we can’t know where it’s headed in the future. Here at BOLT, we encourage the Indian government to take action. We also encourage it to benefit from the many potential advantages of improving the infrastructure. Indian citizens and the environment alike will benefit from a robust EV charging infrastructure.

FAQs

How big is the Indian EV charging market in 2022?

The Council on Energy, Environment, and Water (CEEW) and Center for Energy Finance (CEF) estimate around 1 million EVs will be sold in India before the end of 2022. In addition, sales are expected to increase and total around 102 million units sold before the end of 2030.

Who are the top 5 market shareholders for EV charging networks in India?

Based on recent data, around 18,274 public EV charging points have been deployed in India as of June 2022. These are currently in cities like Delhi, Mumbai, Hyderabad, and Pune. The top 5 EV charging providers operating these (by market cap) are Bolt.Earth, Energy Efficiency Services Limited (EESL), Rajasthan Electronics and Instruments Limited (REIL), Tata Power, and EVI Technologies.

Who are the critical stakeholders in the EV charging value chain who will determine the future of EV charging in India?

Charge Point Operators who operate vast charging point networks can help determine the future of EV charging in India. Additionally, Mobility Service Providers, who provide aggregated charging services, will also be responsible for the nationwide rollout of EV charging infrastructure in India.

What’s the difference between slow and fast charging stations?

The main difference is the availability and usage of these stations. For starters, slow charging is usually meant for private settings. Conversely, fast charging stations might be best suited for public charging found on national highways. Secondly, fast chargers are more ideal for EVs with higher battery capacity. Finally, fast stations are more efficient per time spent charging.

Can I set up an EV charging station in India?

The Indian government has announced that anyone can establish EV charging stations throughout the country. That said, the station needs to comply with the Indian government’s specifications. This relative freedom presents an excellent opportunity for the EV value chain in India to establish and operate efficient EV charging stations. Contact Bolt.Earth for more information about EV charging stations.

Feb 23, 2026 • EV Technology and Trends

Emergency Stop Systems in EV Chargers: Principles of a Good Design and Their Role in Safe Charging

Read More

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More