Exploring South Korea’s EV Success

Raghav Bharadwaj

Chief Executive Officer

Published on:

11 Dec, 2023

Updated on:

22 Jan, 2026

In Asia’s booming electric vehicle (EV) market, South Korea is demonstrating a much greater commitment to a cleaner environment than many other nearby countries.

South Korea initially invested in hydrogen-powered EVs, much like Japan. However, it made a swift transition to pure EVs, thanks to determined policy support, advanced technology and innovation, a robust supply chain, and an export-oriented industry strategy. Since then, South Korea has emerged as a booming economy in the EV industry.

This article will explore the factors behind South Korea’s leadership in the Asian electric vehicle market. In particular, it will address the following questions:

- Who are the major players in the South Korean EV industry, and how do they shape the market?

- How are the South Korean government and private sector promoting EV usage?

- What are the current challenges associated with EV adoption in South Korea, and how can they be overcome?

South Korea’s EV Market

In South Korea, eco-friendly vehicles are usually called green cars or new energy vehicles (NEV). There are several types available, including battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). FCEVs use a hydrogen-based fuel cell to power the motor, and are therefore sometimes categorized as HEVs.

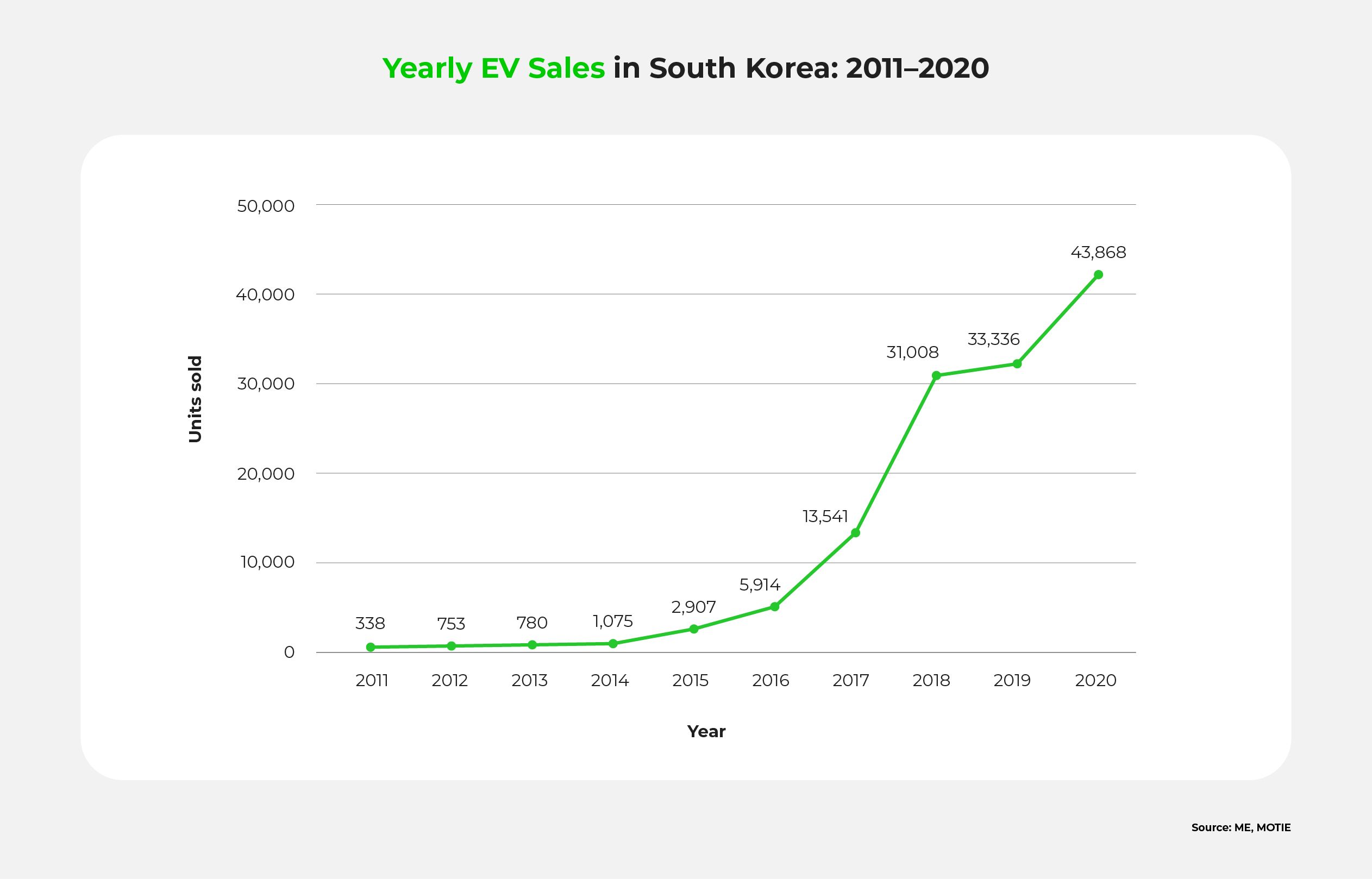

South Korea boasts a rich automotive history, particularly in the 1990s, when it became the world’s fifth largest automobile producer. When its market share declined in 2018, the government promptly responded by offering subsidies and incentives to boost the EV industry, and by investing in charging infrastructure. Leading OEMs like Kia and Hyundai began launching new EV models in 2004, and have been producing EV components domestically since 2009.

This proactive approach resulted in significant growth in EV adoption. In 2022, the Ministry of Land, Infrastructure, and Transport (MOLIT) reported a remarkable surge in green vehicle registrations: electric vehicle registrations increased by 72.7% YoY, hydrogen vehicles by 54.3%, and hybrids by 29.6%. Total EV sales exceeded diesel vehicle sales for the first time, reaching 448,934 units. Among EV power sources, hybrids led with 274,282 units sold, followed by 164,324 BEVs, marking a 63.7% sales growth from 2021.

Nevertheless, there is still work to be done. In particular, stakeholders must find a way to meet the government’s extremely ambitious goals for the next few years.

Meanwhile, South Korea’s adoption of electric 2-wheelers has slowed, due to limited range, inconvenient charging requirements, and extended charging times. These factors, coupled with reduced subsidies averaging ₩1.8 million (USD 1,365), down 13% from the previous year, have substantially dampened consumer demand.

EV Charging Infrastructure Growth

As a key initiative, in August 2016, the MOLIT, along with the Korea Electric Power Corporation (KEPCO) revealed plans to construct ₩200 billion of charging infrastructure. By November 2020, they had installed a total of 62,789 public chargers, including 9,661 rapid and 53,128 slow chargers. In 2021, they added 3k fast-charging stations, distributed as follows:

- 2,280 charging stations at locations such as private supermarkets

- 290 charging stations in parking garages

- 300 fast-charging stations at pit stops

- 123 high-powered charging stations by the automotive industry

As of 2021, South Korea had the world’s best ratio of EVs to charging points: 2.6 vehicles per charging point.

Major Players in South Korea’s EV Market

South Korea’s thriving EV landscape is partly attributed to the efforts of leading automakers. They have rapidly adopted EVs, and have leveraged the country’s strong automotive industry and existing supply chains to compete globally.

South Korea utilizes economies of scale to achieve competitive EV production. Its well-established network of suppliers and manufacturers, in addition to a substantial pool of engineers and technicians well-versed in cutting-edge production methods, supports efficient, cost-effective manufacturing of high-quality EVs.

Global OEMs in South Korea

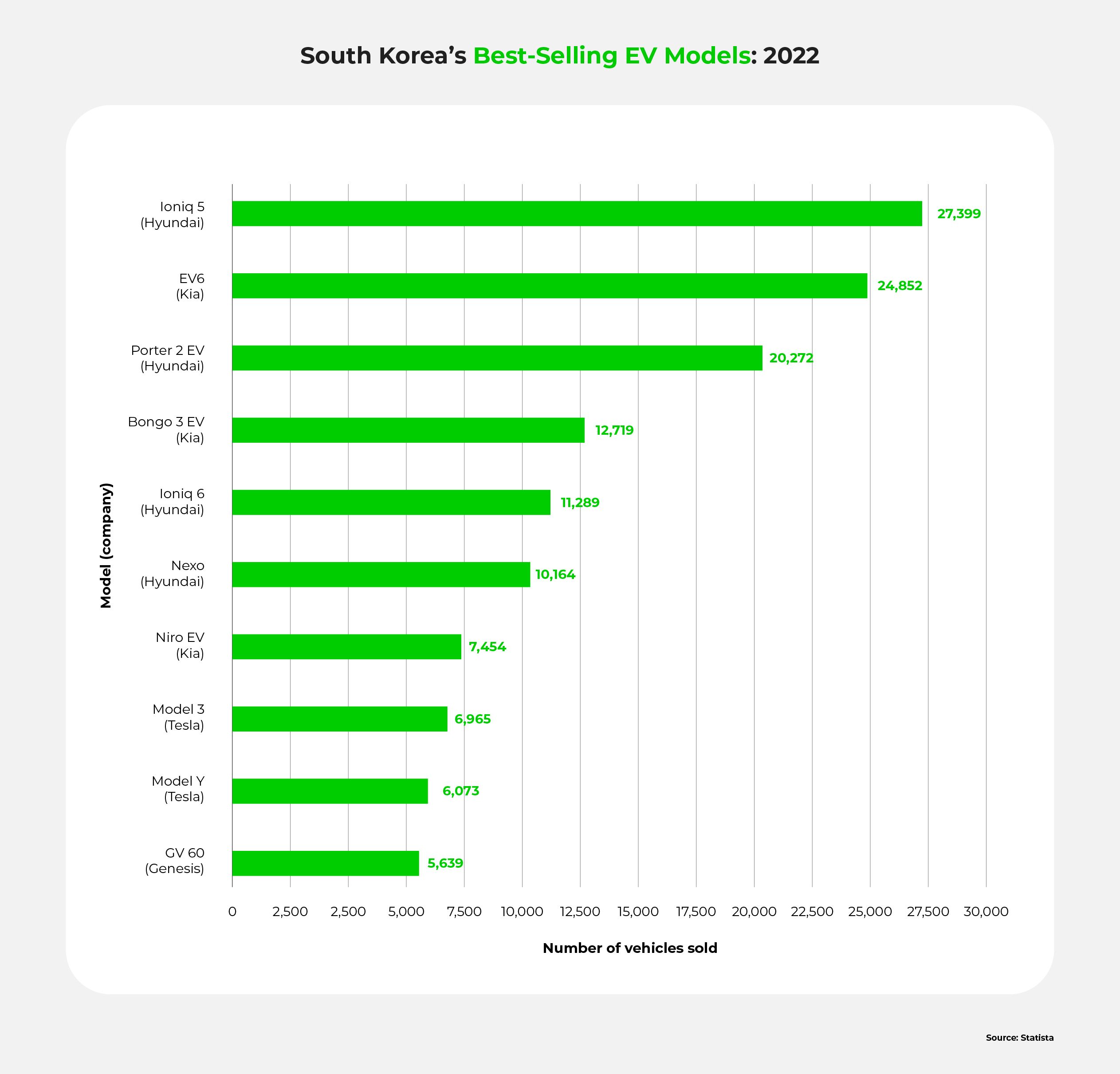

In 2022, the top three players in South Korea’s domestic passenger EV market were Hyundai Motor Group, Tesla, and Kia, which is a subsidiary of Hyundai. In the context of the global market, Hyundai was the fifth largest EV seller in 2022.

Hyundai did not enter the EV market until 2015, but has achieved immense success, with a 75% domestic market share. The company initially emphasized hydrogen vehicles, and only shifted its focus to BEVs in 2018, in response to Tesla’s success.

Hyundai’s vertically integrated supply chain network, modular EV platform, and export-oriented focus have all proven instrumental to the company’s success. The vertical integration spans various subsidiaries, streamlining EV production from batteries to software, and enabling strategic partnerships involving the whole EV supply chain. By adopting a dedicated EV platform early on, Hyundai set itself up for successful rapid model development; it plans to launch 31 EV models by 2030.

In addition to supplying EVs to South Korean consumers, Hyundai has a strong focus on exporting to foreign markets. In fact, South Korea’s EV exports rose by 112.2% between 2019 and 2022, led by Hyundai and Kia.

South Korea’s EV Component Manufacturers

EVs contain many parts, including a speed reducer, a thermal management system, batteries, motors, inverters, and tires. As mentioned above, due to South Korea’s strong value chain, the country has many prominent suppliers of these components.

Three major battery cell companies, LG Energy Solution, Samsung SDI and SK On, recently announced their plan to work with the government to jointly invest ₩20 trillion (USD 15.1bn) through 2030 to develop advanced battery technologies, including solid-state batteries.

Hyundai Mobis, LG Electronics, and S&T Motiv produce motors, and are all core suppliers of Hyundai Motor Co., Ltd.

Hanon Systems is the main contributor to the heating system segment, while Hwaseung R&A produces important components like air conditioner hoses and coolant hoses.

Major EV Fleets

South Korea’s government recognizes the importance of commercial vehicles and fleets in terms of EV industry development. In 2020, the country introduced 94,430 EVs and hydrogen cars, including 11k two-wheeled EVs, 7,500 electric delivery trucks and 650 electric buses.

Electric Taxis

Between January and November of 2022, the number of newly registered electric taxis surged to 15,038 units — roughly triple the previous year’s figure. These taxis have rapidly gained ground against their ICE counterparts, primarily thanks to their higher fuel efficiency and lower maintenance costs. Green taxis’ market share is expected to grow to 40% in the future.

Car-Sharing Services

South Korea’s car-sharing pioneer, SoCar, plans to transition its entire fleet to electric vehicles by 2030. In collaboration with leading charging service provider Everon, SoCar will expand the charging station network and enhance EV charging and car-sharing services. This partnership aims to leverage the two companies’ expertise and data on EV charging, including charging times and battery capacity.

Car Rental Companies

Local rental companies are rapidly adopting EVs; in fact, projections indicate that rental companies could account for 8% of green vehicle sales by 2025. This trend is particularly pronounced in large cities, where long-term lease packages for EVs are gaining popularity, driving the adoption of new energy vehicles.

Postal Services

Postal and logistics companies globally are piloting EV programs to explore their environmental benefits. Public procurement of EVs, exemplified by Korea Post’s plan to introduce 10k EVs by 2020, demonstrates these programs’ effectiveness, and, in turn, encourages wider adoption. Replacing conventional vehicles with EVs offers operational and non-market advantages, such as replacing gasoline-fueled delivery motorcycles with compact EVs in Korea Post’s fleet.

Government Incentives & National EV Targets

South Korea’s electric vehicle policy is overseen by three ministries: the Ministry of Trade, Industry and Energy (MOTIE) for vehicle and auto parts technology development; the Ministry of Environment (ME) for EV promotion and infrastructure; and the MOLIT for safety certifications.

The South Korean government strongly supports the EV industry, with incentives like tax breaks, financial aid and R&D spending. These measures encourage investment and drive sector growth to achieve the government’s ambitious goals for EV adoption.

EV Master Plan

South Korea’s government has been continuously updating its EV policies since 2011. Currently, there are two main sources of guidance for EV goals: the 4th Master Plan for Eco-Friendly Cars, and the Korean New Deal.

MOTIE and ME unveiled the 4th Master Plan in February of 2021. It aims to support 2.83mn eco-friendly cars by 2025, and 7.85mn by 2030.

The Korean New Deal sets another ambitious goal: 1.3mn electric and 200k fuel cell vehicles by 2025. It also involves increasing renewable energy usage and expanding the smart grid.

South Korea also has some additional EV-related goals:

- Charging infrastructure goal: have 50% more chargers than EVs, including ultra-rapid chargers that take only 20 minutes to provide enough charge for a 300 km range.

- Export plan: achieve a 12% share of the worldwide NEV market by 2030, in the interests of becoming a global automotive industry leader.

- Commercial EV target: launch 20k hydrogen-powered buses and 10k hydrogen-powered trucks by 2030.

To support all of these ambitious goals, the government has revised the incentive scheme every two years.

EV Supply-Side Incentives

Research and Development Support

South Korea offers substantial R&D tax incentives, and is even allocating 70% of its yearly R&D budget to fund 40 projects in 11 key industrial areas, such as secondary batteries and future mobility. This includes investments of around $4.7bn from 2023 to 2027, with a long-term target of $10.2bn by 2030.

Tax Incentives for Manufacturers

The government offers tax credits for companies in key tech sectors, including EV-related ones. Large firms currently receive tax credits of up to 15% tax credit, while small- and medium-sized enterprises receive up to 25%. An additional 10% credit is available for 2023, based on increased average investments over the past three years.

Sales Quota

The South Korean government has implemented a sales quota whereby EVs must comprise at least 15% of each car manufacturer’s sales. The aim is to eventually make 20% of all South Korean-produced cars EVs, and then transition to all-EV production in the public sector.

Export Support

The government is using tax incentives to encourage car manufacturers to invest up to ₩95 trillion (USD 66.03bn) in EVs by 2026, in the interest of stimulating the production of EVs for export. The government is further supporting this goal by providing ₩7 trillion won (USD 5.3bn) in loans and guarantees to battery and material firms in North America.

Investment Incentives

The Foreign Investment Promotion Act aims to attract foreign investment primarily through tax support, cash grants, and industrial site support.

Collaborations and Partnerships

In response to various challenges, South Korea has adopted a trans-regional R&D strategy. This approach aims to reduce regional inequalities within the country and foster collaborative innovation in areas such as EV technology.

EV Demand-Side Incentives

Subsidies and Grants

In 2023, South Korea will revise its EV subsidy policy to favor domestic producers based on performance, infrastructure, battery density, and price. This will particularly benefit Hyundai and Kia. Subsidies range from ₩2.5mn to ₩6.8mn (USD 1,867 – 5,078), excluding vehicles over ₩85mn (USD 63,481). Makers who have installed at least 100 chargers over the last three years get extra incentives, as do makers who have implemented vehicle-to-load (V2L) technology.

Tax Benefits

In 2019, South Korea’s government announced plans to extend tax breaks for purchases of electric vehicles. These tax breaks were originally set to expire, but were extended to incentivize more people to buy EVs.

Discounted Parking and Tolls

EV users in South Korea enjoy incentives including a 50% discount on public parking facility fees and highway tolls. Notably, hybrid vehicles no longer qualify for these discounts; only compact cars and fully electric vehicles are eligible.

Residential Charging Support

In keeping with the revised Environment-Friendly Automobile Act, new apartment complexes must install EV chargers in 5% of their parking spaces, while existing apartment complexes need chargers in 2% of theirs.

Key Challenges in South Korea’s EV Market

To generate ongoing momentum and keep making sustainable progress, South Korea will need a combination of proactive investments and supporting regulations. South Korea is certainly on the right track, but must still overcome a few challenges.

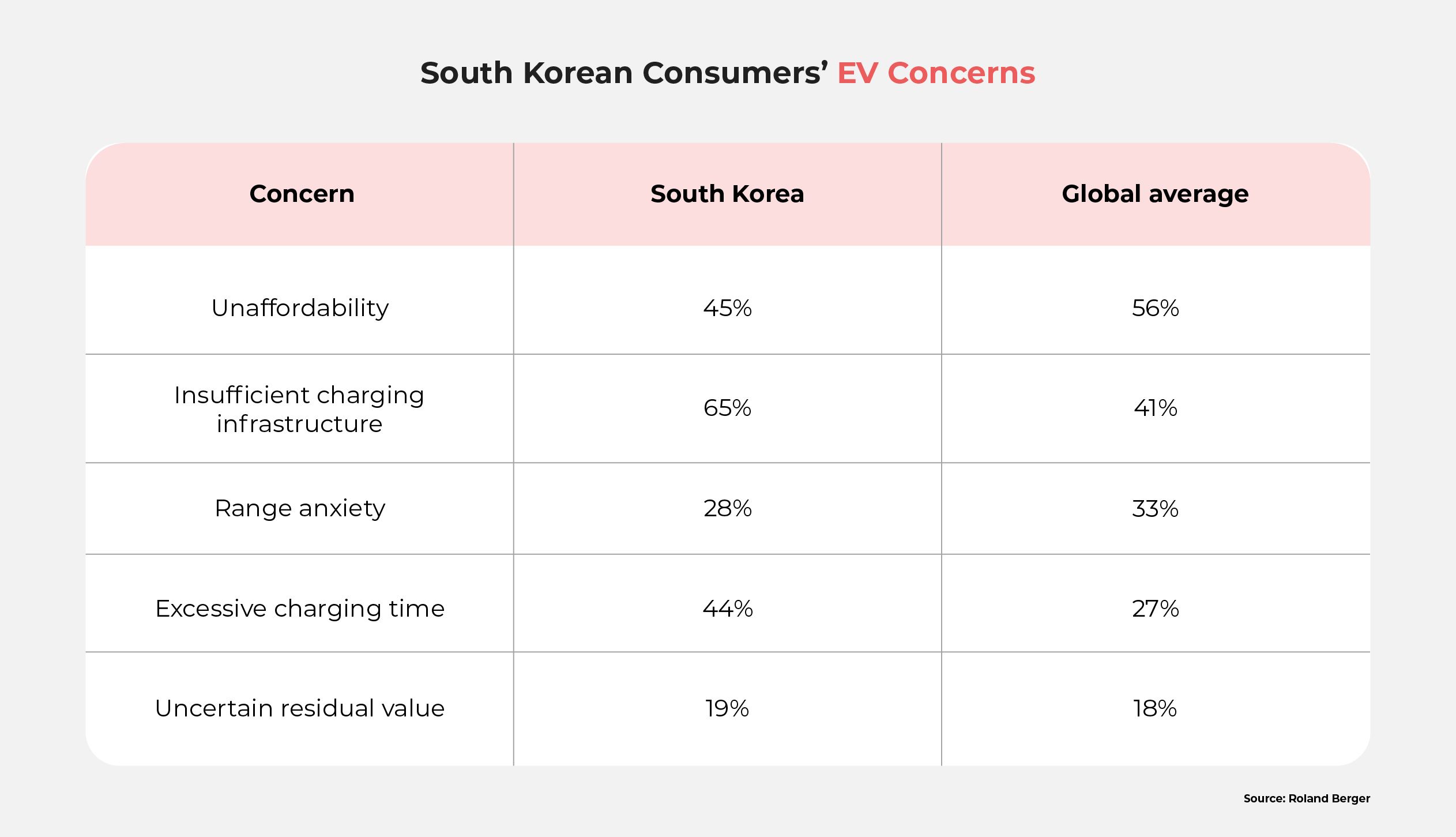

Government Subsidy Dependence

South Korea successfully achieved early EV adoption by heavily relying on government support. The downside of this strategy is that the market has been shaped by government policies rather than by consumer demand. In fact, according to a recent survey, price concerns persist despite biennial incentive revisions, significantly impacting purchase decisions. As South Korea’s EV industry advances, balancing government support with consumer demand will become increasingly important.

Charging Infrastructure Issues

The survey also indicated that charging infrastructure poses a significant challenge for prospective EV users in South Korea, particularly because multi-family housing with limited parking facilities is so common there. Unfortunately, economic issues discourage the establishment of new charging infrastructure. The government has capped charging fees, but does not directly subsidize the high initial costs of building a charging station, meaning that both public and private charging facilities have struggled to stay afloat. The government offers subsidies aimed at encouraging private investment in charger infrastructure, but this has led to market distortions, with companies prioritizing subsidies over charger optimization and demand considerations.

Talent Shortages and Organizational Inefficiencies

The IMD World Competitiveness Ranking evaluates a nation’s capacity to foster a business-friendly environment. Between 2020 and 2023, South Korea’s ranking dropped from 20th to 28th out of 64. This decline has raised concerns about South Korean companies’ ability to sustain growth and contribute to their citizens’ well-being. Despite strong technological foundations, the country ranks low in workforce productivity growth and management practices.

The service sector, including many small- and medium-sized enterprises, under-utilizes technology, and inadvertently hinders productivity by imposing excessive working hours and rigid hierarchical structures. Promotions are based on seniority rather than skill, compounding the problem. Senior leaders lack international exposure and skills, depriving them of hands-on knowledge about how to manage modern organizations. As a result of all these issues, even though South Korea’s government is encouraging EV-related research and development, the relevant companies may not be able to live up to their full potential.

Opportunities for Future Growth

South Korea has stepped into a prominent role in the global EV industry, even though its domestic market lags behind considerably. Looking ahead, the country has plenty of growth opportunities, both global and domestic.

Collaborative R&D Initiatives

South Korea actively engages in collaborative EV research and development with strong support from the EV value chain. Stakeholders including automakers, battery manufacturers, and technology companies have already formed R&D partnerships.

To promote international researchers’ participation, the government is increasing the international R&D budget by 29.3%, focusing on outstanding joint projects led by overseas institutions. This shift responds to global tech challenges and intensifying competition. Ssangyong Motor’s partnership with BYD and Renault Korea’s planned collaboration with Geely reflect a growing trend of international cooperation within the EV industry. Such partnerships leverage strengths and resources from different countries to advance EV development and adoption. The collaboration also benefits the labor market, which will in turn boost the industry. Kia’s groundbreaking EV plant in South Korea offers employment opportunities, with a 31% increase in staff. This strategic move aims to secure a skilled workforce, providing stability amid the global trend of job reductions in the electric vehicle industry.

Charging Infrastructure Investment

The South Korean government has already stressed the need to significantly expand the number of charging stations. For example, upcoming laws require new buildings to be equipped with EV chargers.

Seoul, South Korea’s capital city, will replace 400k ICE vehicles with EVs by 2026. They plan to install 220k chargers to ensure that residents can access them within a five-minute walk from anywhere in the city. To meet this goal, the city has come up with innovative solutions such as street lamp chargers: 50kW fast chargers resembling street lamps, which can fully charge an electric vehicle in just one hour.

Meanwhile, back in 2013, the city of Gumi introduced two electric buses which utilize dynamic wireless charging technology. The buses receive electricity at 20 kHz and 100 kW, with an 85% maximum efficiency rate, by drawing power from cables under the road’s surface. The innovative charging method offers a solution to long charging times and bulky batteries. If other cities go on to implement this wireless charging technology, South Korea could significantly boost its EV adoption rates.

Export-Oriented Manufacturing

South Korea relies heavily on exports to grow its EV industry, and is therefore sensitive to global conditions. As a result, various geopolitical developments could benefit South Korean companies, especially in the US market. For example, the US Inflation Reduction Act signals commitment to boost EV adoption and production, giving Korean firms a competitive edge in the US and North American markets.

Moreover, South Korea actively participates in international negotiations and agreements related to minerals and EVs. These include free trade agreements, negotiations with Indonesia, and discussions about leveraging Argentina’s lithium resources to produce lithium-ion batteries.

To support its export strategy, South Korea plans to implement smart manufacturing practices, improve productivity, and reduce costs. This initiative will provide training for 40k workers, benefiting employment rates.

South Korea’s Electric Future

South Korea has emerged as a leader in the EV industry, propelled by strong policy support, advanced technology, and an export-oriented strategy. Major players like Hyundai, Kia, and Tesla have contributed to exponential growth in EV adoption, with green vehicle registrations surging significantly. The government’s ambitious goals include supporting millions of eco-friendly vehicles by 2030, and expanding charging infrastructure. Substantial incentives for manufacturers and demand-side subsidies for domestic EV producers further propel the nation’s EV industry. However, challenges such as government subsidy dependence and charging infrastructure economics must be addressed. Nevertheless, South Korea’s commitment to collaborative R&D initiatives and international partnerships, along with its export-oriented manufacturing approach, promises a bright future for the nation’s EV industry and economic development.

FAQ

Why is the South Korean EV market gaining attention?

The South Korean EV market is gaining attention due to its rapid growth and its commitment to green transformation. Factors such as determined policy support, advanced technology, a robust supply chain, and an export-oriented industry strategy have propelled South Korea to a leadership position in the Asian electric vehicle market.

How are government policies influencing EV growth in South Korea?

Government policies in South Korea are playing a pivotal role in driving EV growth. These policies include tax breaks, financial aid, R&D spending, and subsidies for both manufacturers and consumers. They encourage investment, production, and adoption of electric vehicles, in line with the government’s ambitious goals.

What opportunities exist for investors in the South Korean EV market?

Investors in the South Korean EV market can capitalize on opportunities in various sectors, including EV manufacturing, battery technology, and charging infrastructure development. The government’s strong support and incentives for EV-related projects make South Korea attractive to investors with an interest in sustainable transportation.

Who are the major players in South Korea’s electric vehicle sector?

Major players in South Korea’s electric vehicle sector include Hyundai, Kia, and Tesla, with Hyundai leading the domestic market. These companies have rapidly adopted EV technology and are leveraging their strong automotive industry and supply chains to compete globally.

What key factors are driving South Korea’s shift towards sustainable transportation?

South Korea’s shift towards sustainable transportation is driven by factors such as government policies promoting eco-friendly vehicles, investments in charging infrastructure, and the rapid growth of EV adoption. Consumers are increasingly considering electric vehicles, due to governmental incentives and rising environmental awareness.

What are the projections for EV market growth in the coming years?

Projections for South Korea’s EV market growth are positive, with the government targeting support for millions of eco-friendly cars by 2030. The country aims to substantially boost EV production and exports, with ambitious goals for increasing market share and expanding charging infrastructure.

Resources

Journal of Technology Management & Innovation: Industrial Policy and the Development of the Electric Vehicles Industry: The Case of Korea

Read about the current state of South Korea’s EV industry here.

IOP Conference Series: Study on Electrical Vehicle Policy in South Korea as a Lesson Learning for Indonesia

Learn about South Korea’s EV policies here.

Storm4: Why South Korea Is Dominating The EV Sector In Asia

Discover South Korea’s prominent role in the Asian EV market here.

Invest Korea: The Rapidly Developing Electric Vehicle Industry in Korea

Understand South Korea’s EV export landscape here.

EVVAP: Electric Vehicle in South Korea

Explore South Korea’s history of EV development here.

Feb 19, 2026 • EV Charging Infrastructure

EV Charging for Quick Commerce Fleets in India: Scaling Sustainable Delivery

Read More

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More