The Rise of Electric Vehicles in South Africa

Raghav Bharadwaj

Chief Executive Officer

Published on:

22 Nov, 2023

Updated on:

24 Nov, 2025

Road transport remains a key source of greenhouse gas (GHG) emissions in South Africa. Nevertheless, South Africa has committed to the Paris Agreement, and is determined to transition to new-energy vehicles. This commitment is poised to accelerate electric vehicle (EV) adoption in the near future, despite some significant challenges. Thanks to its large mineral reserves, South Africa has even more opportunities on the horizon.

This article explores South Africa’s nascent EV landscape. In particular, it addresses the following questions:

- What is the current state of South Africa’s EV market?

- How is the South African government supporting the EV industry?

- What potential challenges and opportunities does South Africa’s EV market face?

South Africa’s Nascent EV Market

South Africa’s overall auto sector is growing. In 2021, the automotive industry contributed 4.3% to GDP, with vehicle and component exports making up 12.5% of total exports. In 2023, new vehicle sales rose by 5% YoY to 265,970 units by June 2023, exports increased by 4% to 172,836 units YoY, and production grew by 10% to 284,035 units.

South Africa’s robust auto assembly industry is heavily reliant on exports to the European Union (EU), particularly Germany.). As a result, the EU’s 2035 ban on new petrol and diesel vehicles strongly incentivizes South African manufacturers to transition to new energy vehicles (NEVs).

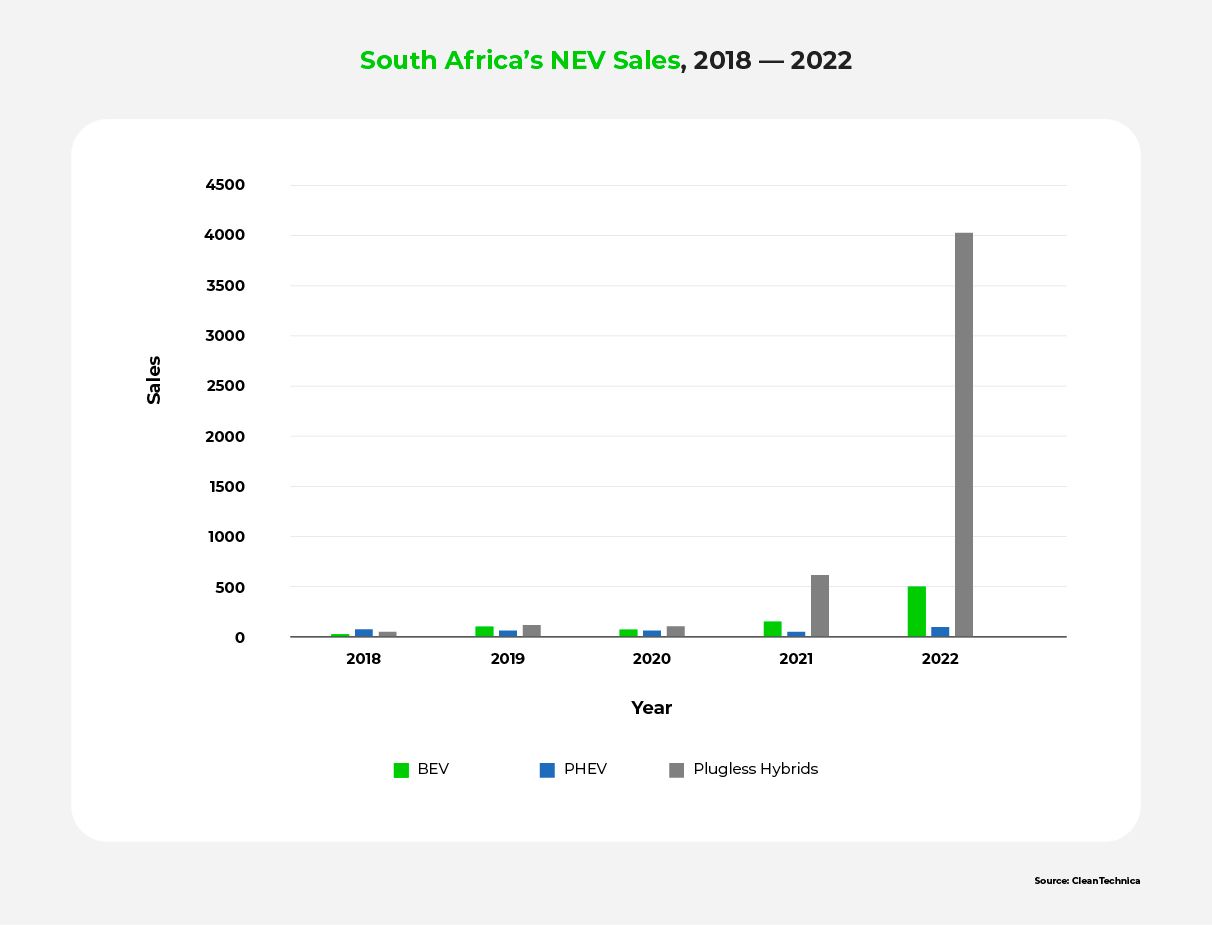

Within South Africa, NEV sales have been slow, but are now gaining momentum. Data from the National Association of Automobile Manufacturers of South Africa (NAAMSA) shows that NEVs accounted for nearly 1.2% of YTD June 2023 sales. Notably, NEV sales surged by 47.1% YoY in June 2023.

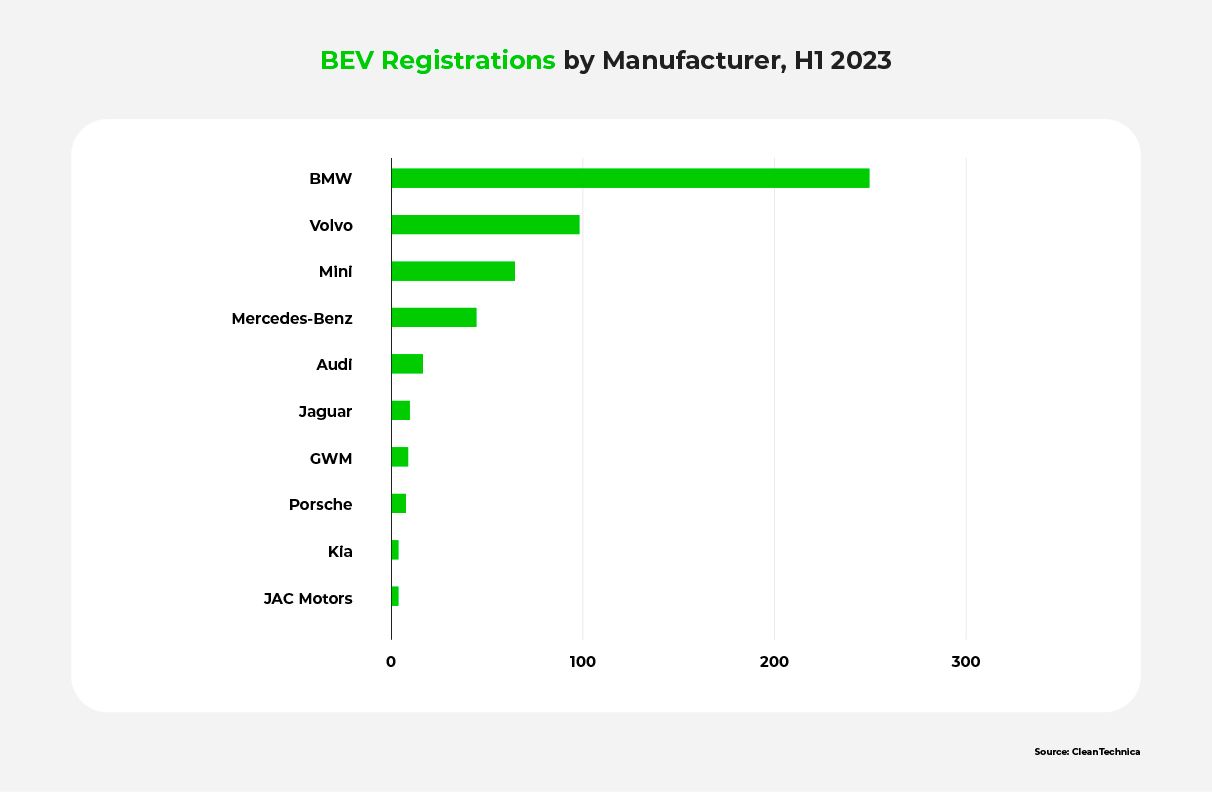

Battery electric vehicles (BEVs) constitute a minor but fast-growing segment in South Africa’s NEV market. In the first half of 2023, South Africa saw the sale of 502 BEVs, matching the total number of BEVs sold during the entirety of 2022. This suggests the potential for over 1,000 BEV sales in a single year.

As depicted in the chart below, plugless hybrids (HEVs) have experienced a significant surge in sales since 2022. This momentum continues into the first half of 2023; in 2022, a record-breaking 4,050 plugless hybrids were sold, and 2,561 have been sold in 2023 so far. This increase can be attributed to the growing availability of plugless hybrids, such as the Toyota Corolla Cross hybrid. As OEMs actively promote plugless hybrid models, consumer interest and purchases are aligning with this trend.

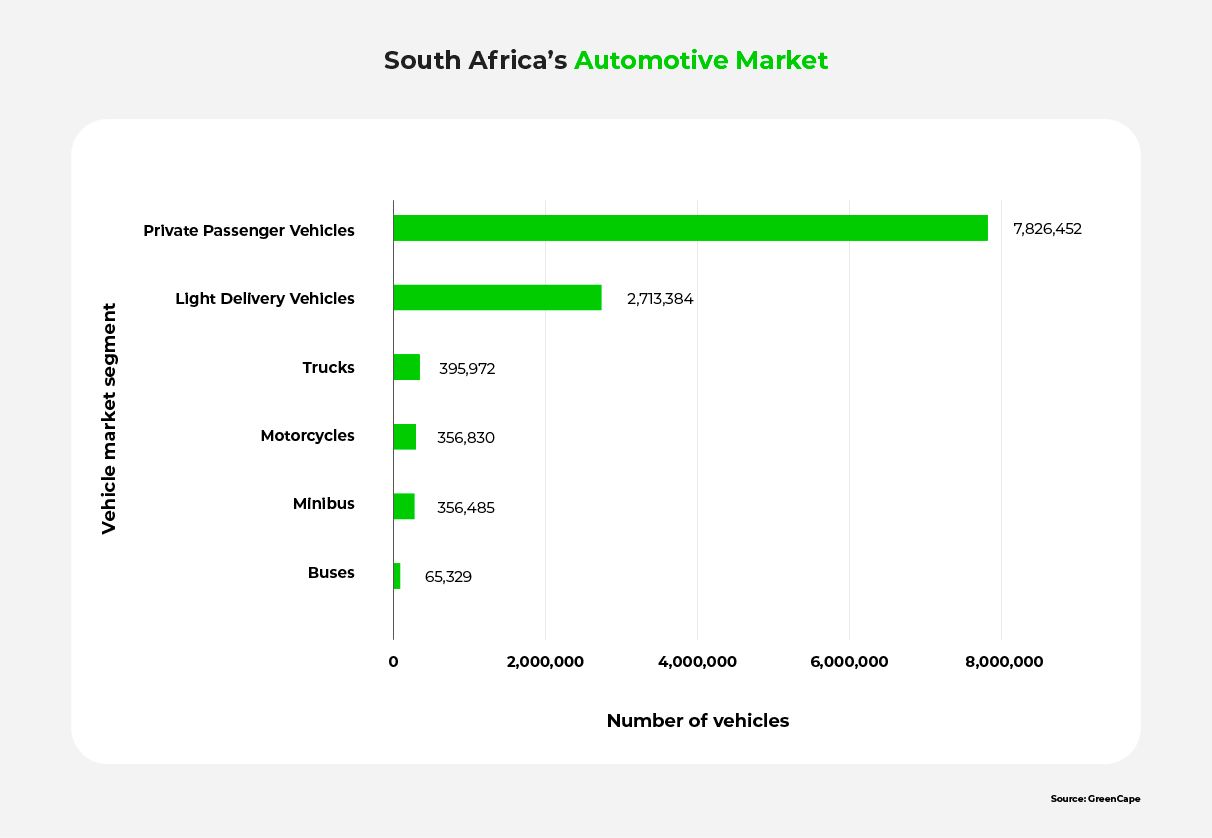

Private passenger vehicles comprise the largest segment in South Africa’s market, but electrifying them poses significant challenges. Nevertheless, 506 BEVs were sold in 2022 for private passenger purposes.

The second-largest segment consists of light commercial vehicles, primarily for last-mile delivery services. Several OEMs are entering this market, including Takealot, Spar, DPD, Skynet, and DHL.

Another emerging category is electric 2- and 3-wheelers, projected to see a compound annual growth rate (CAGR) of 24.35% and 14.38%, respectively, by 2030. Due to South Africa’s high urbanization rate, this sector is poised for growth, primarily driven by fleet owners who want to save money on fuel.

The electric public transportation sector is also gaining ground. South Africa has approximately 65,239 buses and minibuses, and 356,485 minibus taxis, that could be replaced with electric buses. The City of Cape Town has already successfully tested and deployed electric buses for daily commuter use.

Current Charging Infrastructure

South Africa’s EV charging network currently consists of over 350 publicly accessible charging stations, including ones at dealerships.

In 2022, several companies made substantial investments in expanding South Africa’s public EV charging network. Most notably, Audi South Africa partnered with Grid Cars to establish 70 new EV charging stations. These included 4 150kW DC super-charging stations, as well as slower chargers, across 33 locations.

Other major EV manufacturers have also made significant contributions to South Africa’s public charging infrastructure. BMW, for instance, has deployed over 60 ChargeNow stations across the country. Jaguar and Nissan have also invested in expanding the charging network.

The public EV charging station sector is expected to experience the most significant growth as South Africa’s network continues to expand. This expansion is essential to facilitate long-distance EV travel between cities and provinces.

Key Players

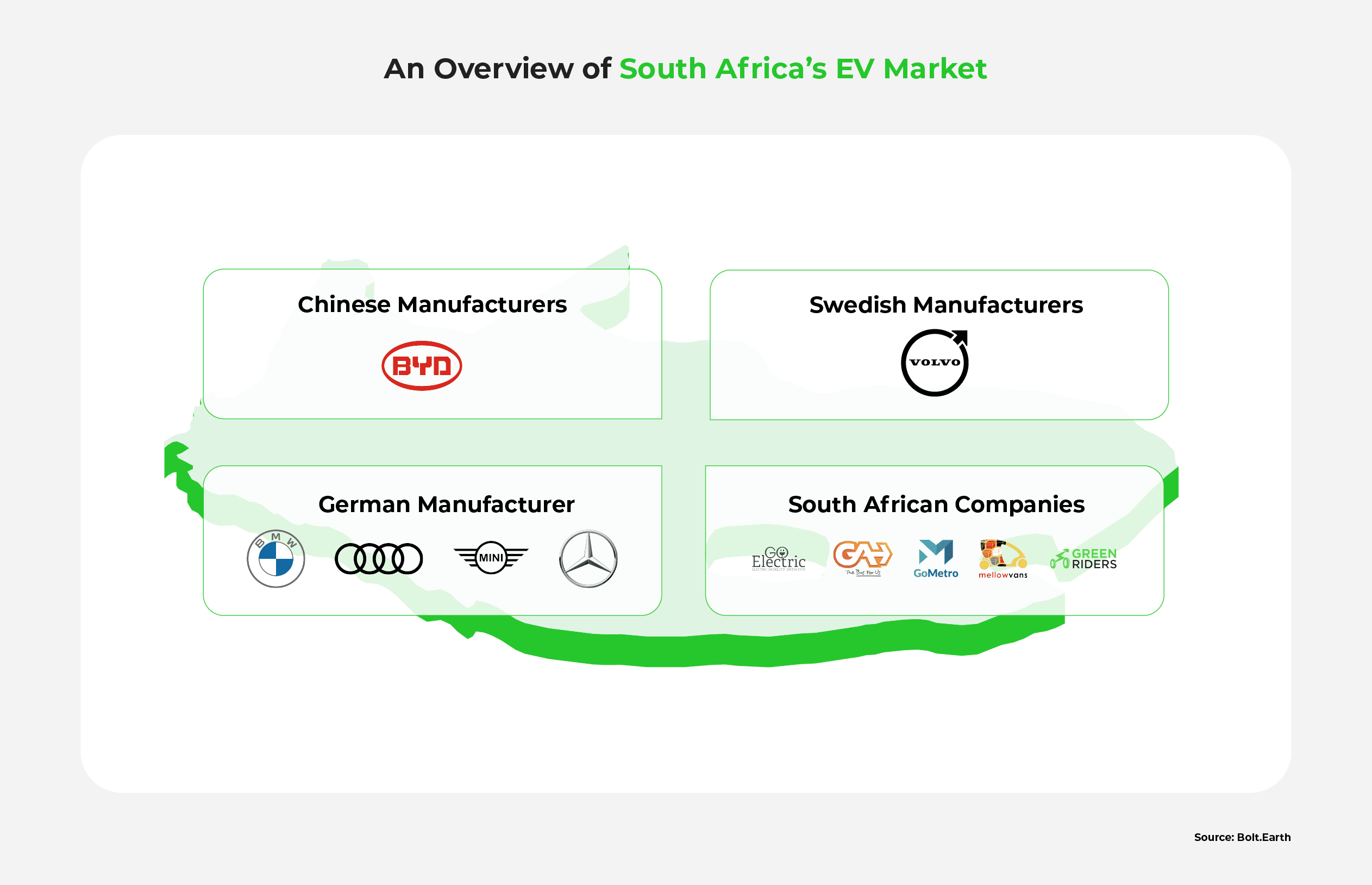

Numerous OEMs currently operate in South Africa, serving the private passenger vehicle market. There are key automotive manufacturing hubs in the Eastern Cape (EC), KwaZulu-Natal (KZN), and Gauteng (GP) regions. Despite having fewer commuters, the EC has attracted substantial investment due to its proximity to sea and river ports.

German brands, including BMW, Audi, and Mercedes-Benz, dominate the BEV sector, mainly catering to South Africa’s private passenger vehicle market. BMW maintains its position as the BEV sales leader due to its wide range of EV options, while MINI, a part of the BMW Group, is also growing steadily. Mercedes-Benz has achieved some success by focusing on convenience; it offers home charging kits, and has installed charging stations at 36 of its dealerships.

The Swedish Volvo XC40 is another common choice in South Africa, offering a 423km range at a lower price than the Mercedes-Benz EQA 250. Furthermore, the Chinese company BYD recently launched the Atto 3, priced between R 768,000 and R 835,000 (USD 40,941 – 44,479). Tesla vehicles, despite their popularity in other countries, are not yet available in South Africa. Volkswagen plans to produce its first African-market electric SUV by 2035, emphasizing the need for localized EV supply chains.

Although Japanese OEMs make up a significant portion of South Africa’s overall auto sector, Japan’s historical focus on hybrid electric vehicles precludes its participation in the BEV market.

The Domestic EV Fleet Market

Several players are focusing on South Africa’s fleet market, including public transport, last-mile delivery, and niche sectors such as tourism vehicles.

Public Transport

Golden Arrow Bus Services (GABS) and BYD have jointly announced the deployment of two electric buses in Cape Town. These are the first electric buses in operation in the entirety of Southern Africa.

GoMetro, in partnership with several firms and researchers, successfully tested the first minibus taxi in South African conditions in January 2023.

Last-Mile Delivery

Many South African startups participate in the last-mile delivery market segment. MellowVans has introduced a cargo e-rickshaw equipped with a 4KW motor and a 9kWh battery pack, allowing it to travel up to 100 kilometers on a single charge. Their production facilities in Stellenbosch and Strand can currently manufacture four electric three-wheelers daily, with nearly 70% of components sourced locally.

In 2022, Go Electric collaborated with AEVERSA and the Spar Group to initiate a pilot project employing electric mopeds for Spar’s online grocery delivery service.

Green Riders has launched a fleet of 600 electric cargo bicycles to support the growing electrification of last-mile food and grocery delivery services such as Uber Eats and Mr. Delivery. They aim to have 3,000 Green Riders in South Africa’s Western Cape and Gauteng provinces by the end of 2023.

Other Niche Markets

In 2020, Makanyi Private Game Lodge pioneered the first electric safari vehicle, in the Timbavati Game Reserve within Kruger National Park. This innovative initiative involved converting a traditional diesel 4×4 safari vehicle into an electric one, plus making it fully rechargeable via solar panels.

Government Incentives and National EV Targets

South Africa’s manufacturing industry urges clear EV policies for automotive sector stability, motivated both by the EU’s ICE phase-out and by South Africa’s GHG reduction goals. In response, a government-issued Auto Green Paper, released in 2021 for feedback from 7 major automakers, is poised to become a guiding White Paper in 2023.

EV Master Plan

The Auto Green Paper, South Africa’s first NEV industry guidance, has not been publicly issued yet, but its intentions are clear: it will focus on creating a competitive EV manufacturing hub. It aims to boost job creation, develop EV tech, transition to clean fuels, and reduce emissions through green manufacturing.

Although industry players applaud these goals, some concerns remain. First, the paper’s call for local NEV production and exports may not be feasible, due to South Africa’s small market and high import duties. Second, charging infrastructure development is uncertain, raising questions about whether the government or the private sector should take responsibility for it.

The new South African Automotive Master Plan (SAAM) offers incentives to encourage the automotive industry transition but, notably, remains silent on the issue of NEVs.

EV Supply-Side Incentives

Many stakeholders have requested that the government provide guidance or incentives for EV manufacturing, research, and development. Furthermore, the government-issued Green Transport Strategy for South Africa (2018 – 2050) proposes providing financial incentives for OEMs to produce and sell affordable EVs within South Africa. Thus far, however, the government has not actually implemented any of these measures.

EV Demand-Side Incentives

South Africa’s government has not issued demand-side incentives yet. However, early this year, NAAMSA released a document entitled the “New Energy Vehicle Roadmap Thought Leadership Discussion, The Route To The White Paper,” in which they recommend a detailed subsidy structure to drive consumption.

Import tariffs on EVs in the South African market are a contentious issue. EVs are subject to a 25% import tariff, significantly higher than the 18% applied to traditional internal combustion engine (ICE) vehicles. In response, the Democratic Alliance (DA) advocated for the removal of all import duties on EVs in order to make these vehicles more affordable for consumers, especially in light of rising petrol prices. The government has not yet responded.

Potential Challenges in South Africa’s EV Market

In addition to the political uncertainty surrounding the EV industry, South Africa’s transition to electric mobility faces several other challenges. The primary hurdles involve high prices and limited charging infrastructure. Moreover, South Africa’s power supply constraints are not conducive to a swift transition to EVs.

Limited Charging Infrastructure

As of 2020, South Africa had one of the highest ratios of public EV chargers to EVs: close to 1.8 chargers per 10 EVs. However, this number does not reveal the whole picture; the ratio is so favorable because the country’s EV penetration rate is so low.

Furthermore, charging infrastructure shortages may be in store. In 2020, there were about 143 public charging stations in South Africa, increasing to over 350 in 2023: approximately a 50% annual growth rate. However, in the same period, EV penetration saw a CAGR of 55%. South Africa’s EV goals will probably accelerate this CAGR even more. In other words, the number of chargers is rising more slowly than the number of EVs, which may lead to future problems.

High Initial Costs

Currently, South Africa’s EVs are priced much less competitively than ICE vehicles. South Africa’s expanding middle class, which represents a significant portion of the market, typically purchases vehicles priced between R150k and R350k (USD 7,923 – 18,487). However, most EVs in South Africa, with the sole exceptions of the Funky FE-1 and the Eleksa CityBug, are priced outside this range. This dearth of affordable options contributes to South Africa’s low EV adoption rates.

South Africa’s taxation system compounds the problem. In addition to the 25% import tax mentioned above, EVs are subject to a further ad valorem tax, which can be as high as 30%. As a result, an EV often costs twice as much as a comparable ICE vehicle from the same manufacturer.

Electricity Supply and Grid Infrastructure

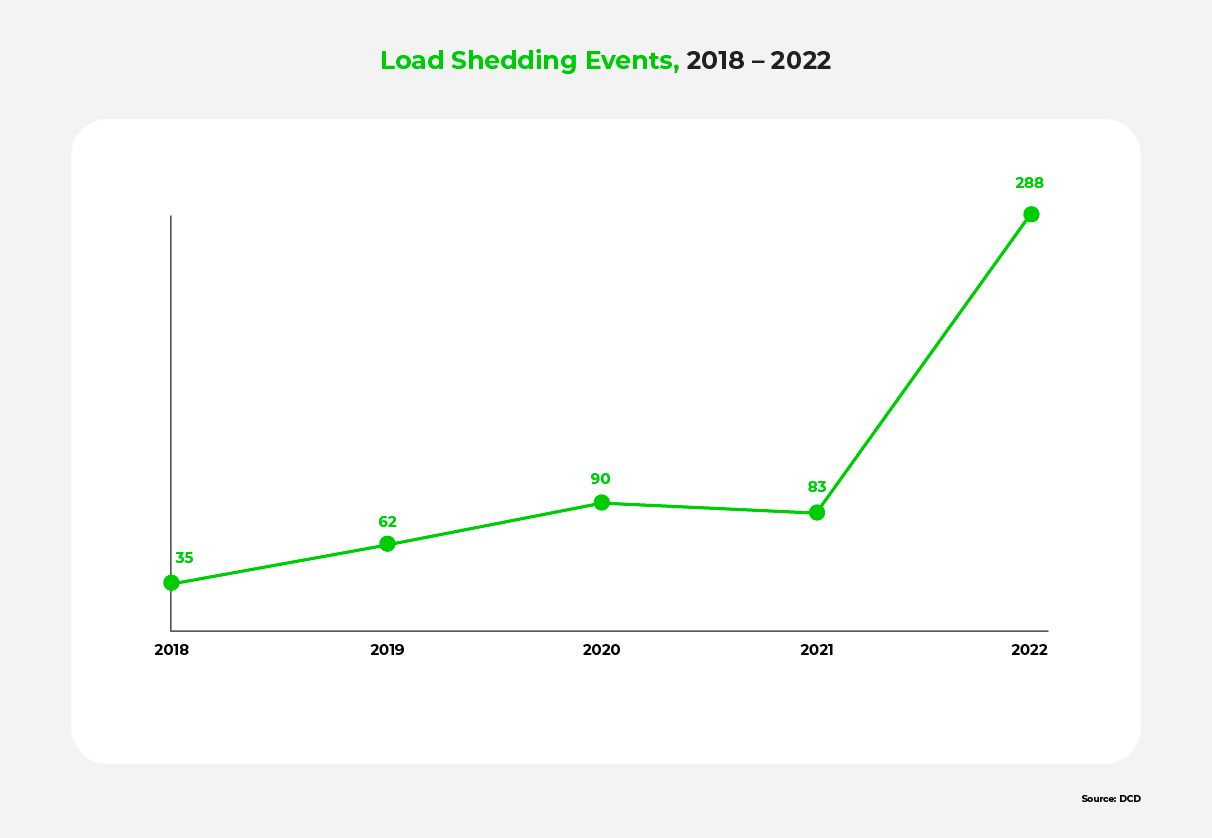

South Africa is notoriously prone to power shortage issues, as a result of outdated grid infrastructure. Eskom, the state-owned national power utility, supplies more than 95% of the country’s electricity, but has not attained high efficiency, due to plant breakdowns. According to CEO Calib Cassim, although the power utility has approximately 47,500MW of installed capacity, it can utilize only 26,500MW. This has resulted in a continuous electricity crisis since 2007. Eskom has responded by implementing load shedding: strategic blackouts on a rotating schedule.

In 2022 alone, South Africa underwent 288 load shedding events. Since mid-January of 2023, the country has typically been without electricity for 8 to 10 hours a day, causing economic losses and disrupting daily life. As a result, residents are reluctant to purchase vehicles that they will be unable to charge on a regular, reliable schedule.

Opportunities for Future Growth

Although South Africa has significant obstacles to EV adoption, it also holds great potential for progress.

Energy Upgrades

South Africa, like many other countries, presents opportunities for charging infrastructure development. However, it will need to support this development by improving its existing electricity system. The country has abundant forms of new energy, such as solar and wind power, which it could upgrade its infrastructure to harness. Alternatively, South Africa could leverage advanced technology such as V2G and distributed energy resources to relieve the strain on the state grid. It could also attract private sector investment in transmission, following Brazil’s example.

Cape Town is already pioneering some of these solutions. They have commissioned a major solar and battery storage project, which is expected to generate more than 60MW of renewable energy. They are also exploring purchasing solar power from households and small producers.

As EV growth continues, significant opportunities for charger infrastructure development, particularly in the private sector, will emerge. Several companies are already entering or planning to enter this market. Notably, Rubicon and Audi are collaborating on an ongoing charger installation project, including South Africa’s first ultra-fast charger.

Green Incentives and Policy Overhaul

South Africa could directly support EV adoption by offering subsidies and reducing taxes. However, this may not be a realistic option for a developing country. South Africa may be able to work around this if it funds EV incentives by leveraging the EV value chain to boost the country’s economy. In particular, South Africa’s existing battery industry and rich manganese resources make it an optimal destination for lithium-ion battery assembly and manufacturing. South Africa could also draw inspiration from Indonesia, which has successfully attracted investment in local processing. If South Africa steps into a role in global lithium-ion cell manufacturing, its economy and employment rates would improve, creating a positive production-demand cycle. Policy support from the demand side could further catalyze industry development.

Public transportation holds additional potential. Government-level procurement and policy support for public transportation could incentivize EV adoption and create opportunities.

Public Awareness and Education Campaigns

A 2020 national survey revealed a significant disparity: 68% of respondents expressed high willingness to own an EV, but actual EV ownership is only 1.8%. This mismatch is largely due to concerns about load-shedding, range issues, and upfront costs.

The Department of Transport partnered with several other entities to launch an Electric Vehicle Road Trip (EVRT) campaign in 2019. The journey aimed to promote electric mobility by demonstrating the feasibility of crossing the country without traditional fuel. The positive public sentiment expressed by the 2020 survey results may be attributable to this campaign. This suggests that future public awareness and education projects would meet with success.

The Future of EVs in South Africa

South Africa stands on the cusp of a significant transition towards EVs, driven by global commitments to reduce greenhouse gas emissions, and supported by the nation’s rich mineral reserves. Although the EV market is in its infancy, it shows promising signs of growth. A variety of EV types are gaining traction, especially in the private passenger vehicle and last-mile delivery sectors. However, this transition is not without challenges, including high initial costs, limited charging infrastructure, and ongoing power supply issues.

As South Africa looks ahead, it could make progress by leveraging its potential in battery manufacturing, pursuing green incentives, and raising public awareness through education campaigns. The forthcoming Auto Green Paper on new energy vehicles and continued policy support promises to guide the nation toward a cleaner, more sustainable automotive future.

FAQ

How is charging infrastructure developing in South Africa?

Charging infrastructure in South Africa is steadily growing. Currently, there are over 350 publicly accessible charging stations. Major investments from automakers like Audi have expanded the charging network, with a focus on facilitating long-distance travel.

What incentives exist for South African electric vehicle buyers?

South Africa does not yet offer direct incentives for EV buyers. However, there are proposals for subsidies, and the Auto Green Paper aims to guide future policies in this regard.

Are there any government policies supporting EV adoption?

The government has drafted the Auto Green Paper as the first guidance specifically addressing the NEV industry. It aims to create a competitive EV manufacturing hub, promote job creation, develop EV tech, transition to clean fuels, and reduce emissions through green manufacturing.

How do electric vehicles compare to traditional cars in terms of cost?

EVs can be more expensive upfront than traditional cars due to high import tariffs. However, the government is considering proposals for subsidies and reduced taxes to make EVs more affordable.

What future trends can we expect for electric vehicles in South Africa?

South Africa is predicted to continue adopting electric market private passenger vehicles and last-mile delivery service vehicles. Battery manufacturing, green incentives, and public awareness campaigns promise to boost EV growth.

Resources

NAAMSA: SA Automotive Market Analysis, Aug 2023

Explore South Africa’s overall automotive market here.

GreenCape: 2023 Electric Vehicles Market Intelligence Report

Get details about South Africa’s EV market sector here.

GreenCape: Electrification of public transportation

Discover Cape Town’s successful electric bus initiative here.

South African Government: Auto Green Paper on the advancement of new energy vehicles in South Africa

Find South Africa’s current policy guidance here.

Earth.Org: Understanding the Energy Crisis in South Africa

Learn about South Africa’s ongoing energy crisis here.

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More

Feb 09, 2026 • EV Charging Infrastructure

The Current State of EV Charging in India [2026]: Public, Home, and Fleet Networks

Read More