An In-Depth Analysis of the Thailand EV Industry

Raghav Bharadwaj

Chief Executive Officer

Published on:

10 Jul, 2023

Updated on:

06 Oct, 2025

Thailand, the top automobile producer in the south-east Asia region, is home to renowned global automakers who export internationally, besides supplying to consumers within the country. However, given the worldwide shift to electric vehicles (EV), Thailand is seeking to re-position itself at the forefront of EV manufacturing.

To retain its central position in the auto manufacturing and export world, Thailand aims to transition 30% of its auto production to EV by 2030. Its initial focus is to promote EV sales within the country, then replace its automobile export with EVs.The production-led EV policy is bearing fruit — Thai EV sales made up 3% of total sales in 2022.

The Thailand EV market poses an important learning opportunity for India. By analyzing the intricacies of the EV scene in Thailand’s economy, India will be better equipped to achieve its 30% EV sales target by 2030.

This article is the first in a 6-part series that analyzes different EV markets in Asia and draws conclusions relevant to India’s EV market. This first part takes a deeper dive in the Thailand EV market, and discusses the following three questions:

- Who are the major players in the Thailand EV industry, and what role do they play in the market evolution?

- What initiatives is the government taking to promote the EV industry in Thailand?

- What challenges, solutions, and investment opportunities exist in Thailand’s EV industry?

Current State of the Thailand EV Market

In 2017, Thailand’s Board of Investment (BOI) announced the Electric Vehicle and Hybrid Incentive Program. Under this program, the government offered incentives to manufacturers who use locally-produced batteries and other components in their vehicles. These players received steep excise tax reductions and corporate income tax exemptions of up to eight years. The program attracted over US$3.3 billion in investments.

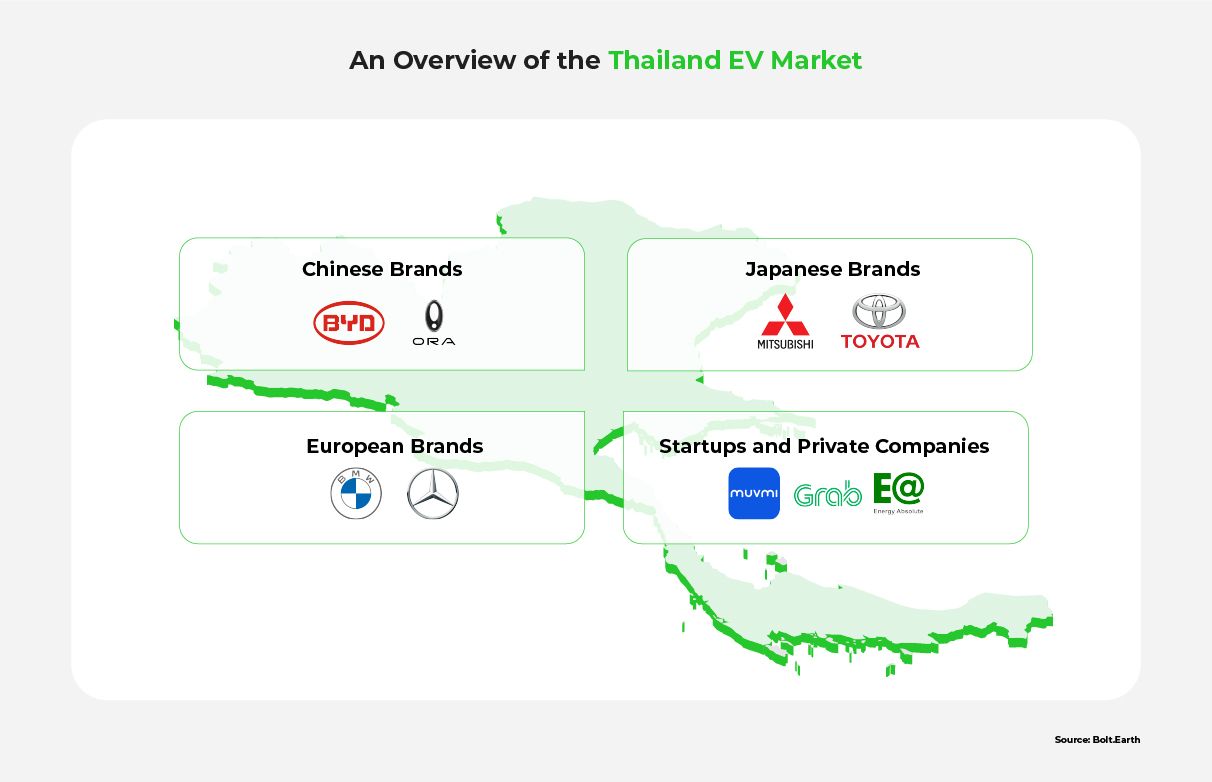

All the major players from Japan and Europe participated in this initiative. These included Toyota, Honda, Nissan, Mitsubishi, Mercedes-Benz, and BMW. It’s important to note that these players’ presence in the country was primarily through ICE vehicles up until that point. However, the production in this early stage of the program was mainly concentrated in hybrids and plug-in hybrids (PHEVs).

In 2020, the BOI finally shifted its attention to battery electric vehicle (BEV) technology. It announced higher incentives for BEV project investments. These incentives attracted heavy-weight Chinese automakers. By the end of 2022, the Chinese brands dominated the BEV segment.

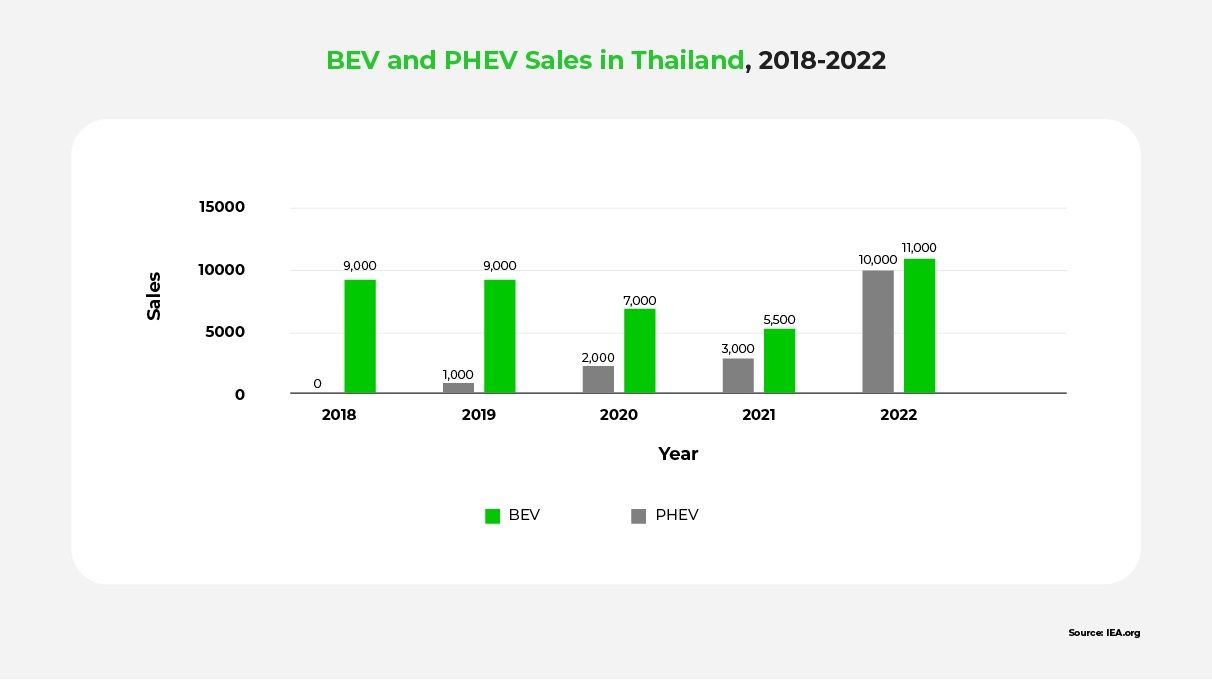

The graph below shows the aftermath of these incentives: the number of sales in BEVs and PHEVs has seen a substantial growth between 2018 and 2022.

Electric Cars Market in Thailand

Two years after this shift, electric car sales reached 21,000, doubling the volume from 2021. Up until 2021, PHEVs dominated the Thai market, manufactured mostly by Japanese and European brands that were transitioning from ICE to EV technology. In 2022, the sales volume is split evenly between PHEV and BEV. Increasingly, BEV variants are gaining a greater share.

Chinese Brands Taking Thailand by Storm

In Q1 2023, the Chinese BEV brand, BYD, was the best selling EV. Chinese carmakers have played a significant role in accelerating the adoption of electric vehicles in the country with the launch of BEV models. According to the IEA, Chinese BEV Ora Good Cat became Thailand’s top-selling electric car in 2022, with nearly 4,000 units sold.

The second and third best-selling electric cars in Thailand were also Chinese models. That’s no surprise; Chinese automakers were able to offer lower-priced EVs by availing of the financial incentives offered by Thailand’s government, such as subsidies, excise duty waivers, and import duty reductions.

Japanese and European Players Exert their Influence

Japanese and European brands are also competing with Chinese brands in Thailand. That’s especially true as more prominent brands are transitioning to EVs.

For instance, Mercedes-Benz chose to manufacture the electric Mercedes-EQS in Thailand. The company also chose Thailand as one of its seven locations worldwide to produce high-performing Li-ion batteries.

BMW also had early success in the Thailand EV market with its charging station-focused strategy. As of 2022, the company has cornered almost one third of the total EV base in Thailand.

Toyota — the largest vehicle manufacturer in Thailand, Mitsubishi — the first automaker to export out of Thailand, and several other major auto brands have also announced investments in the EV Thai sector.

Beyond EV Cars

Thailand’s public transportation is characterized with the tuk-tuk, or 3-wheeler auto rickshaws. Even this sector of the market is being reimagined as EVs, with innovative startups and private initiatives.

For instance, Thai startup MuvMi is planning to triple its fleet size to about 1,000 EV tuk-tuks in 2023. Grab, a ride-hailing app company, is also converting 450 of its traditional tuk-tuks to EVs.

Despite their higher upfront costs, 3-wheeler EVs have 80% lower running costs. As a result, demand for MuvMi and Grab EV tuk-tuks is increasing as they’re economical and also eco-friendly.

The transition to EVs is spreading to other modes of transportation such as public buses, longtail boats, and ferries. One of the companies which has invested heavily in this EV transition is Energy Absolute, which is planning to run electric public buses, ferries, and charging stations.

With these external players all contributing to the Thailand EV market, the government is playing an active role in promoting the transition to EVs.

Thailand EV Targets and Incentives

To achieve its national goal, Thailand has to have about 725,000 EVs by 2030. Ultimately, the plan is to increase production to 2.5 million EVs by 2040.

Thailand currently exports more than half of its total vehicles produced. And with incentives, the country hopes to replicate this success in EVs as well. Below we see three incentives provided by the Thai government to make this goal a reality:

- Tax holiday to EV manufacturers with 5,000 million + baht investment capital; PHEV: 3-year exemption; BEV: 8-year exemption + 1 to 3-year exemption in case of R&D investment

- Tax holiday to EV component producers: Battery pack assembly, 5-year exemption; Battery module/cell production, 8-year exemption + incentive of 90% import duty reduction for raw and essential materials not available within the country for 2 years; other key EV component, 8-year exemption

- Tax holiday to EV charging station providers: 5-year exemption to companies that build at least 40 chargers, of which at least 25% are fast chargers

Government policy is encouraging the switch to EV by offering subsidies that should reduce the price of EVs by between around US$ 2,200 and US$ 4,800 per vehicle depending on the model and battery capacity. Despite this push, however, the Thailand EV market currently appears to be unable to unlock its full potential.

3 Challenges in Thailand EV Market

Although the Thai EV policy is among the most dynamic and aggressive policy frameworks, it may not be enough to achieve the national EV goals. This is because of the challenges that plague the Thai EV market.

1. Non Comprehensive EV Policy and Regulatory Challenges

The international regulatory environment poses a challenge for Thailand. Currently, Thailand exports most of its automotive production to Australia, Japan, China, Vietnam, and the Philippines. If these countries shift their preference to local producers, Thailand may need to look for new export destinations.

Thai EV policy also needs to address the lack of local mineral supply as it does not have adequate sources required for Lithium-Ion batteries (LIB). Unless this constraint is dealt with, the country may be reduced to a mere EV assembly hub.

The policies and regulations related to EV manufacturing, sales, import, and charging infrastructure in the targeted export destinations will play a crucial role in determining the success of Thailand’s EV strategy.

2. Lack of Charging Infrastructure

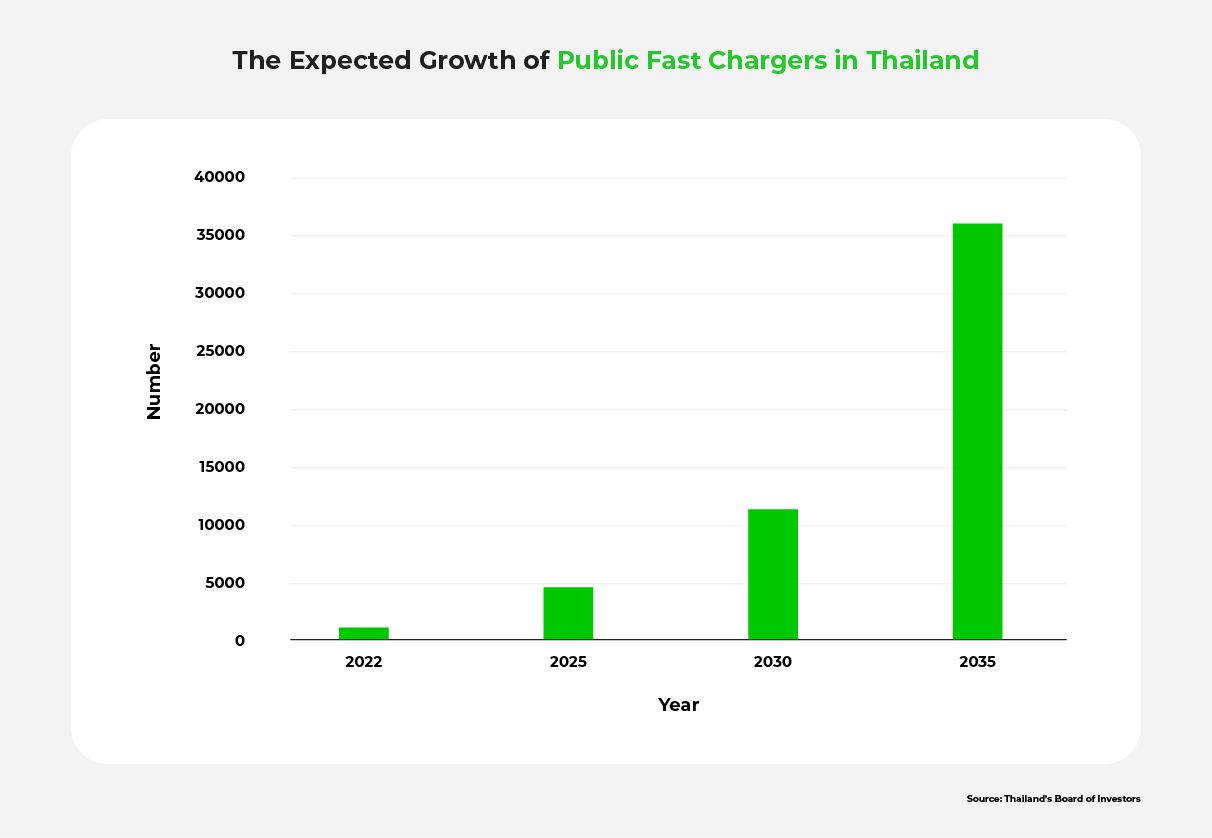

The current state of charging infrastructure in Thailand limits the widespread adoption of EVs. In 2022, Thailand had 900 fast chargers, but the goal is to have 4,400 by 2025. These fast chargers will also have to work in tandem with home chargers, slow chargers, and battery swapping stations. As newer technologies, such as wireless charging and Vehicle-to-Grid (V2G), are commercialized the market supply will need to respond to these developments.

The government is prioritizing EV charging expansion by offering tax benefits and other financial incentives. However, unless investors have visibility of a commercially viable business model for charging infrastructure, this problem is unlikely to be resolved. In the absence of easily accessible charging infrastructure, customer demand for EVs will remain low.

3. Need for Higher Investment in the EV Industry

The current level of investment in Thailand’s EV market needs to be sustained to retain the competitive edge that the country enjoys in auto manufacturing and export. This might prove to be more challenging than anticipated.

For instance, lack of awareness around the technical aspects of EVs might create a blur around the viability of EV investments. Lower consumer awareness and acceptance of EVs might also drive away potential investors.

The opportunities of the transition to EVs aren’t limited to well-established global players — they extend to startups, too. Therefore, it becomes important to attract investment from a diverse set of players who can enable access to globally competitive EV technology.

If Thailand fails to address these issues, it might face an investor exodus as it moves to EVs. In this event, Thailand will lose out on an important economic opportunity and its auto sector will be in crisis.

Potential Solutions to Drive Growth in the Thailand EV Market

Thailand will suffer grave consequences if it doesn’t maintain its spot as an auto exporter. As a result, the country must establish strategies to overcome the obstacles hindering its progress in the EV export and manufacturing landscape.

Below we analyze three potential solutions to Thailand’s EV problems.

1. International Orientation of EV Policy

Because Thailand is primarily targeting international EV markets, the country should establish a clear framework to coordinate with other nations.

In south-east Asia, Thailand can build mutually beneficial relationships with other markets. For example, Indonesia is rich in minerals and could be a good source of supply for raw material required in EV batteries. Similarly, other countries in the region could offer potential for collaboration to develop the EV market in the regions.

The key is clarifying the guidelines that will govern these relationships. This way, Thailand can ensure it reaches its goals without suffering any negative side effects from the lack of clear EV policies.

2. Build EV Charging Infrastructure

Having a sustainable business model for charging is a key step to building charging infrastructure. One way to ensure Thailand’s EV charging infrastructure grows properly is to establish data collection systems from the existing charging points.

These data collection systems can provide information about location, user behavior, utilization, and time. From there, decision-makers can understand how to create charging infrastructure suited to specific market conditions.

For example, high-density locations with a lot of EV traffic could benefit from fast-charging stations. On the other hand, low-density locations may be able to focus on building a network of slow chargers.

Once the charging points have been established according to the country’s needs, EV charging will be easily available. This will greatly reduce Thai consumers’ range anxiety, further boosting EV adoption within the country. Due to this widespread EV adoption, the Thailand EV market will see significant growth.

3. Promote Investment in Thailand’s EV industry

Thailand’s existing strengths in the automotive industry and strategic location in Southeast Asia provide a competitive advantage for the manufacturing and export of EVs and EV components.

These advantages can be leveraged to forge partnerships with emerging EV players. Government policy should provide a platform and framework to enable the players to engage and explore partnership opportunities.

EV technology is expected to evolve rapidly and early investments can help gain crucial first-mover advantage. For example, research and development in battery and charging technology could help accelerate the growth of EV. Innovative modes of financing such as public-private participation and green financing should be explored to encourage research in EV technology.

Potential of EVs in Thailand

Thailand is a prominent figure in the worldwide auto industry. This, however, does not guarantee its success in the EV transition. As a result, the country is putting intense efforts to grow its EV market.

Greatly aided by external auto players, mainly from China, Japan, and Europe, Thailand is slowly becoming an EV manufacturing and export hub. Nonetheless, the country is still facing significant regulatory, infrastructure, and financing challenges.

Investors who can leverage policy incentives to navigate these challenges will be well-placed to take advantage of the huge opportunity offered by Thailand’s EV industry. The Thailand EV market offers investors a pathway to tap not only the national market but also international markets in south-east asia, asia-pacific, and beyond.

The next part of this series will focus on Indonesia’s EV market. It will also discuss the players and challenges facing electrification in the country.

To learn more about the Thailand EV market, please see the FAQ and Resources sections below.

FAQ

What are the incentives for EV investors in Thailand?

Thailand’s Board of Investment has announced various policy incentives to attract EV investors. These include a reduction in excise tax and import duties on completely knocked down and completely built-up units of EVs. Thailand also offers an exemption of import duties on EV parts, such as batteries, traction motors, compressors, battery management systems, drive control units, and reduction gears. Finally, the country provides tax holidays for EV manufacturers, component producers, and charging station providers.

How is the Thai government promoting the adoption of EVs in the country?

Government policy is encouraging the switch to EV by offering subsidies that reduce the price of EVs by around US$2,200 to US$4,800 per vehicle, depending on the model and battery capacity. Moreover, to address range anxiety among consumers, the government is prioritizing EV charging infrastructure development by offering tax and other financial benefits to charging providers.

How does the cost of owning and operating an electric vehicle compare to a gasoline-powered car in Thailand?

An EV has a higher upfront cost when compared to traditional fossil-fuel vehicles. However, the running cost of an EV is much lower. For those who commute daily, an EV may be more economical because the daily saving in fuel cost and in maintenance cost over time may offset the high upfront cost.

What investment opportunities are available in Thailand’s EV market?

The Thailand EV market presents many investment opportunities. For example, policymakers are encouraging all EV manufacturers, component producers, battery companies, and charging station providers to invest in Thailand. This is an interesting opportunity since each segment has multiple sub-segment. This means investors and companies can diversify their assets in the Thai EV market, which ultimately benefits them.

Resources

Baker Mckenzie: Thailand: Electric Vehicles — A New Automotive World Order

Discover how Thailand is preparing for nationwide EV adoption.

Reogma: Assessment of the Electric Vehicle (EV) Landscape in Thailand

Dive deep into Thailand’s EV landscape. Understand the risks, drivers, and restraints that influence the Thailand EV market.

KPMG: Electric Vehicles in Thailand

See the progression of the EV market in Thailand with numbers.

Fitch Solutions: Thailand EV Profile

See how the EV market in Thailand will continue to evolve between 2023 and 2032.

Feb 17, 2026 • EV Charging Infrastructure

The Psychology of EV Charging: What EV Drivers Want at a Charging Station

Read More

Feb 12, 2026 • EV Charging Infrastructure

What Is the Real Bottleneck in Scaling India’s EV Charging Network?

Read More

Feb 09, 2026 • EV Charging Infrastructure

The Current State of EV Charging in India [2026]: Public, Home, and Fleet Networks

Read More