Part 2: Developing Electric Vehicle Charging Infrastructure in India–Business Opportunities and Risks

Raghav Bharadwaj

Chief Executive Officer

Published on:

14 Jun, 2022

Updated on:

03 Nov, 2025

Recently, the Indian government has focused on following a uniform strategy for its EV charging infrastructure. They also aim to bolster EV adoption in the country. Bolt.Earth operates the world’s largest EV charging network and marketplace. We also currently occupy a 50% market share of India’s EV charging network with the chargers we deployed. As such, we want to become the default EV charging solution for EV users across India.

The first part of this series was a market analysis of the current Indian EV charging infrastructure. This part will focus on the EV transition in India. First, we’ll show the opportunities it creates for the country’s industry and society. Then, we’ll also discuss some risks associated with this surge.

Let’s delve into India’s 3 prime opportunities with its growing EV charging infrastructure.

3 Opportunities for India in Deploying EV Charging Infrastructure

1. Tier 1 and Tier 2 Indian Cities May Not Need Large Scale Public Charging Infrastructure

According to the International Energy Agency (IEA), almost 90% of the existing EV charging points are private slow chargers. This isn’t surprising, considering EV user charging patterns. In fact, 80% of all EV charging is done at homes and workplaces. There, vehicles spend most of their time parked.

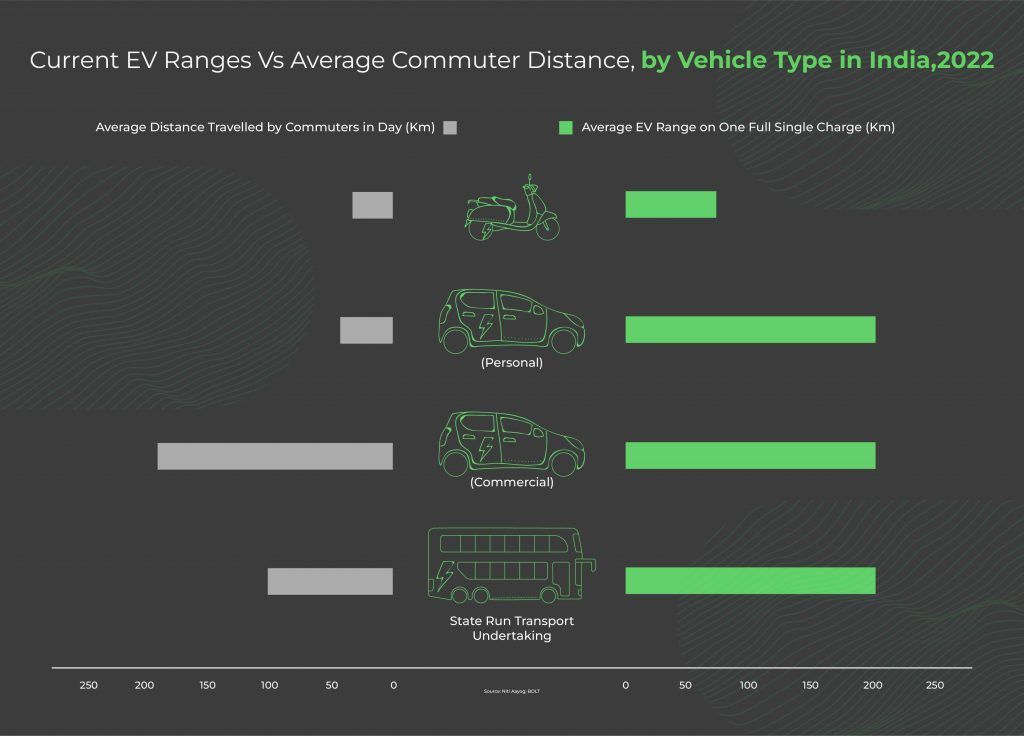

The NITI Aayog vice-chairman also states that the current EV battery capacity is much higher than the average distance traveled in a day within the city.

Current EV Vehicle ranges in India are comfortably larger than the average distances traveled by commuters across the board.

This all means most EV owners won’t use public EV charging points much. That said, private and commercial EVs may need them periodically. That’s especially if they travel longer ranges. India also won’t need large government investment in EV charging infrastructure. Most EV charging stations would be privately owned. That means India only needs enough public charging sites to manage the demand for long-range EV transportation.

A unified approach to charging infrastructure needs to occur. Otherwise, the infrastructure won’t be adopted and utilized by commercial enterprises. It wouldn’t make sense to roll out EV charging for commercial vehicles by district. That’s because long-range vehicles would need nationwide coverage. Instead, a nationwide approach should expand infrastructure with a focus on motorways. Then, the infrastructure should propagate to lesser-used commercial routes.

Key Take-Aways

- Indian cities can become EV-ready. They simply need a few thousand strategically-placed universal EV charging stations.

- Public EV charging infrastructure will still have low usage until EVs reach a tipping point because most EV charging happens at home.

2. India is a 2- and 3-wheeler-led market by volume, possibly catered by slow charging standards

Two and Three-Wheelers are taking over the Indian EV market.

>Today, the upfront initial capital costs for EVs are generally larger than Internal combustion engine-based vehicles. However, 2- and 3-wheeler EVs have already reached price parity in India.

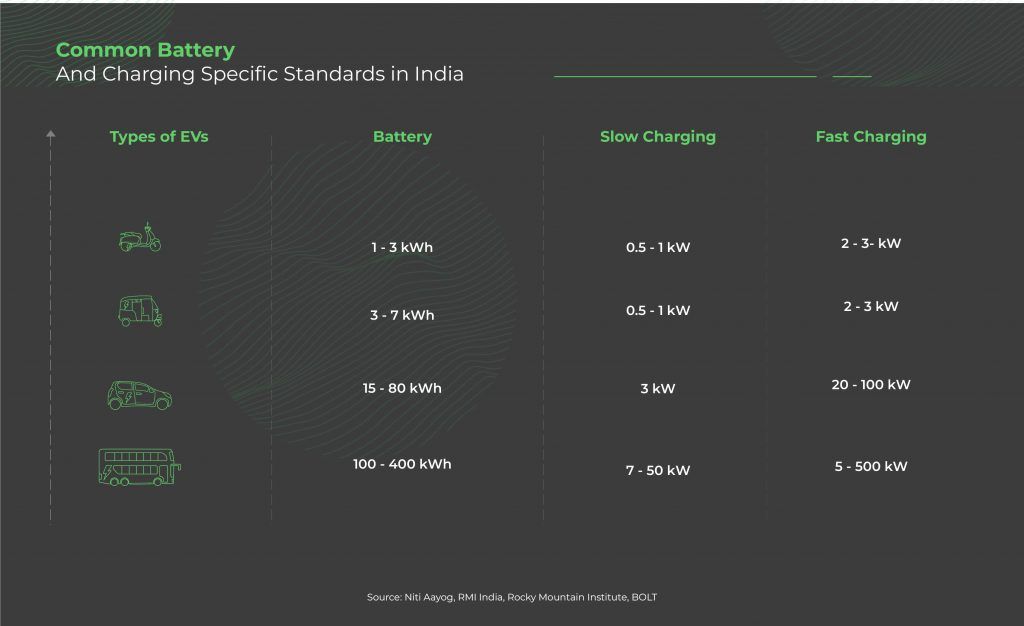

As of July 2021, 2-wheel (2W) and 3-wheel (3W) EVs accounted for 98% of the current Indian EV sales. These segments require only smaller battery capacities. That means most EVs in this sector can use a standard AC outlet to charge.

CPOs especially have a significant opportunity here. They could develop a holistic network of smart and connected slow charging points. This segment can also use IoT-enabled EV charging! This advancement won’t need expensive EV charging infrastructure upgrades. It also doesn’t require significant regulatory or market reforms.

Electricity distribution companies (DISCOMs) need help with demand planning. To achieve that, we need a foundational smart charging point-based layer. It’ll then grant extreme network visibility into EV charging trends.

Key Take-Aways

- In India, the electrification case particularly suits the 2- and 3-wheeler segments, and it’s very robust. That means it’ll see rapid growth.

- The first EV charging network generation can happen in India without new charging technology. It’s possible through a peer-to-peer free-market and a consumer-driven charging marketplace setup.

3. Improved Grid Management Requires New Data and Analytics Businesses

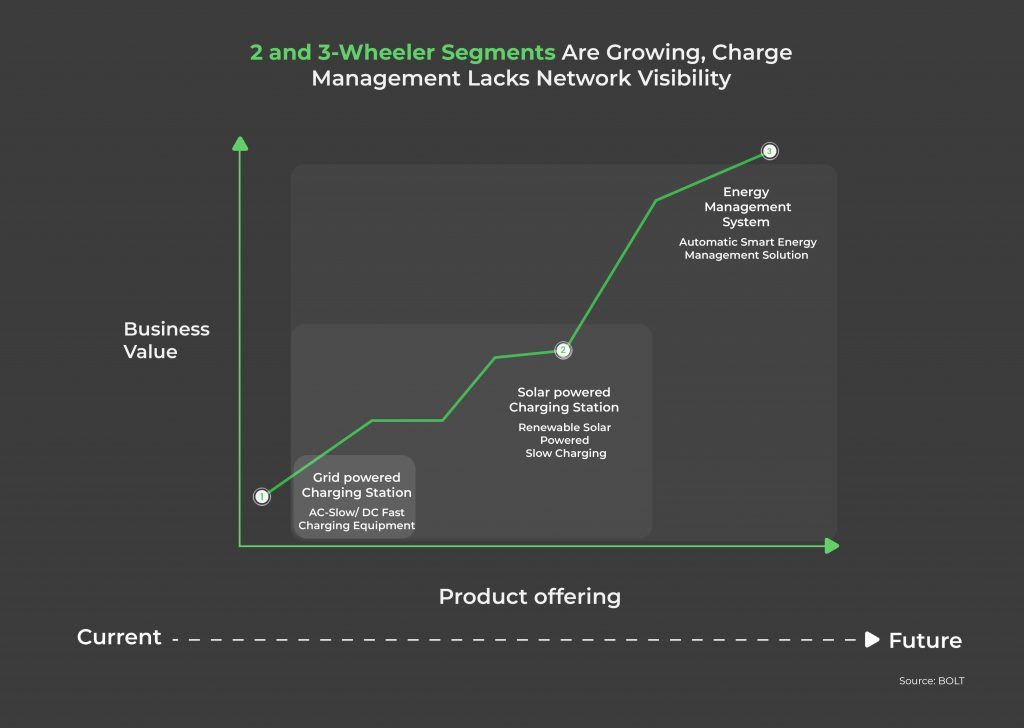

Grid-powered stations, Solar charging stations, and energy management systems are all emerging businesses.

Today, most EV charging infrastructure players focus on powering EV charging stations with the existing electricity infrastructure. However, we might see a shift towards renewable energy-powered charging stations soon. Eventually, the EV charging infrastructure will also move towards end-to-end energy distribution and management solutions for EV charging.

In this eventuality, CPOs that operate large public EV charging infrastructures will want to make charging patterns more visible. They’ll also need to visualize the long-term peak demand trends.

DISCOMs will also need to suggest the right pricing signals to EV customers. That way, they can optimize grid balancing efforts. EV charging, as a commodity, should operate on a decentralized free-market model. In turn, it’ll facilitate load management and grid balancing through pricing economics. DISCOMs will also gain visibility from CPOs. This means DISCOMs can ensure that supply-demand economics will act as checks and balances for peak load challenges in the long run.

Key Take-Aways

- EV charging points will evolve, moving away from simple grid-connected charging points. Instead, they’ll become smart, connected charging networks optimized for energy management.

- A robust EV charging infrastructure market in India will provide many opportunities. For example, it’ll enable revenue augmentation for DISCOMS and distribution network upgrades. It’ll also encourage private companies and start-ups to set up a reliable charging point network.

Since we’ve discussed the opportunities, we can now move on to see the risks. Most notably, we can count 3 risks in the EV charging infrastructure in India.

3 Risks for India in Deploying EV Charging Infrastructure

1. 2 and 3-Wheeler Segments Are Growing, Charge Management Lacks Network Visibility

In this section, we’ll take a look at 3 risks that may impact the nationwide growth of EV charging infrastructure in India. As we’ve discussed above, most risks will not fall on the majority of EV users. Rather, they will impact commercial usage. For many companies, their success depends on range, reach, and fast charging. To assess the risks involved, we’ve split up EVs by vehicle type. In turn, this will reflect their use case.

Learn the consumer trends, dominate the market.

By 2030, India’s 2-wheeler segment electrification is expected to grow rapidly. It’ll also be a leading market segment.

EV drivers can charge their new EVs using a standard Indian AC outlet. That means DISCOMs may not know where EV demand rises from. The lack of smart and connected IoT-based charging points will also pose a risk for DISCOMs. They’ll operate without consumer trend visibility.

The additional electric load on the nation’s grid won’t cause any challenges. In fact, electricity shortage isn’t an issue for mass EV adoption. This is only a myth. According to BloombergNEF, electrifying all road transport will only add 25% to global electricity demand by 2050. Electricity generation in India as of March 2022 is 448.11 GW. Yet, the country uses only 180 GW at present. Assuming constant population growth and demand, India can already support a nationwide EV charging network.

Key Take-Aways

- Standard outlets are found anywhere in India, which can facilitate charging. Yet, a huge segment of the EV population could be adding battery charging loads. DISCOMs won’t be aware of these patterns. As a result, they may fail to implement proper demand planning.

- The lack of a connected charging network could lead to serious grid stability issues as EV usage grows. Vehicle-Grid Integration solutions will also be a critical risk if left unresolved. For example, we can mention the EV charging management solutions that mitigate the negative impacts of uncontrolled EV charging on the power system.

- India already generates enough electrical energy to support a nationwide EV charging network and cater for future population requirements.

2. EV Ecosystem Management Lack Regulatory Clarity

India’s regulations lack provisions for EVs, specifically the principles or implementation models for resource utilization. In turn, companies that want to provide grid services and vehicle grid integration are facing a major barrier to implementation.

India also doesn’t clarify the long-term role of state-owned utilities that are working to deploy EV charging stations. This lack of clarity poses an issue.

Key Take-Aways

- Policymakers haven’t clearly defined the long-term role of state-owned utilities. They also didn’t address the evolution of EV charging tariffs.

- Policy provisions are lacking for ethical user data handling and privacy.

- Cross-platform usage is hard to achieve with the unclear strategy of registration for charging usage.

3. Revenue for Governments from Fuel Taxes Will Likely Reduce

In the long run, EV adoption will replace oil products with electricity. This will impact government taxation. In turn, it may impact EV incentives. This may also elevate the road tax to compensate. In addition, the revenue from EV charging and usage may not fully offset the revenues from the fossil fuel tax. The net tax loss is also due to EVs being more energy-efficient than traditional vehicles.

Not all crude oil is fractionally distilled or used as automotive fuel. Even though EV growth will reduce dependency on crude oil, it won’t end it. This means the Indian government will still receive revenue from taxing trade on crude oil.

Key Take-Aways

- The EV market is evolving rapidly, but India isn’t suffering significantly from the net tax loss just yet.

- Net fuel tax losses might also become extremely significant as EV uptake increases.

- Governments will anticipate taxation changes while designing mechanisms that support EV deployment.

Final Thoughts

The Indian EV charging infrastructure is still developing. As a result, many opportunities can arise for the Indian commercial sector. First, India’s EV market won’t need extensive charging point installations. Second, the EV charging infrastructure won’t need further development to be fully functional. Finally, this evolution will create many business opportunities for DISCOMS.

That said, the EV charging infrastructure deployment isn’t without risk. Regulatory clarity is one of the largest challenges faced by India at present. In addition, the Indian government may lose revenue from future fossil fuel taxes. This may make EV adoption unappealing. That said, this loss may be balanced by an increase in road tax.

Bolt.Earth supports India’s government in implementing a nationwide infrastructure. That way, we support EV adoption. Here at BOLT, we’re keen to see how state officials implement public EV charging infrastructure. As the largest market share (50%) EV charging network supplier, our offering goes beyond charging hardware. We provide a whole charging solution. In future activities, we hope to work hand-in-hand to roll out a total charging solution. We will help private and commercial transport users get where they need to go.

FAQs

What are the challenges to owning an EV in India?

EV owners face many challenges. For example, you may lack mechanical service options. You may also notice a lack of standardization in connector types and parking spots. Finally, you may even worry about a lack of EV charging infrastructure for long-range travel. Here at Bolt.Earth, we aim to support the EV surge in the country.

What are the EV benefits in India?

EVs reduce noise pollution and carbon emissions. EV maintenance and running costs are also lower than ICE vehicle costs. Lastly, with a proper EV charging infrastructure, EVs are very convenient to charge. Contact Bolt.Earth to learn more about the best EV charging solutions in India.

What are some business opportunities in the EV sector?

The EV boom can pave the way for many innovative, useful businesses. For example, it can promote a battery swapping and recycling industry. We can also see a rise in EV parts manufacturing. It’s also possible to see solar EV charging mechanisms. The EV charging infrastructure is bright, and Bolt.Earth is growing these opportunities.

Why should India use electric cars?

To achieve Net Zero Emissions, India needs a revolution in the transportation system. One way to achieve that is through EV adoption. EVs play a very important role in reducing emissions and saving on fossil fuels. That’s why India needs to improve the EV charging infrastructure to facilitate EV adoption in the long run.

Does India have EV charging stations?

Yes! Currently, India has 1,640+ operational public charging points for EVs. That’s not counting the private ones installed in homes. Overall, India’s EV charging infrastructure will grow as EV adoption increases. As a result, EV users will have less range anxiety.

Feb 27, 2026 • EV Technology and Trends

Renewable Energy and EV Charging in India: Technical Integration [+ Challenges]

Read More