Mapping the Future of EVs in USA

Raghav Bharadwaj

Head of Strategy and Leadership

The United States is leading the charge toward sustainable and widespread electric vehicle (EV) use. In 2022, the United States saw a whopping 55% surge in electric car sales, pushing its global market share to a significant 8%. While cars are certainly predominant in the EV market here, the story goes far beyond sedans and SUVs.

This article delves deeper into the dynamics of the USA's EV market, and in particular, it explores the following questions:

- What is the current state of the USA’s EV market, and how is the market share distributed?

- What are the challenges in the USA's EV market, and what can stakeholders do to solve them?

- How do government incentives and national targets help the USA’s EV market?

The USA’s Current EV Market

Various EVs are currently available in the American market. These comprise hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), battery electric vehicles (BEVs), and fuel cell electric vehicles (FCEVs). Plug-in vehicles (PEVs), encompassing both PHEVs and BEVs, are especially popular.

Plug-In Vehicles Are Gaining Ground

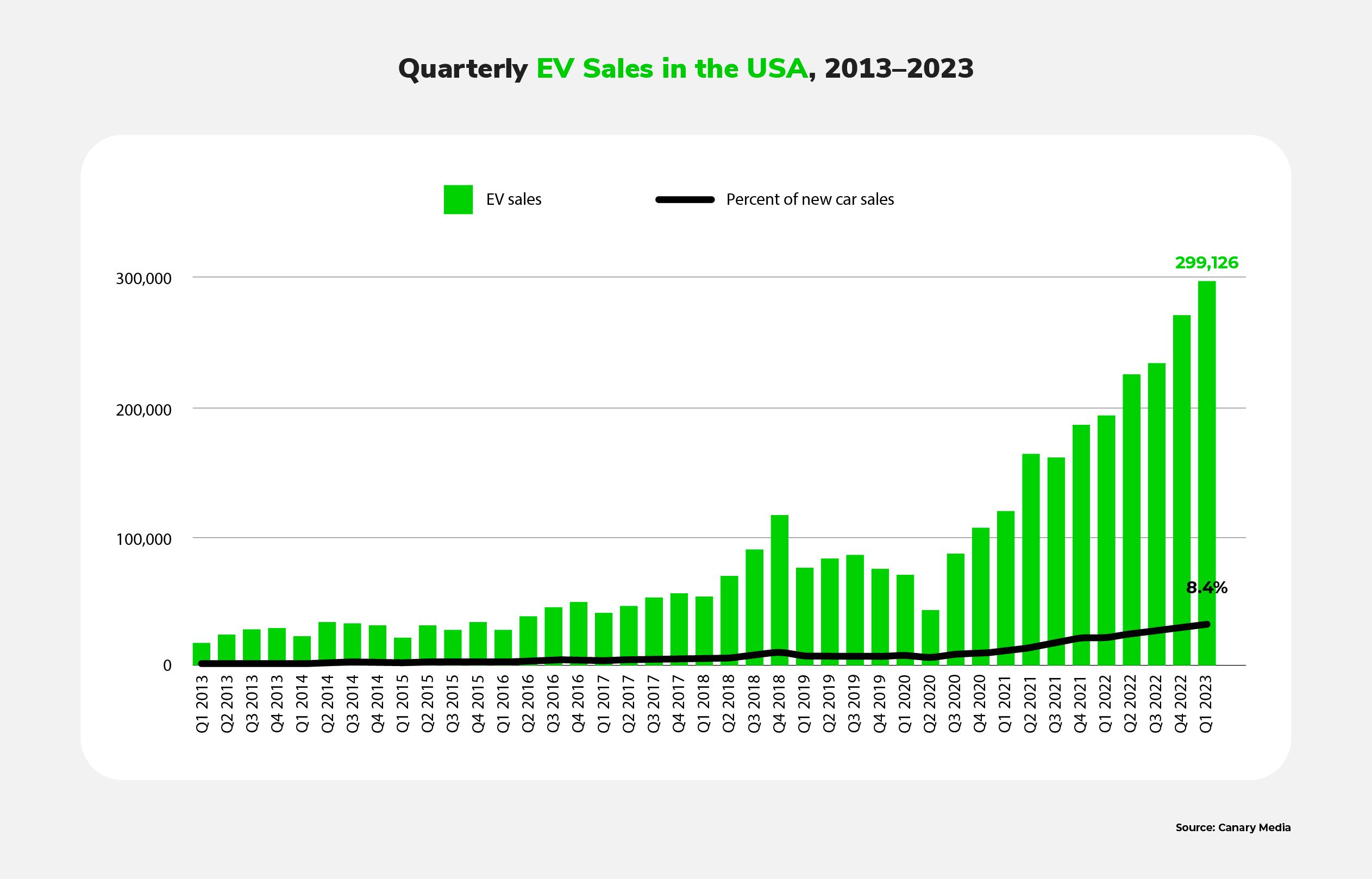

In 2022, a record-breaking 928,884 PEVs were sold in the USA This momentum continued into Q1 of 2023, with nearly 300 thousand EVs and plug-in hybrids sold. In Q2, BEV sales alone reached 300k, an increase of 48.4% from Q2 2022.

Even though EV sales are on the rise, however, EVs still constitute less than 10% of all US vehicle sales.

Regional Disparities

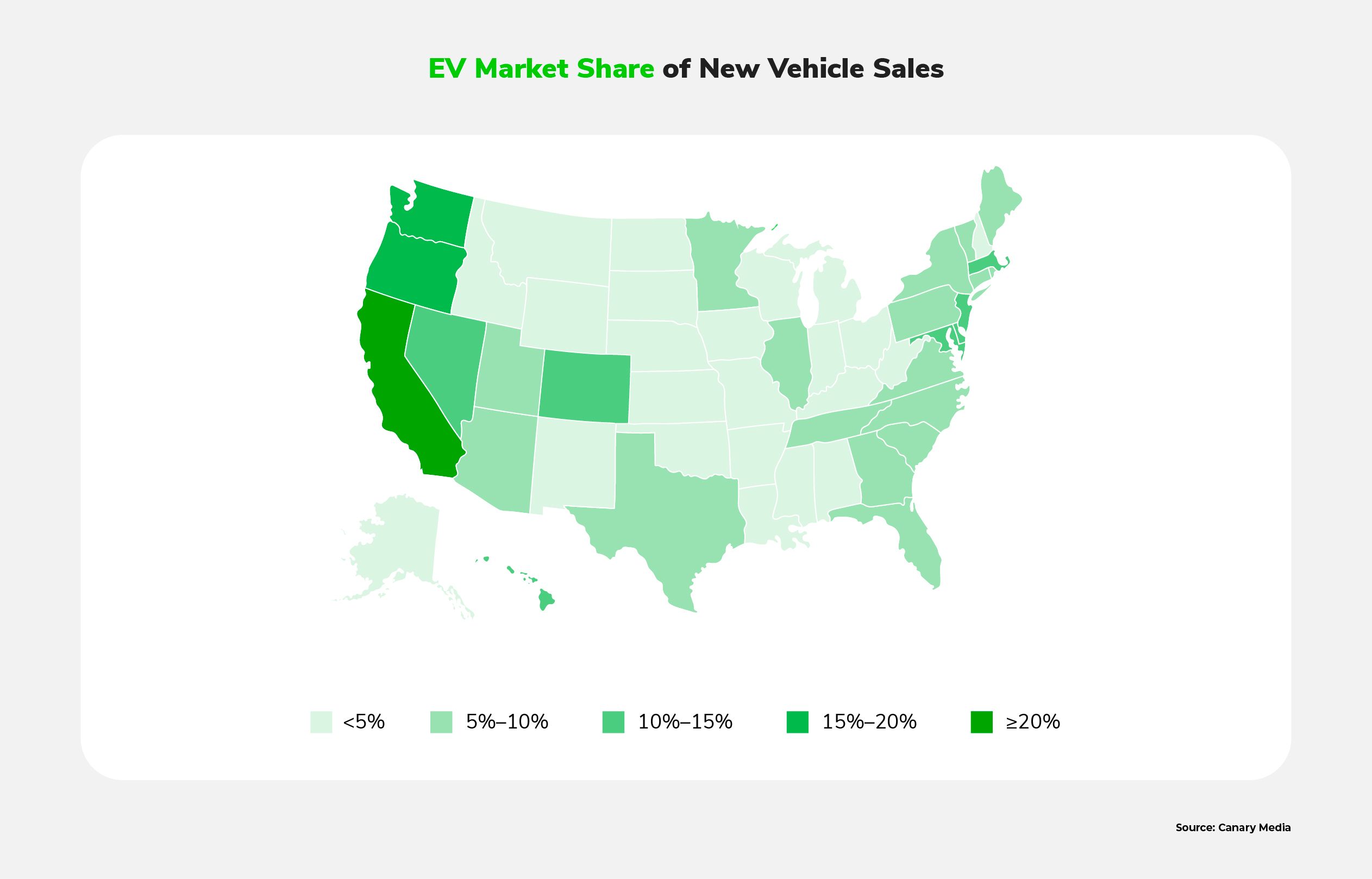

The USA’s EV market varies widely by region. Currently, the state of California leads the country in EV registrations.

In 2022, 18.8% of new cars sold in California were PEVs, compared to the national average of 5.8%. California’s PEV sales rose even higher in 2022, reaching 22.5%. Washington and Oregon are following, with market shares of over 15%, while Colorado, New Jersey, Maryland, and Massachusetts have market shares of over 10%.

E-Bike Momentum

The US e-bike market was valued at $1.98 billion in 2022, and is set to grow at a 15.6% CAGR from 2023 to 2030. This growth is largely driven by the rising post-COVID demand for daily commutes and recreational activities, as well as by environmental concerns and governmental incentives.

The growing demand for e-bikes has propelled the industry’s development, both locally and globally. It has also nurtured many innovations such as bikeshare platforms. However, many U.S. cities lack dedicated e-bike lanes, secure parking, and charging stations, posing challenges to safe and convenient e-bike commutes; this could delay the industry’s continued growth.

Charging Infrastructure

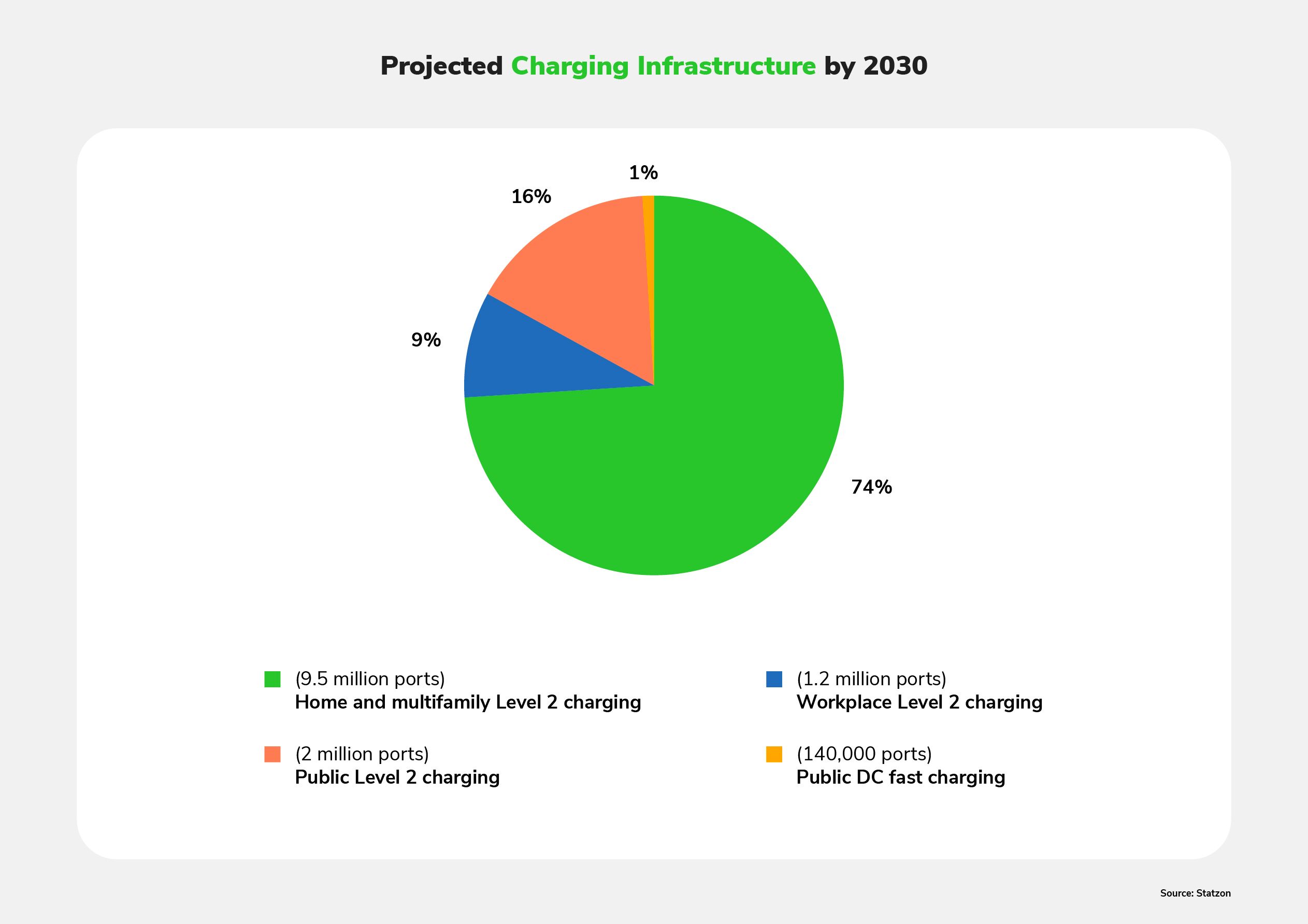

As of Q3 2023, the U.S. has 152k EV charging ports across 58k stations, up from 136k in 2022. Level 2 chargers dominate at 76%. DC fast chargers, 63% of which are part of Tesla’s network, lag behind at 23%. California leads, with 42k charging points, but rural areas lack coverage.

Charging facilities at workplaces and apartment buildings are set to rise, reaching 17% of the market each by 2030.

Major Players in the USA’s EV Market

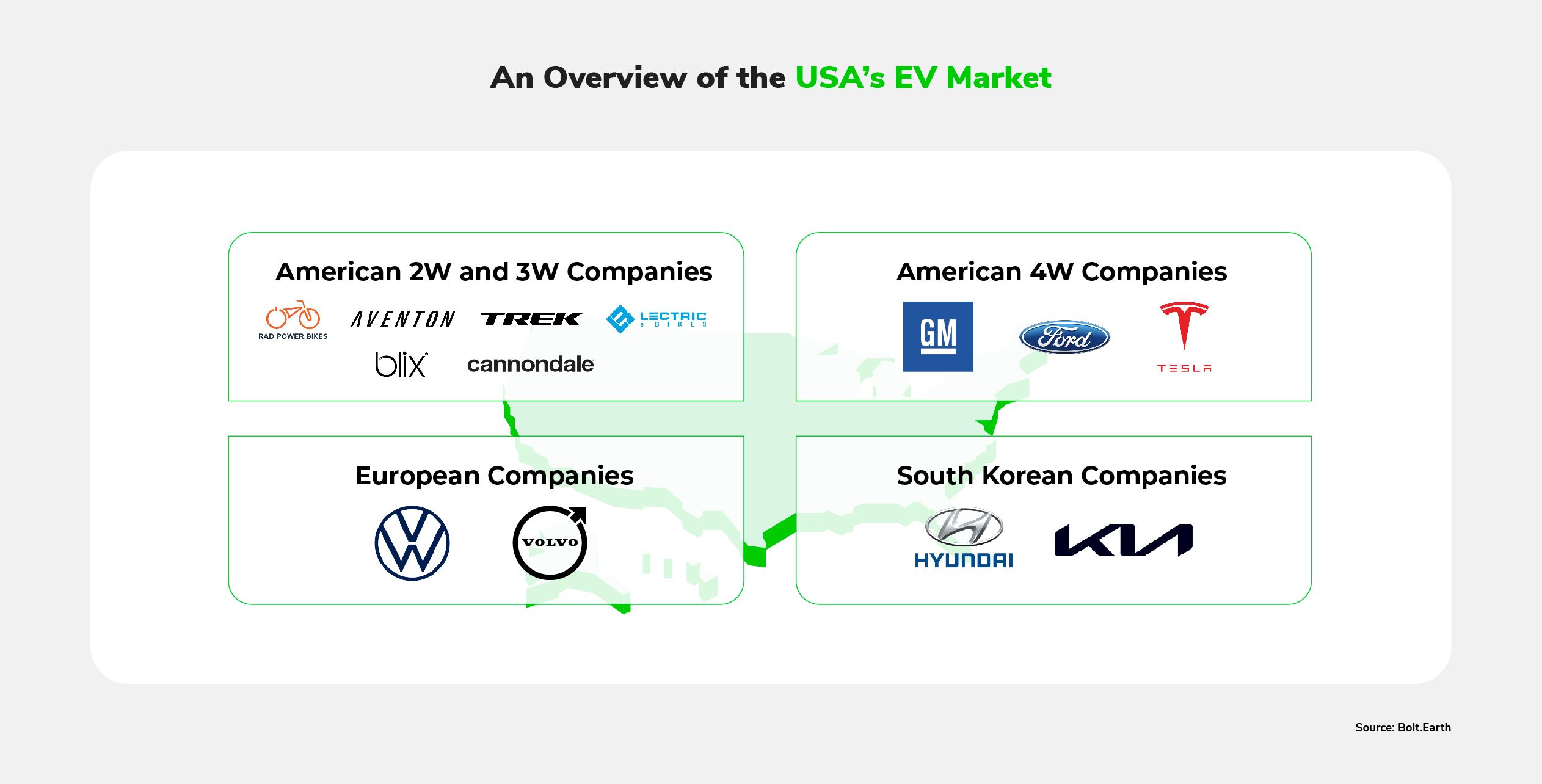

Major 2- and 3-Wheeler Market Players

Major players in the US e-bike market, such as Trek Bicycle Corporation, Aventon, Rad Power Bikes, Lectric eBikes, Blix, and Cannondale, lead in innovation. They heavily invest in R&D, emphasizing battery tech and motor efficiency to make sure their models are reliable. By diversifying their product lines to include urban, mountain, folding, and cargo e-bikes, they cater to varied preferences. Strategic moves like expansions, new launches, and partnerships, demonstrate their commitment to market strength.

Most major e-bike players are domestic, but, in 2022, Chinese manufacturer AIMA Technology partnered with Juiced Bikes, providing technical support and products in an effort to expand its presence in the US e-bike industry.

Trendy 3-Wheelers

Electric tricycles have become a trend in the USA, especially in suburban areas. Several e-bike players have started to design these and add them to their pipelines. For example, Rad Power Bikes, the biggest electric bike producer, entered the 3-wheeler market in 2022 by introducing the futuristic RadTrike, designed for senior citizens to reclaim the capability to travel anywhere.

Major EV Fleets

Federal Fleet

In 2021, US president Joseph Biden issued an Executive Order mandating that the US government’s 650k-vehicle fleet, which is currently less than 1% electric, transition to acquiring American-made EVs. 26 out of the 30 affected agencies are preparing for this transition by updating fleet practices, and by planning to add 8,500 charging ports and 9,500 EVs during FY2023. Hawaii’s Department of Transportation is being particularly proactive; it has obtained a service contract with Sustainability Partners for a cost-per-mile EV model.

Major Business Fleets

Delivery service FedEx achieved a milestone on June 21, 2022, acquiring its first 150 electric vehicles from technology start-up BrightDrop. This move aligns with FedEx's goal to electrify its entire parcel fleet by 2040. BrightDrop’s model Zevo 600, with a 250-mile range, will see 2,500 units integrated into FedEx's operations in the near future.

CEMEX and Volvo Trucks unveiled the world's first fully electric heavy concrete mixer truck in 2021. The Volvo FMX electric truck can complete a full day’s work on a single charge. This aligns with CEMEX’s commitment to cut CO2 emissions below 430 kg per metric ton of cementitious materials by 2030, contributing to its net-zero company goal by 2050. Volvo Trucks aims for half of its total sales to be electric by 2030, adhering to the Paris Agreement and targeting net-zero greenhouse gas emissions throughout its value chain by 2040.

Major Electric Bus Operators

The electric bus market reached $1.6bn in 2022, and is predicted to grow at a CAGR of 16.61% between 2023 and 2028. Several companies have played a crucial role in the adoption of electric buses. For example, Blue Bird Corporation, a leader in electric and low-emission school buses, has secured an order for eight electric buses from California’s Orange Unified School District (OUSD). These electric buses promise significant cost savings by reducing fuel and maintenance expenses for OUSD, which is attempting to cut its annual fuel costs by over $120k.

In 2014, the Chicago Transit Authority (CTA) adopted its first electric buses, and by 2023, Chicago had fully electrified two of its bus routes — the #66 and #63 63rd — with Proterra 600-Series buses. Currently, the CTA has 25 electric buses, and charging facilities in three of its seven garages. After the initial investment, it has found electric buses to be an extremely cost-effective option, at only $2.01 per mile, compared to $3.08 and $2.63 for diesel buses and diesel-electric hybrids, respectively.

Major 4W Market Players

The USA’s best-selling EV models in 2022 and 1H 2023 largely comprised offerings from domestic, German, and Korean OEMs.

Tesla

Through a combination of strategic growth and technical innovation, Tesla has dominated the USA’s EV market. Tesla's strong base, global reach, and production growth ensure ongoing success, while innovations in self-driving tech, energy storage, and core improvements keep the company on a positive trajectory. Although Tesla has encountered some challenges and revenue fluctuations, its focus on autonomy and tech advancements sets it up for long-term growth in both the EV and energy sectors.

General Motors Company

General Motors Company (GM), a multinational OEM headquartered in Detroit, is aggressively entering the American EV market. With new battery plants and a diverse EV lineup, it is poised for significant market share growth by 2025. In 2022, GM delivered 39,096 EVs, representing a 57% YoY increase, and it plans to achieve over 1mn annual productions in North America by 2025. GM is also active in R&D; it has invested in battery projects including Ultium technology, and collaborated with Lithium America for lithium extraction.

Volkswagen

Volkswagen excels in the EV market, with affordable, well-designed electric vehicles and a robust service system. Significant investments in battery production and charging infrastructure, the creation of the modular electric drive matrix (MEB) platform, and six gigafactories ensure a stable battery supply. Thanks to these strides, as well as a partnership with Ford and a plan to introduce electric commercial vehicles, Volkswagen has emerged as a formidable competitor with a focus on extended driving range.

Hyundai and Kia

Closely related South Korean companies Hyundai and Kia sold 38,457 EV units in the USA during the first half of 2022, representing an 11% increase over the previous year’s figures. This growth was propelled by robust government backing including tax credits and US purchase incentives from the Inflation Reduction Act (IRA), which have rendered Hyundai EVs particularly affordable.

Hyundai and Kia’s success is further enhanced by an innovative marketing strategy: allowing buyers who lose their income within one year of purchasing a vehicle to return it for free, with no credit rating penalties.

Challenges to the USA’s EV Market

The USA faces several potential obstacles to its electric future. These mainly include regulatory and infrastructural problems, as well as customer acceptance issues.

Policy and Regulatory Barriers

Nationwide, there is limited support for policies promoting EV adoption. In April of 2023, only 35% of survey respondents favored stricter emissions rules for automakers to boost EV sales, while a mere 27% approved of a mandate for all new car sales to be electric or hybrid by 2035.

Interoperability Issues

Persistent interoperability challenges render widespread EV adoption difficult. The Open Charge Point Protocol (OCPP) and ISO 15118 standards are intended to help, but have experienced operational problems due to technical and authentication errors. Tesla’s proprietary North American Charging Standard (NACS) further complicates the issue; Tesla products are not compatible with the more common, and more widely distributed, CSS1 chargers.

Supply Chain Insecurities

The EV revolution faces a critical hurdle in the scarcity of key minerals like lithium, nickel, cobalt, and rare earth elements. Although these are vital for sustained EV production, there is a notable lack of government initiatives to secure the relevant supply chains. This challenge is increasing due to slow development in processing plants for these elements, creating delays in supplying minerals to battery factories. Geopolitical conflicts pose further uncertainties to the EV industry. Notably, China's recent export controls on graphite may impact the USA’s EV supply chain.

Inconsistencies Across States

In the United States, many EV policies are issued at the state level. This has the potential to impede mass EV adoption across the country. Some states, such as California, prioritize environmental protection, and have robust EV policies including financial incentives, charging and parking benefits, and EV zoning and building codes. A growing number of Republican-led states, however, are actively impeding EV adoption by leveraging new taxes on charging station users, imposing restrictions on how automakers can sell EVs, and implementing punitive registration fees. For example, in Texas, EV owners are subject to an additional $200 annual registration fee. Meanwhile, Texas has one of the lowest gas taxes in the country, indirectly incentivizing ICE vehicle usage.

Infrastructural Shortcomings

The US anticipates 26mn EVs by 2030, necessitating 12.9mn charging ports. DC fast charging is an optimal choice to enable long-distance travel, but it has high installation costs and therefore requires strategic investment and policy focus.

Some regions face different charging infrastructure challenges. For example, the East Coast has adequate infrastructure, but low-quality stations hinder EV adoption. Meanwhile, the West Coast, with the exception of California, lacks sufficient chargers to meet the high demand.

Central states face a shortage; notably, Arkansas has only 124 stations across a vast area, contributing to its mere 0.06% EV registration. Socioeconomic factors and restrictions on direct-to-consumer sales further impede affordability and adoption in many of these regions.

Pricing and Oversupply

Although EV prices have decreased, they still exceed the cost of the average ICE vehicle. As a result, 43% of consumers consider EVs unaffordable. Meanwhile, an EV production surge has created a significant oversupply. Nationwide, there are over 92,000 EV units in stock, representing almost double the industry average, and far exceeding the current demand.

Directions for Future Growth

Technological Advances

Despite the EV industry’s rapid growth, EVs still represent only a small fraction of US automotive sales. Various technology advances are poised to address this. Enhanced batteries promise affordability, efficient production is set to remedy availability issues, and evolving infrastructure will facilitate convenient charging. Furthermore, the US contains 1,929 EV startups, bringing about remarkable innovation within the industry.

Particularly promising technology developments include NASA's sulfur-selenium battery, which boasts an energy density of approximately 227 watt-hours per pound. It is safer, more powerful, and 40% lighter than lithium-ion batteries, and capable of withstanding higher temperatures. Meanwhile, autonomous ride-hailing company Zoox boasts a more futuristic option; it uses Amazon Web Services (AWS) to keep its EV fleet safe and scalable, and cost-efficient.

Collaborations

In the current EV landscape, collaboration and partnerships are indispensable for long-term success.

Collaboration Within the EV Industry

Collaboration with contract manufacturers is crucial for cutting EV costs and boosting efficiency. According to the International Council on Clean Transportation (ICCT), this strategy could enable EVs with a 300-mile range to match ICE vehicle prices by 2027. Joint ventures, shared investments and manufacturing capabilities, and collaborative vehicle development also hold significant potential to advance the American EV industry.

Partnerships Between States

As discussed above, US EV policies vary by state, posing challenges due to differing attitudes toward electrification. However, nascent collaborative efforts are proving beneficial, particularly for charging infrastructure. For example, the Regional Electric Vehicle Midwest Coalition (REV Midwest) unites multiple states to create a regional charging network, successfully encouraging fleet electrification, economic growth, and environmental goals. This collaboration is also attracting funding and addressing range anxiety for US travelers considering long-distance trips.

Materials Innovation

The weight of EVs directly impacts their energy efficiency and range. Innovative materials are increasingly being leveraged to address this challenge.

Lightweight Materials

Using lightweight materials, like aluminum, magnesium, and carbon fiber, is essential for enhancing EVs’ efficiency; this is howTesla's Model S has achieved weight reduction and increased range. The US Vehicle Technologies Office (VTO) is prioritizing the advancement of these materials, focusing on enhancing properties and refining manufacturing. Immediate efforts involve substituting heavy steel components with materials like high-strength steel and aluminum, which can decrease component weight by 10 – 60%. Ongoing research aims to reduce costs and improve processes for joining, modeling, and recycling.

Gallium Nitride

Within the automotive sector, gallium nitride (GaN) has traditionally been used in control and infotainment systems. Ongoing research and advancements suggest that GaN could also be used to create lighter and more efficient EV batteries, chips, and semiconductors. For example, Power Integrations has introduced the InnSwitch3-AQ switcher ICs, specifically designed for electric vehicles using 400V bus systems. These devices deliver 100W output power with an impressive 93% efficiency, effectively managing the highly inductive noise spikes often found in automotive settings.

Government Incentives & National EV Targets

As previous articles in this series have demonstrated, government support is crucial to EV success. This section will provide a full picture of the USA’s EV-related policies, regulations and programs.

EV Master Plan

Under President Biden’s climate initiative, 50% of US vehicle sales will be electric or plug-in hybrid by 2030. Ford, GM, and Stellantis have expressed their support, and announced in a joint statement that they are aiming for 40 – 50% electric sales by 2030.

In the interests of advancing this national target, the American government has issued policies including the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act.

Bipartisan Infrastructure Law

The Bipartisan Infrastructure Law (BIL) represents a historic investment in U.S. infrastructure. It aims to address climate change by building a national network of EV charging points and expanding the domestic EV industry. To that end, it allocates $7.5bn to EV charging, $10bn to clean transportation, and over $7bn to EV components.

CHIPS and Science Act

The CHIPS and Science Act allocates $280bn to enhance semiconductor research and manufacturing in the U.S. It aims to bolster competitiveness, innovation, and national security, catalyze investments in semiconductor manufacturing, attract private sector investment, maintain technological leadership, and fund exploratory and translational research. This is predicted to support EV growth by stimulating domestic production of chips used in vehicles.

Inflation Reduction Act

The 2022 Inflation Reduction Act allocates funds for a variety of purposes, including investing in domestic energy, cutting carbon emissions, and addressing climate change. Among other measures, it implements incentive credits for particular communities to transition to electric mobility, and updates eligibility criteria for clean vehicle tax credits.

Several states and cities are using this as a springboard to advance ambitious EV initiatives. For example, California has proposed mandating that 35% of all new passenger cars and truck sales consist of EVs by 2025.

EV Supply-Side Incentives

Manufacturing Grants and Incentives

The Department of Energy will allocate $2bn to enhance domestic EV manufacturing. This funding focuses on cost-shared grants for refurbishing or retooling facilities producing various types of EVs.

Loan Guarantees for Manufacturers

The DOE Loan Guarantee Program supports domestic production of efficient EVs and associated infrastructure. Guarantees cover at least 50% of the loan amount, increasing to 80% for specific projects with additional funding from the Treasury Department.

Federal Infrastructure Funding Program

The Bipartisan Infrastructure Law allocates $5bn for EV charging along highways and an additional $2.5bn in competitive grant funding. At least 50% of these funds must be put towards building EV charging infrastructure for communities, especially in rural and low-income areas. Meanwhile, the Section 30C credit for Alternative Fuel Vehicle Refueling Property has been extended through the end of 2032, and now includes bidirectional charging stations.

EV Demand-Side Incentives

Federal Tax Credits

The IRA has reinstated a $7,500 consumer tax credit for EV purchases, expanding credits for new and used EVs. It also supports electrifying heavy-duty vehicles, and funds EV charging infrastructure. To qualify, vehicles must meet specific requirements, such as having undergone final assembly in North America.

State Rebates and Tax Credits

45 states and the District of Columbia all provide incentives for purchasing electric 4-wheelers. For example, Colorado offers a $500 rebate. Some states and cities also offer incentives for electric 2-wheelers and 3-wheelers. Notably, Alameda Municipal Power provides a cash rebate of up to $600 to encourage residents of Alameda, California to purchase e-bikes.

Incentives for Low-Income Consumers

Several states are implementing policies to enable low-income and disadvantaged communities to access the growing EV market. For example, Virginia recently introduced a rebate program to help low-income customers purchase new or used EVs.

Fleet Tax Credits

As of January 1, 2023, businesses can get tax credits for new EV and FCEV purchases. The credit is 15% of the price for plug-in hybrids, and 30% for EVs and FCEVs, capped at $7,500 and $40k for vehicles under and 14k pounds, respectively.

The Future of the USA’s EV Market

The USA is heading for an electric future, but its journey will involve tackling a range of challenges. By embracing state collaborations, technological innovation, and strong government support, the nation could achieve a green transformation in the next decade. EVs are on track to seamlessly become a part of daily life in the USA.

FAQs

What is the current status of the electric vehicle market in the USA?

The USA's electric vehicle market is thriving, with nearly 300k EVs and plug-in hybrids sold in Q1 2023.

How are collaborations shaping the future of the USA’s EV industry?

Collaborations, both within the EV industry and between states, are key for growth. Partnerships among manufacturers reduce costs, and state collaborations like REV Midwest create regional charging networks, fostering fleet electrification and environmental goals.

How does autonomous driving technology factor into the USA’s EV landscape?

Autonomous driving technology, exemplified by Zoox's collaboration with Amazon Web Services, accelerates testing and improves data processing.

How is the USA’s EV market projected to grow?

The USA's EV market is poised for immediate growth, driven by technological convergence, increased government incentives, and collaborations.

What are the implications of the USA's EV targets and policies for investors?

Investors can benefit from the USA's EV targets and policies, such as the Bipartisan Infrastructure Law and EV incentives. Collaborations and government backing create a favorable environment for investments in EV manufacturing, infrastructure, and related technologies.

What factors are driving the future of EV adoption in the USA?

Future EV adoption in the USA is driven by technological innovations, government incentives, and collaborations. Lightweight materials, like aluminum and carbon fiber, enhance efficiency. Government policies, such as rebates and tax credits, make EVs more accessible, and collaborative efforts address infrastructure challenges, facilitating widespread adoption.

Resources

Statzon: US EV Market Share Rose to 7.2% by Mid-2023 Learn about recent US EV market trends here.

Grand View Research: U.S. E-bike Market Size, Share & Trends Analysis Report By Propulsion Type, By Drive Type, By Application, By Battery, By End-use (Personal, Commercial), And Segment Forecasts, 2023 - 2030 Examine the forecast analysis of the USA’s e-bike market here.

McKinsey & Company: Net-zero emissions in US government fleets Find out about the USA’s federal EV fleet electrification here.

International Council on Clean Transportation: Evaluating electric vehicle market growth across U.S. cities Learn about the evolution of the USA’s EV industry here.

PwC: The US electric vehicle charging market could grow nearly tenfold by 2030: How will we get there? Discover short-term predictions for the USA’s EV market here.

May 30, 2024 • EV Infrastructure

How Bolt.Earth Helps Manage Charging Demand for Large-Scale EV Fleets

Read More

Apr 23, 2024 • EV Infrastructure

How CMS-OCPP Compatibility Can Revolutionize EV Charging Infrastructure

Read More

Feb 26, 2024 • EV Infrastructure

Dealership Strategies for Embracing Future Tech in The EV Industry

Read More